Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

To start an LLC in Alaska, file Articles of Organization with the Alaska Division of Corporations. This costs $250 and takes 1 day for approval.

There are 6 steps to follow:

There are 6 steps to follow:

- Choose an LLC Name

- Select a Registered Agent

- File Articles of Organization

- Create an Operating Agreement

- Get an EIN

- File your Initial Report & Biennial Report

If you want to form your LLC yourself, follow our free guide below.

If you want someone to take care of it for you, we recommend hiring Northwest Registered Agent

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(We recommend Northwest. We've reviewed all the top companies in the industry. And Northwest is our #1 pick for prices, customer support, and address privacy. Check out Northwest vs LegalZoom to learn more.)

How much does it cost to start an LLC in Alaska?

It costs $250 to start an LLC. And then it costs $200 every 2 years.

What are these fees for?

- The $250 is to file the Articles of Organization – the document that creates an LLC.

- $50 per year is for your Alaska Business License.

- $100 every 2 years is for your Biennial Report – a mandatory filing that keeps your LLC in good standing.

To learn more about LLC Costs, see LLC Costs in Alaska.

How long does it take to get an LLC in Alaska?

If you file your LLC by mail, it will be approved in 10-15 business days (plus mail time).

But if you file online, your LLC will be approved immediately.

Please see How long does it take to get an LLC in Alaska to check for any delays.

Here are the steps to forming an LLC

1. Search your LLC Name

Search your LLC Name to make sure it’s available in the state.

Search your LLC Name to make sure it’s available in the state.

You need to do this because two businesses in the state can’t have the same name.

First, search your business name and compare it to existing businesses in the state. You can make sure the LLC Name you want is unique from existing businesses using the Alaska Division of Corporations’ Search Corporations Database.

Second, familiarize yourself with the state’s naming rules (so your LLC gets approved).

We’ll explain both in more detail here: Alaska LLC Name.

2. Choose a Registered Agent

The next step is to choose a Registered Agent.

An Alaska LLC Registered Agent is a person or company who accepts legal mail and state notices on behalf of your Limited Liability Company.

An Alaska LLC Registered Agent is a person or company who accepts legal mail and state notices on behalf of your Limited Liability Company.

Who can be the Registered Agent for a Limited Liability Company?

You have 3 options for who can be the Registered Agent:

- You

- A friend or family member

- A Registered Agent Service

The Registered Agent for your Alaska LLC must have a physical street address in Alaska. PO Boxes aren’t allowed.

And the Registered Agent’s name and address will be listed on public records.

If you don’t have an address in Alaska, or you want more privacy, you can hire a Registered Agent Service for your LLC.

We recommend Northwest Registered Agent

Our favorite feature about Northwest is they’ll let you use their office address throughout your LLC filing. This way, you can keep your address off public records.

They’ll also scan any mail sent to your LLC and upload it to your online account.

Northwest has excellent customer service, and they’re who we trust to be our own Registered Agent.

Special offer: Hire Northwest to form your LLC ($39 + state fee), and you'll get a free year of Registered Agent service.

(Why is Northwest the best? Read our Northwest Registered Agent review)

3. File LLC Articles of Organization

To start an LLC, you need to file LLC Articles of Organization with the Alaska Division of Corporations.

To start an LLC, you need to file LLC Articles of Organization with the Alaska Division of Corporations.

It costs $250 to file your LLC Articles of Organization online.

This is a one-time fee to create your Limited Liability Company.

If you want to file this yourself, see our step-by-step guide: Alaska LLC Articles of Organization.

Or, you can hire a company to do it for you.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

4. Create an LLC Operating Agreement

You can think of an LLC Operating Agreement as a “companion” document to the Articles of Organization.

You can think of an LLC Operating Agreement as a “companion” document to the Articles of Organization.

The Articles of Organization creates your LLC, and the Operating Agreement shows who owns the LLC.

Additionally, some banks require your LLC’s Operating Agreement when you open an LLC bank account.

And having an Operating Agreement will be very helpful if you ever end up in court. Reason being, it helps prove that your LLC is being run properly.

That’s why we recommend that all LLCs have an Operating Agreement – including Single-Member LLCs.

Furthermore, an Operating Agreement is an “internal document“. Meaning, you don’t need to file it with any government agency (like the Division of Corporations or the IRS (Internal Revenue Service). Just keep a copy with your business records.

You can download a free template below.

Then, learn how to fill it out by watching our step-by-step Alaska Operating Agreement video.

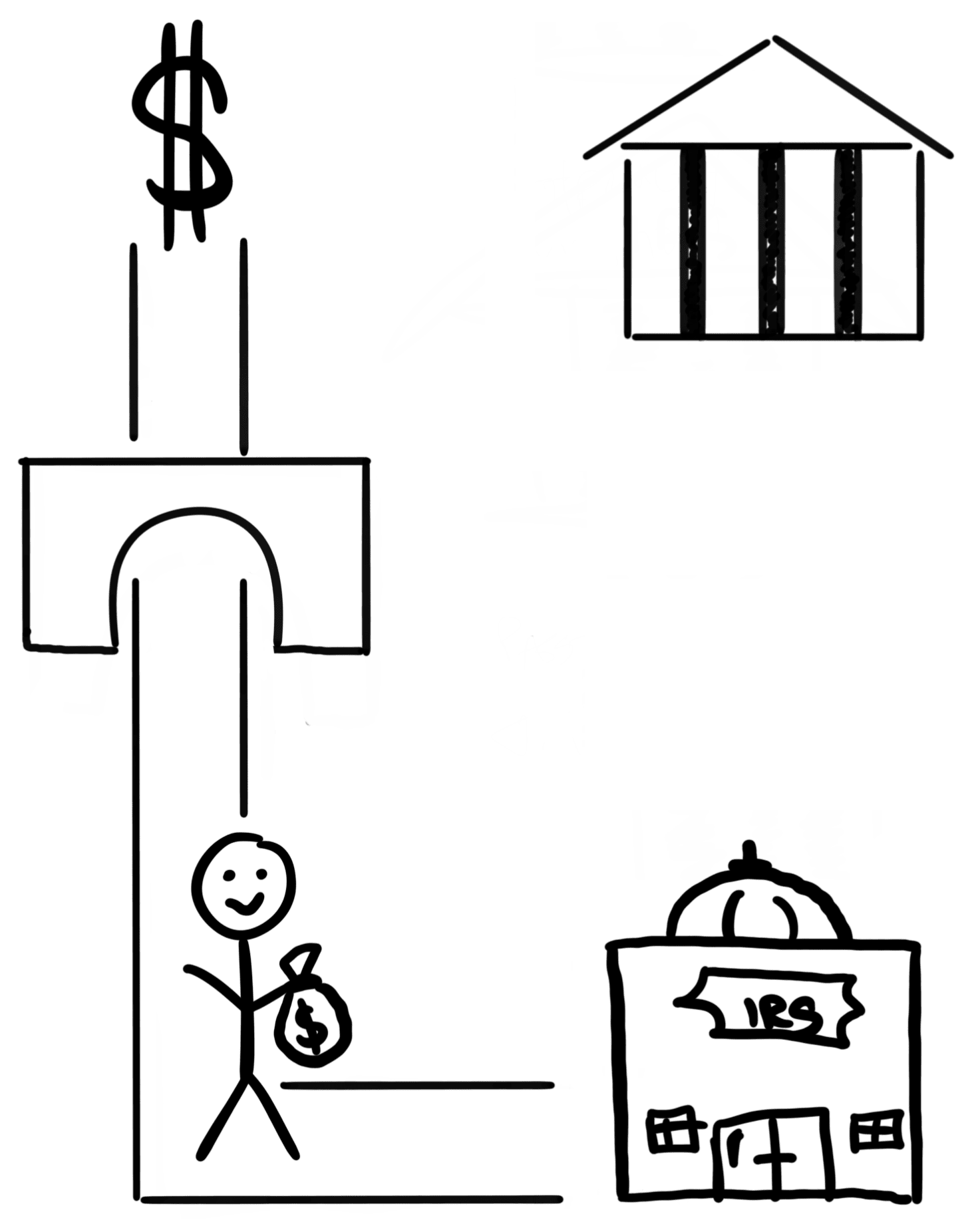

5. Get an EIN for your LLC

The next step is to get an Alaska LLC EIN Number from the IRS (Internal Revenue Service).

Note: An EIN Number is also called a Federal Tax ID Number or Federal Employer Identification Number.

An EIN Number is used to:

An EIN Number is used to:

- identify your LLC for tax purposes

- open a business bank account

- apply for business licenses and permits

How much does an EIN cost?

Getting an EIN Number from the IRS is completely free.

How long does it take to get an EIN?

If you apply online, it takes 15 minutes.

If you apply by mail or fax, it can take 1-3 months.

How can I get an EIN?

US Citizens/US Residents: If you have an SSN or ITIN, you can apply for an EIN online. Follow these instructions: Apply for an EIN online.

Non-US Residents: You can’t get an EIN online, but you can still get one by fax or by mail. Follow these instructions: How to get an EIN without an SSN or ITIN.

6. File your Initial Report & Biennial Report

All LLCs in the state must file an Initial Report within 6 months of forming the LLC.

All LLCs in the state must file an Initial Report within 6 months of forming the LLC.

The Initial Report is a one-time filing and must be filed with the Division of Corporations regardless of business income or activity.

Then, you must file an LLC Biennial Report every 2 years after that.

The Initial Report and Biennial Report keep your LLC in good standing with the state.

How much does an Alaska Initial Report cost?

It costs $0 to file your Initial Report. Said another way, there is no filing fee for the Alaska Initial Report.

When is the Initial Report due?

Your Initial Report is due within 6 months of forming your LLC.

This is a one-time fee.

How much does an Alaska Biennial Report cost?

The Biennial Report filing fee is $100 every 2 years.

When is the Biennial Report due?

The Biennial Report is due every 2 years.

- If you filed your Initial Report in an even-numbered year, then your Biennial Report will be due every even-numbered year.

- If you filed your Initial Report in an odd-numbered year, then your Biennial Report will be due every odd-numbered year.

The due date for the Biennial Report filing is January 2nd.

When is my first Biennial Report due?

Your first Biennial Report is due two years after your LLC was approved.

For example, if you filed your Initial Report in 2025, then your first Biennial Report will be due by January 2, 2026. Then it’ll be due every two years after that (also by January 2).

How do I file my LLC Initial Report and Biennial Report?

You can file your LLC’s Initial Report and Biennial Report online or by mail. We recommend the online filing because it’s easier to complete.

Follow our step-by-step guide here: Alaska LLC Biennial Report.

What do I do after my LLC is approved?

After your LLC is approved, there are some additional steps.

LLC business bank account

You’ll want to open a business bank account for your LLC.

This makes accounting and record-keeping much easier for your business finances.

Having a separate business bank account also maintains your personal liability protection. This is because it keeps your business finances separate from your personal finances.

Get business licenses and permits

Alaska requires all businesses to get a general Alaska business license from the state government.

Alaska requires all businesses to get a general Alaska business license from the state government.

And depending on where your LLC is located, you may also need a local business license or permit.

For example, if you want to start a daycare, you may need a business license from the city or county.

Learn more in our step-by-step Alaska Business License guide.

File and pay taxes

LLCs don’t pay federal taxes. Instead, the LLC Members pay the taxes for the LLC.

Said another way, the owners pay taxes for the LLC as a part of their personal tax return.

How will my LLC be taxed?

By default, the IRS taxes an LLC based on the number of owners your LLC has:

- A Single-Member LLC is taxed like a Sole Proprietorship.

- A Multi-Member LLC is taxed like a Partnership.

Alternatively, you can ask the IRS to tax your LLC like a C-Corporation or S-Corporation.

Besides federal taxes, there are also state and local income taxes – and sales tax.

The good news is that Alaska doesn’t have state-level income tax. This means you don’t have to file a state-level income tax return for your LLC income if you have a Single-Member LLC.

And if all of your Multi-Member LLC Members are “natural persons” (actual people), then you aren’t required to file a state income tax return.

Alaska also doesn’t charge sales tax at the state level. However, your LLC may be required to collect sales tax at the local level.

Learn more in Alaska LLC Taxes.

How to Start an LLC in Alaska FAQs

Can I start an LLC online in Alaska?

Yes, you can file your LLC online. The Articles of Organization filing fee is $250.

When you start your LLC online, it will be approved immediatelyimmediately.

What are the benefits of an LLC?

The first benefit of an LLC is protecting your personal assets. Meaning, if your business is sued, your personal assets – like your home, cars, and bank accounts – are protected.

This protection applies to all LLC owners (called LLC Members). It doesn’t matter if you have a Single-Member LLC or Multi-Member LLC. All of the LLC owners are protected from the business debts and liabilities.

This type of protection wouldn’t apply if you operate as a Sole Proprietorship or Partnership. With these types of informal business structures, the owners aren’t protected in the event of a lawsuit. For that reason, Limited Liability Companies (LLCs) are a much more popular business structure.

Another benefit is LLC pass-through taxation. This means the LLC itself doesn’t pay federal income taxes. Instead, the profits “pass through” to the LLC Members. Then the Members pay the taxes on their personal tax return.

Another benefit is LLC pass-through taxation. This means the LLC itself doesn’t pay federal income taxes. Instead, the profits “pass through” to the LLC Members. Then the Members pay the taxes on their personal tax return.

And Alaska doesn’t have state income taxes.

To learn more, please see How are LLCs taxed.

What’s the difference between the Initial Report and Biennial Report?

They’re pretty much the same thing, but the state calls them slightly different names.

The Initial Report is just your “first” Biennial Report. The names, due dates, and filing fees are different, but the information they communicate to the state is the same.

Said another way, the Initial Report is just the Biennial Report with a different name and due date.

And while the Initial Report is a free, one-time filing, the Biennial Report costs $100 to file every two years.

Is Alaska a good state to start an LLC?

Whether Alaska is a good state to start an LLC depends on where you live – and where you’re doing business.

Meaning, if you live in or do business in Alaska, then you should start your LLC there. While many websites talk about tax rates and advantages of certain states, none of that applies if it’s not the state where you live and do business.

For example, if you form an LLC in Nevada, but live in and conduct business in Alaska, you’ll also need to register your Nevada LLC in Alaska (and pay extra fees). And you’ll end up paying Alaska taxes anyway. This ends up leading to more costs and more headaches with no advantages.

In summary, if you live in and conduct business in Alaska, then yes, it’s a good state to start a business. If you don’t live in and do business in Alaska, then no, it isn’t a good state to start a business.

Real estate exception: If you’re purchasing real estate outside of Alaska, you should form your LLC in the state where the property is located.

For more information, please see Best State to Form an LLC.

References

Alaska Division of Corporations

Alaska Division of Business Licensing

Alaska Division of Corporations: Forms and Fees

Alaska Division of Corporations: Entity Type FAQs

Alaska Division of Corporations: Biennial Report FAQs

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Does Alaska have the best laws that make it impossible for crediotrs to penetrate the LLC veil .

How do they compare with Nevada.

Hi Pat, it depends on a multitude of factors. State of formation isn’t the only thing that matters, since it depends on where the lawsuit is brought, what type of lawsuit it is, what the contract/terms are, where the incident occurs, where you reside, and much more. If I could sum it up, I would, but a conversation like this is best had with an asset protection attorney. Thanks for your understanding.

I have multiple real estate rental properties in AZ, AK and Fl When forming an LLC does the name on your LLC have to match with your state business license and the name on your EIN

example:” EIN Business name is Diamond Ventures in the 49th State, LLC Name on borough license is Blue Diamond Dream, LLC name on State Business License is Blue Diamond Dream, LLC Arizona Real estate license and LLC is Diamond Ventures in the 49th State. Fl Rental LLC and business licence is Emerald Diamond, LLC

My primary business name that i operate under is Diamond Ventures in the 49th State. Can this be a Parent LLC and the others put under this LLC as Child LLC’s

How would I do this. Thanks, Frank

Hi Frank, it sounds like you are thinking about it backwards. Meaning, an LLC in Alaska should have a business license and an EIN Number. That business license and EIN Number are in the name of the Alaska LLC. And yes, you can have an LLC own another LLC.