Where does “SOLE MBR” and “MBR” show up?

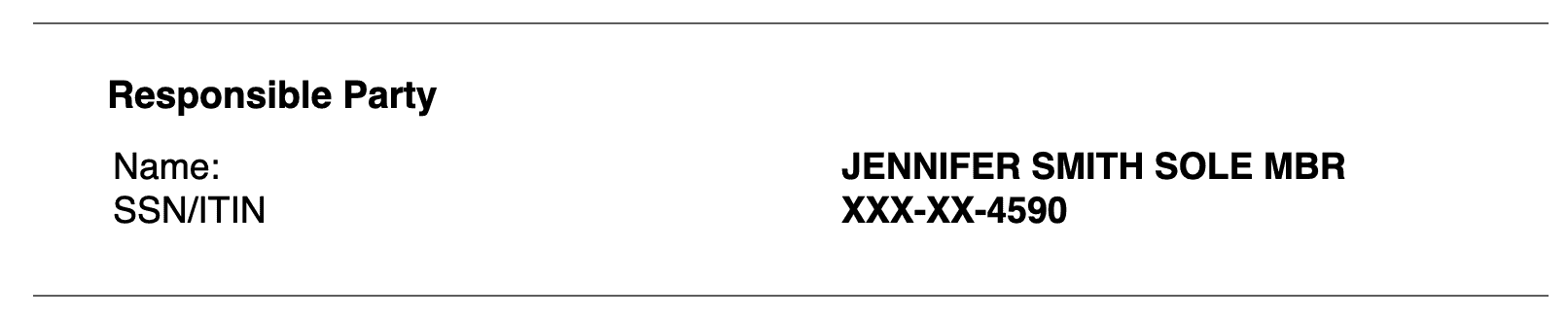

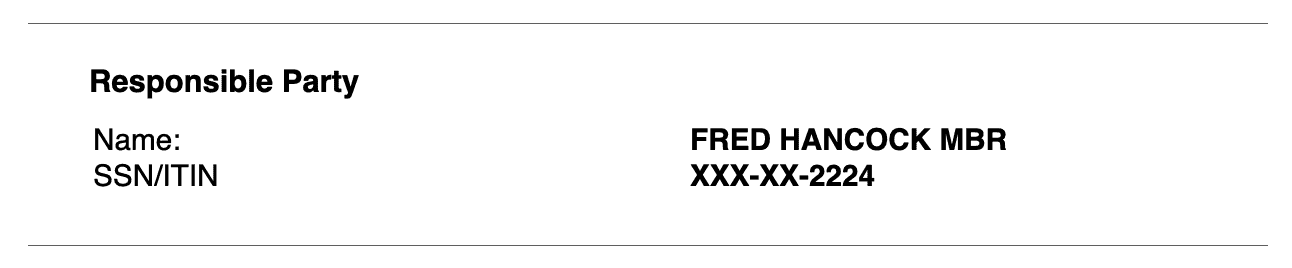

When applying for an EIN online, you’ll see the EIN Responsible Party listed on the review page.

Here are two examples:

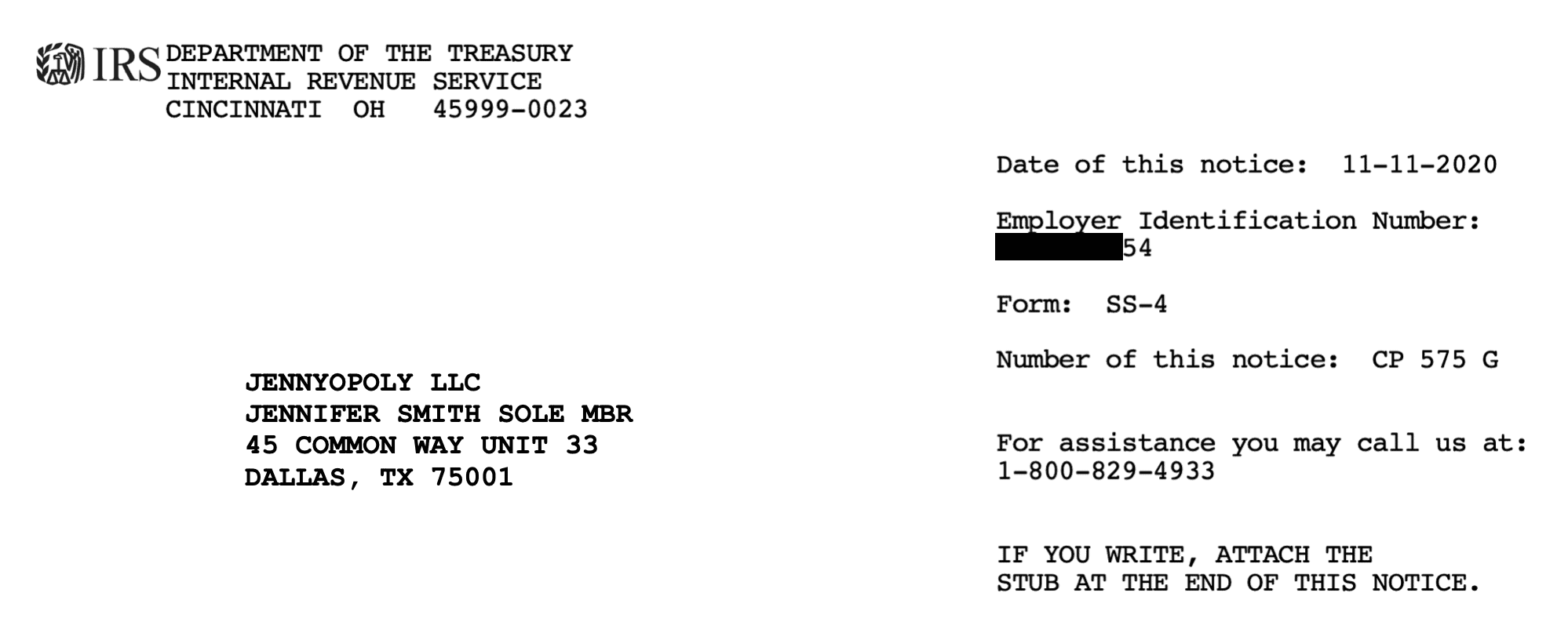

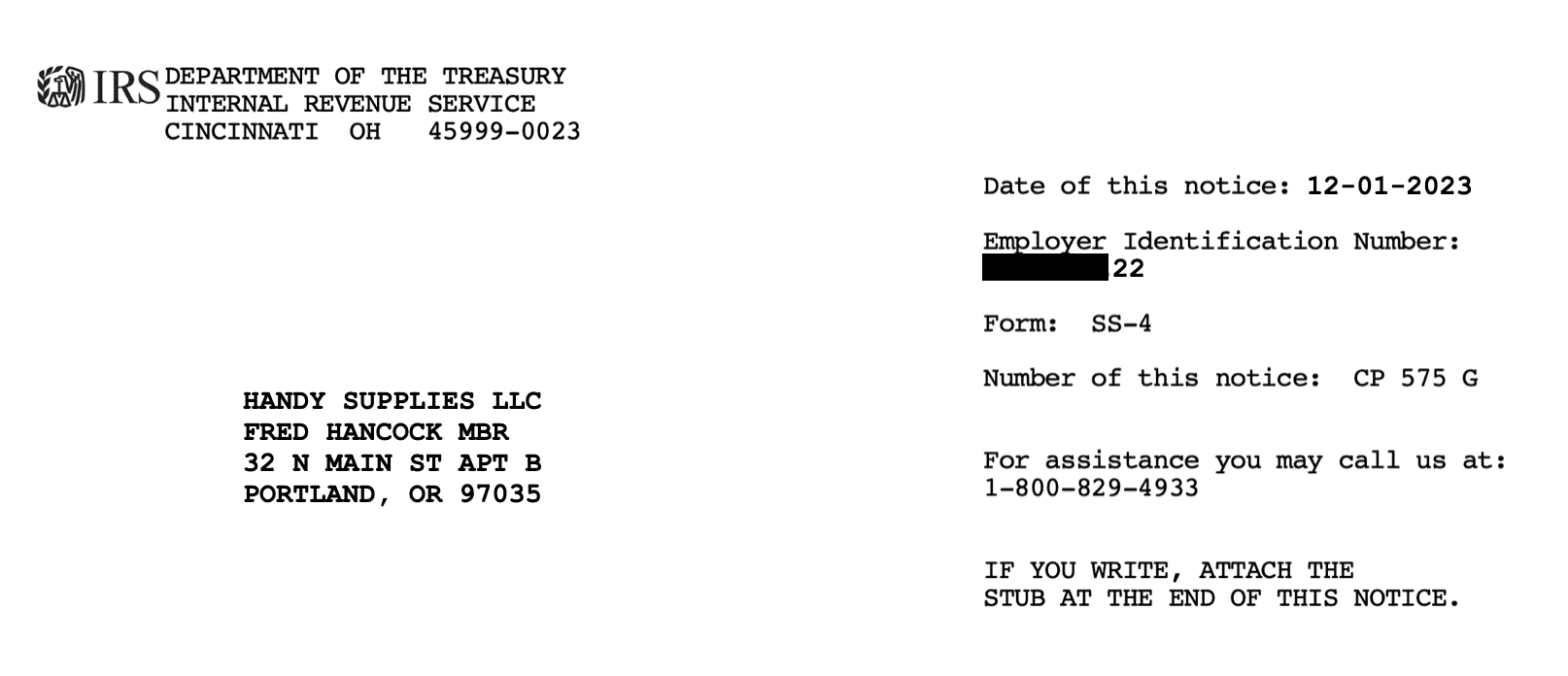

Or, if you already applied for an EIN, you’ll see the EIN Responsible Party listed at the top of your EIN Confirmation Letter (CP 575).

Here are two examples:

What does “SOLE MBR” and “MBR” for LLC mean?

These abbreviations are used by the IRS.

And they denote whether the EIN Responsible Party is the only Member of the LLC, or one of the Members in a Multi-Member LLC.

- “SOLE MBR” stands for Sole Member (in a Single-Member LLC)

- “MBR” stands for Member (in a Multi-Member LLC)

Note: The EIN Responsible Party is the “contact person” for your EIN. And an LLC Member is an owner of an LLC.

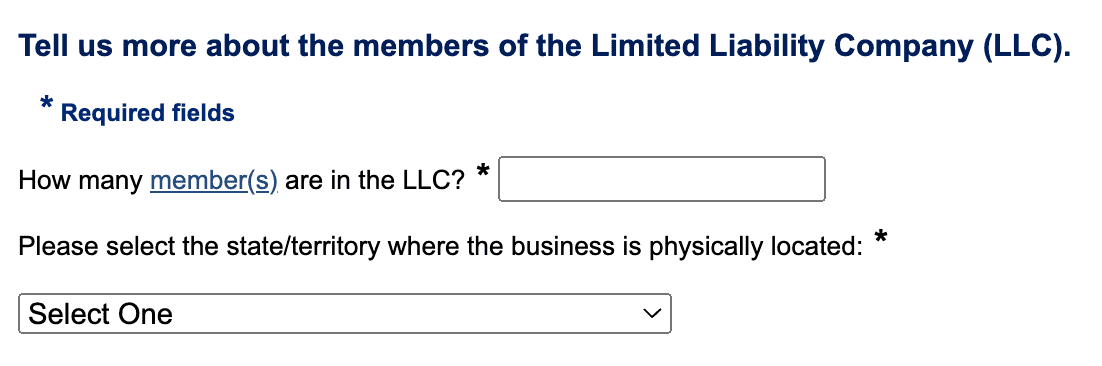

During the EIN online application, you’ll be asked “How many Member(s) are in the LLC”:

- If you enter 1, you’ll see “SOLE MBR” on your EIN Confirmation Letter

- If you enter 2 or more, you’ll see “MBR” on your EIN Confirmation Letter

Exception: If you’re a husband and wife Single-Member LLC (aka Qualified Joint Venture), you should see “SOLE MBR” on your EIN Letter, even though you may have entered 2 Members. Note, husband and wife Single-Member LLCs are only available in certain states.

So what’s all the confusion about?

Regardless of who you list as the Responsible Party (meaning whether or not they’re an actual owner of the LLC), that person will still have “SOLE MBR” or “MBR” followed by their name on your IRS letter.

This could mean two things:

- You’re confused (but there’s no action needed)

- Something is incorrect (and needs to be fixed)

Don’t worry.

I’ll explain everything below, and give solutions to the most common problems.

My EIN letter shows “MBR”, but I’m a Single-Member LLC

Problem: “I made a mistake when I got my EIN and listed 2 Members. However, it’s just myself. I’m the sole owner. Please help!”

Don’t worry. There’s a simple solution. This can be corrected on your tax return.

Solution: Just file your Schedule C with your 1040 tax return (instead of a 1065 Partnership Return). This will notify the IRS that there’s just 1 Member.

Note: You don’t need to file Form 8832 to change your entity’s tax classification.

Why does this work? Because technically, even though you may have told the IRS there were 2 Members, the LLC was really always a Single-Member LLC. And the IRS observes state law. So the minute your Single-Member LLC went into existence, it was by default, taxed as a Sole Proprietorship. You just happened to enter the wrong number of Members on the EIN application. As long as you file your taxes as a Single-Member LLC (using Schedule C with your individual 1040 return), the IRS will update their records.

My EIN letter shows “SOLE MBR”, but we’re actually a Multi-Member LLC

Problem: “My business partner and I formed an LLC, and then I got an EIN online. I must have messed something up and only told them there was 1 Member, because the EIN Letter has my name, followed by “SOLE MBR”. But there’s actually 2 Members. How do I fix this?”

Don’t worry. There’s a simple solution. This can be corrected on your tax return.

Solution: Just file a 1065 Partnership tax return for your Multi-Member LLC.

Note: You don’t need to file Form 8832 to change your entity’s tax classification.

Why does this work? Because technically, even though you may have told the IRS there was only 1 Member, the LLC was always a “true” Multi-Member LLC. And the IRS observes state law. So the minute your Multi-Member LLC went into existence, it was by default, taxed like a Partnership. You just happened to enter the wrong number of Members on the EIN application. As long as you file your taxes as a Multi-Member LLC (using a 1065 Partnership return), the IRS will update their records.

My EIN letter shows “SOLE MBR”, but we’re actually a husband and wife Qualified Joint Venture LLC

Problem: “My wife and I are in California and started an LLC. We had no idea what we were doing when we filed for our EIN. Our EIN Confirmation Letter only has my wife’s name on it with “MBR” behind it, not “SOLE MBR”. In your experience does this mean that we filed as a Multi-Member LLC instead of a Single-Member LLC and need to file a 1065 Partnership Return (and include our K1s in our 1040)?

From this question, I don’t know for sure if the couple intended to be taxed as a Qualified Joint Venture LLC – aka Single-Member husband and wife LLC – (which is allowed under California law) or if they intended to be taxed as a Multi-Member LLC. Either way, the solution is simple.

If they want to be taxed like a Qualified Joint Venture:

Then there is nothing they need to do. Meaning, they don’t need to notify the IRS. They can simply file taxes on a Schedule C as a Single-Member LLC.

If they want to be taxed like a Multi-Member LLC:

There is also nothing they need to do. Meaning, they don’t need to notify the IRS. They can simply file a 1065 Partnership Return.

My LLC is owned by another LLC, and it shows “MBR” (or “SOLE MBR”) next to someone who isn’t a Member

Problem: “Hello, I have a Multi-Member LLC (the “Parent” LLC) that 100% owns another LLC (the “Child” LLC). I was applying for the EIN for the Child LLC, and I listed one of the Members of the Parent LLC as the Responsible Party. But now the EIN Confirmation Letter shows that person and it says “MBR” next to their name. But they aren’t a Member of the Child LLC. What should we do?”

This is very common. And there’s actually nothing to worry about. And no actions are needed.

Here’s the backstory:

Prior to 2018, you used to be able to list an entity (and its EIN) as the EIN Responsible Party for another entity.

However, after 2018, the IRS no longer accepts entities as the EIN Responsible Party. Instead, they only allow a person to be listed.

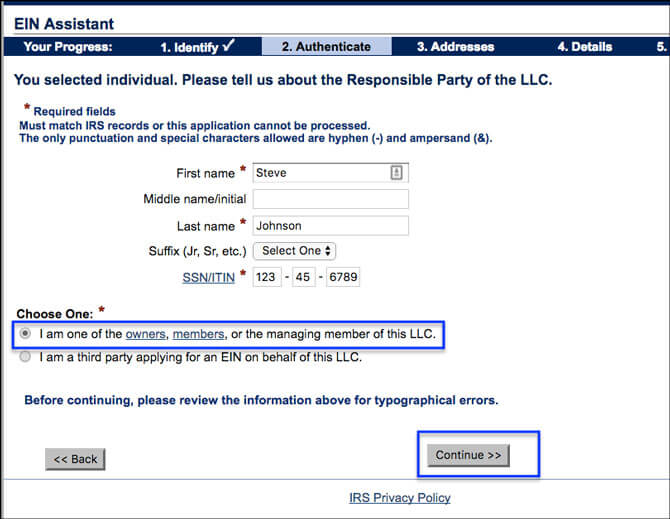

But when you apply for an EIN, you’re only presented with these two options:

- “I am one of the owners, members, or the managing member of this LLC”

- “I am a third party applying for an EIN on behalf of this LLC”

There basically isn’t an option for “This LLC is owned by another LLC”.

So while it seems incorrect, the best thing to do is:

- select “I am one of the owners, members, or the managing member of this LLC“.

- and list one of the owners of the parent LLC as the Responsible Party

And yes, this will put “SOLE MBR” or “MBR” to the right of this person’s name (even though they aren’t an owner). But you don’t have to worry about this.

Simply have your accountant file the taxes correctly. Meaning, the subsidiary LLC (aka Child LLC) will simply be taxed as a brand/division of the Parent LLC.

Matt’s thoughts: I still can’t believe the IRS hasn’t fixed this issue. It’s been years. All it would take is for them to add another option to select “The LLC is owned by another entity, and I’m the owner – or Responsible Party – for that entity“. But the IRS is big, and busy… so I’m not sure if they’ll ever get around to this.

But again, don’t worry. This is totally okay if it says “MBR” or “SOLE MBR” to the right of your name, but you don’t own the LLC. The IRS doesn’t think you personally own the Child LLC. The EIN Confirmation Letter is not “permanent” in that way. Instead, they rely on the information you submit to them (about ownership) in the LLC’s tax returns.

The wrong person is listed as the EIN Responsible Party

For all of the examples below, they all have the same solution:

Complete Form 8822-B and mail it to the IRS in order to change the EIN Responsible Party.

You can find the instructions here: How to change the EIN Responsible Party.

A 3rd Party Designee is listed as the EIN Responsible Party

Problem: “I have an LLC, and a 3rd Party Designee got my LLC’s EIN for me. When the confirmation letter came from the IRS, it listed the 3rd Party Designee’s name next to “SOLE MBR”. What should I do?”

If the 3rd Party Designee is listed as the Responsible Party (and it says “SOLE MBR” or “MBR”), you can change this to yourself. This is what I recommend doing.

Action: File Form 8822-B to change the EIN Responsible Party to yourself.

My Registered Agent is the Responsible Party

If your Registered Agent is listed as the Responsible Party on your EIN Confirmation Letter, you can change this to yourself.

Action: File Form 8822-B to change the EIN Responsible Party to yourself.

The person who formed my LLC is listed as the Responsible Party

The person who formed your LLC is known as the LLC Organizer. And typically, they shouldn’t be the EIN Responsible Party for your LLC. You can change this to yourself.

Action: File Form 8822-B to change the EIN Responsible Party to yourself.

I’m the Manager of the LLC, but it shows “SOLE MBR” next to my name

It’s technically better to have a Member be the EIN Responsible Party. You can change this to one of the Members.

Action: File Form 8822-B to change the EIN Responsible Party.

Other common problems (and how to fix them)

Below are other common issues with EIN Confirmation Letters and how to fix them.

There’s a typo in my name on my EIN Letter from the IRS

Problem: “Please assist me. My name is spelled out ‘Zaeem’ instead of ‘Azeem’. How can this be changed?”

Unfortunately, this happens sometimes and the IRS makes a mistake. You’ll need to mail them a letter and let them know there is a typo. They’ll then mail you back a letter letting you know it’s been fixed.

Your letter must include:

- Date

- LLC Name

- EIN Number

- Your mailing address

- Your signature

- Your name and title

- Use the title “Owner” if you have a Single-Member LLC

- Use the title “Partner” if you have a Multi-Member LLC

Mail your letter to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201

Note: Please allow 60 to 90 days before you hear back from the IRS.

My EIN Letter doesn’t have “LLC” in the name

If you forgot to add “LLC” in your business name when applying for your EIN, there are a few solutions.

If you already formed an LLC:

Then you just need to mail a letter to the IRS and tell them to update it. Please see Change your LLC name with the IRS.

If you didn’t form an LLC:

Just getting an EIN from the IRS doesn’t form your LLC. LLCs are formed at the state-level. Only after your LLC is approved by the state, should you then apply for an EIN.

So if you have an EIN Number from the IRS, but no LLC yet, there are a couple solutions:

- You can form an LLC with the identical name, and if it’s approved, you can use the current EIN Number you have. The IRS doesn’t care about the order. Meaning, it’s okay to get an EIN Number for a (non-existent) LLC first, and then form an LLC (with the identical name). As long as the names match, there’s no issue.

- If you try to form an LLC with the identical name, but it’s rejected by the state, this won’t work. You’ll need to form an LLC with a different name. Then get a new EIN Number from the IRS for that new name. Then cancel your old EIN.

- If you want to form an LLC with a different name, then form that LLC first. And after it’s approved, get a new EIN Number from the IRS. Then cancel your old EIN (use the link above).

Summary

Hopefully that has cleared things up regarding any confusion on “SOLE MBR” and “MBR” appearing on letters from the IRS.

Frequently Asked Questions

What does Sole MBR mean?

Sole MBR means “Single-Member LLC” and it’s used as an abbreviation by the IRS. Said another way, it’s a one-owner – or one-person LLC.

What is a Sole Member LLC?

A Sole Member LLC is an LLC with one owner. That owner can be a person or another company. A Sole Member LLC is more commonly known as a “Single-Member LLC”.

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

I have an SDIRA checkbook LLC, owned by my Trust Custodian SDIRA account. I don’t personally own the LLC. The sole owner/member is my SDIRA account. I’m in the Operating Agreement as the Manager, with no management fees or financial interest in the LLC. The organizer had me sign the SS-4, and it said “MANAGER” after my printed name, above my signature. But the IRS sent the CP 575 with “SOLE MBR” after my name. As manager, I believe it is correct that I am the EIN responsible party, but I am certainly not a member/owner, and I’m wondering whether I should apply to have it changed to say “MANAGER” after my name.

Hi Hillary, I understand. You did everything correct. And this is just a function of the IRS. It will only say “SOLE MBR” or “MBR”. It will never say “Manager”. But it actually doesn’t matter and doesn’t impact your SDIRA checkbook LLC. Hope that helps.

We setup 3 LLC. One is holding company the is spouse and myself. We then setup two single member LLC owned 100% by the holding company. We then filed for EIN for all three. Holding Company EIN came back correct as Multi-Member. The two child LLC, one came back my Spouse Sole Member and the second came back with Clinton Wooton MBR. We know have two businesses that are required to file form 1065 instead of one. Our accountent says we need to correct the child LLC using form 8832 before we can file taxes to single member LLC. We wanted simply one holding company (Parent) with two single member (Child Disregarded Entities) LLC. Reading your post, it looks like I should be able to file using the Holding Company that includes both child EIN and I will be fine. Is my understanding correct?

Clint

Hi Clint, yes, you are are 100% correct. Just file as you wish. The part about needing to file an 8832 is incorrect. As per the IRS rules, they recognize “what is”, not what abbreviation is listed next to the EIN Responsible Party. So you’re all good. I know, it’s super confusing lol.

Any insight on an LLC whose EIN letter has no responsible party written? It just has the company name and address.

This is a new client, and since the letter doesn’t say what form to told it appears that it’s a single-member llc but I can’t confirm as it doesn’t have SOLE MBR written, I assume because there is no responsible party listed.

The letter doesn’t say which form** to file, that is.

Hi Tania, that’s interesting. My first time hearing of something like this. However, it’s pretty simple. Just file for however the LLC is. If it’s a Single-Member LLC, just file the LLC’s return within the personal 1040. If it’s a Multi-Member LLC, just file the 1065 Partnership Return and issue K-1s. Hope that helps :)

Hi Matt,

we recieved our EIN for our LLC, i created it under my name only but my wife and I live in california.. i’m the solembr on the ein but i’m assuming she’s still eligble to submit expenses incurred for the business related training on our tax return correct? we file joint returns and i was under the assumption this would be ok given community property/common law rules for california

Hi Raul, yes, you’re correct. However, it’s also a good idea to send a letter to the IRS letting them know you want be taxed as a Single-Member LLC (aka Qualified Joint Venture LLC). We have a letter you can send on this page: husband and wife LLC. Hope that helps.

I have an EIN for an LLC. It shows SOL MBR. The LLC receives consultant payments as 1099 and has expenses. When filling out a W9, should it be as a Sole Proprietorship or an S Corp? Does the SOL MBR on the EIN restrict in anyway whether a W9 is a SP or S Corp?

Hi Michael, no, the “SOLE MRB” on the EIN Confirmation Letter doesn’t restrict your LLC. For example, if you decided an LLC taxed as an S-Corp is something you wanted, you could make that election with the IRS. (However, there are some costs and a number of extra administrative items to handle with an LLC/S-Corp, so best to read that article I linked).

Filling out a W9 for an LLC is not about making a tax election though. It’s about “reflecting” the current tax election/information about your LLC. So in this case, you’d be checking off the “Individual/sole proprietor” box in section 3a. Hope that helps.

My partner and I have a 2 member LLC, when applying for the EIN they asked if we were married, since I selected no, they reclassified our LLC as a partnership only allowing me to enter information as an individual. I entered my information, however, it never directed me to enter his information. When the EIN was issued it has our business name, then under it, my name followed by mbr, which I understand is for a multi-member LLC. and accurate. Is there a problem though that his name doesn’t appear anywhere on the EIN issued? His name is on the LLC and all other documents we had to obtain. Thank you.

Hi Tabatha, all is 100% okay here. This is totally normal. Technically, the IRS just needs the name of 1 person to be the EIN Responsible Party. They get the rest of the names and addresses in the tax return ;)

Thank you, I appreciate you taking the time to respond.

☺️

You’re very welcome Tabatha :)