Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

A Georgia business license gives your Limited Liability Company (LLC) permission to operate in a certain location or within a specific industry.

We can’t walk you through any applicable license applications step-by-step, because every business is unique. But we do provide helpful resources like:

- information about state licensing rules

- instructions for researching municipal licenses

And if you want to just hire a company to do the research for you, we have a recommendation below.

Georgia Business License Requirements

After you form a Georgia LLC, you may need to obtain a business license or permit.

Your requirements are determined by the industry you are in and where your Georgia Limited Liability Company is located.

Because of the large number of industries and all of the municipalities in Georgia, it’s not possible for us to explain them all. However, you can use the search tools below, call your local municipality, or hire a company for help.

Need to save time? We recommend hiring MyCompanyWorks (for $99) to handle the business license research for you.

How to get a Business License in Georgia

You can obtain a business license in Georgia by applying with the relevant licensing or regulatory agency. The agency you apply with will depend on where your business is located and what business activities it engages in.

The business license application typically requires basic information, such as your LLC name, EIN Number, business address, and contact information. Many also include a questionnaire that asks about your business activity.

There are three main licensing jurisdictions:

- State licensing

- Local licensing, such as county, city, township, etc.

- Federal licensing

Does Georgia Require a Business License?

That depends on where your business is located, and what it does.

There are two types of state-level business licenses:

- a general business license

- and an occupational license

Georgia General Business License

Some states have a general license requirement, which means all businesses operating in those states must have the license, regardless of what they do.

But good news: Georgia doesn’t require a general license to do business in the state.

Meaning, your Georgia LLC doesn’t need a general state business license. But depending on what type of business you run, your LLC might need an occupational license.

Georgia Occupational License

Most states have occupational business license requirements. This means a license or permit may be required depending on what your business does or what your occupation is. For example, if you sell used cars, or run a hair salon, you may need an occupational business license. But a license may not be required for other types of businesses.

Most business licenses in Georgia are issued by the Secretary of State’s Licensing Division.

You can review the list of licensing boards that are part of the Professional Licensing Boards Division to help you determine if your Georgia business needs an occupational license or permit. Once you go to the relevant licensing board’s website, they will have a fee schedule and instructions for applying.

You can apply for a business license using Georgia Online Application Services.

The Professional Licensing Boards Division has created guides to show you how to apply for specific licenses. Search the results here to find your industry’s Licensing How-To Guide.

You can also contact the Professional Licensing Boards Division with questions.

Professional Licenses Not Issued by the Secretary of State

Many Georgia business licenses are administered by the Licensing Division of the Secretary of State.

However, some professions have licensing agencies that aren’t part of the Secretary of State, including:

- certified nurse aid, dentist, pharmacist, physician

- insurance agent

- lawyer

- pesticide applicator

- real estate agent

- vehicle tag & title business

- installment lender

- water well contractor

The Secretary of State has links to the licensing agencies for these professions on this page. Just scroll down to the box titled “Professions Not Licensed by the Georgia Secretary of State.”

How much is a Georgia Business License?

Georgia doesn’t have a general business license at the state level, so there are no fees there.

However, your business may need a state-level occupational license or municipal-level license or permit to operate. The filing fee for these licenses will vary depending on where you’re doing business and what industry you’re in. To be honest, we can’t predict your specific Georgia business license cost.

For example, licenses issued by a county that contains a large city are usually more expensive than licenses in less populated, rural counties. And licenses for regulated industries, like child care facilities, are usually more expensive than generic business licenses.

But your LLC might not need a license or permit at all. So your Georgia business license cost could be $0.

See LLC Cost in Georgia to learn about all the possible LLC fees.

Municipal Business License

Municipal business licenses can be issued by the city, town, county, parish, township, borough, etc. We refer to all of these as a “municipality” to keep things simple.

There are two types of municipal business licenses:

- general business license

- industry-specific license

For example, if a municipality has a general business license requirement, all businesses operating in that municipality must have the license, regardless of what they do.

And if a municipality has industry-specific business licenses, a license or permit may be required depending on what your business does. For example, if you operate a food truck, or run a daycare, you may need an industry-specific municipal business license. Or if you’re purchasing or leasing real estate, you may need a zoning permit.

But a license may not be required for other types of businesses, like making wedding invitation templates or offering marketing consulting.

The Georgia Secretary of State’s First Stop Business Guide provides an overview of licensing rules in the state. This guide helps you find the right local office to contact for a municipal business license.

You can contact your municipality to check on their local licensing requirements:

- Association of County Commissioners of Georgia: Georgia County Information

- Georgia Municipal Association: Member Cities

Georgia Tax Registration

Most businesses in Georgia need to register for one or more tax identification numbers or tax licenses. Luckily, the process is centralized in one filing system through the Georgia Department of Revenue.

You can register for business tax with the Department of Revenue through their online Georgia Tax Center.

The Department of Revenue Registering a New Business page will help you with this process. You can also refer to the Business Registration FAQ.

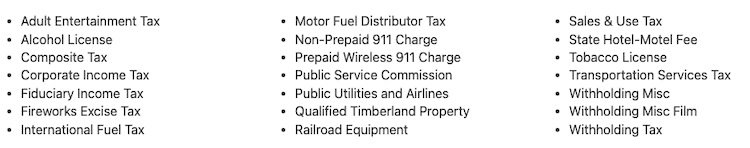

You can use the Georgia Tax Center to register for a variety of business taxes:

Georgia Sales Tax License

If you sell products to consumers in Georgia, you may need to collect sales tax and file a Sales and Use Tax Return.

If your business activities are subject to Georgia sales and use tax, your LLC must register with the Department of Revenue. You will use the same process described above for other business tax registrations.

Note: This requirement will apply whether you sell products online or in a physical location in Georgia.

For additional information about the Sales Tax License, check out these resources from the Georgia Department of Revenue:

Tip: Save time by hiring an expert. We recommend using TaxJar. They'll help you register for, collect, and pay sales tax.

Do I need any federal business licenses?

Most businesses in Georgia don’t need a federal business license. However, certain industries do need federal licenses:

| If your business… | Contact this agency about business licenses |

|---|---|

| Transports animals, plants or biotechnology over state lines | Department of Agriculture |

| Imports or exports animal products, wildlife, or products derived from wildlife (including fish) | Fish and Wildlife Service |

| Fishes commercially | Fish and Wildlife Service |

| Broadcasts on radio or TV | Federal Communications Commission |

| Makes alcohol and sells it at a retail store | Tobacco Tax and Trade Bureau |

| Makes or sells firearms, ammunition or explosives | Bureau of Alcohol Tobacco Firearms and Explosives |

| Transports cargo by sea | Federal Maritime Commission |

| Transports goods or people by air | Federal Aviation Administration |

Check out the Small Business Administration’s Licenses and Permits page for a full list of industries with federal license requirements.

If your business isn’t one of these special cases, then the only federal requirements are that your LLC get an Georgia EIN Number (aka Federal Employer Identification Number) and that you file taxes.

Georgia Business License FAQs

How much does a business license cost in Georgia?

Georgia doesn’t have a general business license for LLCs, so there are no fees there.

If your business has to get an occupational license or municipal (city or county) permit, the fees are hard to predict. Depending on your LLC’s location, and what type of business or industry you’re in, the fee varies.

And you might not need a business license at all!

Unfortunately, we can’t say what your LLC’s business license costs would be, because it depends on several factors and the cost of Georgia licenses varies.

Is an LLC considered a business license?

No, an LLC is not a business license. They are two completely different things.

An LLC is a type of business structure created by filing a document with the state government.

And a business license is a document that gives a person, or a company, the right to transact business. It doesn’t create an LLC.

Does a Sole Proprietor need a business license in Georgia?

Sometimes a new business owner chooses to operate as a Sole Proprietorship in Georgia instead of an LLC.

Even if you’re just trying out a business idea as a Sole Proprietorship, you may still be subject to license requirements at the state and municipal levels. It just depends on what you will be doing, and where you will be operating your business.

Does the Georgia Secretary of State provide a business license?

Yes. Most Georgia Licensing Boards are part of the Secretary of State. Only a few professions are licensed by agencies that aren’t part of the Secretary of State.

However, there is not a “general” business license that the Secretary of State issues to every business. Only certain types of businesses (companies in certain industries or professions) have to get a business license in Georgia.

So your LLC might not need a license from the Secretary of State. It depends what your business does.

For more information, or to determine if there is a Georgia business license cost for your business, we recommend contacting the appropriate licensing board and/or your local government agency. For example, your local county or city government will have information about any local licenses.

How to start an LLC in Georgia

Here are the steps to starting an LLC in Georgia:

- Select a business name for your Georgia LLC

- Choose your Registered Agent

- File the LLC Articles of Organization with the state

- Complete and sign an LLC Operating Agreement

- Get a Tax ID Number (EIN) from the Internal Revenue Service (IRS)

- Open an LLC bank account

- Check whether you need a business license or tax permits in Georgia

References

Georgia Secretary of State: Licensing

Georgia Dept. of Revenue: Sales & Use Tax

Georgia Secretary of State: Georgia Licensing Boards

Georgia Secretary of State: First Stop Business Guide (PDF)

Georgia Code: Chapter 295, Professional Licensing Boards

Georgia Dept. of Revenue: Registering a Partnership, Corporation or LLC

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Im starting up my epoxy flooring business soon and im putting in for my LLC do I need a business license if its based out of my home at the moment???

Hi Mitch, you don’t need a state-level business license. But you may need one from your city, even if you’re running the business from your home. However, you can still proceed with the LLC formation, and look into the local/city business license afterward.

I am looking to get an LLC and start a small nail shop (that may expand into lashes or hair). I am the only employee, and my shop would be a tiny home converted. What would I need to make sure I am legally operating

Hi Hanna, after forming your LLC, you can contact the Georgia State Board of Cosmetology and Barbers (404-424-9966) to get the proper license. Hope that helps.

Hello Matt,

Thanks for sharing all the knowledge there.

We have started a LLC based out of our home however no income so far. I am not sure what are the licenses required and when to get them. I am based out of Gwinett County GA.

Hi Anirban, you’re very welcome! What type of business activities will you have going on?

Hi Matt,

As a Dog Walker in Atlanta Georgia can you tell me if I need a business license and for an online business ( Etsy Shop) do I need one? I am very confused .Any information that you can provide would be greatly appreciated.

Hi Gina, yes, you need a business license to operate a business in Atlanta (including a Business Occupational Tax Certificate). You can reach out to your municipality for filing instructions and fees. Hope that helps.

Hi Matt!

I have an LLC for my steel construction business and I just applied for a local city occupational business license, which is home-based because our work is wherever the projects we get are located so we do not have a physical office. We are a specialty trade so we are not required to have a GC License, but are we required to have any other type of permit or license? Thank you!!

Hi Trista! We can’t comment on exactly what a business will need, since there’s over 3,000 licensing jurisdictions int he US. So best bet is to make some calls and check with your city/municipality, or hire a company to check on that for you. We have recommendations above on this page. Thanks for your understanding.

Hi Matt,

I formed an LLC in GA but not sure which lincense I should apply for since I am a contractor agent for processing company in nationwide.

Thank you in advance!

Wendy.

Hi Wendy, my guess is that you don’t need a state or local license for this work. What exactly do you do?

Dear Matt,

Thank you for your prompt response.

I am an external sales independent contractor responsible for onboarding various merchants that accept the credit cards, including stores, restaurants, retail outlets, and salons. Previously, I operated as a sole proprietor without obtaining any licenses. However, I have recently decided to establish a separate legal entity and have formed an LLC for this purpose.

Thank you.

Wendy

You’re very welcome Wendy. And thank you. I’m quite sure there are no state or local licenses you need. You should be fine with just your LLC. Just go out there and get that business! Best wishes :)

I am looking to register a homebased online business in Georgia. I am using a virtual business address to keep my home address private. However, the city/county the virtual address is different from the city/county my home is located. Which county do I apply for a business license? The home address or the virtual business address?

Hi Kat, you may not need a business license for a home-based online business in Georgia. Were you told otherwise by your city or county?

Hi Matt,

I recently formed my LLC and registered a trade name. My business is online retail. To operate do I need both the GA tax registration/certificate and local county registration/business license?

Hello Ms. S, apologies for the slow reply. We got backed up. Yes, you’ll need to register at the state level and the county level.

Hi Matt,

When renewing a Georgia business license, do all of the owners need to submit the proper forms each year?

Meaning, does each owner have to upload his or her photo ID, and SAVE and Everify Notarized Affidavits each year to renew the business license? So if there were three owners, do we need to have one application but three photo IDs, and three SAVE and Everify Notarized Affidavits?

Hi Renee, we don’t specialize in business licenses (just LLC formation). You’ll need to contact the county, city, or town for renewal instructions. Thank you for your understanding.

We formed an LLC to manage our own rental properties. Do we need business license in the city of Atlanta or Fulton county? We are only managing our properties.

Thanks in advance.

Hi Bel, we don’t specialize in business licenses, so you’ll need to check with the city and county regarding any general business license and/or rental license. Thank you for your understanding.

Hi there!

What is the difference GA State license vs GA business license? Do I need both for running a contractor or/and GC business in GA? can I get these license if I’m not an GA resident? Can you help me with that and how much is it? Thanks!

Sincerely,

Rob

Hi Robert, yes, you can get a general contractor’s license without residing in Georgia. You likely just need this license to conduct business. We don’t offer this as a service, but if you call the city/town where you are doing business, they should be able to point you to the forms and instructions. Hope that helps.

I was doing some research to help a client with licensing and permits information and came across your site. It has tons of great information and links. I also see our link. We appreciate the plug and I will be sure to share your site for our clients needs as well.

Thank you!

Thanks Deanna!