If you’re a Non-US Resident with a Single-Member LLC, you need to file Form 5472 and Form 1120 every year

A few important notes:

1. This article is written for non-U.S. residents and non-U.S. citizens (foreigners) who have formed an LLC in the U.S.

2. Your LLC must have an EIN in order to file Form 5472 and Form 1120. If you don’t have an SSN or ITIN you can still get an EIN for your LLC. We have instructions here: how to get an EIN without an SSN or ITIN.

3. This article is only an overview of Form 5472. It is not detailed step-by-step instructions. Additionally, as a foreigner, this is not your only reporting requirement with the IRS. We strongly recommend that you work with an accountant.

4. This requirement should be taken seriously. If Form 5472 is not filed or filed incorrectly, the IRS charges a minimum penalty of $25,000 USD (increased from $10,000).

Overview of Form 5472

The requirements for foreign-owned U.S. Corporations to file Form 5472 and Form 1120 have been around for some time, however, the IRS released TD 9796 and added new regulations to Section 1.6038A-1 of the Code of Federal Regulations. These changes went into effect on January 1st, 2017 and affect all foreign-owned Single-Member LLCs that are Disregarded Entities.

Since 2017, all foreign-owned Single-Member LLCs that are Disregarded Entities are treated as Corporations for federal reporting requirements (submitting information) to the IRS. This doesn’t mean the LLC is taxed like a Corporation, but rather, it’s simply reporting information like a Corporation.

A Single-Member LLC is automatically considered a Disregarded Entity by the IRS unless the LLC has made a special election to be taxed as a Corporation. The word “disregarded” simply means the IRS “ignores” the LLC for federal tax purposes and taxes the LLC the same way the owner is taxed.

The following types of LLCs have to file Form 5472 and Form 1120 every year:

- a Single-Member LLC that is Disregarded and owned by a non-US resident or foreign company

- a Single-Member LLC that is Foreign-owned and taxed as a Corporation

- a Multi-Member LLC that is taxed as a Corporation and has at least 1 Foreign owner that owns 25% or more of the LLC

Note: If you have a Foreign-owned Multi-Member LLC that is taxed as a Partnership, you are not required to file Form 5472 and Form 1120.

Direct and Indirect Ownership:

Form 5472 and Form 1120 requirements apply to foreign-owned Single-Member LLCs that are owned directly or indirectly:

- Directly owned means that the owner is a foreign person or a foreign company

- Indirectly owned means the LLC is owned by another Disregarded Entity LLC, which then owns the Single-Member LLC

There are more complex examples of indirect ownership, however, that is beyond the scope of this article and you will need to speak to an accountant for assistance if you have a more complex entity structure.

Purpose of Form 5472

The purpose of Form 5472 and these new regulations is to prevent foreigners from evading U.S. taxes and to close some loopholes that existed in the tax code.

Overview of steps for Single-Member LLCs that are foreign-owned

The requirements for foreign-owned Single-Member Disregarded LLCs are:

1. Get an Employer Identification Number (EIN).

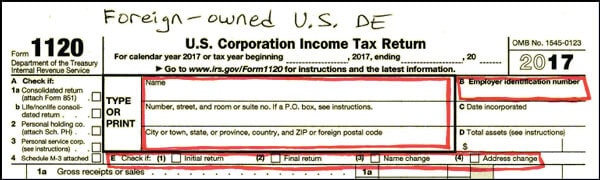

2. File Form 5472 and Form 1120. On Form 1120, you only need to complete the LLC name, address (2 lines), Employer Identification Number (B), and check any applicable boxes (E). For example, check the “Initial return” box if this is your first year filing.

3. Maintain financial records that prove the information on Form 5472.

4. Depending on multiple factors (type of business, your tax filing status, the country where you reside, and US tax treaties), you may need to file a 1040NR (Nonresident Alien Income Tax Return) and get an ITIN (Individual Taxpayer Identification Number).

Having said that, depending on those same factors, you may not have US source income and you may not have to file a 1040NR or get an ITIN. You’ll need to speak with an accountant to determine your tax filing obligations in the US. If you need help, we recommend O&G Accounting and GW Carter.

How to get an EIN for your LLC?

EIN stands for Employer Identification Number and is also called a Federal Tax ID Number. In order to file Form 5472 and Form 1120, your LLC is required to have an EIN.

If you have an ITIN (Individual Taxpayer Identification Number) you can get an EIN for your LLC online. Instructions are here: how to get an EIN online.

If you don’t have an ITIN (or an SSN, Social Security Number), you can’t get an EIN online, but you can still get an EIN for your LLC. Instructions are here: how to get an EIN without SSN or ITIN.

What is a Foreign Person?

A Foreign Person (aka “foreign-owned”) is any of the following:

- Non-Resident Alien Individual

- any Foreign Company, Foreign Corporation, or Foreign Partnership (or their U.S Branches)

- Foreign Trust or Foreign Estate

- and any other person who is not a U.S. Person

Most of our foreign readers will be Non-Resident Aliens, and are therefore considered a Foreign Person for U.S. tax purposes.

If that’s the case, you fall under the new reporting requirements for Foreign-Owned Single-Member LLCs and you must file Form 5472 and meet its related requirements.

What is a U.S. Person?

A U.S. Person is any of the following:

- U.S. Citizen

- Resident Alien (determined by green card test or substantial presence test)

- Domestic Corporation or Domestic Partnership

- any Estate that is not a Foreign Estate

- Trust that meets certain requirements

- and any other person that is not a Foreign Person

Resident Alien vs Non-Resident Alien:

For more information on the difference between a Resident Alien and a Non-Resident Alien, please see this IRS page: determining alien tax status.

Takeaway (foreigner vs U.S. person)

Any foreign person that owns (directly or indirectly) a Single-Member LLC, must file Form 5472 and Form 1120.

A U.S. person who owns an LLC doesn’t have to file Form 5472 and Form 1120.

What about Foreign-owned Multi-Member LLCs?

Multi-Member LLC taxed like a C-Corporation:

If you have a Multi-Member LLC that is taxed as a C-Corporation (and has at least 1 Foreign owner that owns 25% or more) you must file Form 5472 and Form 1120.

Multi-Member LLC taxed like a Partnership:

On the other hand, if you have a Foreign-owned Multi-Member LLC that is taxed as a Partnership (the default treatment), you are not required to file Form 5472 and Form 1120.

The reason why is because Multi-Member LLCs taxed as a Partnership are considered “Domestic Partnerships” by the IRS. And Domestic Partnerships are “U.S. persons”, which must file a U.S. tax return.

Foreign-owned Multi-Member LLCs must:

- file a Partnership Return (Form 1065)

- issue K-1s to each LLC Member

Important: The above is a brief overview of U.S. taxation for a foreign-owned Multi-Member LLC, however the details are more complex including who your LLC Members are, where your LLC is located, how income is made, and your U.S. tax filing requirements. For example, many foreign-owned Multi-Member LLCs also need to file Form 8804 and Form 8805. You will need to speak with an accountant to determine all of your U.S. tax filing requirements.

Reportable Corporations, Reportable Transactions, and Related Parties

While reading IRS instructions, you may come across the following language:

“Form 5472 must be filed by Reportable Corporations that have Reportable Transactions with Related Parties.”

That’s a lot of “R” words, so let’s define them.

Reportable Corporations

A Foreign-owned Single Member Disregarded Entity LLC is considered a Reportable Corporation under Section 1.6038A-1 of the IRS code. It doesn’t matter if the LLC Member is a foreign individual or a foreign company. It is still a Reportable Corporation.

Additionally, a foreign company that is engaged in trade or business in the U.S. is also considered a Reportable Corporation.

Related Parties

The definition of a Related Party in Section 1.6038A-1(d) is a bit difficult to understand since it’s written for Corporations (however, it still applies to Single-Member LLCs).

Here are some examples of who’s a Related Party to a Single-Member LLC:

- The LLC owner

- The LLC owner’s parents, grandparents, brother, sister, spouse, etc.

- Other companies owned (directly or indirectly) by the LLC owner

These are just a few common examples of Related Parties, however, there are more complex examples, many of which are beyond the scope of this article.

Your LLC is still allowed to have transactions with Related Parties, it just must be properly reported to the IRS.

We are unable to help you determine who is and who isn’t a Related Party, however, we strongly recommend you speak with an accountant who works with foreign-owned LLCs. You can also review the following for definitions of Related Parties:

- Section 267(b)

- Section 707(b)(1))

- Section 482

- IRS publication 550

Multiple Forms 5472 for multiple Related Parties

If your LLC has Reportable Transactions with more than one Related Party, you must file a Form 5472 for each Related Party.

For example, if your LLC has Reportable Transactions with yourself and another Related Party, you need to file two Forms 5472.

Reportable Transactions

A Reportable Transaction is the movement or exchange of money (or property) between an LLC and its foreign owners. Reportable Transactions can be, but are not limited to, the following:

- Money deposited/invested into the LLC by a Related Party owner (“capital contribution”)

- The LLC paying/giving money to a Related Party (“capital distributions”)

- Loans made by the owner to the LLC or from the LLC to a Related Party

- Money paid to form the LLC, dissolve (shut down) the LLC, or any filings paid to the State by a Related Party.

- Any exchange of money between the LLC and a Related Party, including a sale, assignment, lease, license, loan, advance, or contribution.

Notes:

– Even if your U.S. LLC doesn’t conduct business or have trade in the U.S., if you made a capital contribution to your LLC, you still have to meet IRS Form 5472 filing requirements.

– The above is a simple overview of what a Reportable Transaction is and doesn’t cover all applicable examples. You will need to work with an accountant to make sure you are properly documenting all Reportable Transactions.

IRS Tax Treaties and worldwide information sharing

The IRS has tax treaties with over 60 countries. This means the governments of those countries agree to share information about their tax citizens in order to better collect tax revenue.

The requirement to file Form 5472 should not be taken lightly. The United States Treasury Department spends billions of dollars enforcing its laws on those that have filing requirements in the U.S.

Download Form 5472

Download Form 5472

IRS instructions for Form 5472

You can complete the form by hand, but it’s better to do it on the computer:

Don’t edit the PDF in your web browser (it might not save properly). Instead, download the PDF and save it to your computer. Then open it with a PDF application, like Adobe Acrobat.

Reminder: The information below is not detailed, step-by-step instructions, but rather an overview. We strongly recommend working with an accountant in order to properly file Form 5472 and meet all other U.S. tax reporting and filing requirements.

Part I – Reporting Corporation

Part 1 requires contact information and basic details about the Reporting Corporation/LLC.

You’ll list the LLC name, the LLC’s EIN, address, total assets, and business activity. You’ll also list total payments, total value of those payments, country of LLC formation, and date of incorporation, to mention a few.

Part II – 25% Foreign Shareholder

If your U.S. LLC is owned by you, you’ll enter your information in 4a through 4e.

If your U.S. LLC is owned by your foreign company, you’ll enter your foreign company’s information in 4a through 4e.

Part III – Related Party

Part 3 includes information for the Related Party that had Reportable Transactions.

Important: A separate Form 5472 must be filed with the IRS for each Related Party.

Part IV – Monetary Transactions Between Reporting Corporations and Foreign Related Party

Part 4 needs to be completed if the Reportable Transactions were with foreigners.

If the transactions were made with U.S. persons, Part 4 doesn’t need to be completed (although a Form 5472 still needs to be filed).

Part V – Reportable Transactions of a Reporting Corporation that is a Foreign-Owned U.S. DE (Disregarded entity)

If you have a foreign-owned U.S. LLC that is a Disregarded Entity, you need to check off the box in this section and include an attachment that describes these transactions.

By “attachment“, we mean to type something on the computer and print it out and include it with the forms.

Examples are any money paid or received in order to:

- form the LLC

- shut down the LLC

- purchase the LLC

- sell the LLC

Additionally, monies paid from the LLC Member to the LLC (LLC capital contributions) and monies paid from the LLC to the LLC Member (capital LLC distributions) are also Reportable Transactions.

Part VI – Nonmonetary and Less-Than-Full Consideration Transactions Between the Reporting Corporation and the Foreign Related Party

Part 6 requires a statement to be attached to (included with) Form 5472 if the Reportable Transactions were with foreigners.

If the transactions were made with U.S. persons, an attachment is not needed for Part 6.

Part VII – Additional Information

Part 7 must be completed.

These are mostly “yes/no” questions.

While most don’t apply to the majority of people, please read through and answer them.

Here’s how a typical Part 7 might look:

- 37 (LLC importing goods from foreign related party) = this depends

- 38 (a, b, and c) = only answer if you checked “yes” for 37; otherwise leave blank

- 39 (cost sharing arrangement) = most people check “no”

- 40a (interest/royalties under section 267A) = most people check “no”

- 40b = only answer if you check “yes” for 40a; otherwise leave blank

- 41a (foreign-derived intangible income) = most people check “no”

- 41 (b, c, and d) = only answer if you check “yes” for 41a; otherwise leave blank

- 42a (loan w/ safe-haven rate rules within range) = most people check “no”

- 42b (loan w/ safe-haven rate rules outside range) = most people check “no”

- 43a (covered debt instrument) = most people check “no”

- 43b (1 and 2) = only answer if you check “yes” for 43a; otherwise leave blank

Part VIII – Cost Sharing Arrangement (CSA)

This part usually doesn’t apply for most people.

If that’s the case:

- 44 = enter “Not Applicable”

- 45 = “No”

- 46 = “No”

- 47 = leave blank

- 48 (a, b) = leave blank

- 48c = “No”

- 49 (a, b) = leave blank

Part IX – Base Erosion Payments

What is this? Base erosion payments are payments made to a company in another country (where a deduction is allowed) to reduce taxes.

This section doesn’t apply to most people.

Most people leave this entire section blank.

A separate Form 5472 required for each Related Party

As mentioned earlier, each Related Party that had Reportable Transactions with the LLC must file their own Form 5472.

Form 1120 is also required

Note: Form 1120 is a tax return for Corporations, however, it is now required by foreign-owned Single-Member LLCs under the new IRS regulations.

Form 5472 must be sent to the IRS attached to Form 1120. “Attached” just means Form 5472 is submitted together with Form 1120.

For LLCs who handle taxes on the calendar year, January through December, (which is the most commonly used) Form 5472 and Form 1120 are due every year by April 15th.

For example, if your LLC was formed anytime in 2024, then you have to file Form 5472 and Form 1120 by April 15th, 2025.

Download Form 1120

IRS instructions for Form 1120

How to complete Form 1120:

Form 1120 requirement is referred to as a “pro forma” requirement, meaning, you don’t have to complete the entire Form 1120, just a small part of it.

You only need to complete the Name, Address, Section B, and Section E on the 1st page. Don’t enter anything else on page 1 or any other pages of Form 1120. Leave everything else blank.

At the top of the form:

Hand write “Foreign-owned U.S. DE” at the top of Form 1120. It will look like this:

Name:

Enter the complete name of your LLC.

Address (two lines):

Enter the main address or place of business for your LLC. It’s best to use the same address listed on Form 5472 and on your EIN Application (Form SS-4). The address can be a U.S. address or it can be a non-U.S. address.

Section B:

Enter the Employer Identification Number (EIN) for your LLC.

If you don’t have an EIN for your LLC, you will need to get one as soon as possible. You can’t submit Form 1120 or 5472 without your LLC’s EIN. Doing so will cause your filing to be rejected and the IRS will charge a $25,000 penalty as listed below.

- If you have an SSN or ITIN, you can get an EIN for your LLC online. We have instructions here: how to get EIN for LLC online.

- If you don’t have an SSN or ITIN you can’t get an EIN online. You have to apply by mail or fax. We have instructions here: how to get an EIN without SSN or ITIN.

Section E:

A box only needs to be checked if this is your first return or last return for your LLC.

For example:

– The first time you file Form 5472 and Form 1120, check off “Initial return”.

– If you shut down the business and dissolve the LLC, check off “Final return”.

– For all years in between, don’t check off any boxes in Section E.

Sign here:

At the bottom, sign your name, enter today’s date, and for title, enter “Owner”.

When is Form 5472 due

Because Form 5472 is sent to the IRS with Form 1120, the Form 1120 due dates apply to both forms.

For tax purposes, most U.S. LLCs operate on the calendar year (January – December), as opposed to the fiscal year.

For LLCs that operate on the calendar year, Form 5472 and Form 1120 are due by April 15th each year. This due date will apply to most filers.

If on the other hand, your LLC operates on a different fiscal year, please see Form 1120 instructions and look at the “When to File” section.

For example, if your LLC was formed anytime in 2024, then you have to file Form 5472 and Form 1120 by April 15th, 2025.

Where to send Form 5472

Form 5472 needs to be sent to the IRS by mail or by fax. Make sure Form 5472 is attached to Form 1120. “Attached” simply means that Form 5472 is behind Form 1120 when you submit them to the IRS.

Mailing address:

Internal Revenue Service

1973 Rulon White Blvd.

M/S 6112, Attn: PIN Unit

Ogden, Utah 84201

Fax number:

855-887-7737

Remember: Write “Foreign-owned U.S. DE” across the top of Form 1120.

Important: Please confirm the above mailing address (or fax number) with the information listed on IRS: Form 5472 instructions (search for the section titled “When and Where to File”). The mailing address and fax number may change from time to time. The last time we confirmed the mailing address and fax number above was January, 2025.

Nothing is sent back

The IRS doesn’t send anything back letting you know that they’ve received Form 5472.

As mentioned above, we recommend that you work with an accountant that is also an IRS Acceptance Agent, since they specialize in working with foreigners who have formed LLCs in the U.S.

Extension of 5472 due date

As mentioned in the When is Form 5472 due section of this article, for most people, Form 5472 (and Form 1120) are due by April 15th… that is, April 15th in the year following the year that your LLC was formed.

If you need more time to file Form 5472 + Form 1120, you can request an Extension by filing Form 7004 and this will extend the due date to file the forms 6-months, until October 15th.

However: This isn’t an extension to pay any taxes (if you/your LLC owes taxes). It’s just an extension to file the paperwork (Form 5472 + Form 1120). If you/your LLC owe any taxes, you must pay those taxes by the due date (if you overpay, you’ll get a refund later after you file). We strongly recommend speaking to an accountant (or a few) to determine if you have any US tax filing (or tax reporting) requirements.

If for you, Form 5472 and Form 1120 are due by April 15th, then Form 7004 must be postmarked by April 15th, too.

Across the top of Form 7004, write “Foreign-owned U.S. DE” across the top (just like it’s required on Form 1120).

On Form 7004 (in Part 1, number 1), you need to tell the IRS for which form you are requesting an extension. This is done by entering a form code. There is a table under Part 1 with the form codes. You need to use the form code for Form 1120 (since the 5472 is filed with the 1120).

Note: In Part 2, you’ll see a question about a “foreign Corporation”. Please keep in mind, you don’t own a foreign Corporation or a foreign LLC. A foreign Corporation/foreign LLC is a company that was formed outside of the US. On the other hand, you have a US LLC; it just happens to be a foreign-owned LLC. However, a foreign-owned LLC and a foreign LLC (or foreign Corporation) are very different things.

We recommend working with an accountant to complete the rest of Form 7004. For additional information, please see IRS: Instructions for Form 7004.

Accurate books & records

Along with filing Form 5472 and Form 1120, a Foreign-owned Single-Member LLC must maintain financial records that prove the accuracy of Form 5472.

The financial records must detail all Reportable Transactions with all Related Parties.

In addition to Reportable Transactions with Related Parties, your LLC’s records should accurately reflect your LLC’s federal income tax return filing history along with any other required IRS filings.

The IRS can charge its penalty for failing to maintain proper books and financial records.

We strongly recommend working with an accountant on this.

$25,000 Penalty

Important: The penalty used to be $10,000, but in mid-2018, the IRS increased it to $25,000.

The IRS penalizes LLC Members (owners) that don’t file Form 5472 on time. Each LLC Members will be jointly and severally liable.

Note: Filing a “substantially incomplete” Form 5472 is considered as a late filing and will be penalized.

Your LLC will be first assessed a $25,000 penalty for late or non-filing of Form 5472. The assessment from the IRS usually comes with a notice reminding you to file Form 5472 within 90 days. If you fail to file Form 5472 within that grace period, the IRS will then assess another $25,000. After that, the IRS will fine your LLC $25,000 every 30 days until you finally file Form 5472 and pay the fees.

In addition to the penalties above, the IRS may also file criminal charges against you under Sections 7203, 7206, and 7207 of the Internal Revenue Code.

Getting penalties reduced: If you are late and need to file Form 5472, you may be able to get your penalties abated (reduced) if there is “reasonable cause”. If your LLC makes $20 million (or less) and has a limited presence in/with the United States, the IRS is usually more flexible. We recommend working with a tax professional who is knowledgeable about foreign-owned LLCs. If you need help, we recommend O&G Accounting and GW Carter.

Other IRS tax forms for foreigners

Important: This article doesn’t list all requirements foreign owners of U.S. LLCs have with the IRS.

You will need to speak with an accountant who specializes in working with foreigners who formed a U.S. LLC and are doing business in the U.S.

Some things to research and speak to your accountant are:

- US Nonresident Alien Income Tax Return (1040NR/1040NR-EZ)

- Sales tax and/or excise tax

- Conduct of a U.S. trade or business (USTB)

- Effectively Connected Income (ECI)

- Fixed, Determinable, Annual, Periodic Income (FDAP)

- Federal Withholding Tax for Foreign Nationals

- Foreign Bank Account Annual Report (FBAR)

- Real Estate and Foreign Investment Real Property Tax Act (FIRPTA)

- Payroll taxes (if applicable)

- Federal and state unemployment taxes (if you have U.S. employees)

- Form 1042-S

- Form W-8 BEN

- and more

How to find an accountant for your LLC

We recommend calling a few accountants who specialize in working with foreigners. U.S. taxes for foreigners are much different than for U.S. citizens and the rules vary a lot depending on what country you live in (the U.S. has tax treaties with 60+ countries).

The IRS Acceptance Agent list can help you find an accountant located in the state where you formed your LLC. All the accountants listed as IRS Acceptance Agents work with foreigners.

We also have a list of accountant recommendations in all 50 states. We recommend phoning a few to see which one you feel most comfortable with, and who understands your business fully.

Not sure? File anyway

If you’re not sure whether or not you have to file Form 5472 and Form 1120 for your foreign-owned LLC, as we’ve mentioned above, it’s best to speak with an accountant.

And the general rule of thumb in the tax world is that if you’re not sure if you should file, it’s best to file anyway.

Submitting information to the IRS does not automatically mean you have to pay taxes. It simply just reports the information to the IRS and keeps you and your LLC in compliance with U.S. tax laws.

IRS Contact Info

If you have any questions, you should first contact an accountant since the IRS doesn’t give tax advice. However, if you need to contact the IRS, you can call their International Department at 1-267-941-1000. Their hours are Monday through Friday from 6am to 11pm U.S. Eastern Time.

Related Articles

How to apply for an ITIN

How to apply for an EIN without SSN or ITIN

References

IRS: Foreign Persons

IRS: About Form 5472

IRS: Table 3 – List of Tax Treaties

IRS: International Taxpayers – Tax Treaty Tables

IRS: International Taxpayers – Classification of Taxpayers for US Tax Purposes

IRS: Corporations – United States Income Tax Treaties – A to Z

Code of Federal Regulations Title 26: Section 7203

Code of Federal Regulations Title 26: Section 7206

Code of Federal Regulations Title 26: Section 7207

Code of Federal Regulations Title 26: Section 7701

Code of Federal Regulations Title 26: Section 1.482-1

Code of Federal Regulations Title 26: Section 6038A

Code of Federal Regulations Title 26: Section 1.6038A-1

Code of Federal Regulations Title 26: Section 1.6038A-2

US Treasury: Resource Center – International Tax

US Treasury: Resource Center – Treaties and TIEAs

US Government Publishing Office: FR Doc 2016–29641 (2016-12-13)

Office of the Federal Register: Requirements for Taxpayers Filing Form 5472

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Dear Matt,

Thank you very much for the valuable information in the article. I found your Site on Google by searching for some information related to IRS Forms 5472 and 1120. I have a specific situation and don’t know what to do. I tried to find some answers on various places, but without success. I will be so free to ask you for advice. You don’t have to explain in detail, just some short information about what you think it would be good to do in my case. Here is my situation:

Background:

– LLC Formation: My Wyoming LLC was registered in October 2024.

– Ownership: I am a non-U.S. resident living in Croatia and am the sole owner.

– 2024 Financial Activity:

— No U.S. bank account was opened for the LLC during 2024 (the account was only opened in July 2025).

— The LLC had no income, no payments, no expenses, and no financial transactions with any third parties in 2024.

— All formation and registration fees were paid directly from my personal debit card (issued by a Croatian bank); these were not reimbursed by the LLC nor withdrawn from an LLC account.

— No property or assets were transferred to or from the LLC or any other party in 2024.

Until recently, I was not aware of any federal filing requirements for dormant LLCs in this specific scenario. My initial understanding—based on communication with my registered agent last year—was that any required filings and compliance matters would be managed by the registered agent, and that I would be contacted if anything further was required from me.

My specific questions are:

1. Given that there were no financial transactions, no bank account, and no movement of money or property in 2024, am I, as the owner, required to file IRS Forms 5472 and 1120 for the 2024 tax year under these circumstances?

2. In the event that a filing is indeed required, what would be the best course of action given my late discovery of these requirements?

3. If possible, could you please reference the relevant IRS regulations or instructions that apply to this situation?

Thank you very much for your time and assistance. I greatly appreciate any insight you can provide to help me ensure full IRS compliance.

Hi Sinisa, you’re very welcome. You’re supposed to file Form 5472 and 1120, even with no income, no bank account, and no transactions. The payment you made to form the LLC is a “reportable transaction”. The best course of action is to just file, even though it’s late. You can include a short explanation for the late filing (ex: “First-year oversight, no activity, no U.S. income, misunderstanding about obligations”). There isn’t a specific section of the CFR or IRC that talks to this exact scenario, however, this is pretty common and normal. Hope that helps.

Hi Matt,

Thanks for the detailed and amazing article. I’m a non resident and have a single member wyoming llc that was opened on September 2024. There were no business activities done or reportable transactions. Although it seems that LLC opening costs could be considered under reportable transactions. I missed the filing due date for form 5472 and 1120F pro forma and having talked to two accountants who recommended me not to file now and instead do it next year for both the years together. I was told submitting it late would automatically result in a penalty being issued for $25000.

Would you say it’s best to wait until next year now and file them together since there weren’t any transactions? How likely is it that IRS would pursue penalties in this case?

Thanks again for the awesome content you put out.

Hey Kay, I mostly think the penalty is a “scare tactic” to get people to comply. We haven’t heard of anyone getting the penalty yet. And while I don’t disagree with the accountants (you could file next year), I think it’s also totally fine to just file it now. Hope that helps.

Hi,

First of all thanks for the great article.

I have a Delaware based LLC Owned by two Non Us residents.

Delaware don’t keep any records of partners, but I have submitted this information in the BOI.

Please can you suggest what forms I have to fill in?

I already paid DW tax of $300, but I was told that I also have to fill few others forms.

thanks

Sd

Hi Sd, you’re very welcome. You don’t have to file Form 5472 because you have a Multi-Member LLC. In that case, your LLC needs to file a 1065 Partnership. And in terms of any other potential filings, we recommend checking with an accountant.

Thanks for reverting back Matt…

So just to be clear, I have file Form 1065 and Form 1120.

Just a FYI… my LLC have zero income/transactions last year, so can i ignore the accountent and just file it myself.

You’re welcome. Ah, good question. Just Form 1065, not Form 1120 (and not Form 5472). We don’t recommend self-filing for most people. Even thought it’s a zeroed out return, you still must also complete Schedule K-1s, Balance Sheet, and Schedule M-1, along with the 1065 Return.

Thanks, Matt!!

Please can you suggest some budget accountant to help with this.

I only have 1 week to file as for non-resident the last date is 15 June.

Hi SD, I’m not sure of a budget accountant, but you can find our recommendations on our LLC accountant page.

I was re-reading your article and noticed the below section

——————————————————–

Foreign-owned Multi-Member LLCs must:

– file an informational Partnership Return (Form 1065)

issue K-1s to each LLC Member

and each Member is responsible for filing a U.S. income tax return

– If the Foreign-owned Multi-Member LLC has no income (and no expenses, deductions, or credits it would like to claim), then there is no Form 1065 and K-1 filing requirement.

——————————————————–

these details exactly fit my situation.

i.e. I have a Foreign-owned Multi-Member LLCs with no income (and no expenses, deductions, or credits it would like to claim), So I don’t need to file anything??

Hi SD, apologies for the confusion. That sentence (“If the Foreign-owned Multi-Member LLC has no income – and no expenses, deductions, or credits it would like to claim – then there is no Form 1065 and K-1 filing requirement.“) is incorrect and has since been removed. Apologies for the confusion. All Multi-Member LLCs need to file a 1065 Partnership Return.

Thanks, Matt!!

You’re welcome SD! 🙌

Hi Matt,

This is very helpful! These forms can be very overwhelming to fill out.

I have a question about my form 5472 from last year. Would appreciate any feedback.

I am the owner of a single member foreign owned US DE. I do not have any US source income and do not owe US taxes. Last year when I filed my first return, I made a mistake on the date part of form 5472. My company was set up on September 5th 2023.

Instead of writing tax year starting from 09/05/2023 and ending 12/31/2023, I wrote starting from 05/09/2023 and ending 12/31/2023. So now the IRS might think my company was set up in May, not September. Can I be penalized for this mistake? Do you recommend I amend it?

A year has passed and the IRS never followed up. However, I recently submitted my second return with the correct info and I’m concerned if the mismatch between this year and last year will cause me any problems.

Based on your experience, is a minor issue like this something I should worry about?

Hi Kate, you’re very welcome. I totally agree. Form 5472 is not very “user friendly”. Personally, I don’t think this is a big deal (saying the company’s tax year started in May 2023 instead of September 2023). I don’t think you have to do anything. You can always double-check with an accountant too.

I have a US LLC. I don’t have any US sourced income. All income is done online while I reside in UAE.

I have to file form 5472 + proforma 1120.

My US LLC does not have any tax obligations in the UAE. I do not file a tax return for the corporation in UAE.

For part 1 on form 5472: “Where does the reporting corporation file a tax return as a resident” line 1n

What’s the correct answer here? “None” or “UAE”?

This section is asking about the corporation details. Not the foreign owner details.

I had someone tell me to put UAE, however since I do not file a tax return for the corporation in UAE, I feel like that’s incorrect.

I am thinking of writing “UAE” for principle country where business is conducted and “NONE” for where does the reporting corporation file a tax return as a resident.

Would appreciate any advice you have. Thanks!

All work is done online while I reside in UAE*

Hi Yaz, I’d list UAE there (even though there is no return due). Hope that helps.

Thanks for your reply. My concern is that if I list UAE there, it could potentially signal to local authorities that I have tax obligations in the UAE.

I consulted with two UAE accountants, and both confirmed that my US LLC does not fall under the scope of UAE corporate tax, since it is not effectively managed or controlled from the UAE and doesn’t have a permanent establishment (PE) here.

They explained that factors like having employees, clients, offices, or accepting payments and conducting banking in the UAE are what determine tax obligations. In my case, none of that applies—I work remotely online from my apartment, and all business operations are outside the UAE. Based on that, they advised there’s no corporate tax liability for my US LLC here. Won’t listing “UAE” there maybe raise questions down the line by UAE authorities?

I was thinking I’ll list UAE in Part 2 and Part 3 of the form. However, for the specific section that asks where the CORPORATION files an income tax return, I was thinking of putting “None.” Please let me know your thoughts. Am I looking at this the wrong way?

You’re welcome. I certainly hear your concern, but I doubt something like this will make any difference to the UAE. While the IRS does have the authority to share tax information with foreign governments, it’s typically done under the terms of a tax treaty or intergovernmental agreements (IGAs). However, as of now, the US and UAE don’t have a tax treaty in place. Having said that, I think putting “None” is also fine. I don’t think either is very material. Hope that helps.

Hello Matt!,

Thanks a lot. Very valuable content, and super clear!

I would like to have your feedback on the following topic:

Let’s assume the owner is a single US LLC member who created the company in Wyoming, and is a non – US resident from Spain. The company was created in 2022, and you must file for 2024 the 1120+ 5472 form.

Would you report these transactions on section IV or V of the form 5472?

– Doola Agent fee ($197) → Paid from my LLC wise business account to Doola, a U.S. agent based in New York

– Legal fees to manage forms 1120+ 5474 ($375) → Paid from my LLC wise business account to a US LLC company that works in taxation;

– Wyoming Annual Report ($62.25) → Paid from owner’s personal account.

Thank you and kind regards!

Hi Maria, you’re very welcome! You wouldn’t need to report the Registered Agent fee (Doola Registered Agent) or the legal fees (aka tax services) on Form 5472. You can leave them off. This is because they aren’t Reportable Transactions between the LLC and its foreign owner(s). For the Wyoming Annual Report fee, since you paid this yourself, you can list it in Part V. You can describe it as: “Capital Contribution (Wyoming Annual Report paid by foreign owner)“. Hope that helps!

Hi Matt,

Thanks for the most straightforward and comprehensive guide I’ve found online — it’s been incredibly helpful.

I’m still unsure about what exactly to report. The only financial activity of my single-member LLC so far has been paying the LegalZoom formation fee and its virtual address service, both using my personal card.

Based on the instructions, I understand that Part IV must be completed as a foreign party, but I don’t believe I have any applicable transactions to report there. I’m thinking of listing the formation and virtual address fees in Part V, entering all “0” in Part IV, and leaving Part VI blank.

Still, I’m unsure since it feels like Part IV and VI are the main focus of the form. Do you have any thoughts on how these transactions should be classified?

Thanks again for your help!

Oliver

Hi Oliver, that’s so great to hear! Thank you. And yes, you’re correct. You can leave Part IV blank, and then report the formation fee and virtual address in Part V. Hope that helps :)

Hi Matt,

Is the NAICS code 545110 discontinued? Can I still use it in the IRS forms 1120-5472?

Hi Maite, what was that code for? Code 545110 doesn’t exist in the official North American Industry Classification System (NAICS).

E-Commerce

Try 454110 ;)

Hi Matt, thank you, that’s the one I was having doubts about, sorry I wrote it incorrectly. So 454110 is active?

You’re welcome Maite. Yes, 454110 is active.

Hi Matt,

Thank you for this great article! If the sole member of an LLC (foreign-owned U.S. DE) paid on the first year directly from his personal bank account some courses to learn how to make an LLC, how to manage the business and how to market the products: are these courses/trainings reportable transactions? If so, should they be reported in Part V of form 5472 as a contribution of capital? Is this related to the formation of the LLC or just detailed apart as contributions of capital? I suppose the website paid from the owner’s personal bank account is also a contribution of capital reported in part V?

Thank you! Have a great day!

Hi Maite, you’re very welcome! You technically don’t need to report this is Part V since it’s not a capital contribution, and it’s not directly related to forming the LLC. However, there is no harm/risk if you want to add them in Part V. Hope that helps :)

It certainly does, thank you Matt!

Wonderful! You’re very welcome Maite.

Hi Matt,

Thanks for your detailed instructions :)

I have Foreign-Owned U.S. Disregarded Entity, and I’m still confused about what the IRS expects for “Line 1o – Principal country(ies) where business is conducted.”

Should I list:

– The countries where my clients are located (which would be the US), or

– The countries where I was physically present while performing the work (which would be the NL, BE, FR, DE, and a few others)?

Unfortunately, the official guidelines available on https://www.irs.gov/instructions/i5472

state merely “Do not include any country(ies) in which business is conducted solely through a subsidiary. Do not enter “worldwide” instead of listing the country(ies).” do not provide clarity on this matter…

Thanks,

Leon

Hello leon.

I’m on the same situation as you are.

I found that video perfect:

https://www.youtube.com/watch?v=3eDz7koTmR8

Hi Ahemd,

Yes, you are right. According to this (linked) video

https://www.youtube.com/watch?v=07-D3PTa7Bs&t=1585s

(starting from 26:20), it’s the place where you are actually physically located while doing business.

The case in the video is about a French bookkeeper, doing business in France for a number of French and German clients.

Hi Leon

Happy to help, in any case, we have to fill both forms before 15th April.

Hi Leon, you’re very welcome! This would be where you generally work from. Listing NL, BE, FR, and DE will be fine. Hope that helps.

Hi Matt! Thanks so much for the amazing article!

One question about the related parties:

Non-resident owned disregarded entity LLC with no ECI purchased services from a related party abroad owned by the same member. I understand that in this scenario it might be necessary to complete an additional form 5472. But here is the confusion – purchasing services is not a capital distribution, so it wouldn’t make sense to report in the Part V – typically used by non-resident LLCs. Would this be reported in Part IV? Or maybe this isn’t even a reportable transaction for the disregarded entity – according to Part IV instructions it wouldn’t affect the taxable income in the US because it is not taxed there anyway. What would you suggest?

Hi Paula, you’re very welcome! And you’re correct: purchasing services isn’t a capital contribution or distribution, but it’s still considered a “Reportable Transaction” because it’s a transaction between your LLC and a related foreign party.

Here’s how it works:

Since your LLC purchased services from a related foreign party, this transaction should be reported in Part IV of Form 5472. Hope that helps.

Hi, Matt do you offer courses on LLC with foreign members and employees?

Hi Nallely, we don’t have specific courses for non-US residents and employees at this time, but do feel free to send your question here. Thank you for your understanding.

Hi Matt I have lived in a foreign country for the past 2 years. I am a US citizen. I own a single member LLC. As per your article I don’t need to file a 5472 form cause I’m a US citizen, correct? My US LLC is taxed as sole proprietorship disregarded entity.

Hi Hamza, yes, correct. You don’t need to file Form 5472 because you are a US citizen.

Hi Matt. I own foreign owned single member LLC(disregarded Entity) that is dormant and have 0 revenue. Which means. No business and not a single sales. Which forms i have to submit?

Hi Waseem, technically, you’re still supposed to file Form 5472.

Hi Matt,

Very good article. Question, in the case of a LLC (C-CORP), the penalty for failure to file 5472 is imposed to the owners or to the corporation? what happens in this case? we are two partners with an LLC treated as a c-corp. IRS will extend the responsibility to us? in the case it was an omission. Or the entity will have the civil penalty. In this case the corporation does not have any asset / cash. It is an inactive company.

Thanks!

Thanks Eduardo. Interesting question. And to be honest, I’m not 100% sure as we don’t know all the ins and outs of how the IRS handles enforcement.

Hello,

February December 28, 2022 is the date of my LLC formed, but the date I received an EIN is February 2023.

some CPA’s say that I don’t need to file a declaration this year because EIN was taken in 2023. what is your opinion?

It’s hard to say for sure, but you’re probably fine to just begin filing Form 5472 in April 2024.

Hello,

I really cant finde any accurate answer even from IRS tax agents. Does a disregarded foreigner owned single member LLC (which not elected to be treated as a corporation) have to tick the box in Part I Number 3 of form 5472?

My personal opinion is “yes”. My IRS registered preparer says no and my CPA says again “yes”.

Hi Daniel, Foreign-owned Single-Member LLCs (not taxed as a Corporation) are treated as Corporations for the purpose of this 5472 filing (as per Section 1.6038A-1), so yes, you would check the box.

Hi Matt, so After sending the 1120 and the 5472.

Do I need to file the 1040NR too?

Hi Doris, it depends on your country of residence, how your income is generated, and other details. You’ll need to check with an accountant.

Hi, thanks for this very helpful article. Is there any Federal supporting statement official template available to download and attach at the end of 5472 form ? Or we must create our own template ?

Hi Miguel, there isn’t a federal template at this time. Some people create their own and others hire an accountant.

Hi Matt, thanks for the comprehensive and helpful information.

However, I have a question: could you please indicate the concret source from the IRS from which you got the information (link to website), where it is indicated that foreign-owned Single-Member LLCs fill out only the top of the 1120 form (Address, Section B, Section E only)?

I didn’t find that information in the IRS instructions: https://www.irs.gov/instructions/i1120

but this proof is requested from me by Compliance in my bank, where my DE has its account.

Hi Svetlana, you can find that in IRS: Form 5472 instructions. See “When and Where To File”:

“Foreign-owned U.S. DEs. While a foreign-owned U.S. DE has no income tax return filing requirement, as a result of final regulations under section 6038A, it will now be required to file a pro forma Form 1120 with Form 5472 attached by the due date (including extensions) of that Form 1120. The only information required to be completed on Form 1120 is the name and address of the foreign-owned U.S. DE and items B and E on the first page. The foreign-owned U.S. DE has the same tax year used by its owner for U.S. tax filing requirements or, if none, the calendar year.”

Hi Matt, thank you very much!

You’re welcome Svetlana :)

Hi, I have WY LLC Owned by two Non Us residents, it is Foreign-owned US Disregaeded entity. This LLc owns two FL LLC that owns une propety each, This are long term rented. I am having a hard time on how shold I do taxes. do I need to file only one or its one per LLC? Can you please recomend me someone to work with me. thanks. !

Hi Franco, a Multi-Member LLC owned by two non-US residents isn’t a disregarded entity (because it’s taxed like a Partnership). We have recommendations on this page: Account for my LLC.

Thank you for the detailed article.

My LLC is foreign-owned single member LLC. (And not elected for corporation).

…

My question is related to your point #4.

4. Depending on multiple factors (type of business, your tax filing status, the country where you reside, and US tax treaties), you may need to file a 1040NR (Nonresident Alien Income Tax Return) and get an ITIN (Individual Taxpayer Identification Number).

Do I have to pay LLC based taxes only.?

I’m doing only Amazon FBA. Does this model lead to file Non-resident alien tax? For 1040nr?

You’re welcome Muhammad. Whether or not a non-US resident with a US LLC pay taxes is complicated. Meaning, it’s not a simple yes or no answer. You’ll need to speak with an accountant who specializes in working with non-US residents.

If I don’t have to file 1040nr. I only have to file 5472 and 1120. Do I still need ITIN?

ITIN is necessary for 1040NR form. Is that correct?

You don’t need an ITIN to get an EIN, but you may need an ITIN for other things (ex: opening a merchant processing account, getting a credit card, or paying US taxes). And yes, an ITIN is needed for 1040-NR. In fact, you’d send in your ITIN application along with your 1040-NR.

I am a foreigner. I have a single member LLC & I have not made election to be taxed as a corporation. Like I have not filed Form 8832.

So, Do I still need to to file Form 1120? Because form 1120 is used for U.S. Corporation.

Hi Malik, no, you don’t have to file a Form 1120 tax return. However, as a part of the Form 5472 filing, you do need to send in a Form 1120, but you only need to complete the top section, as described on this page.

I am a foreigner. I have a single member LLC.

Can I file Form 5472 and Form 1120 without filing Form 8832?

Hi Bui, you don’t need to file Form 8832 (unless you want your LLC taxed like a C-Corporation).

Do you need a LLC to get an EIN (question 8a) for foreigner?

That is the most common, however an EIN can be obtained for a business entity or trust.

Since I only need to fill in the first page of the 1120 form, can I avoid sending the rest of pages?

We recommend just sending everything.

Hi, thanks for the awesome content you share on your site. It is a true life-saver.

I have a somewhat stupid question but could not find an answer online.

At the top of Form 5472, assuming it is an LLC that was created in on August 1, 2020 and follows the calendar year, should the start date be the date of the formation of the LLC (August 1, 2020) or January 1, 2020?

Thanks in advance!

Hi Jeremie, I apologize for our slow reply. You’re very welcome! You can enter the created date of August 1, 2020. If you entered January 1, 2020 and already filed, that’s okay too. It’s not a big deal either way. Hope that helps.

Thanks for this insightful article!

Maybe this is a stupid question,

You said: “Make sure Form 5472 is attached to Form 1120. “Attached” simply means that Form 5472 is behind Form 1120 when you submit them to the IRS.” I don’t get it (I mean Do I have To Merge the two completed forms Into One File;pdf or what?)Could you clarify that, please?

Regard.

Hi Nizara, I apologize for our slow reply. We updated the page to make it easier to understand. “Attach” just means to include with the forms. It’s still different forms, but you just submit them all together. Hope that helps.

Congrats Matt, great article! Question for the 1120 form, D.E:

No signature, no title required?

Only Name, Address, Section B, Section E and “Foreign-owned U.S. DE” at the top of Form 1120?

Question 2: Do I only have to fax page 1 of 1120 for a D.E.?

Hi Manfred, yes, you just need to send page 1 of Form 1120 with the Form 5472.

Hi Manfred, thank you! Correct, just the sections/stuff you mentioned. You will sign at the bottom of Form 1120. Sign your name, enter the date you are completing the form, and for title, enter “Owner”.

Thanks for a great article!

I have a few questions regarding part 5.

How thoroughly should you describe the transactions in Part 5? Is it enough to write “Formation Cost $xxx.xx” and “Capital Contribution $xxx.xx”? Or should it be more detailed?

If you have made multiple capital contributions should you then enter each transaction and the amount, or just write the total amount?

Hi Gabriel, we don’t have instructions/information on exactly how to fill out Form 5472 at this time (we plan to in the near future). You may want to check with an accountant, but my guess is the more detailed, the better. And I’d list out each capital contribution. Thank you for your understanding.

Hello Matt,

Thank you for the value you provided here. This is gold!

I have one question, if you can help me I would appreciate it.

It is about reportable transactions (money paid to form the LLC). What if I am the owner, it is a single-membered LLC and I paid with my friend’s or wife’s credit card to form it? Is it a problem or it has to be paid from a credit card with my name on it?

Thanks again and stay safe.

Kind regards,

Boban

Hi Boban, thank you! You’re very welcome. I don’t know the honest answer here, but my thoughts are that it’s not likely to be audited, so you can probably report it as if you paid it. I don’t think the IRS would really care.

Thank you, Matt. You are the best!

You’re welcome Boban :) Thanks!

hey

I’ve an LLC that was created on 30/3/2020 on Wyoming, I know that I have to file the 5472&1120 forms before the 15th of April this year,

the issue is that I didn’t use my LLC anywhere, I do have an EIN which I also didn’t use at all, I just simply created an LLC and leave it, that’s all, I don’t have any revenue or profits, no products no website no bank account, nothing yet, it’s been almost a year but I literally didn’t use my LLC anywhere,

my question is what exactly should I write on my forms ? you’ve mentioned how to fill the 11120 form, but can u give more details on how to fill the 5472 form in my case ( had zero money from my LLC )

thank u very much for this article, it’s been very very useful.

please note that I can’t afford asking an accountant, that’s why I need your help..

Hi Ghaith, you’re welcome. We don’t have instructions on how to complete Form 5472 at this time. However, you would just report the initial amount you put into the LLC and the money you paid to form the LLC.

Hello! Maybe this is a stupid question, but once the form is filled: where should I sign it? The 1120 pro-forma has a place where it says “Sign Here”, but I can’t find that anywhere in the Form 5472. Thanks!

Hi Pablo, you don’t sign Form 5472, but you sign Form 1120. At the bottom of page 1 on Form 1120, sign your name, enter the date you completed the form, and for title, use “Owner”. Hope that helps :)

Great article Matt. I have an LLC in Alabama, and I’m a non-resident alien who has been in the US since 2010 on subsequent O1 Visas. I left the USA to visit my family in Australia, and then Covid hit so I stayed for most of 2020.

I arrived back in the US on Dec 26 and was only in the USA for 26 days in 2020. Can the status of an LLC change for one year? I will be in the US permanently going forward, so if I file form 5472 and 1120 for 2020 how would I change the status of the llc to domestic owned for 2021?

I’ve emailed Gary at GW Carter about this but looking for any helpful insight I can get ;)

TIA

Thanks Nick :) We are not experts in this matter, so please check with an accountant (or a few), however, I believe you are considered a “Resident Alien” for tax purposes because of the “substantial presence test” (easiest to watch Youtube videos for explanation), even in the 2020 tax year because the substantial presence test would be calculated using the years 2020, 2019, and 2018. If you are considered a Resident Alien for the 2020 tax year, then you should not file Form 5472 + Form 1120 in April 2021. Hope that helps.

Hi,

Thank you for another fantastic article. Quick question: if LLC elects to be treated as a Corp with the IRS, it basically becomes a C Corp for all tax reporting purposes?

Thanks in advance!

-Inna

You’re welcome Inna! Yes, you are correct. An LLC electing C-Corp taxation is treated as a C-Corporation for federal tax purposes.

Hi Matt!

This page is great! Thank you for your work.

I have a question.

I am planning to open an LLC.

I have an SSN “Valid for work only with DHS authorization”.

Do I have to use this number to get the EIN for the LLC, or should use the INTL number that that page is giving me?

Thank you

Hi Marcelo, thanks! What do you mean by “INTL number”? Do you mean the international phone number? If so, no, that number is used for companies that were formed outside of the United States. You can use your SSN to apply for the LLC EIN online. Hope that helps.

Hi Matt! Thank you for this helpful article. I am still in the planning stage of putting up my business in the United States. I am a foreigner planning to open a small online shop for dresses in the Us. From what I have gathered, it would be a one-member LLC, foreign owned. Do you have any recommendations on which state I should incorporate since it is going to be an online shop?

Hi Rosie, if you are not physically doing business anywhere in the US, you can pick any state you’d like. We don’t have specific recommendations at this time. Hope that helps.

1. Where to record my member contribution of $150 to register the LLC. Should this be in Part IV, Line 12 or documented in Part V?

2. Where to record my member distributions. Should this be in Part IV Line 25, or documented in Part V?

Hi Aditya, we recommend seeking assistance with Form 5472. We have recommendations on this page. We’re unable to answer how the form should be filled out as it depends on the relationship of the people, the type of transaction, and the tax status/residency of the person. Thank you for your understanding.

Matt,

Good day!

Is it still required to file 5472 even if there were no reportable transactions during the first year (formation date June 2019)?

Also, if the scenario is like this

US individual > Foreign Co> US LLC (100% owned by foreign Co)

do i report the US individual and the foreign co as related parties?

Thank you in advance

Hi Anne! Actually, the formation of the LLC is a reportable transaction as well as the initial capital contribution. You’ll want to find assistance from an accountant on this completing this form (we have recommendations on the page), however, those parties sound like Related Parties. Hope that helps.

Hi,

Is it possible for the Foreign owned US LLC to have a tax due? If so, who will be reporting/paying the tax and how should it be reported?

Also, should we file a return(like 1040R) for the foreign owner?

Thanks

Hi Grace, yes, it is possible. It first depends on whether or not you are considered a Resident Alien or a Non-resident Alien for tax purposes. If you are not a green card holder and you don’t pass the substantial presence test, then you are considered a Non-resident Alien for US tax purposes. As to whether or not you have to file a 1040NR comes down to how you make your money (personal services, sale of inventory, interest, dividends, real estate, etc.) and where the money is made. It also depends if the income is “effectively connected” to a trade or business in the United States. It also depends on what country you are a resident of since the US has about 60 tax treaties with different countries. Having said all that, if you have a Single-Member LLC that is not engaged in a trade or business in the US and you don’t have US source income, you may not have a US tax filing requirement (besides Form 5472). In summary, it depends on multiple factors and it’s not something that we can answer. We recommend hiring an accountant who specializes in working with non-US residents. We recommend Gary at GW Carter. Hope that helps!

Loved your article! In the paragraph “Overview of steps”, could there be one more step added?

File Form 1120, 1120S, or 1040NR for income tax purposes depending on your filing status.

As a Foreign-owned Single-member LLC, although you file form 1120 and 5472, do you not still have to file an income tax return to report and pay your taxes?

Thanks Andrew! And thanks for your comment. We just updated that section to make it more clear. You may need to view the page in a private/incognito tab due to browser caching to see the update. The 1040NR and ITIN are necessary if there is US source income and they have a filing requirement. There are some types of businesses that are foreign-owned that don’t have US source income and don’t need to file a US tax return. They just need to file an information return, like the 5472. For example, a non-US resident owning a Single-Member LLC that is not engaged in a US trade or business in the US (ETBUS) and has no dependent agent(s). Having said that, the term “trade or business within the United States (ETBUS)” is not fully defined in the Code or Treasury regulations, and the IRS hasn’t provided an advanced ruling on whether a taxpayer is engaged in a US trade or business.

Hello Matt,

Thank you so much for your article. its very helpful.

I am have just submitted article of organization as multi member LLC in Florida but I was not sure if I should have chosen single member LLC in terms of tax return…

We have a headquarter in Japan and would like to form LLC as a branch of our foreign entity.

In this case, would it be possible to establish single member LLC with our headquarter business entity name ?

Not sure if we need to add an individual person as a member (a person who has SSN) to form LLC in this case if we do, it will be Multi member LLC and I don’t want each member to be taxed.. is there a way to set up only one member to be taxed for multi member LLC ?

Thank you for your help in advance

Kohsuke

Hi,

I have to file 5472 and 1120 Is there anything else I have to file as I am foreign-owned Single-Member LLC Disregarded Entity NOT engaged in “trade or businesses” in the U.S. (only Amazon FBA, this is not consideret engaged in trade or business IN the U.S.)

Thanks,

Ville

Hi Ville, we’re not able to answer at this time as there could be more details involved. You’ll want to speak with an accountant who works with non-US residents. Check out Gary Carter’s company, GW Carter LTD out of Minnesota. They specialize in working with foreign nationals. Hope that helps.

Hi. Thank you for the informative article.

I have registered a LLC, I am the only owner and I am a foreigner.

What I do not understand is about the reporting terms – must I choose which option to use – fiscal year or calendar year or this is determined by the Law?

My LLC was registerd in March 2018 in WY and had no acitivity up to now.

Thank you very much.

Hi Tsvetina, you’re very welcome. By default, an LLC will run on the calendar year (January 1st to December 31st) unless it makes an election or request with the IRS. The majority of LLCs run on the calendar year. So no, you don’t have to take an action for using the calendar year. Although you have no business activity, you likely have reportable transactions (such as money paid to open the LLC, money contributed to the LLC, etc.) and you’ll want to file Form 5472 and Form 1120 by April 15th, 2019. Hope that helps.

Thank you very much, Matt. That helps a lot.

In January 2019 I set up a LLC (Sole-Member). I plan to keep the company dormant. The LLC is foreign owned. Does the company formation alone constitutes a Reportable Transaction so I need to file the 5472 form ?

Hi David, I think so. When it doubt, it’s best to file Form 5472. Hope that helps.

Very good information, when it is necessary to present these forms?

After the incorporation or at the end of the first fiscal year?

I have contacted some accountants but are unaware of the subject.

Thanks Ralf. They are due after the close of the first fiscal year. Most LLCs run on the calendar year, January to December. Following that example, if your LLC was formed sometime in 2019, then Form 5472 and Form 1120 will be due by April 15th 2020. Hope that helps.

great article. Very thorough.

Hey Jim, thanks for stopping by. Appreciate that!

Hi Matt,

I’m a foreign person (Canadian) and formed a foreign-owned U.S. LLC that is a Disregarded Entity in 2015. Since this formation, I have not done any business transactions and no EIN have been applied to date. I plan to dissolve this LLC in the near future. However, my wife paid the Delaware registered agent in 2015 for form this LLC. Do I still need to file Form 5472 for the money paid by my wife in 2015? Is this considered a reportable transaction by a related party? Also, the requirement to file Form 5472 is for starting 2017 tax year – does this mean I don’t need to file this form because of the prior year transaction? Thank you

Hi Richard, we’re not able to get into the details on 5472. It’s best practice to speak with an accountant who is familiar. Having said that, that does sound like a reportable transaction with a related party that took place before the reporting requirement. When in doubt, it’s best practice to file the form anyway. Hope that helps.