Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

In this lesson, we will walk you through how to start a Nebraska LLC. This is done by filing a Certificate of Organization with the Nebraska Secretary of State.

In this lesson, we will walk you through how to start a Nebraska LLC. This is done by filing a Certificate of Organization with the Nebraska Secretary of State.

This document officially forms your Nebraska LLC.

After completing your Certificate of Organization form, you can submit it to the Nebraska Secretary of State by mail or online.

You can file this yourself or you can hire a company to file it for you. If you want to hire a company, check out Best LLC Services in Nebraska.

Nebraska LLC Certificate of Organization Fees

Online: The filing fee is $100.

By mail: The filing fee is $110.

Note: The “LLC filing fee” (the fee to create a Nebraska LLC) is the same thing as the “Certificate of Organization fee”. The Certificate of Organization is the document that, once approved by the Secretary of State’s office, creates your Nebraska LLC.

How much is an LLC in Nebraska explains all the fees you’ll pay, including the Certificate of Organization filing fee.

Overview of the filing process

- Regardless of whether you file by mail or online, you’ll need to complete the Certificate of Organization paper form.

- You can complete the form by hand or on your computer.

- Once the form is complete, you can either:

- mail it to the state

- or scan it and upload it online.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Filing Methods & Approval Times

Uploading the form online has a few more steps, but it has a faster approval time. Your LLC will be approved in 2-3 business days.

Filing by mail is a little slower – your LLC will be approved in 2-3 business days (plus mail time). But filing by mail doesn’t involve any scanning and uploading. So for some, it might be a simpler process.

Note: Filing times may take longer due to government delays. For the most up-to-date LLC processing times, check how long does it take to get an LLC in Nebraska.

- We recommend filing online if you need your LLC approved as fast as possible.

- We recommend filing by mail if you’re not comfortable with scanning and uploading PDF documents.

Instructions for Completing the Nebraska LLC Certificate of Organization

Download the Certificate of Organization

Download the Nebraska LLC Certificate of Organization

Handwritten or typed

You can print the form, fill it out by hand (use a blue or black pen), then sign. Or you can type in the form on your computer, then print and sign. When printing, use regular white paper (8.5″ x 11″).

Name of Limited Liability Company

Before you begin: The most common reason LLCs are rejected in Nebraska is because the name is not available. To avoid this happening to you, make sure you’ve searched your Nebraska LLC name before filling out your Certificate of Organization.

Enter your LLC name exactly as you would like it in the field for “Name of the Limited Liability Company“. Include your preferred capitalization, as well as the designator. In Nebraska, you can use any of these designators:

- LC

- L.C.

- LLC (most common)

- L.L.C.

- Limited Co.

- Ltd. Company

- Ltd. Liability Co.

- Limited Company

- Limited Liability Co.

- Ltd. Liability Company

- Limited Liability Company

Note: You can use a comma in your Nebraska LLC name or you can leave it out. For example: “Meadow Mowers, LLC” and “Meadow Mowers LLC” are both acceptable.

Initial Designated Office

Your Initial Designated Office is also known as your “principal place of business”. Basically, the state wants to know where your LLC is located in Nebraska.

Street Address for Initial Designated Office:

You must enter an address here. It needs to be a physical address in Nebraska (it can’t be a PO Box). This address can be a home address, an office address, or the address of your Registered Agent.

Mailing Address for Initial Designated Office:

This section is optional. Meaning, if you don’t have a separate mailing address, you can leave this blank. If you have a separate mailing address for your Initial Designated Office, you can enter it here.

Initial Agent for Service of Process

- Note: Your Initial Agent for Service of Process is the same thing as your Registered Agent.

- Prior lesson: Make sure you have read the Nebraska Registered Agent lesson before proceeding.

Name of the initial agent for service of process

Enter your Registered Agent’s full name (or company name).

Street Address (of the initial agent for service of process)

Enter your Registered Agent’s street address. This must be a physical address in Nebraska. Your Registered Agent address can’t be a PO Box.

PO Box/Mailing Address (of the initial agent for service of process)

This section is optional. Meaning, if your Registered Agent doesn’t have a separate mailing address, you can leave this blank (this is the most common). If the Registered Agent you’re using provided you an alternate mailing address to use, enter it here.

Pro Tip: If you don’t have a street address in Nebraska, or if you prefer not to use your address for privacy, you can hire a Registered Agent Service. We recommend Northwest Registered Agent. Northwest has been in the business for over 20 years and they have great customer support. Any mail that is sent to your LLC will be scanned by them and uploaded to your online account.

Effective Date of Filing

Leave this section blank if you want your LLC to be effective upon filing. This means your LLC will go into existence on the date it is approved by the Nebraska Secretary of State.

If you need your LLC to go into existence at a later date, enter that date on the line for “Effective date if other than the date filed”. The later date can’t be more than 90 days out.

Pro Tip: If you’re forming your LLC in October, November, or December, and you don’t need your business open those months, forward date your filing to January 1st. This will save you the hassle of doing unnecessary taxes. For more information, please see LLC effective date.

Organizer’s Name and Signature

Enter the LLC Organizer’s full name on the “Printed Name of Organizer” line. Then print out the form and have the Organizer sign.

The Organizer is the person responsible for filing the documents with the state. An Organizer can be a Member of the LLC, but they don’t have to be.

Tip: Most people are filing their own LLCs, so they are both a Member and an Organizer. For more information on the difference between a Member and an Organizer, please read these short articles: LLC Organizer vs Member and Registered Agent vs LLC Organizer.

What to do next: Online Upload or Mail

After you’ve completed your Certificate of Organization, you can submit it to the Nebraska Secretary of State either by mail or online.

As mentioned earlier, the approval time when filing by mail is 2-3 business days (plus mail time), and the approval time when filing online is 2-3 business days.

We have instructions for both filing methods below. Feel free to use whichever filing method you are most comfortable with.

How to file Nebraska Certificate of Organization by Mail

Important: If you file by mail, you will need to submit 2 copies of your Certificate of Organization. The Secretary of State will stamp their approval on one copy and send it back to you. That’s your LLC approval document, which you’ll use to open a business bank account, among other things.

Prepare Payment

Prepare a check or money order for $110 payable to “Nebraska Secretary of State”.

Mail Documents

Mail 2 copies of your completed Certificate of Organization along with your $110 filing fee to:

Secretary of State

PO Box 94608

Lincoln, NE 68509-4608

Congratulations, your Nebraska LLC has been submitted for processing! Now you just need to wait for approval.

LLC Approval (filing by mail)

Your LLC will be approved in 2-3 business days (plus mail time).

Once your LLC is approved, the Secretary of State will send you back a stamped and approved copy of your Certificate of Organization. They’ll also send an Acknowledgement of Filing Letter (which acts as your receipt).

How to file a Nebraska Certificate of Organization Online

Scan your Certificate of Organization to PDF

Make sure you’ve completed, printed out, and signed your Certificate of Organization. Then scan it to your computer and save it in PDF format. The state only accepts files uploaded in PDF format.

Nebraska’s Corporate Document eDelivery

Visit Nebraska’s Corporate Document eDelivery page.

Note: You can ignore the part about becoming a subscriber. This isn’t required.

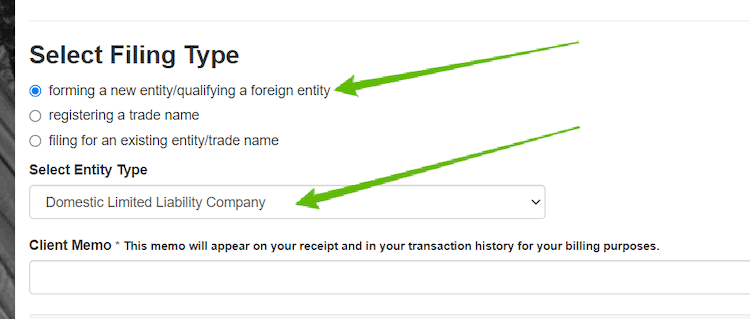

Select Filing Type

Select Filing Type

Click “forming a new entity/qualifying a foreign entity”. A new drop down menu will appear below.

Select Entity Type

Choose “Domestic Limited Liability Company” from the drop down menu.

You can leave the “Client Memo” line blank and then click “Continue” to proceed.

Important: The information you enter on this page must be exactly the same as the information in the paper Certificate of Organization you completed and scanned. If the information doesn’t match exactly, the state will reject your filing.

Certificate of Organization

Entity Name

Name of Entity: Enter the name of your LLC exactly as you wrote it on the Certificate of Organization. Be sure to include the designator (like “LLC”).

Designated Office Address

Enter your LLC’s Initial Designated Office street address.

Effective Date of Filing

Select “Effective When Filed” if you wanted your LLC to go into existence right away (and you left the Effective Date section blank on the paper Certificate of Organization form).

If you want your LLC to go into existence at a later date, select “Delayed Effective Date” (and enter that delayed effective date in “yyyy/mm/dd” format).

Submit Document

Click the “Choose File” button, locate the scanned PDF of your Certificate of Organization, and then upload it.

Corporate and Business Document eDelivery

Registered Agent

On the next page you will enter your Registered Agent information, also known as your Initial Agent for Service of Process.

Individual

If your Registered Agent is an individual (such as you, a business partner, a friend, a family member, or an attorney), select “Individual” and then enter their first and last name. Remember to match your paper Certificate of Organization.

Then, click the “Search” button. A box will appear below stating “No Results Found” (or you’ll see other people with a similar name). This is normal for having an individual as your Registered Agent. Just click the “Create New Registered Agent Record” button. A popup box will appear where you need to enter the individual’s street address. Enter their street address exactly as you did on the paper Certificate of Organization and click the “Finish” button.

Entity

If you hired a Commercial Registered Agent, select “Entity” and then search for their name by entering it in the “Entity Name” box and then clicking “Search”. Once you find your Commercial Registered Agent, click “Select Agent” underneath their name.

If you hired Northwest Registered Agent, their official name in Nebraska is “NORTHWEST REGISTERED AGENT SERVICE, INC.”

Review

Review your information for accuracy and check for typos. If you need to make any changes, click the “edit information” icon to the right of any section.

Optional: Request Certified Copies

This is not a requirement and is not needed for most people, but if you’d like a more official (and prettier) LLC approval document (with the official state seal), you can order a Certified Copy for an additional $10 charge.

If you don’t want to order a Certified Copy, just skip this step and don’t click the button.

If you do want to order a Certified Copy, click the “Request Optional Certified Copies” button. A new page will now load.

- Under “Request Certified Copy”, select “Yes”.

- The number “1” will automatically be entered in the “Quantity” box. Only change this if you want to pay more for extra copies.

- Next, enter your LLC name, your name, and the address where you’d like the Certified Copy mailed to.

- Then click the “Continue” button.

Required to submit

Check the box to agree to the terms.

Email address for filing notifications

Enter your email address here. The state will send a notification to this email when your LLC is approved. Then you can download your approved Certificate of Organization document.

Note to SOS Filing Officer (optional)

You can leave this notes section blank.

Click the “Submit” button at the bottom to proceed to the next step.

Payment Information

Enter your billing information, phone number, and enter your email twice.

Enter your credit card or debit card information.

Then click the “Verify Information” button and submit your payment to the state.

Congratulations! Your Nebraska LLC has been submitted for processing. Now you just need to wait for approval.

Nebraska LLC Approval

Your LLC will be approved in 2-3 business days.

Once your LLC is approved, the Secretary of State will send you an email with a link where you can download your stamped and approved Certificate of Organization.

Note: You won’t receive an Acknowledgement of Filing Letter (like you do if you file by mail), since the email serves as your receipt instead. The email will be sent to the address you provided during the online filing.

Nebraska Secretary of State Contact Info

If you have any questions, you can contact the Nebraska Secretary of State at 402-471-4079.

(Nebraska Secretary of State, Business Services Division Building)

Search your domain name

If you plan on building a website, you can quickly register your domain name. Creating a website with your business name as the domain name can help people find your business online. You can easily search and purchase a domain name through GoDaddy.

Find a domain name

Nebraska LLC Certificate of Organization FAQs

How much does it cost to start an LLC in Nebraska?

It cost $100 to file your LLC online. And it costs $110 to file your LLC by mail.

The filing fee for the Nebraska LLC Certificate of Organization is a one-time fee paid to the Nebraska Secretary of State.

How much does an LLC cost per year in Nebraska?

Unlike other states that have an Annual Report (and an annual fee), Nebraska does not.

Instead, all LLCs in Nebraska file Biennial Report, and this is due every 2 years.

The cost is $13 every two years. This fee is paid to the Nebraska Secretary of State.

Filing the Biennial Report keeps your LLC in good standing.

What is the Certificate of Organization for an LLC in Nebraska?

The Nebraska Certificate of Organization is a form that tells the Secretary of State important information about your LLC. Once the Secretary of State approves your Certificate of Organization, your LLC officially goes into existence.

The Certificate of Organization form asks for your LLC name, business address, Registered Agent, and other information.

References

Nebraska LLC Act: 21-117

Nebraska Secretary of State: New Business Information

Nebraska Secretary of State: Forms and Fee Information

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Nebraska LLC Guide

Looking for an overview? See Nebraska LLC

First, the information on this website is very well written and helpful.

I’m converting a Partnership into an LLC and wasn’t sure if you would have an idea how to fulfill the last two requirements established in Nebraska Revised Statute 21-175. I’m not really sure how to format what the SoS is asking in the following sections.

(3) the terms and conditions of the conversion, including the manner and basis for converting interests in the converting organization into any combination of money, interests in the converted organization, and other consideration; and

(4) the organizational documents of the converted organization that are, or are proposed to be, in a record.

https://nebraskalegislature.gov/laws/statutes.php?statute=21-175

Thanks Matt! Nice job finding that statute, however, that doesn’t apply to a Partnership, since a Partnership is not a legal entity (aka organization), therefore, it can’t convert to an LLC. “Converting” (more accurately “changing over from”) a Partnership to an LLC involves forming a Multi-Member LLC and stopping to operate as a Partnership. Do you have a bank account in place for the Partnership? Does the Partnership have assets or liabilities? Does your partnership have a Trade Name (aka DBA)?

Thanks for the quick reply! I started the company with a coworker who didn’t put in equal work. I had him sign a form that an attorney wrote up that basicly stated that he was withdrawing from the partnership and releasing all assets to myself.

For all the questions you stated the answer is yes to all three. When I called the NE SoS they directed me to statute 67-448.1 which refereed me to that one. I have the whole Cert of Org written, except for the actual conversion part. SoS said that I had to include an article in the Cert of Org stating my business was a partnership prior, and will now be an LLC.

I’m mainly switching it from a partnership since It’s just myself now, and I have new directions for the company.

Sure thing! Let me just back up a little bit here. Do you have a legal entity partnership, such as a Limited Partnership or a Limited Liability Partnership filed in Nebraska, or was it just a “regular” General Partnership (GP)? If it was a GP, did you file the optional Statement of Partnership Authority with the Nebraska Secretary of State? Is this new business the same as the prior? What I’m trying to get at is that you might not need to convert from a GP to an LLC, especially if the Statement of Partnership Authority isn’t on public record. Furthermore, it sounds like your GP actually dissolved, so converting it would be technically incorrect, since it sounds like it doesn’t exists anymore. Said another way, it may be easier (and cleaner from a records/documentation standpoint) to simply form a new LLC (I’m assuming you’ll be the sole owner?) If the GP has a Statement of Partnership Authority on record, you can file a Statement of Dissolution. Or you could just “walk away”, as it sounds like statutorily, the Partnership has already been dissolved (since the 2-person GP no longer has 2 partners). Also, do you want form an LLC with the same name as the Partnership?

I just pulled up my documents and searched the Partnership name on the SoS website. It only pulls up a tradename and nothing of a Partnership. We never filed a Statement of Partnership, so I’m actually thinking that we never fully set it up. If that’s the case then I should not need to so anything with that statute at all I would think.

So I guess the only legal representation of the ‘partnership’ was a tradename. I want to form a LLC with that name. We submitted it using this form, and we checked the “partnership” box.

It’s just going to be myself on the new LLC.

Thanks Matt.

Hi Matt, your General Partnership always existed, regardless of a Statement of Partnership Authority being on record or not. The Statement of Partnership Authority just registers an already existing General Partnership (it doesn’t create it). The same thing applies to the Partnership’s Trade Name: that didn’t create the Partnership, it just gave the Partnership a “nickname” that it could legally use. In essence, the Partnership was always just John Doe 1 & John Doe 2. The Trade Name is just those two guys’ “nickname”.

After your LLC is formed, you can transfer the Trade Name (via an Assignment of Trade Name), however, that may or may not be needed. To make sure I provide helpful information, can you tell me the name of the Partnership’s Trade Name as well as your desired LLC name? If you don’t want to provide the actual names, please use dummy names.

Interesting, both tradename and desired LLC are PatchPhrase.

Okay, very helpful. Do you have a good relationship with your partner? Said another way, could you get them to sign a form with you? Disregard the prior comment about the Assignment of Trade Name. That won’t help. What’s easier is to form your LLC by filing the Certificate of Organization and to also include written letter signed by you and your partner cancelling the Trade Name (aka Cancellation of Trade Name). The examiner at the Secretary of State will first cancel the Trade Name (making it immediately available) and then the LLC will be formed using PatchPhrase, LLC (or PatchPhrase LLC).

I actually have a statement of withdrawal signed that says he turned over all assets and the business to me. I can send that in.

That wouldn’t work. You would need a Trade Name Cancellation letter sent in (along with your LLC Certificate of Organization) signed by you and your old partner, since you are both still on record as the owners of the Trade Name.

After filing the LLC paperwork, is it possible to amend any of the articles? Let’s say down the road, I have members I want to add or an organizer or maybe I want to change the type of management it’s listed as. Does that require a whole new Certificate of Organization?

Hi Michelle, yes, you can amend the Certificate of Organization. The filing is called an “Amended Certificate of Organization”.

Well documented and resourceful, thank you. Best of luck to you and LLCUniversity

You’re welcome Eric :) Thanks for the awesome comment!

I submitted mine and it was denied saying, “As you are providing a professional service you will need to state this in your Certificate of Organization.” Where would I put this info?

Hi Ashely, we’re preparing a page for a professional service Nebraska LLC. I’ll reply with the link next week. What type of license do you hold? And thank you for your email.

LIMHP and CMSW in NE. Both are mental health services.

Thank you Ashley. You’ll want to confirm with the Secretary of State by phone, but you will likely need to submit an Application for Electronic Access of Records along with your Certificate of Organization.

Hi Matt,

Wow this information is so helpful. I am setting up two simple single member LLC’s in Nebraska. I was quoted $3400 by an attorney. Your information is allowing me to not only learn and know info but complete all of this for only $300. Thank you Thank you Thank you

I have been a successful sole prop for 10 years. I never wanted to mess with the legal jumbo and attorney part of this. If I would have found your site I would have done this a decade ago!

I do have one question. If Im filing my certificate of organization for my LLC with my Nebraska state secretaries office, do I also need to register a trade name or will the certificate of origin do that for me?

Chris / Matt, I was wondering the same thing.

I’ll answer for all of us. No, as long as you use your registered business name. You only need to file a trade/DBA when you plan on operating under a different name.

“You don’t need a DBA/fictitious name statement filed. For example, if you have registered your LLC as “Super S Stores” and that’s the name on all your stores, you don’t need a DBA.”

Good info Michael. That makes sense. Thank you

Michael, thanks so much for chiming in and helping Chris! I also left a link to “Do I need to file a DBA” below in my reply to Chris. Thanks again :)

Chris, thank you SO MUCH for your comment. It really means a lot! You likely do not need a Trade Name (DBA) if you’re going to be doing business under the LLC’s actual legal name (as opposed to using a “nickname”, which is a great way to think of a Trade Name). However, we cover more details on whether or not a Trade Name/DBA is needed after forming an LLC here: Do I need to file a DBA. Hope that helps!

That makes sense. And yes for me the exact LLC name is what I’m operating under, so I’m good!! Thanks Matt

You’re welcome Chris. This is usually the case… most people forming LLCs don’t also need a Trade Name. Glad we could help straighten things out for you :)