How a non-US resident can get an EIN Number (Federal Tax ID Number) for a U.S. LLC

Important notes:

- This information is for non-US residents forming an LLC in the US

- Make sure you read what is an EIN and IRS taxpayer ID numbers

Don't have an LLC yet? Hire Northwest to form your LLC for $39 + state fee (then add EIN to your order).

Have an LLC, but no EIN? Hire Northwest to get your EIN:

I have an SSN | I don't have an SSN

There is a lot of incorrect information online about non-US citizens and non-US residents (foreigners) getting an Employer Identification Number (EIN) from the IRS.

Most of the information is wrong or incomplete, either due to lack of knowledge or because someone is trying to sell you something.

At LLC University®, we don’t create content in order to sell you something. We create content in order to educate you.

In this article, we will debunk a few myths and tell you the truth. Then we’ll show you how to get an EIN for your LLC without an SSN or ITIN.

Myth #1 – An EIN costs money

This is false.

EINs are completely free ($0) from the IRS.

The only reason you would pay money is if you hire someone to get your EIN for you.

While you certainly can hire someone to get your EIN, you can also apply for an EIN yourself. It’s not complicated and this article will walk you through the steps.

Myth #2 – You need to be a US citizen or US resident to get an EIN

This is false.

You don’t have to be an American to get an EIN.

You don’t have to be a U.S. citizen to get an EIN.

And you don’t have to be a U.S. resident to get an EIN either.

In fact, there are no citizenship or residency requirements to forming an LLC in the U.S. and there are no citizenship or residency requirements for getting an EIN for your LLC.

As long as you complete Form SS-4 properly (which we’ll show you below), the IRS will give you an EIN for your LLC.

Myth #3 – You need an SSN to get an EIN

This is false.

You don’t need an SSN (Social Security Number) to get an EIN.

You only need an SSN (or ITIN) if you want to apply for an EIN online.

Solution:

You can get an EIN without an SSN by sending Form SS-4 to the IRS by mail or fax (instructions).

Myth #4 – You need an ITIN to get an EIN

This is false.

You don’t need an ITIN (Individual Taxpayer Identification Number) to get an EIN.

In fact, you can’t even apply for an ITIN unless you need to file a U.S. tax return. Meaning it’s impossible to get an ITIN before forming your LLC because the LLC would first need to exist and generate income for a tax year, then when April 15th of the following year comes around, you would submit your U.S. tax return along with your ITIN application.

Solution:

You can get an EIN without an ITIN by sending Form SS-4 to the IRS by mail or fax (instructions).

Myth #5 – You need a Third Party Designee to get an EIN

This is false.

You are not required to use a Third Party Designee to get an EIN.

You only need to use a Third Party Designee if you are hiring someone to get your EIN, not if you are applying for the EIN yourself.

Solution:

You can get an EIN without a Third Party Designee by sending Form SS-4 to the IRS by mail or fax (instructions).

Myth #6 – You need an attorney or accountant to get an EIN

This is false.

While yes, you can certainly hire an attorney or an accountant to help you get an EIN (they’ll act as your Third Party Designee), you are not required to do so.

Solution:

You can get an EIN without an attorney or an accountant by sending Form SS-4 to the IRS by mail or fax (instructions).

Myth #7 – You can get an EIN online

This is false.

You can’t get an EIN online unless you have an SSN or ITIN.

And even if you have an ITIN, many foreigners get an error message (an IRS reference number) at the end of the online EIN application and end up having to use Form SS-4.

Solution:

You can get an EIN by sending Form SS-4 to the IRS by mail or fax (instructions).

Myth #8 – You need to call the IRS to get an EIN

This is false.

While yes, the IRS does have a department called the International EIN Department (1-267-941-1099), as a foreigner who’s formed a U.S. LLC, you can’t call this number to get your EIN.

This phone number is used for companies that were formed outside of the U.S., not companies formed inside the U.S. that are owned by foreigners.

Solution:

You can get an EIN by sending Form SS-4 to the IRS by mail or fax (instructions).

Myth #9 – You need a U.S. address to get an EIN

This is false.

You don’t need a U.S. office address or U.S. mailing address to get an EIN.

The IRS just needs a “mailing address”, which can be a U.S. address or it can be a non-U.S. address.

However, if you want to open a U.S. bank account for your LLC, it looks much better when your EIN Confirmation Letter shows a U.S. address. For this reason, we recommend hiring Northwest Registered Agent. Northwest will let you use their address for your Registered Agent address, your LLC’s office address, and your EIN application so you can open a U.S. bank account for your LLC. Any mail that is sent to your LLC will be scanned by them and uploaded to your online account.

Sending Form SS-4 to the IRS to get an EIN

Form SS-4 is called the Application for Employer Identification Number (EIN).

Once you fill out Form SS-4 you can then send it to the IRS by mail or fax.

Fax has a faster approval time than mail.

We’ll discuss the details of how to complete Form SS-4 further below, but before we do, there are a few other important things to discuss first.

Make sure your LLC is approved before getting an EIN

Make sure your LLC is approved first before applying for your EIN to avoid having an EIN attached to the wrong LLC name (if your LLC filing gets rejected).

You’ll also want to send to the IRS your LLC approval along with the EIN application. The name of your LLC approval form will vary depending on the state, but it will either be a stamped/approved Articles of Organization, Certificate of Organization, or Certificate of Formation.

However, if you apply for your EIN first and your LLC is later approved, then there are no issues. The IRS doesn’t check to make sure an LLC exists first before getting an EIN, so if the LLC name on your state forms matches your EIN Confirmation Letter, you’re good.

If you apply for your EIN first and then your LLC is rejected because of a name conflict, you’ll need to resubmit your LLC filing forms, get a new EIN, and then cancel your first EIN. You don’t have to wait for your first EIN to be cancelled before getting a new EIN.

The only exceptions are if you’re forming an LLC in Louisiana or West Virginia where you may need to get your EIN before forming your LLC.

EINs are used for:

An EIN is primarily used by foreigners to open a business bank account in the U.S. for their LLC.

Your EIN will also be used for U.S. tax reporting and filing requirements, hiring employees (if applicable), and sales tax licenses/permits.

Your LLC’s EIN will also be used for account registrations for Amazon FBA, eBay, Youtube, Google Adsense, Paypal, Shopify, Stripe, and many more.

Many foreigners have online businesses these days, like dropshipping, affiliate marketing, blogging, and freelance work, where they need an EIN for their LLC.

How to complete the EIN Application (Form SS-4) for Foreigners

Download Form SS-4:

IRS: Form SS-4, Application for Employer Identification Number

Instructions for Form SS-4:

IRS: Instructions for Form SS-4

Complete Form SS-4 by hand or on your computer:

You can either print the form, fill it out by hand (use a black pen), then sign; or, you can type in the form on your computer, then print and sign.

USE CAPITAL LETTERS:

If you are filling out Form SS-4 by hand, we recommend using ALL UPPERCASE letters. The IRS prefers UPPERCASE letters and this can help speed up your EIN application.

EIN (upper right)

You’ll see an “EIN” box in the upper right of the form. DON’T ENTER ANYTHING HERE.

The IRS will enter your EIN number in this field after they approve your application.

1. Legal name of entity (LLC)

Enter your LLC name in the exact same way it’s listed in your Articles of Organization, Certificate of Organization, or Certificate of Formation.

Note: If you’re forming an LLC in Louisiana or West Virginia, you may need to obtain your EIN before forming your LLC, so make sure your LLC name is available (or you’ve reserved it, as per Louisiana LLC filing instructions) before getting an EIN for your soon-to-be LLC.

If you’re forming your LLC in any other state, don’t apply for your EIN until your LLC is approved.

2. Trade name of business (if different than #1)

Most foreigners who have formed an LLC don’t also have a Trade Name (aka DBA, Doing Business As, or Fictitious Name).

Most foreigners leave #2 empty.

(related article: Do I need a DBA for my LLC?)

If on the other hand, you’ve filed a DBA after forming your LLC, your DBA is owned by your LLC, and you want your LLC to do business under that name, then you can enter your Trade Name/DBA Name/Fictitious Name in #2.

3. Executor, administrator, trustee, “care of” name

Leave this empty. This field does not apply to LLCs obtaining an EIN.

4a and 4b: Mailing address

On lines 4a and 4b enter a mailing address where the IRS can send you reminders and tax documents.

This address can be a U.S. address or it can be a non-U.S. address. This address can be the same address you used listed on your LLC filing forms, but it doesn’t have to be.

This address should be one that is reliable and where you can regularly receive mail for your LLC. This should also be the address that you will use when filing future tax returns with the IRS.

However, using a U.S. address here may make it easier when opening up a U.S. bank account. The address that is listed in 4a and 4b will be the same address that is listed at the top of your EIN Confirmation Letter. Some banks accept this as a proof of U.S. address.

The best and least expensive way to get a U.S. address (if you don’t have friends or family in the U.S.) is to hire a Registered Agent that will allow you to use their address not only as your LLC’s Registered Agent address, but also as your LLC’s office address. The company we recommend for this is Northwest Registered Agent. They’ll let you use their address for your U.S. LLC and any mail that is sent to your LLC will be scanned and uploaded to your online account. They are a great company and have been in business for over 20 years.

Notes:

- If the address is a non-U.S. address, make sure to enter the city, province (or state), postal code, and the name of the country. Enter the full country name. Don’t use an abbreviation.

- If you need to change your LLC mailing address with the IRS in the future, you file Form 8822-B.

5a and 5b: Street address (if different)

You can leave 5a and 5b empty.

6. County and state where principal business (LLC) is located

Enter the county (not the country) where your LLC is located in the U.S.

This will either be your LLC’s principal address or your LLC’s Registered Agent address.

Example: Broward County, Florida

Tip: To find out what county your LLC’s address is located in, you can use the following tool: What County Am I In.

7a. Name of Responsible Party

The EIN Responsible Party must be an individual person, therefore, it will be an LLC Member (owner).

If you own a Single-Member LLC, you will be the Responsible Party.

If you own a Multi-Member LLC, any of the LLC Members (owners), including yourself, can be the Responsible Party.

7b. SSN, ITIN, or EIN (of Responsible Party)

This is the box that confuses most people who don’t have an SSN or ITIN and want to get an EIN for their LLC.

The solution is to enter “Foreign”.

The IRS issues EINs to foreigners all the time and this is what you must enter if you don’t have an SSN or ITIN.

Note: If your LLC is owned by another LLC (a “Parent LLC”), you can’t use your Parent LLC’s EIN. You must enter “Foreign”. And you also must list a person (not a company) in 7a.

For more information, see EIN Responsible Party for LLC.

8a. Is this application for a limited liability company (LLC)?

Check off “Yes”.

8b. If 8a is “Yes,” enter the number of LLC members

Enter the number of LLC Members (owners) for your LLC.

Single-Member LLC: Enter “1”.

Multi-Member LLC: Enter the total number of Members in your LLC.

Note: If your LLC is a subsidiary owned by another company (or companies), enter the number of companies that own this LLC.

8c. If 8a is “Yes,” was the LLC organized in the United States?

Check off “Yes”. Although your LLC will be foreign-owned, your LLC will still be organized in the United States.

9a. Type of entity

Notes:

- We recommend that you have a conversation with an accountant before deciding how your foreign-owned LLC will be taxed.

- The term “foreigner” means non-resident alien.

- The term “U.S. person” means U.S. citizen or U.S. resident alien.

You will pay U.S. taxes based on what country you are from, what tax treaty is in place, how and where your LLC makes money, where your clients are, if your LLC has a “permanent establishment” in the U.S., if your LLC’s income is “effectively connected” to a U.S. trade or business, and much more.

Taxes are complicated for U.S. residents. Taxes are more complicated for foreigners, so please speak with a professional.

We are unable to provide tax assistance or tax advice. Thank you for understanding.

Single-Member LLC (foreign-owned):

If you have a foreign-owned Single-Member LLC you can choose to be taxed as a Disregarded Entity or as a C-Corporation.

– If you want your LLC to be treated as a Disregarded Entity, check off “Other (specify)” and enter “Foreign-owned U.S. Disregarded Entity” on the line.

– If you want your LLC to be treated as a C-Corporation, check off “Corporation (enter form number to be filed)” and enter “1120” on the line. After you receive your EIN you must then file Form 8832 to make your C-Corporation election.

Notes:

- All foreign-owned Single-Member LLC Disregarded Entities must file Form 5472 every year. More information here: Form 5472 and foreign-owned LLC.

- If your Single-Member LLC is owned by a foreign company, your LLC will be considered a branch or division of the parent company for tax purposes.

- If you are considering LLC taxed as C-Corporation (which is not very common), please see here: LLC taxed as C-Corp.

Multi-Member LLC (foreign-owned):

If you have a foreign-owned Multi-Member LLC you can choose to be taxed as a Partnership or a C-Corporation.

- If you want your LLC to be treated as a Partnership, check off “Partnership“.

- If you want your LLC to be treated as a C-Corporation, check off “Corporation (enter form number to be filed)” and enter “1120” on the line. After you receive your EIN you must then file Form 8832 to make your C-Corporation election.

Note: The same thing will apply to Multi-Member LLCs that are owned by a foreigner (or foreigners) and a U.S. person (or persons). You can choose for your LLC to be taxed as a Partnership or a C-Corporation. If you are considering LLC taxed as C-Corporation (which is not very common), please see here: LLC taxed as C-Corp.

9b. State & foreign country (if applicable)

State

Enter the state where your LLC was formed. Use the state’s full name. Don’t use an abbreviation.

For example: enter “Florida” (not “FL”).

Foreign country

Don’t enter anything here. Leave this blank.

Note: These instructions are non-US residents that formed an LLC in the US. These instructions are not for people who formed a company outside of the US.

10. Reason for applying

Select “Started a new business (specify type)” and enter the type of business your LLC will be engaged in to the right.

The best place to start is to look at the options in #16. If one of the default checkboxes in #16 matches your LLC’s business purpose, then just enter those words here in #10.

If not, enter a word (or words) you see fit, or you can use language from the NAICS Code, which is the business classification system used by the IRS.

The NAICS Code (North American Industry Classification System) is used by government agencies to identify a business’s line of work.

The IRS uses the NAICS Code for two primary reasons:

- Statistical purposes which are used to produce reports and industry analysis.

- In the case of an audit, the IRS will know how a business may compare against similar businesses in the same industry.

Please see NAICS Code for LLC for more instructions on how to find the NAICS Code for your LLC.

Note: Although your foreign-owned LLC may have multiple purposes, multiple products or services, and multiple revenue streams, just enter the primary business activity. And don’t worry, this doesn’t force your LLC into doing this forever. You can also change your LLC’s line of work at any time and you don’t need to update the IRS. This information is just needed on the LLC’s initial EIN application.

11. Date business started

Enter the date (month, day, and year) your LLC was approved by the state (aka the LLC effective date).

Look on your approved Articles of Organization, Certificate of Organization, or Certificate of Formation (different forms for different states) for your LLC’s approval date.

This is the date your business started, even if there wasn’t actual business activity.

It should be formatted like this: month/day/year. For example, if your LLC was approved on January 15th 2025, you would write 01/15/2025.

12. Closing month of calendar year

Most foreigners run their taxes on the calendar year, which is January through December. If that’s the case for your LLC, enter “December”.

13. Employees

Note: Most foreigners won’t have U.S. employees, so this section may not be applicable. Most foreigners will be entering “0” “0” “0” in #13.

When hiring a W-2 employee, as their employer, you must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment taxes on their wages.

On the other hand, you can hire 1099 independent contractors, in which you are not responsible for withholding and paying the above taxes.

We cannot help you determine whether someone is an employee or an independent contractor, however, you can speak with your accountant, in addition to reading the following information provided by the IRS: employee vs independent contractor.

If you plan to hire U.S. employees within the next 12 months, then enter the approximate number of employees in each category (Agricultural, Household, and Other). If there won’t be employees in a certain category, enter “0”. Don’t leave any field empty.

If you won’t be hiring U.S. employees within the next 12 months, you’ll need to enter a “0” “0” “0”.

An agricultural employee is someone who works on your farm and may take on various roles, such as harvesting agricultural or horticultural products, raising livestock, operating machinery, clearing land, and more.

A household employee is someone who works in or around your home on a regular and continual basis. Think of wealthier people who employ people in their home on a regular basis. Some examples are maids, housekeepers, babysitters, and gardeners. And keep in mind, this isn’t the same thing as hiring these people in an independent contractor scenario. For more information on what determines a household employee, please see this page from the IRS: household employees.

For the majority of foreigners who have (or plan to have) U.S. employees, their employees will likely fall within the “Other” category.

Important: Just being an owner of your LLC doesn’t make you an employee of your LLC.

14. Employment tax liability

Note: Most foreigners won’t have employment tax liability, so this section may not be applicable. Most foreigners will just leave the box unchecked.

If you have (or will have) U.S. employees, you’ll need to withhold and pay certain taxes to the IRS on behalf of your U.S. employees. Please speak with your accountant to first estimate your employment tax liability.

If your employment tax liability will be less than $1,000 in an entire calendar year, you can choose to file Form 944 annually (instead of filing Form 941 quarterly). If you’d like to do that, you’ll need to check the box in #14.

Leave the box unchecked in #14 if:

- You don’t have U.S. employees

- Your employment tax liability will be greater than $1,000

- Your employment tax liability will be less than $1,000, but you’d rather file Form 941 quarterly

15. First date wages or annuities were paid

Note: Most foreigners won’t have wages or annuities paid, so this section may not be applicable. Most foreigners will just enter “N/A”.

If you don’t have employees, enter “N/A”.

If you have U.S. employees and have already begun paying wages (or annuities), enter the date (month, day, year) they were first paid.

If you have U.S. employees, and you’re not sure when you will begin paying them, just enter an estimated date. Don’t worry, the IRS isn’t going to hold you to it and it won’t mess up your EIN application. You’re simply just giving them an approximate heads up.

16. Principal activity

You can make #16 match what you entered in #10.

Check a box if it’s applicable or select “Other (specify)” and enter whatever you entered in #10.

17. Explain #16 (merchandise, construction, products, or services)

#17 is just asking for a little more details regarding your LLC’s principal business activity.

The IRS wants to know, within that type of business activity, what is your primary product being sold, service being offered, type of construction being done, or line of merchandise you’re selling.

Just enter a few words to explain your LLC’s principal business activity.

18. Applied for an EIN before?

If you’ve applied for an EIN for this LLC before, select “Yes” and enter the previous EIN.

Most foreigners have not applied for an EIN for their LLC and they select “No.”

Third Party Designee

If you’re completing this form for your own LLC and you are the Responsible Party, then leave the following 4 fields empty:

- Designee’s name

- Designee’s telephone number

- Designee’s Address and ZIP code

- Designee’s fax number

Applicant’s signature, phone, and fax

Name and title: Enter your full name and title. If you are the LLC Member (owner), use the title “Member”. For example, “John Smith, Member“.

Signature and date: Sign your name and enter today’s date.

Applicant’s telephone number: Enter your phone number. This can be a home, office, or cell number. This number can be a U.S. phone number or it can be a non-U.S. phone number. If you’re entering a non-U.S. phone number, make sure to put the country code at the beginning of your number.

Applicant’s fax number:

- If you are submitting SS-4 by mail, you don’t have to enter a fax number. You can leave this empty.

- If you are submitting SS-4 by fax, then you must enter a fax number. The fax number can be a U.S. fax number or a non-US fax number.

Page 2

Page 2 is just an informational page and you don’t have to submit it to the IRS. Although, if you happen to send in Page 2, don’t worry, the IRS will just throw it away.

Make a copy of Form SS-4 before sending to the IRS

We recommend making a few copies of Form SS-4 before sending it to the IRS.

Just keep the copies with your LLC’s business records.

Include your LLC approval document

Along with Form SS-4, send the IRS your stamped and approved LLC documents.

Depending on the state where you formed your LLC, this document will be called one of the following:

- Articles of Organization

- Certificate of Organization

- Certificate of Formation

How to file Form SS-4

You can send Form SS-4 to the IRS in one of two ways:

- By mail

- By fax

The approval time for fax is 4 to 8 weeks.

The approval time for mail is 6 to 8 weeks.

Note: There is a delay because of the pandemic. It can take 2.5 to 3 months to get an EIN if you file by fax. It can take 3 to 3.5 months to get an EIN if you file by mail. After 62 days, you can call the IRS and ask for an EIN Verification Letter (147C). There is no other way to get an EIN for non-US residents, so please be patient.

If you’re mailing Form SS-4 to the IRS

You can mail Form SS-4 to the IRS from any country. It doesn’t have to be from the U.S. And it doesn’t matter what address you list on the envelope as your “from address”.

Just mail your completed and signed SS-4 form to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, Ohio 45999

Note: There is no street address (ex: “123 Main Street”) for the IRS. The above address is the complete address.

If you’re faxing Form SS-4 to the IRS

If you want to fax Form SS-4 to the IRS for a faster approval time, fax SS-4 to:

1-855-641-6935

No cover sheet needed:

You don’t need a cover sheet with your fax. You can just fax page 1 of Form SS-4 to the IRS.

Digital fax recommendation:

We recommend using Phone.com. You will get a digital fax service included when you sign up for a U.S. phone number. Their plans start at $13 per month.

After you sign up with Phone.com, you can just call their support team or do a live chat and they’ll show you how to send a digital fax. It should only take you a few minutes.

Note: You can use any digital fax service. It doesn’t have to be Phone.com. Phone.com is just the service we use and recommend.

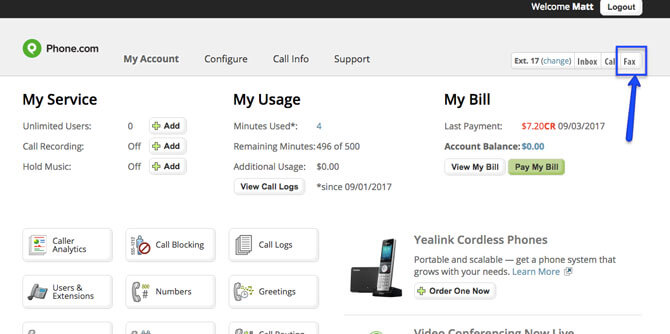

Once in your account, click “Fax” in the upper right corner.

Then enter the IRS fax number at the top, followed by your name and email.

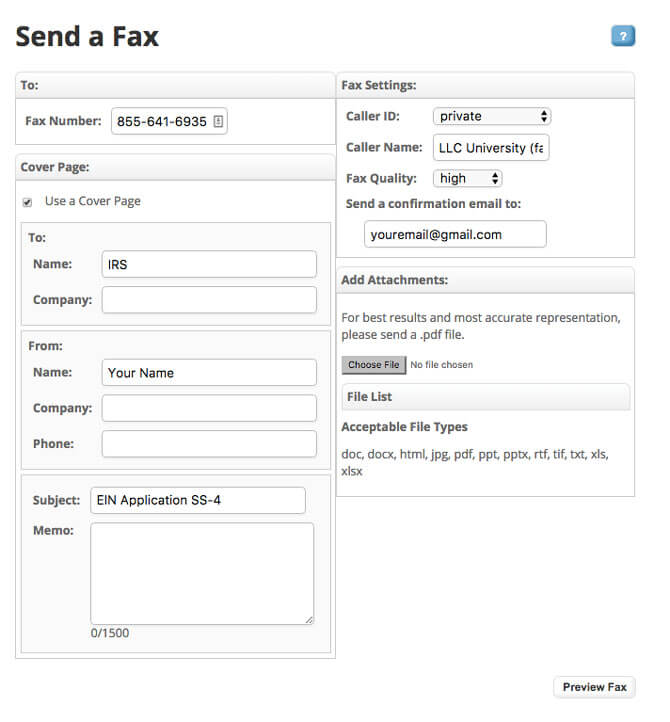

Here is a screenshot from the fax setting page:

Set the fax quality to “high” and then click “Choose File” under “Add Attachments”.

Once ready, click the “Preview Fax” button at the bottom.

Note: On the next page you’ll see a note about “FCC regulations require us to use a US geographical caller ID when sending faxes to toll-free numbers”. This is just Phone.com letting you know that your “from” fax number will be different. But don’t worry, this will not impact your EIN fax application with the IRS at all.

Click the “Send Fax” button at the bottom to fax your EIN application to the IRS.

Congratulations. Your EIN application has been sent to the IRS for processing!

Now you just need to wait for your EIN approval.

EIN approval time for foreigners

If you faxed Form SS-4 to the IRS

If you faxed Form SS-4 to the IRS, it can take 4 to 8 weeks before they fax you back your approved EIN Number.

Note: If you haven’t heard from the IRS within 62 days of your fax, you can call the IRS and ask for an EIN Verification Letter (147C). The 147C instructions are linked below. There is no other way to get an EIN for non-US residents, so please be patient.

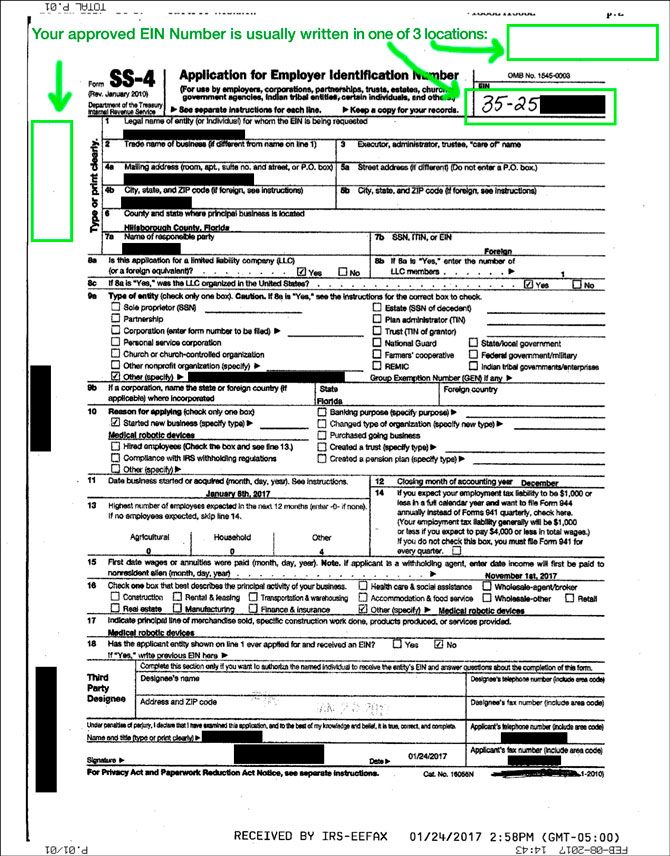

Your approved EIN Number will be handwritten on your SS-4. It looks unofficial, however, it is official.

Here is what the approved SS-4 fax looks like:

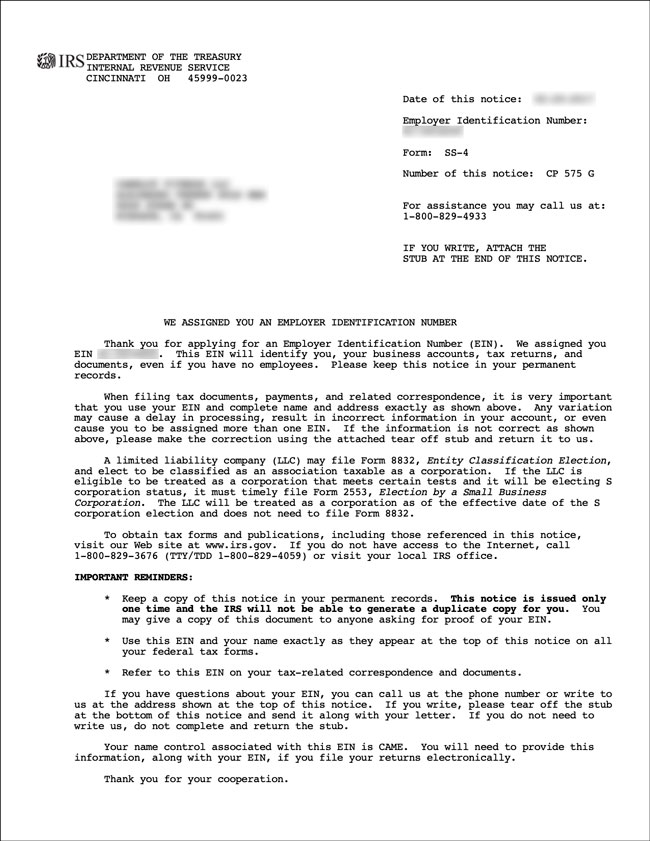

At the same time as the fax approval, the IRS will also mail you another confirmation letter. This letter is called the EIN Confirmation Letter (CP 575). The EIN Confirmation Letter will be mailed to the address you listed in 4a and 4b. This will usually arrive 1-2 weeks after you get the fax.

Here is what the EIN Confirmation Letter (CP 575) looks like:

If you have the approved fax, but have not received the EIN Confirmation Letter (CP 575), you can get an EIN Verification Letter (147C) while you wait for your EIN Confirmation Letter (CP 575).

The 147C serves the same purpose as the CP 575. They are both official letters from the IRS that show the approved EIN Number for your LLC.

Once you have your EIN Number, you can proceed to open a non-US resident LLC bank account and continue on with your business.

“SOLE MBR” or “MBR” on Confirmation Letter:

- For Single-Member LLCs, you’ll see “SOLE MBR” next to the EIN Responsible Party’s name.

- For Multi-Member LLCs, you’ll see “MBR” next to the EIN Responsible Party’s name.

- For more info, see What does SOLE MBR and MBR mean.

If you mailed Form SS-4 to the IRS

If you mailed Form SS-4 to the IRS, it can take 6 to 8 weeks before they mail you back your approval.

They will mail you an EIN Confirmation Letter (CP 575). It will be mailed to the address you listed on 4a and 4b. Please see above for a screenshot example.

Please be patient and don’t send SS-4 multiple times

At maximum, we have seen that it can take up to 2 months before an EIN is approved for a foreigner.

Please be patient and don’t resend SS-4 to the IRS. Doing so can create confusion and delay the approval time.

Also, please keep in mind that the IRS is busiest in January, March, April, and October, and December. So please be extra patient during these times of the year.

If you feel you’ve waited long enough, but still haven’t received your EIN approval, you can call the IRS and request an EIN Verification Letter (147).

How foreigners can open US LLC bank account

The three most common ways to open a US bank account are:

- Travel to the US and open a bank account in person

- Open an online payment account with Wise

- Open an online bank account with Mercury

For more details and the pros and cons, please see this page: How a non-US resident can open an LLC Bank account in the US.

Form 5472 requirements for Single-Member LLCs

If you have a foreign-owned Single-Member LLC (one owner), you must file Form 5472 and Form 1120 with the IRS every year.

If you don’t, the IRS can charge penalties.

For more information, please see this article: foreign-owned Single-Member LLC and Form 5472.

U.S. taxes for foreigners

This page does not discuss additional tax requirements that foreigners must follow in order to properly report and file taxes with the IRS.

You will need to hire an accountant who works with foreigners that have a U.S. LLC.

We recommend sending an email to Gary at GW Carter. His office specializes in working with non-US residents that have US LLCs.

Some of our readers (those with Single-Member LLCs and online businesses) may not have US tax filing obligations (except for Form 5472).

However, other readers (with Multi-Member LLCs) have to file a 1065 return with the IRS.

And other readers (depending on the type of business and what country they are from) need to file a 1040NR with the IRS and get an ITIN (Individual Taxpayer Identification Number).

Gary can help figure out your US tax obligations and he can file them for you.

Here are a few of the things that may apply to you:

- Sales tax and/or excise tax

- Effectively Connected Income (ECI)

- Fixed, Determinable, Annual, Periodic Income (FDAP)

- Conduct of a U.S. trade or business (USTB)

- Federal Withholding Tax for Foreign Nationals

- Foreign Bank Account Annual Report (FBAR)

- Payroll taxes (if applicable)

- Form 1042-S

- Form W-8 BEN

- US Nonresident Alien Income Tax Return (1040NR/1040NR-EZ)

- Federal and state unemployment taxes (if you have U.S. employees)

- Real Estate and Foreign Investment Real Property Tax Act (FIRPTA)

How to find an accountant for a foreign-owned LLC?

Besides our recommendation of Gary at GW Carter, you can also use the IRS Acceptance Agent list.

The IRS Acceptance Agent page lists tax professionals that work with foreigners. You’ll want to find about 5-10 tax professionals that are located in the same state where you formed your LLC.

Write down their information and call them all and ask a few questions (or email them). Each tax professional will give you a few minutes of their time since you are a potential customer.

Then compare their answers. This will help you eliminate bad candidates and find the best tax professional for your LLC.

Worldwide information sharing & tax treaties

The U.S maintains tax treaties with over 60 countries around the world. These treaties usually include disclosure agreements, where each government agrees to share information on a person or LLC’s taxable activity outside their country of origin when requested by his home country.

The agreements are in place to make sure that people and companies who earn income outside their home country file the proper returns and pay their taxes in both the U.S. and in their home country.

IRS Contact Information

You can call the IRS at:

The International Department at 1-267-941-1000. Hours are Monday through Friday, 6am – 11pm, U.S. Eastern Time.

OR

The EIN Department at 1-800-829-4933. Hours are Monday through Friday, 7am – 7pm, local time.

It’s important to know that the IRS will answer general questions, but they don’t give out tax advice and can’t explain every single requirement to you over the phone. For that reason, as we’ve mentioned earlier, it’s a good idea to find an accountant for help.

References

IRS: Taxation of Nonresident Aliens

IRS: Taxation of Nonresident Aliens 1

IRS: Publication 901 – US Tax Treaties

IRS: Employer Identification Number FAQs

IRS: United States Income Tax Treaties A to Z

IRS: Publication 519 – US Tax Guide for Aliens

IRS: Form 8833 – Treaty-Based Return Position Disclosure

US 26 CFR 1.513-1: Definition of Unrelated Trade or Business

US 26 CFR 1.864-4: U.S. Source Income Effectively Connected with US Business

IRS: Publication 515 – Withholding of Tax on Nonresident Aliens and Foreign Entities

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hi

If you fax the form to the IRS using phone.com, will the IRS send the form with the EIN number to your inbox of phone.com?

Regards

Hi Francisco, yes, correct. If you use Phone.com (or any online fax), you’ll list your fax number on the application. Then the IRS will fax you back the approval to your fax number, which will appear in your online dashboard (and you’ll likely get an email notification too). Also, the IRS will mail a physical copy of your EIN Confirmation Letter a few weeks after they send the fax. Hope that helps.

Hi thanks for this guide !

I sent the fax ( SS-4 pdf ) 57 days ago with hellofax but still not receive anything from the IRS. Is it possible to help me to check what’s wrong ?

Hi Ben, it’s likely that nothing is wrong and that the IRS is just a bit slow right now. Sometimes it can take 3-4 months to get the approval back. However, you can call and request a 147C EIN Verification Letter. This is the only way to have the IRS look into your EIN filing. Hope that helps.

Hi Matt,

Thank you for all of the helpful information. I’m an International Student and about opening an Airbnb business in the U.S. The landlord who doesn’t live in the property that I rented allows me to use part of the house for short term rental. I opened a LLC in California and got approved. The next step is get an EIN from IRS. Should I apply the form SS-4 for foreigners or the regular form to IRS. I have a SSN since I got work permit from USCIS. Thank you!

Hi R, I’d just get the EIN online (using your SSN), since the approval time is much faster, and it’s an easier filing.

Thanks for these great informations! I have a question, can I use the registered agents address? I am a long term traveller and have no address anywhere. I read on different websites, that it’s not possible to use the registered agents address for the application of the EIN. Is that right?

Hi Sandra, the IRS doesn’t really care, since they just treat it as a “mailing address”. It really comes down the Registered Agent and what they allow and are comfortable with. Which Registered Agent company are you using?

I use Northwest Registered Agent.

Hi Sandra, Northwest usually doesn’t mind. Having said that, there’s a small chance they (Northwest) may ask you to change this in the future. So you could use it for now and then if needed, you can change it later by changing your LLC address with the IRS.