Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Instructions on How to Change an LLC Address in PA

If you started a Pennsylvania LLC and your LLC address (aka Registered Office address) changed, you need to update the Pennsylvania Department of State and other government agencies.

In order to do this, you’ll need to file a “Change of Registered Office” with the Pennsylvania Bureau of Corporations and Charitable Organizations.

You might be updating your PA LLC Registered Office because you moved, or because you hired a Registered Agent Service.

Either way, we’ll walk you through how to file this below.

Note: The “Registered Office” in Pennsylvania is the same thing as a “Registered Agent address”.

Approval time

The PA Bureau of Corporations will process both mail and online filings within approximately 7-10 business days of receiving them.

The mail filing will take a few days longer just because of the document’s travel time. For that reason, we recommend the online filing option.

PA LLC address change filing fee

The filing fee is $5 (for both mail and online filing).

Note: If you need to change your LLC Name, you can’t do that on the Change of Registered Office form. To change anything besides your Registered Office address (like your LLC name), you must instead file a Certificate of Amendment (see Pennsylvania LLC name change). The filing fee for a Certificate of Amendment is $70.

Method of filing

You can submit your PA Change of Registered Agent filing by mail or online.

If you want to file online, it’s a simple process to complete the form online and submit it. We have instructions below.

If you want to file by mail, you can either:

- complete the form online and at the end of the process, choose the option to download, print and mail;

- or you can download the PDF Change of Registered Office form, complete it, and then mail it to the state.

Here’s a video that walks you through filling out the paper form if you choose the 2nd option:

Important: Once the PA Bureau of Corporations approves your LLC address change, you’ll also need to change your LLC’s registered address with the Pennsylvania Department of Revenue and the IRS. More on this is below.

How to File a PA LLC Change of Registered Office

In order to file a Change of Registered Office online, you must have a Keystone Login.

Update: Prior to Keystone Login, the old method of online filing was to just have a PENN File account. Since May 29, 2020, Pennsylvania requires everyone to create a Keystone Login for online filings. And PENN File has been replaced by the new Business Filing Services system.

Step 1 – Create a Login and Request Access

1. Create a Keystone Login

If you don’t have a Keystone Login, visit PA Business One-Stop Hub and click “Register”.

(If you already have a Keystone Login, simply login and skip to #3 Request Access below)

After registering, you’ll see a success message at the top.

Next, you’ll need to go to your email and click the verification link.

After doing that, you should see this success message:

Click the “here to Login” link and then login.

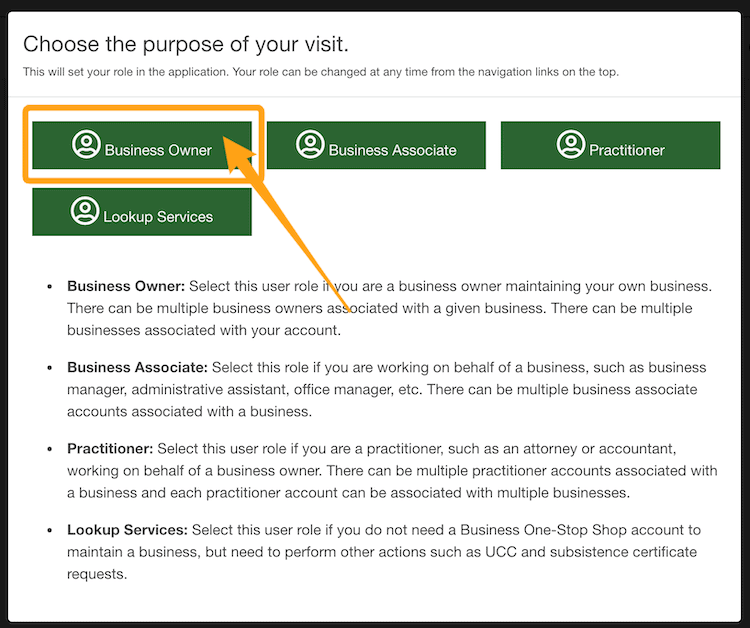

2. Choose the purpose of your visit

You’ll see a pop-up with several buttons to choose what type of filer you are. Select Business Owner.

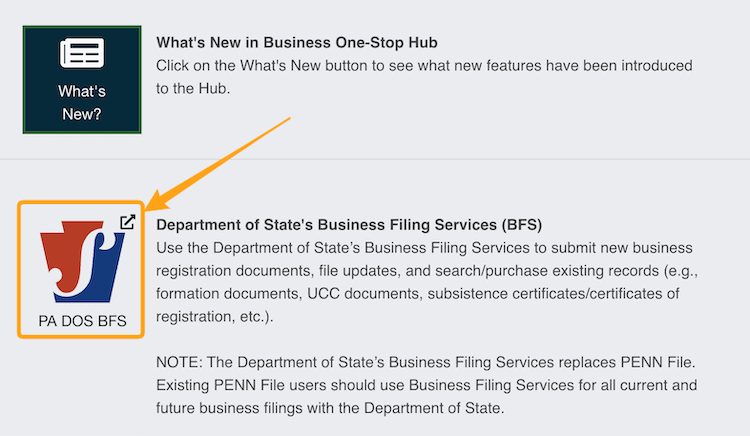

Scroll down and click Department of State’s Business Filing Services (aka PA DOS BFS):

You will now be on the main dashboard for your Business Filings Services account. From here, you can manage your business filings.

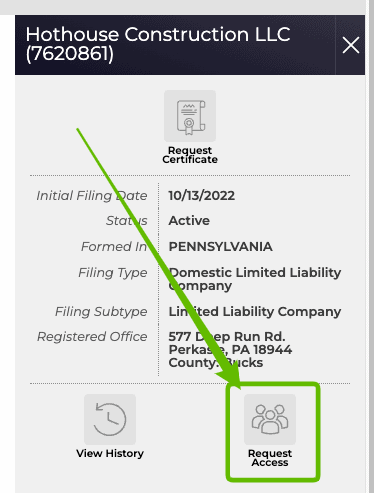

3. Request Access to your LLC

Before getting started, you may need to request access to your LLC. Luckily, it’s a simple system that sends a PIN to your email address.

First, search for your LLC in the Business Search. Click on your LLC Name in the list.

Then click the “Request Access” button.

Next, click the buttons to agree to the statements in the pop-up window confirming you’re an authorized person. Click “Request PIN“.

Leave the Business Filing Services tab open in your browser, and check your email in another tab.

Sometimes the PIN arrives in a few minutes, sometimes it takes up to 4 hours. It’s easiest to copy and paste the PIN from your email, since it can be a combination of letters and numbers and is case-sensitive.

Go back to the Business Filing Services tab.

Pro Tip: Don’t worry if you closed the Business Filing Services window by mistake. Just repeat the process: login to Business Filing Services, search for your LLC, and click “Request Access” again. That will bring you back to this screen and you can continue where you left off.

Click the buttons to accept the terms and confirm you’re an authorized user. Then enter the PIN from your email. Click “Get Access” to continue.

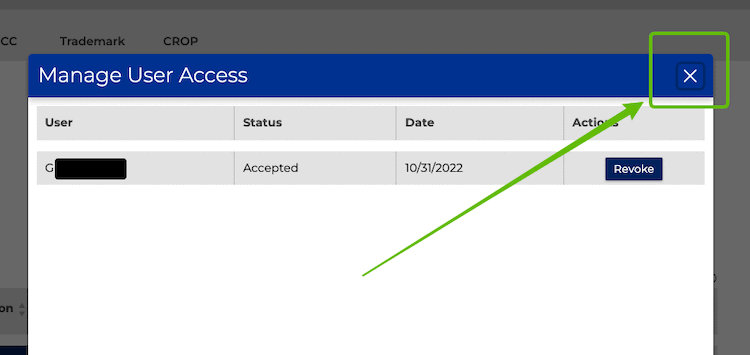

The popup window will change to show you a list of the authorized users for the company. You don’t need to do anything on this screen.

Click the ‘x’ in the top right corner to close this window. Make sure you don’t click “Revoke”, because that will undo the authorization process you just finished.

Step 2 – File the Change of Registered Office

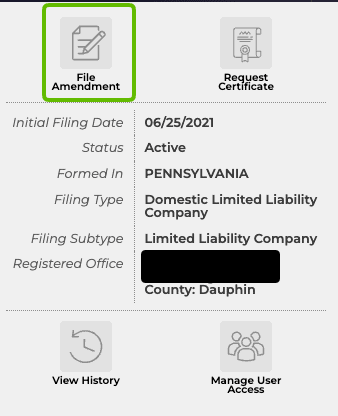

If your LLC’s company record isn’t already pulled up, search for your LLC name and click it in the results list.

Click the “File Amendment” button.

Next, select “Change of Registered Office” from the list of available forms.

The instructions below will walk you through filing the form step-by-step.

Business Details

Record Information

This is pre-filled with your LLC’s File Number, LLC name, and company type.

Email Address for Notifications

You can choose whether to get notifications from the state by mail or by email.

If you prefer to get notices by mail, don’t enable email notifications.

If you prefer to get notices by email, choose the option that starts with “I would like to receive email notifications…“. Then click “Add” and enter your email address.

Click Next Step to proceed.

Current Registered Office or Commercial Registered Office Provider

This displays your LLC’s current Registered Office.

New Registered Office

Now you will enter the new Registered Office information for your Pennsylvania LLC.

If you or someone you know will be the Registered Agent:

If you will be your own Registered Agent, or someone you know will be the Registered Agent for your LLC, and you need to change the address of the Registered Office on file, select the 1st option (“The address of this association’s proposed Registered Office in this Commonwealth is“).

Then enter the updated address and county information.

Note: If you are changing from using a Registered Agent Service to being your own Registered Agent (or using a friend/family member), wait for your Change of Registered Office filing to be approved. Then you can cancel the Registered Agent Service.

If you hired a Registered Agent Service:

If you hired a Registered Agent Service (aka Commercial Registered Office Provider or CROP), select the 2nd option (“The name of the Commercial Registered Office Provider and the county of venue is”).

Search for Commercial Registered Office Provider (CROP):

Search for the Registered Agent company you hired and select them from the list.

Venue and Publication County:

You’ll need to contact the Registered Agent company (or check inside your account) and ask what county their address is located in. Then select it from the dropdown menu.

If you hired Northwest Registered Agent, select Erie from the county list.

Note: Don’t worry about the word “publication”. LLCs in Pennsylvania don’t have to publish anything in the newspapers. Only 3 states have LLC publication requirements and Pennsylvania isn’t one of them.

Click Next Step to proceed.

Processing Fee Information

This page is letting you know that the fee to change your Registered Office in Pennsylvania is $5.

Confirm

Review your information for accuracy and check for typos.

If you need to make any changes, click the appropriate step in the list on the left where you need to make changes.

If everything looks good, click Next Step to proceed.

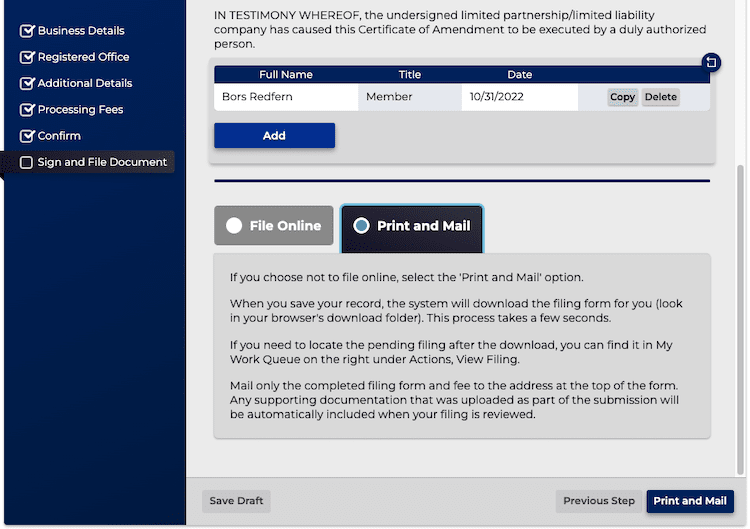

Electronic Signature

Check the boxes to accept the terms and agreements at the top.

Click “Add” and enter your first and last name and click “Today” to enter the date.

- If you’re an LLC Member, enter the title “Member“

- If you’re an LLC Manager, enter the title “Manager“

- If you’re completing the Change of Registered Office for an LLC you don’t own or manage, but you’ve been authorized to file for, enter “Authorized Person“. This is usually for an attorney or employee of an LLC filing company.

Not sure what these words mean? Check out LLC Officer Titles

File Online

Click File Online to charge your card and submit the Change of Registered Office filing.

Note: If you entered your credit or debit card when you set up the Keystone Login account, this will be charged to the card on file. Otherwise, you will need to enter a credit card or debit card.

File by Mail

If you’d rather print out the form to mail the filing and send a check, you can select the Print and Mail option instead. Make your check payable to “Department of State” for $5.

Approval Time for Pennsylvania LLC Address Change

After you file your Change of Registered Office online, the Pennsylvania Bureau of Corporations will review and process your filing in 7-10 business days.

Once it is approved, they will send you a stamped and approved copy of your Change of Registered Office filing.

If you file by mail, you’ll receive your approval back by mail.

If you file online, you’ll receive your approval back by email.

You Still Have to Change Your Address in Other Places

Important: Changing your LLC address with the PA Bureau of Corporations still leaves your old LLC address in place everywhere else. Essentially, you’ve only changed your PA LLC with one part of the state government (the Bureau of Corporations), and it’s your responsibility to change it and update it everywhere else.

How to change your LLC address with the IRS

If you’re using your old Registered Office address with the IRS, you’ll need to update it. We have step-by-step instructions here: how to change LLC address with IRS

If you’re using a different address with the IRS, then you don’t need to update anything.

Update your address with the PA Department of Revenue

After you change your LLC Registered Office with the Pennsylvania Department of State, you need to update your address with the Pennsylvania Department of Revenue.

To file online, you need to use the myPath system. You can follow the Department of Revenue Address Change Guide for instructions.

To file by mail, you need to use Form REV-854 to change your address with the Department of Revenue.

Other Places To Update Your LLC Address

Besides updating your PA LLC name with the IRS and PA Department of Revenue, you may also want to contact the places listed below and let them know about the change.

Remember, the Registered Office address means the address that the state sends notices and where your LLC can receive Service of Process. It might not be your business address (where your LLC’s business is located).

If you’re using your Registered Office address as the address on file with the places listed below, you should update them with your new address. If you’re using a different address that’s still accurate, you don’t need to do anything.

Helpful tip: We recommend making a spreadsheet to keep track of everything. Enter the place you are changing your LLC address, their phone number, and a ‘notes’ section. After you successfully change your business address, highlight the cell(s) and mark them green. Mark everything that still needs to be changed in orange. This will help keep your sanity.

Here are some places to notify about your LLC address change:

- LLC business bank account

- business credit cards

- business checks

- PayPal or other online banking providers

- local tax office (city, county, township)

- business licenses and permits

- website, domain registrar, hosting company

- utility companies

- letterhead, logos, invoices, contracts, and important documents

- accountant

- attorney

- online account registrations

- anywhere else you do business

And we also recommend contacting your accountant or tax professional as there may be other tax offices to change your PA LLC address with.

Stay calm: Don’t stress out thinking you have to change your Pennsylvania LLC address everywhere right away or all hell will break loose! That’s not the case lol. Take your time and do the important ones first. Give yourself a few days or a few weeks to get them all done.

Pro Tip: Technically, your old PA LLC address will still “work” for quite some time. Make sure you’ve set up mail forwarding through the US Postal Service. This way, your LLC still gets its mail while you make these updates.

(Note: you can’t use USPS Mail Forwarding if your LLC was using a private mailbox rental service.)

Banking tip: You don’t have to order new checks right away. Your old checks will still work, but we suggest updating the address eventually.

Pennsylvania Bureau of Corporations Contact Info

If you have any questions, please contact the PA Bureau of Corporations & Charitable Organizations at 717-787-1057.

References

PA Department of State: Business Registration Forms

PA Department of State: Online Business Filing System

PA Department of State: A Guide to Business Registration in PA

PA Business One-Stop Shop: How to Update a Business Address in Pennsylvania

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Pennsylvania LLC Guide

Looking for an overview? See Pennsylvania LLC

I’m not seeing the Change of Office as an option anymore. Do you know where it is now located? I can’t believe it’s so complicated to simply change address.

Hello, after logging in, searching your LLC, and clicking its name, you don’t see “File Amendment”, this means you first need to request access to the record and get a PIN. Click the “Request access” button (more details are above on this page). After you have access to the LLC’s record, click “File Amendment”, and then click “Change of Registered Office”. Alternatively, you can file by mail. The form and instructions are also above on this page. Hope that helps.

Matt, here’s my situation: I have an operating LLC which was formed in PA and only has income from PA sources. It is a multi-member LLC with my wife and we have recently moved to another state. The registered address is in PA but I would like to receive any correspondence at the new address. So effectively it is a PA operating LLC, registered in PA with the PA registered address no longer valid, and would like to have correspondence mailed to our new out of state address. Since the LLC only operates in PA, what would you suggest in this situation regarding address change to avoid establishing a foreign entity?

Hey Jordan, in this case, it might be easiest to hire a Commercial Registered Agent (aka Commercial Registered Office Provider or CROP). Most of them will scan and upload your mail to an online account. So it’s a change of address, but the address would still be in PA. And instead of it being like “mail forwarding”, you’d be retrieving mail digitally. Does that help?

I am changing my physical address (going to use a virtual office) of the LLC, but I am KEEPING my registered agent service. What form do I fill out to keep my RA but change the LLC physical address?

Hi Meghan, there is only one address on file with the PA Bureau of Corporations for a PA LLC. That is the Registered Agent Office address (aka Registered Agent). So you don’t file anything with the Corporation Bureau. You can contact the Pennsylvania Department of Revenue though re: updating your address to your virtual office.

Matt you are a True GEM*** I have PAID ppl in the past BUT no more You laid it all out PERFECTLY . Thanks a Million

TKB, apologies for my slow reply. Thank you so much!! You’re very welcome :)

How soon after you are approved for your llc can you change your address from home to a virtual. Or is it ok to change it as soon as I get a virtual address?

Hi Latoya, the LLC needs to be approved before the state will process a Change of Registered Office form. However, as soon as the LLC is approved, you can file the form. Hope that helps.

also when changing the address do i have to send a change address form to the irs as well? or mailing this change of address form to the Bureau of Corporations enough?

Hi Latoya, this form only changes your address with the PA Bureau of Corporations. Please see how to change LLC address with IRS. You can change your address with the Pennsylvania Department of Revenue by filing Form REV-864. You can find Form REV-864 on this page: PA Department of Revenue: Business Registration Forms. Hope that helps.

Clean video, really simple and effective. The task got done swiftly, thank you.

Thank you Drew! Glad it was helpful :)

Hi Matt,

I recently formed a LLC with IncFile. I am the sole member of the LLC and I moved to different address(home) however my LLC address is still same so what form do I need to file in order to update home address for the sole member.

Hi Imran, the page you’re on shows you how file the Change of Registered Office with the PA Department of State. Please see the instructions above.

Hi Matt, thanks for your website and information. Very helpful. If I’m moving my LLC from PA to TX, do I need to file a change of address in PA, notifying them that I’m moving to TX? Or is it essentially ending the LLC in PA and forming a new one in TX?

Hi Eric, you’re very welcome. No, changing the address of your PA doesn’t “move” (domesticate) your LLC to a new state. The only acceptable address for a Registered Office is one that is in Pennsylvania, so you couldn’t change the address anyway. There are 3 ways to go about it: dissolve and form new, register as a foreign entity, or domesticate (called conversion in Texas) your PA LLC into a Texas LLC (and then dissolve PA LLC). It depends on if you want to keep company history, bank account, EIN Number, etc. Do you want to retain company history, bank account, EIN, etc. or start fresh?

Hi. I will be changing my LLC address from my residence to a virtual business address. Is the Virtual Business address considered a commercial registered agent?

Hi Netara, no, that would not be a Commercial Registered Agent. So for #3 in the Change of Registered Office form, you would enter that address in 3a. Hope that helps.

Hi Matt,

I had IncFile perform the LLC formation for me with personal residence as business address. If I wanted to rent a UPS mailbox, can I just fill out the form with the new rented mailbox address without having them do it? Could you also clarify which address I put on the address change form? The Articles of Org was originally completed with them as the registered office but the business address is personal residence.

Thanks

Hi James, yes, you can change your PA LLC address yourself. You don’t have to hire a filing company to do so. It’s your LLC and you’re in control of its actions. You can use any address you’d like. PA is flexible. Hope that helps.

Can I pay for an address change online with a credit/debit card?

Hi Russell, yes you can. Log in, click “Domestic Limited Liability Company”, then click “Change of Registered Office (1507-8825)”.

Matt I tried to file online and it looks like you cannot do this. Can you please provide more information or pictures to help. I would like do to this online but it doesnt look possible. looks like its only done via mail in.

I just filed and paid online for changing my address.

– Go to the PA Dept of Corporations website

– Create and register a new online account (if you don’t already have one)

– After you login, click “Home” and it will take you to “My Dashboard”

– Scroll down the page, you will see “Start or Manage Business Filings”

– Select your business type and then select what you want to file

Thanks Jeff!

Hi Sean, the outline by Jeff is correct. From the list under the “Start or Manage Business Filings” header, select “Domestic Limited Liability Company”. From there, click on “Change of Registered Office (1507-8825)”. Hope that helps!

Hi Matt, it looks like the PennFile login is not recognizing my username or password. However, they are both correct. I recently created a new account and verified the email.

Hi Oscar, did you create a new Keystone Login and synchronize it with your PENN File account? We recently updated this page with the new information on Keystone Login (new in 2020). Let me know if that works for you.

Hi Matt, I have a login to both and I am looking to change the address for our LLC. We paid to do it by mail a year ago, but it is still showing the old address. I can not seem to find the online method? I tried logging into both systems it just brings me to the printable form.

Hi Joe, have you “synchronized” your PENN File login with your new Keystone Login? If not, please see this page (Pennsylvania LLC Certificate of Organization) and search for “Keystone Login” and “synchronize”. Please let me know if that helps.