Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Tax registration is required for your Basic Business License

We will discuss how to get your Basic Business License (in an upcoming lesson), which is a requirement for every District of Columbia LLC.

However, before you can apply for your Basic Business License, you need to register your LLC with the Office of Tax & Revenue (OTR).

Once your LLC is registered with OTR, they will mail you a Notice of Business Tax Registration.

In the upper-right hand corner of this letter will be your LLC’s Notice Number.

You’ll need this Notice Number in order to apply for your Basic Business License.

Tax Registration with the OTR (FR-500)

In order to register your LLC with the OTR, you need to file an FR-500.

The FR-500 can only be filed online.

FR-500 filing fee: $0

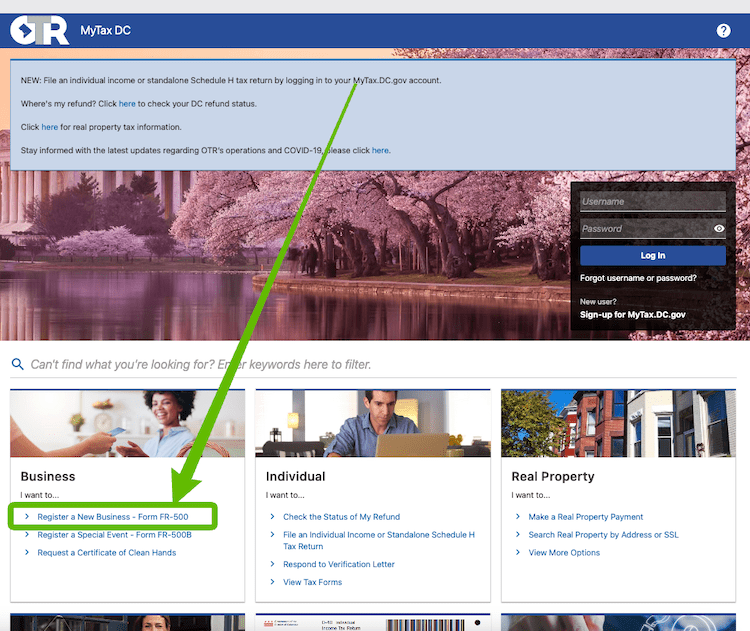

Get started: Go to the MyTax homepage and click “Register a New Business: Form FR-500” (it’s in the middle of the page).

The FR-500 will ask you a series of questions about your DC LLC.

Note: Unlike some of our LLC formation lessons, we cannot walk you through the tax registration process step-by-step. Your answers to the questions will vary widely depending on location, industry, and how you make money.

We have explained some of the topics and made some notes below to help you understand the form. However, if you have any questions while going through your filing, we recommend speaking with an accountant.

Business Activity Code (NAICS)

An NAICS Code (North American Industry Classification System) is used by government agencies to identify an LLC’s line of business activities.

An NAICS Code is a 6-digit number. For example, the NAICS Code for Jewelry and Silverware Manufacturing is 339910.

You’ll need to choose an NAICS Code for your LLC to enter in your FR-500.

You can use the NAICS Identification Tool to find an NAICS Code for your LLC.

How to Use the NAICS Identification Tool: Search

In the “NAICS Keyword Search” box, enter a word or two that describes your LLC’s activities. For example: “nail salon”, “real estate”, or “consulting”. Look through the search results and find an NAICS Code that most closely resembles your LLC’s business activities.

How to Use the NAICS Identification Tool: Browse

Instead of searching by keyword, you can also browse all NAICS Codes by industry. Just scroll below the search box and you’ll see a list of all the industries. Click the industry to find the specific NAICS Code that most closely resembles your LLC’s business activities.

Help with NAICS Codes

If you need help determining your LLC’s NAICS Code, you can call the US Census Bureau at 888-756-2427.

Address validation

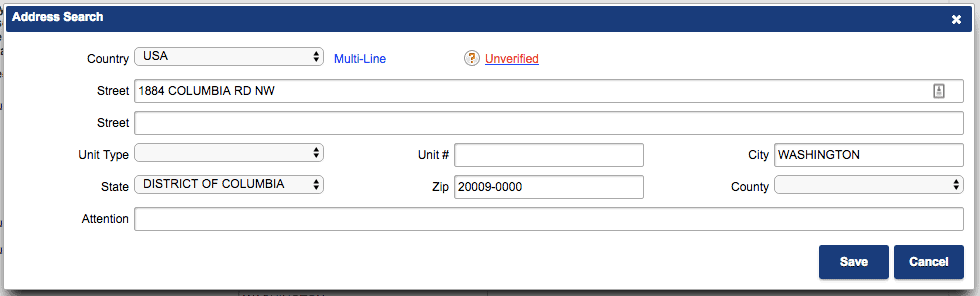

In Step 3 (General Business Information), you need to validate your address with the system. All this does is cross-reference your business address with the USPS database. The OTR does this to ensure tax notices can be properly delivered through U.S. mail.

Note: Your District of Columbia LLC’s business address can be a home address or an office address.

It’s easy to miss, but underneath the address fields is a “Validate” button.

After you enter your business address, click “Validate” and a pop-up box will appear. Click the “Unverified” red link in the upper right. It will look like this:

Then another pop-up box will appear. If the address is correct, select the “Verified” address and then click “Save“.

Date present business commenced in DC or date expected to begin

Towards the bottom of the Step 3 page (General Business Information), you’ll see a question about the date business commenced (started) or will start.

You can use the date that your LLC was approved (or the LLC Effective Date, if applicable). You can find this date on your Articles of Organization or Certificate of Organization.

Officers

In Step 4 (Officers), this is where you’ll enter the owner(s) of your LLC. Owners of an LLC are called LLC Members.

Make sure to add all of your LLC’s Members. When adding a record, in the “Title” drop down menu, use the title “Owner“.

Each owner will need to enter their Taxpayer ID Number, such as their SSN or ITIN.

What if I don’t have an SSN or ITIN?

If an LLC Member doesn’t have an SSN or an ITIN, just add any Members that have a Taxpayer ID Number now. Then later, edit your LLC’s tax profile by logging into MyTax and adding the other Member’s information.

If you need an ITIN, please see: how to apply for an ITIN.

Date on which your taxable year ends

You’ll see this question in Step 5 (Business Tax Registration).

Most filers run their fiscal year as January through December. This is known as the “calendar year” for tax purposes.

If that’s the case for your business, then the date your taxable year ends will be December 31 2025 (the current year).

If you have a different fiscal year, then enter the last date of your fiscal year.

Tax Registration Approval & Notice Number

After you submit FR-500 to the OTR, they will review and process your registration.

Then within 3 – 5 business days, you will receive a “Notice of Business Tax Registration” in the mail. This is an official notice that your District of Columbia LLC has been successfully registered with the OTR.

This notice will be sent to the Business Address that you entered in the FR-500.

There is a very important code (composed of letters and numbers) in the upper-right hand corner of your Notice of Business Tax Registration. It’s called your “Notice Number“.

You will need your Notice Number in order to apply for your Basic Business License, which we’ll discuss in an upcoming lesson.

Certificate of Occupancy or Home Occupation Permit

After you file FR-500 with the Office of Tax & Revenue and receive your Notice Number, you will need either a DC LLC Certificate of Occupancy or Home Occupation Permit. Our lesson will help you figure out which one is right for your business, and help you apply for it.

Office of Tax & Revenue Contact Info

If you have any questions you can contact the Office of Tax & Revenue at 202-727-4829. Their office hours are 8:15am to 5:30pm, Monday through Friday.

References

DLCP: Verify Clean Hands

DC Office of Tax and Revenue: Certificate of Clean Hands

DLCP: Tax Registration & Clean Hands Certification Details

DC Office of Tax and Revenue: Certificate of Clean Hands Webinar

DC Office of Tax and Revenue: Need a Certificate of Clean Hands from the District of Columbia

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

District of Columbia LLC Guide

Looking for an overview? See District of Columbia LLC

Need to save time?

Hire a company to form your LLC:

Northwest ($39 + state fee)

LegalZoom ($149 + state fee)