Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Once you’ve chosen a New York LLC name, you need to compare it against existing businesses in the state.

This is done using the New York Business Entity Database.

And this is necessary because business names in the same state:

- can’t be the same

- can’t be too similar

If you file your LLC paperwork with a name that’s not available, your LLC filing will be rejected.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

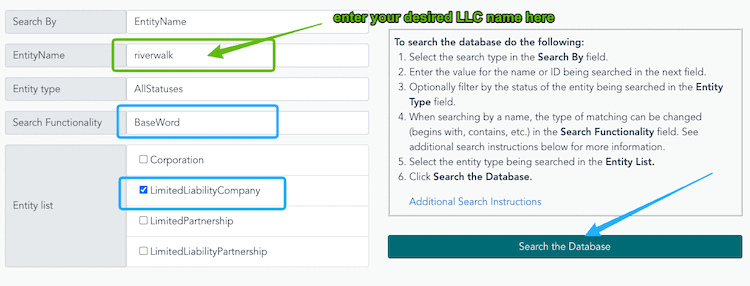

How do I search the New York business entity name database?

Note: This tool is sometimes called the New York Business Name Search or the New York Business Entity Search. They both refer to the same website and get you the same search records.

Visit the New York Business Entity Search page:

New York Division of Corporations: Business Entity Database

It’s simple to use:

- Enter your desired LLC name in the “Entity Name” field.

- Select “BaseWord” in the Search Functionality section.

- Check the box for “Limited Liability Company“.

- Click “Search the Database“

Search tips:

- Leave out “LLC”, “L.L.C.”, “Limited Liability Company”, etc., when doing your searches.

- Leave out any commas, periods, apostrophes, etc.

- You can search using uppercase or lowercase letters.

Tip: It’s best to enter only the main part of your desired LLC name in the search bar. For example, if your desired LLC name is Riverwalk Studios LLC, first do a search for the words “Riverwalk Studio”. And then do a search for “Riverwalk”. This helps make sure that you see everything that is potentially similar.

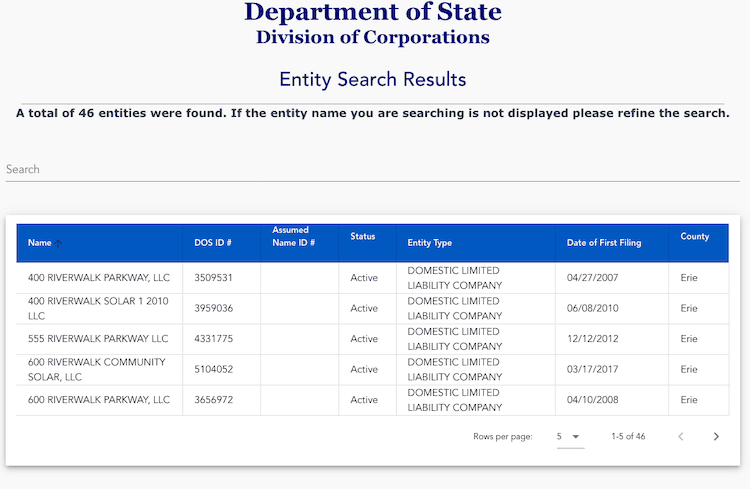

How to interpret the New York LLC search results

If the results show names that are not too similar to yours (meaning yours is distinguishable), then your Limited Liability Company name is available for use.

- Let’s keep using the example above. If your desired name is Riverwalk Studios LLC, and the only similar names you saw were “Riverwalk Rentals” and “Riverwalk Studio Starters”, then your name should be available.

If no results show up, that means your LLC name is unique and it should be available for use. To be safe, run your search again using only part of your LLC name (to double-check that there are no similar names).

- For example, search just the word “Riverwalk” instead of Riverwalk Studios.

If your exact LLC name appears in the list of search records, your LLC name is not available for use because another New York business entity is already using it.

If the results show a name that is very similar to yours, your LLC name may not be available for use.

- If your desired name is Riverwalk Studios LLC, and the search results show a “Riverwalk Studio”, then your name is not available.

What if my desired LLC name isn’t available?

If your name is not unique, you’ll need to come up with a variation or a different name for your LLC.

Tip: Wait until your LLC is approved before you apply for your LLC EIN Number or purchase any other marketing materials. This way you don’t spend money on business supplies you can’t use because your business name isn’t available.

New York Division of Corporations Contact Information

You can call the New York Division of Corporations to ask questions about whether your LLC name is available.

Representatives at the New York Division of Corporations can help you use the New York Business Name Search. They can’t guarantee that your LLC name will be available when you file, however.

The Division of Corporations phone number is 518-473-2492. Their hours are 8:30am to 4:30pm Eastern time, Monday through Friday.

New York Limited Liability Company Name Requirements

As per Section 204 of the New York LLC Act, there are a few rules and requirements for naming a New York business entity that you need to know.

English language or English alphabet

New York state has a rule that business names can only contain the following:

- English alphabet letters

- Arabic numerals (1, 5, 200)

- Roman numerals (I, IX, MMVII)

- Symbols on a standard English keyboard ($, #, “”)

So if your desired LLC name is in another language, it must be either:

- translated into English

- or written in letters of the English alphabet.

For example:

If your desired New York business name is प्राण योग Studio LLC, you must file it as Prana Yoga Studio LLC, using only English letters.

Or if your desired New York business name is Appétit Pâtisserie LLC, you must register it as Appetit Patisserie LLC. You could still use the correct accents in Appétit Pâtisserie on your business’s sign and website. But the documents filed with the New York Division of Corporations can’t use those non-English letters.

Do I have to use a comma in my LLC name?

No, you don’t have to. You can file your LLC name with or without a comma. Both versions are accepted by the Division of Corporations.

For example: If your desired business name is Grandpa Joe’s, you can file it as:

- Grandpa Joe’s LLC

- Grandpa Joe’s, LLC

Or, instead of having “LLC” as your designator (ending), there are a few other options in New York.

What designators (endings) can I use in my LLC name?

Your LLC name must contain one of the following designators at the end:

- LLC

- L.L.C.

- Limited Liability Company

Note: Most people choose “LLC”.

The following designators are not allowed

Your LLC can’t make itself sound like a New York Corporation or any other business entity besides an LLC.

The following words and designators can’t be used anywhere in your LLC name:

- Inc.

- Corp.

- Incorporated

- Corporation

- Cooperative

- Partnership

What words are not allowed in my New York LLC name?

Your LLC name can’t contain words and abbreviations that are restricted by law.

For example, you can’t make your LLC name sound like it’s a bank, part of the government or a government agency, or anything else that misleads the public.

In New York, you can’t use the words “blind” or “handicapped” in a business name without approval from the Department of Social Services. And you can’t use the word “exchange” in your LLC name without approval from the state Attorney General.

You’ll need approval from the Commissioner of Education to use any words that make your LLC sound like an educational institution. This includes words like “school”, “education”, “library”, “history”, “historical”, “academy” and others.

You also can’t use words that are reserved for licensed professionals. These vary by state, but some common examples are accountants, architects, attorneys, dentists, and engineers.

For more information about restricted words for a New York business entity, please see this PDF: Restricted Words for Business Names. There is also a list of prohibited words in the New York LLC Act.

Your New York business name must be distinguishable (unique)

When you search the New York Division of Corporations Business Entity Database, you will compare your desired LLC name to existing businesses in the state.

If your name is not unique, you’ll need to come up with a variation or a different business name.

Below are rules and examples of LLC names that are not distinguishable.

Designators

Differences in designators (endings) don’t create distinguishability.

If your desired LLC name is Beaver Fishing Company LLC, it’s not available to use if any of the following are found in the New York Business Name Search results:

- Beaver Fishing Company, Inc.

- Beaver Fishing Company, Corp.

- Beaver Fishing Company, L.L.C.

Filler Words

Adding non-meaningful or filler words (like “the”) won’t create distinguishability.

These types of filler words don’t create distinguishability in New York:

- the word “Company” or “Companies”

- articles (a, an, the)

- conjunctions (and, or)

- prepositions (of, by, in, on)

If your desired LLC name is Maple Farms LLC, it’s not available to use if any of the following are found:

- The Maple Farms LLC

- On Maple Farms Inc.

- Maple and Farms L.L.C.

- By Maple in Farms Corp

Plural or Singular Words and Possessive Words

Adding a letter “s” to make a word plural or possessive doesn’t create distinguishability.

If your desired LLC name is Garnet’s Gems LLC, it’s not available to use if any of the following are found:

- Garnets Gems LLC

- Garnet’s Gem Inc.

- Garnets Gem, L.L.C.

Numerals or Spelled Out Numbers

Using numerals (like 5 or 101) instead of spelling out the number (like “five” or “one hundred and one”) doesn’t create distinguishability.

If your desired LLC name is 25 Roses LLC, it’s not available to use if any of the following are found:

- Twenty-Five Roses LLC

- Twenty 5 Roses Inc.

Punctuation and Special Characters (Symbols)

Generally speaking, adding or removing punctuation and symbols doesn’t create distinguishability.

If your desired LLC name is Bluebird Beauty LLC, it’s not available to use if any of the following are found:

- Blue/bird/beauty Inc.

- Bluebird “Beauty” LLC

- Bluebird! Beauty! Inc.

Exception: Special Characters that DO Create Distinguishability

Adding these symbols does create distinguishability according to the New York Division of Corporations:

- at sign (@)

- dollar sign ($)

- equal to sign (=)

- percentage sign (%)

- plus sign (+)

- number sign (#)

- cent sign (¢).

For example: Let’s say your desired LLC name is Clever Coins LLC. But there is already a New York company named Clever Coins Inc. You could use a symbol from this list in your name to make it distinguishable: Clever $ Coins LLC.

Note: This rule doesn’t apply to replacing words with symbols. Meaning, using a special character (like “$”) is considered the same as using the character’s name (“Dollar Sign” or “Dollar”). That means the business name Girls Equal Greatness LLC isn’t distinguishable from the name Girls = Greatness LLC and it wouldn’t be available to use.

Spaces and Hyphens

Adding or removing spaces between words or hyphens between words doesn’t create distinguishability.

If your desired LLC name is Honeybee Soapstore LLC, it’s not available to use if any of the following are found:

- Honeybee-Soap-Store Inc.

- HoneybeeSoapstore Incorporated

- Honey Bee Soap Store, L.L.C.

Suffixes, Derivations or Deviations

Using the same word, just with a suffix or a different derivation, doesn’t create distinguishability. This rule can be tricky, because sometimes a different version of a word has a different meaning and would be distinguishable. Really, it all depends on the opinion of the LLC examiner who reviews your paperwork.

If your desired LLC name is Empire Creations LLC, it might not be available to use if any of the following are found:

- Empire Creatives LLC

- Empire Creates Inc.

- Empire Creativity, Ltd. Co.

Verb Tenses

The same rule applies for different tenses of a word. Meaning, the Division of Corporations looks at the key word used, whether it’s in past tense, present tense, or something else. But again, the final determination depends on the LLC examiner who reviews your Articles of Organization.

If your desired LLC name is Go Higher LLC, it might not be available to use if any of the following are found:

- Went Higher Inc.

- Going Higher LLC

Abbreviation vs Complete Name or Word

Using an abbreviation instead of a complete word (or vice versa) doesn’t create distinguishability.

If your desired LLC name is Pennsylvania Pretzel Bros. LLC, it’s not available to use if any of the following are found:

- PA Pretzel Bros, L.C.

- PA Pretzel Brothers, Ltd. Liability Co.

- Pennsylvania Pretzel Brothers Inc.

Business Search Tips for Abbreviations

If you want to use an abbreviation, or a word that has a commonly-used abbreviation, make sure you search for the abbreviation and the complete word when you use the Business Entity Search to check availability.

For example: If you wanted to use the word “February” in your business name, make sure you also search for the business name using “Feb” instead. Or if you wanted to use the abbreviation “NY” for New York, make sure you also search for “New York”.

Capitalization

Differences in capitalization don’t create distinguishability.

If your desired LLC name is Drum and Bass LLC, it’s not available to use if any of the following are found:

- drum and bass Inc.

- drum and BASS LP

- dRuM aNd BaSs LLC

Said another way, you’re allowed to use any capitalization you want. It just doesn’t make your name distinguishable from an existing company with the same name.

Want to watch a video tutorial instead?

The video below shows you how to search LLC names in New York.

The video starts with LLC name rules in New York. Then at the 8 minute mark, you can see LLC searches being completed.

What if my New York business name is rejected?

If you file your New York Articles of Organization (the document that creates your LLC) and the business name is not available, don’t panic. The state will notify you and tell you why your filing was rejected.

You will just need to file again with a variation of your LLC name or a different LLC name.

New York Business Name FAQs

Do I need a name reservation in New York?

No, a name reservation isn’t required to form an LLC in New York. It’s an unnecessary step and a waste of money.

You can just file your LLC’s Articles of Organization with your desired LLC name.

Does New York require LLC in the name?

Yes. Your LLC name must contain one of the allowable designators at the end. You can use any of these designators:

- LLC

- L.L.C.

- Limited Liability Company

Does my New York LLC need a DBA?

No, you’re not required to file a DBA (“Doing Business As”) for your business entity in New York.

A DBA (known as an Assumed Name in New York) lets your LLC conduct business under a name which is different from its true and legal name (the name on your Articles of Organization).

If you want your LLC to do business under a name that’s different from its true and legal name, you have to file a Certificate of Assumed Name and pay an additional fee of $25 to the Division of Corporations. Check out the Division of Corporations Assumed Name Guide for more information on this process.

If you are going to file an Assumed Name for your New York LLC, it must also be distinguishable from existing business names in the state.

There is no limit to the number of Assumed Names an LLC can have.

For more information, please see Does my LLC need a DBA?

When would my LLC use a DBA?

Let’s say you form an LLC called Lady Liberty Cruise Lines LLC, but you also want to use a friendlier, catchy name, like Liberty Cruises. In this case, your LLC would need to file a Certificate of Assumed Name to use the name Liberty Cruises.

If you don’t file a Certificate of Assumed Name for a different name, you can only use your legal entity name of Lady Liberty Cruise Lines LLC.

Similarly, if you want to do business under the name Lady Liberty Cruise Lines, just without the letters “LLC” in the name, you will need to file an Assumed Name for Lady Liberty Cruise Lines.

How do I get a business domain name?

Once you’ve found a business name that you like, it’s a good idea to check if your domain name is available before forming your LLC.

You can search for available domain names with GoDaddy:

Find a domain name

What does “distinguishability” mean?

Each business entity name must be “distinguishable upon the records” of the Division of Corporations.

This means that no two businesses can operate with the same exact name. Said another way, if a business already exists with your desired LLC name, you can’t register your LLC with that name.

For example, let’s say you want to form an LLC called Buffalo Landscapers LLC. But there is already a business in another town called Buffalo Landscapers, Inc. Because your desired LLC name is the same as that existing New York Corporation, it is not distinguishable. You can’t use it and must choose another name.

How do I come up with a business name?

Business names are important for branding and recognition. The name of your LLC can be your company’s brand name, but it doesn’t have to be (please see the FAQ about DBAs above). Either way, picking a good LLC name is an important decision.

Here are some quick tips for coming up with business names:

- First, write down the features of your company and things that you want to be associated with.

- Then list out as many business names as you can think of. Don’t edit or analyze them. Just get as many names on the page as you can.

- Now go back and read through them. Write down any variations that come to mind.

- Next, set the list aside. Do something else, like go for a walk or get groceries, or sleep on it for the night. Then come back and review the list of names. As you go through it, write down additional ideas and variations.

- Read the whole list out loud. If you want, get input from friends, business partners, and family.

- Repeat the process: sleep on the ideas, write down new variations, read them out loud again.

- The best business name will often “rise off the page” and present itself. If it doesn’t, you can try this trick: Close your eyes and count to 10. When you get to 10, you must choose a name. When you open your eyes, force yourself to make a decision. Sometimes we know the best name deep in our subconscious, and this trick can help it come out. Trust yourself and go with what feels best.

For more tips, please see How to Choose an LLC Name.

Can I use the name of another New York entity?

No. You can’t use the same name as another New York business.

And it doesn’t matter what entity type it is – your LLC can’t have the same entity name as another corporation, LLC, or any other entity type.

You can’t use another business’s name even if the entity is in “delinquent” status on the New York Division of Corporations website.

But if a business is dissolved, they no longer have rights to that name. This means you can form an LLC with the same name.

How do I change my LLC name?

You can change your LLC’s name later by filing an Amendment form with the Division of Corporations.

We have step-by-step instructions on how to change an LLC name in New York.

How to start an LLC in New York?

Here are the steps to starting an LLC in New York:

- Choose an LLC name and make sure it’s available

- Choose who will be your New York Registered Agent

- File LLC Articles of Organization

- Complete and sign an LLC Operating Agreement

- Get a Tax ID Number (EIN) from the IRS

- Open an LLC bank account

- Check whether you need a business or sales tax license in New York

References

New York LLC Act, Section 204

New York Division of Corporations: Rules and Regulations (Part 156 – Names)

New York Department of State: Restricted Words in Business Names (PDF)

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

New York LLC Guide

Looking for an overview? See New York LLC

If New York State rejects the LLC Filing due to Business name cannot be used, do we have to refile a new LLC with different business name and pay NY State another filing fee $200?

Hi Nina, no, you’ll get a refund or a credit for $200. They don’t take your money. However, it’s a good idea to make sure your LLC name is available (aka distinguishable) before filing (avoids any potential headaches). If you want to share publicly, feel free to drop your LLC name here and we’ll take a look.

Hi Matt,

Is there anyway I can form an LLC without listing my name? I read somewhere online mentioning setting up an anonymous trust.

Thanks,

CW

Hey CW, LLC owners (Members) aren’t listed on the NY LLC Articles of Organization. They are also not listed on the NY LLC Biennial Statements. If you want further privacy, you’d also want to hire a NY Registered Agent so you can use their address throughout the Articles of Organization and not yours. Furthermore, you’d want to hire a company to both form your LLC and file your LLC’s Biennial Statements. This way, someone else (besides you) signs the Articles of Organization as the LLC Organizer. And on the Biennial Statements, they sign as an Authorized Person (instead of you signing as Member). You will still be the 100% owner via the LLC Operating Agreement. Hope that helps.

the last step that the video was indicating to do going to LLC formation mines end up in three categorys (online filing for business owner )second one is (online filling for 3rd party non-service company filers) and there where the domestic business coporation (for profit )and domestic LLC company is at so im a bit puzzled cause in your video it not like that ,so what should i do ?

Hi Yoseo, the database search has since been redesigned. Are you still looking to search your LLC name? If so, you can refer to the general LLC naming rules. If you’re ready to form your LLC, we have those instructions here: New York LLC Articles of Organization. However, before you file the LLC, we recommend reading about the New York LLC publication requirement first. Hope that helps.

Hi Matt,

Thanks for the great video!

When I try to check my chosen LLC name, I don’t get a message saying that the name is not acceptable & I don’t get a new window with Articles of Organization form either. Instead, I receive the following message:

“The proposed entity name may not be acceptable for the reason(s) listed below. If after reading the WARN message(s), you determine that the name is acceptable, you may click the Save and Continue button to proceed with this filing. If you determine that the name needs to be revised, you may enter a new name above and click Save and Continue to proceed with the filing.”

However, there are no any WARN messages below this text, so I am confused. Does this mean the name is ok or not?

In addition, when I search for the same name but just removing one of the words from the name (which in my opinion would make the name less distinguishable), then I get the message “This name is accepted”.

Thank you again!

Hi Ivana, you’re very welcome! It sounds like you’re talking about the search feature built into the NY LLC online filing. However, we recommend searching the database as linked above on this page. This will help you determine if your New York LLC name is distinguishable. Hope that helps!

Hi, Matt.

Can you provide guidance on changing from a DBA to an LLC? I know it’s not a “conversion”, in the strictest sense of the word, but I’m not sure how to switch, for lack of a better word. Do I simply get a new EIN, follow the customary steps to form the LLC with the state, and then terminate the DBA? What about the funds in that dba bank account etc.?

Much appreciated.

Hey Ray, just to clarify, it’s more helpful to refer to your DBA as a Sole Proprietorship and not a DBA. The DBA is just a nickname for you (aka your Sole Proprietorship). We’ve written about this here: changing form Sole Proprietorship to an LLC. Also, don’t get an EIN until after your LLC is approved. Hope that helps!

I forgot to check the email me box

Hey Rick, you won’t be able to find an LLC until it’s on the state database.

In searching for an LLC name if it’s not yet formed how could it be in the data base?

Hi Matt, Hope you are well. I’m trying to check if a name is available for an LLC but it looks like the links have changed. If you can please let me know where I should search? Thank you for your help. +Elizabeth

Hi Elizabeth, the correct link is at the top of this page. Hope that helps.

Hi,

I’ve just submitted a full payment towards forming a multi member LLC (Be4ipo). Also my partners name was asked for in the beginning of the process, however after finalizing everything I do not see his information anywhere. I wanted to send him some kind of confirmation. I understand that the operating agreement determines all. Does that mean he does not need to show up here?

Thanks,

Henry.

Hi Enrique, LLC Members are not listed in the New York Articles of Organization. Where you saw your name was for the LLC Organizer. We recommend signing a Statement of LLC Organizer (you stepping down as Organizer and appointing you and your partner as the LLC Member) and signing an LLC Operating Agreement. Hope that helps.

I started an LLC in 2012, however I realized that I never followed through with the newspaper filings required by NY. I recently searched on NYS web site and there is a record record of the name and it shows it”s “Current Entity Status as is active. Any suggestions as to what to do??

Hi Neal, your LLC is technically not in good standing (although active), so you can take care of the newspaper publication requirement at any time. Once completed, the LLC will be in good standing. Hope that helps.

Hi Matt,

If one of the purposes for forming an LLC for a rental property is to limit the liability of the owner, why we have to transfer the deed from the owner to LLC? Let’s say if there’s some serious liability issue occurs in that rental property, and LLC get sued, would it affect that rental property which deed is under the LLC? I’m kinda confused…

Hi Sharon, in order to get the protection of the LLC, the asset must be owned by they LLC… hence the deed transfer. You have to “connect” the LLC to the real estate. And yes, the property is an asset of the LLC, so you’re correct. However, the purpose of the LLC is protect your personal assets… and any other business assets from that business/property owned by the LLC. Hope that helps.

Thank you so much Matt!

You’re welcome Sharon!

Dear Matt,

Thank you very much for all provided information and your help, we highly appreciate this!

Is it possible to set up an LLC if I’m a foreigner, I don’t have SSN? I would like to make some real estate investments and later will do some advisory work. If my real estate portfolio will be located in different states (FL, NY, CA) my LLC can be set up in FL for example? If I’m not currently based in US and don’t have permanent address in US, what should be done?

Thanks,

Clair

Hi Clair, yes, you can. There are no residency or citizenship requirements to forming an LLC in the USA. You’ll be doing business in the state(s) where the properties are located, so you’ll want to form the LLC their. For the EIN application, you won’t be able to apply online without an SSN or ITIN, however mail or fax Form SS-4 to the IRS. On line 7b, just write “Foreign” and you’ll be good to go. Hope that helps!