Can I change the name of my LLC in Pennsylvania?

Absolutely! You can easily change your Pennsylvania LLC name.

Absolutely! You can easily change your Pennsylvania LLC name.

The first step is to file a form called the Certificate of Amendment with the Bureau of Corporations and wait for it to be approved. This is how you officially change your LLC name in Pennsylvania.

The filing fee for a Certificate of Amendment in Pennsylvania is $70.

After the state approves your LLC name change, you should then notify the following 3 places:

- the IRS

- state tax department

- your business bank account

And finally, you can update your LLC name in other places like your website and marketing materials.

This page will guide you through the process and include helpful tips along the way.

Note: We’ve changed the names of our own LLCs over the years. So we have first-hand experience with filing the paperwork as well as dealing with the IRS and financial institutions.

What are the steps for changing an LLC name in Pennsylvania?

- Check if your new LLC name is available

- File the Amendment form (and wait for approval)

- Update the IRS

- Update the Pennsylvania Department of Revenue

- Update financial institutions (credit card companies, banks)

- Update business licenses

- Update other places (branding materials, business accounts, etc.)

How much does it cost to change an LLC name in Pennsylvania?

It costs $70 to change your LLC name in Pennsylvania. This is the filing fee for the Certificate of Amendment form.

The fee is the same whether you file the form online or by mail.

How do I change my Pennsylvania LLC name?

In order to change your LLC name, you must file a Certificate of Amendment with the Pennsylvania Bureau of Corporations This officially updates your legal entity (your Limited Liability Company) on the state records.

Note: The Pennsylvania Department of State – Bureau of Corporations is responsible for LLC formation and administration, including name changes.

We provide step-by-step instructions on how to file the Certificate of Amendment online. (Technically, you can also file by mail. However, it’s slower and the state prefers online filings.)

Can I change my LLC name myself?

You can file the Certificate of Amendment yourself or you can hire a company to do this for you.

The Corporation Bureau in PA allows a business owner to file legal documents themselves.

But, because the Amendment filing in Pennsylvania can be confusing and time consuming, many people choose to hire a company for help.

Need to save time? We recommend hiring MyCompanyWorks ($119 + state fee) to file your LLC name change.

Step 1: Make sure your new Pennsylvania LLC name is available

Before filing your Pennsylvania amendment form (the Certificate of Amendment), you should check that your new LLC name is available in Pennsylvania.

This is important because two businesses in the state can’t have the same name, or be too similar. This is called LLC name distinguishability.

If you file an amendment for a name that’s already taken, the state will reject your filing. And if that happens, you’ll need to re-file with a different name.

To avoid that, look up your desired Pennsylvania LLC name ahead of time using the state’s business entity search.

Check name availability: Our Pennsylvania LLC Name page has information about how to use the business entity search tool. It also explains details about name rules in Pennsylvania.

Step 2: File the Pennsylvania LLC name change form

The Pennsylvania LLC name change form is called the Certificate of Amendment.

(It’s called this because you’re amending your Pennsylvania Certificate of Organization.)

How to file a Certificate of Amendment in Pennsylvania

In order to file a Certificate of Amendment online, you must have a Keystone Login.

Prior to Keystone Login, the old method of online filing was to just have a PENN File account. Since May 2020, Pennsylvania requires everyone to create a Keystone Login. And PENN File has been replaced by the new Business Filing Services system.

Step 1 – Create a Login and Request Access

1. Create a Keystone Login

If you don’t have a Keystone Login, visit PA Business One-Stop Hub and click “Register”.

(If you already have a Keystone Login, simply login and skip to #3 Request Access below.)

After registering, you’ll see a success message at the top (in a small green bar).

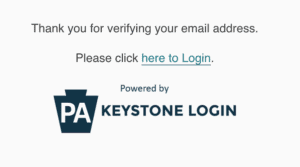

Next, you’ll need to go to your email and click the verification link.

After doing that, you should see this success message:

Click the “here to Login” link and then login.

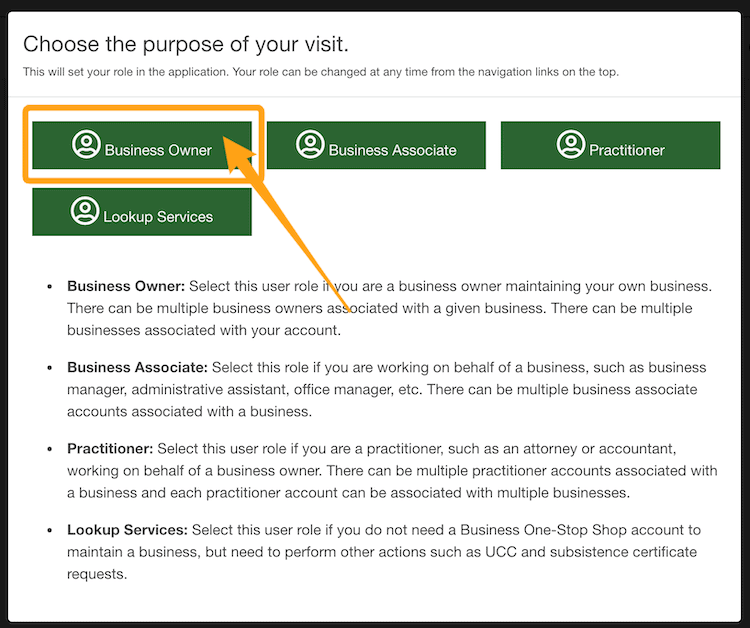

2. Choose the purpose of your visit

You’ll see a pop-up with several buttons to choose what type of filer you are. Select “Business Owner”.

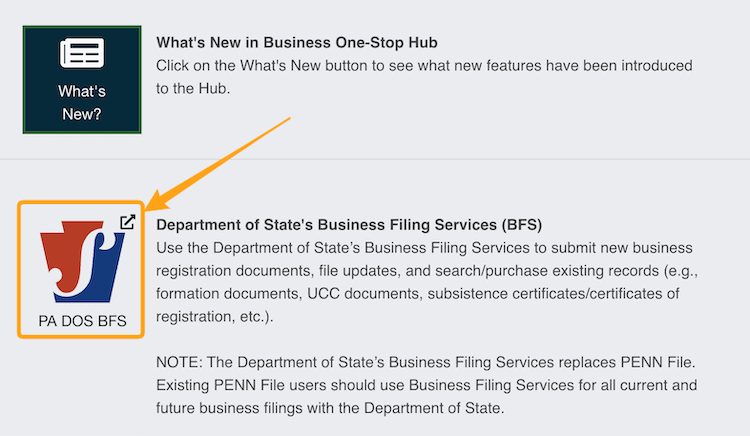

Scroll down and click Department of State’s Business Filing Services (aka PA DOS BFS):

You will now be on the main dashboard for your Business Filings Services account. From here, you can manage your business filings.

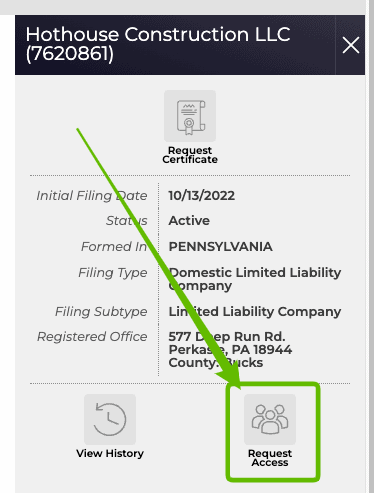

3. Request Access to your LLC

Before getting started, you’ll need to request access to your LLC. Luckily, it’s a simple system that sends a PIN to your email address.

First, search for your LLC in the Business Search. Click on your LLC Name in the list.

Then click the “Request Access” button.

Next, click the buttons to agree to the statements in the pop-up window confirming you’re an authorized person. Click “Request PIN“.

Leave the Business Filing Services tab open in your browser, and check your email in another tab.

Sometimes the PIN arrives in a few minutes, sometimes it takes up to 4 hours. It’s easiest to copy and paste the PIN from your email, since it can be a combination of letters and numbers and is case-sensitive.

Go back to the Business Filing Services tab.

Pro Tip: Don’t worry if you closed the Business Filing Services window by mistake. Just repeat the process: login to Business Filing Services, search for your LLC, and click “Request Access” again. That will bring you back to this screen and you can continue where you left off.

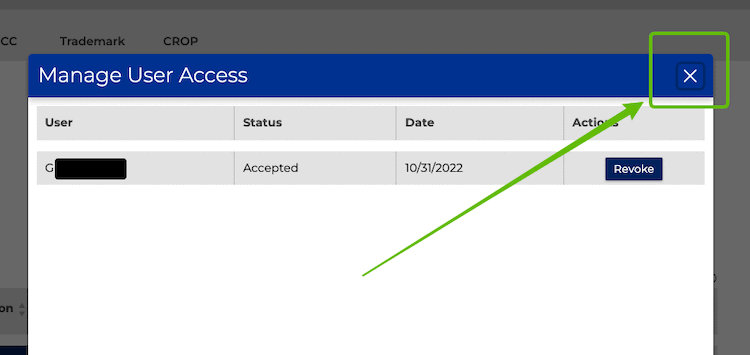

Click the buttons to accept the terms and confirm you’re an authorized user. Then enter the PIN from your email. Click “Get Access” to continue.

The popup window will change to show you a list of the authorized users for the company. You don’t need to do anything on this screen.

Click the ‘x’ in the top right corner to close this window. Make sure you don’t click “Revoke”, because that will undo the authorization process you just finished.

Step 2 – File the Certificate of Amendment

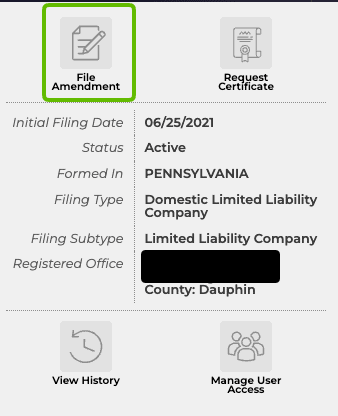

If your LLC’s company record isn’t already pulled up, search for your LLC name and click it in the results list.

Click the “File Amendment” button.

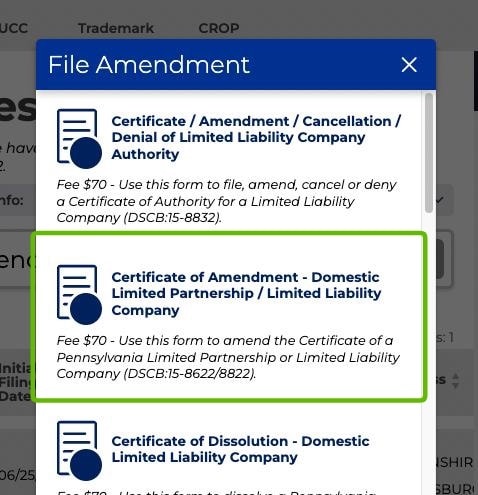

Next, select “Certificate of Amendment – Domestic Limited Partnership / Limited Liability Company” from the list of available forms.

The instructions below will walk you through filing the Certificate of Amendment step-by-step.

Business Details

Record Information

This is pre-filled with your LLC’s File Number, current name, and company type.

Change Business Subtype

Check the box for “I do not want to change the subtype of the association.”

This would let you change your LLC to a Professional LLC or other type of LLC. This is not common, and is not how you change the name of your LLC.

Limited Liability Company Name

Check the box for “I want to change the name.”

A previously filed reserved name will be used for this filing.

Next, the system will ask you whether you have already reserved a name.

Note: You don’t have to reserve a name in order to change your LLC Name in Pennsylvania. It’s usually a waste of money.

If you don’t have a name reservation:

If you don’t have a name reservation, don’t worry. Just click “No” and enter your new LLC name twice. Then click the box for “Consent to use the name is not required because the name is available for use in Pennsylvania.”

Make sure to include the designator in your new LLC name. You don’t have to use the same designator as the one in your current LLC name.

As per Section 15-204, Pennsylvania law allows the following designators:

- LLC (or L.L.C.)

- Ltd (or Ltd.)

- LTD (or LTD.)

- Limited Liability Co.

- Limited Liability Company

- Ltd. Liability Co.

- Ltd. Liability Company

Tip: Most people choose “LLC”.

If you have a name reservation:

If you filed a Name Reservation, click “Yes” and then select your reserved name from the dropdown menu.

Effective Date

If you’d like your LLC name change to go into effect on the date it is approved by the state, check the box for “when filed with the Department of State“.

If you’d like your LLC name change to go into effect on a future date, select “on a future specific date“. Then choose the date using the calendar button to the right. Don’t worry about what time you choose; it’s not important.

Email Address for Notifications

You can choose whether to get notifications from the state by mail or by email.

If you prefer to get notices by mail, don’t enable email notifications.

If you prefer to get notices by email, choose the option that starts with “I would like to receive email notifications…“. Then click “Add” and enter your email address.

Click Next Step to proceed.

Current Registered Office or Commercial Registered Office Provider

This displays your LLC’s current registered office.

Remember, the “Registered Office” in Pennsylvania is the same thing as a “Registered Agent“.

New Registered Office

Note: There’s no extra fee to make multiple changes during this filing. You can change both your LLC name and your LLC registered office on the same Certificate of Amendment.

This is where you would make a change if the Registered Office address has changed because you moved, or because you hired a Registered Agent Service.

Change Registered Office?

If you don’t want to change your LLC’s Registered Office, select “I do not want to change the registered office.” You can click Next Step and continue with the Additional Details screen.

If you want to change your LLC Registered Office, select “I want to change the registered office.”

Then, follow these steps:

You or someone you know will be the Registered Agent:

If you will be your own Registered Agent, or someone you know will be the Registered Agent for your LLC, and you need to change the address of the Registered Office on file, select the 1st option (“The address of this association’s proposed registered office in this Commonwealth is“).

Then enter the updated address and county information.

Note: If you are changing from using a Registered Agent Service to being your own Registered Agent (or using a friend/family member), wait for your Certificate of Amendment to be approved. Then you can cancel the Registered Agent Service.

You hired a Registered Agent Service:

If you hired a Registered Agent Service (aka Commercial Registered Office Provider or CROP), select the 2nd option (“The name of the commercial registered office provider and the county of venue is”).

Search for Commercial Registered Office Provider (CROP):

Search for the Registered Agent company you hired and select them from the list.

Venue and Publication County:

If you hired Northwest Registered Agent, select Erie from the county list.

You’ll need to contact the Registered Agent company (or check inside your account) and ask what county their address is located in. Then select it from the dropdown menu.

Note: Don’t worry about the word “publication”. LLCs in Pennsylvania don’t have to publish anything in the newspapers. Only 3 states have LLC publication requirements and Pennsylvania isn’t one of them.

Click Next Step to proceed.

Additional Details

New Dependent Ratio

Select “There are no additional changes.”

Most people don’t upload anything unless they’ve been instructed to do so by their attorney.

Restated Certificate of Organization

Leave this box unchecked.

Processing Fee Information

This page is letting you know that the fee to amend your LLC Certificate of Organization in Pennsylvania is $70.

Confirm

Review your information for accuracy and check for typos.

If you need to make any changes, click the appropriate step in the list on the left where you need to make changes.

If everything looks good, click Next Step to proceed.

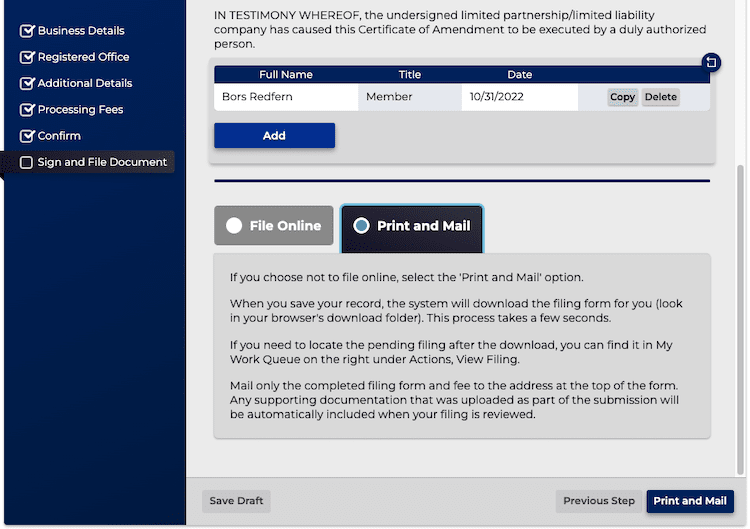

Electronic Signature

Check the boxes to accept the terms and agreements at the top.

Click “Add” and enter your first and last name and click “Today” to enter the date.

- If you’re an LLC Member, enter the title “Member“

- If you’re an LLC Manager, enter the title “Manager“

- If you’re completing the Certificate of Amendment for an LLC you don’t own or manage, but you’ve been authorized to file for, enter “Authorized Person“. This is usually for an attorney or employee of an LLC filing company.

Not sure what these words mean? Check out LLC Officer Titles

File Online

Click File Online to charge your card and submit the Amendment filing.

Note: If you entered your credit or debit card when you set up the Keystone Login account, this will be charged to the card on file. Otherwise, you will need to enter a credit card or debit card.

Wait for approval from the Department of State

After submitting your Certificate of Amendment to the state, please wait for approval.

Approval times vary, but on average, it takes 5-7 business days for your Pennsylvania business name change to be approved.

When you file online, you’ll receive your name change approval by email.

Reminder: Changing your LLC name with the Department of State still leaves your old LLC name in place everywhere else. Essentially, you’ve only changed your LLC name with one part of the state government, and you need to update it everywhere else.

Step 3: Change your Pennsylvania LLC name with the IRS

After your new LLC name is approved, the next step is to update your Pennsylvania LLC name with the Internal Revenue Service (IRS). This updates the name connected to your LLC’s EIN number.

We have step-by-step instructions here:

How to change LLC name with IRS

Step 4: Update your LLC’s Account with the PA Department of Revenue

After your new LLC name is approved, you need to update your business’s account with the state’s tax department (the Pennsylvania Department of Revenue).

Note: In most states, it’s called the Department of Revenue or Department of Taxation. In Pennsylvania it’s called the Department of Revenue, and this is who you’ll update with your new LLC name.

Typically, you can update your LLC name in one of three ways:

- online (through myPATH)

- by mail

- by phone

The PA Department of Revenue has a Name Change Guide you can follow. But there may be other tax filings or places to update your LLC name, so we recommend you contact the PA Department of Revenue. You can ask about the process to update your business name.

Step 5: Update financial institutions with your new LLC name

Besides updating your Pennsylvania LLC name with the IRS and PA Department of Revenue business tax department, you’ll also want to contact the following places and let them know about the name change.

Financial institutions:

- LLC business bank account

- business checks

- business debit card

- business credit cards

- Paypal or other online banking solutions

- business loans or lines of credit

- brokerage accounts

- bookkeeping software, like Quickbooks

Pro Tip: You don’t have to rush to update these the same day or even the same week. Your existing checks and credit cards will still work, but it’s important to eventually get everything updated to your new LLC name.

Step 6: Update or Get a New Business License

If you have a Pennsylvania Business License or a local business permit, you’ll need to change the name on that license.

Sometimes that means applying for a new license and canceling the old one. Or sometimes you can just change the name on your existing license.

Pennsylvania doesn’t have a general state business license requirement. But your LLC might have an industry- or occupation-specific license.

If that’s the case, contact your state licensing agency or licensing board for information on how to update the state business license: PA Licensing Boards & Commissions.

And contact your local government (like a city clerk or county clerk) for the process to update any local business permits. You can find your county clerk on the PA County Commissioners Association website. Then you should look up your: town or city, and borough or township.

Step 7: Update marketing materials and other places with your new LLC name

Tip: We recommend making a spreadsheet to keep track of everything. Enter the place you are changing your LLC name, their contact information, and maybe a notes section. Here’s an LLC name change checklist that you can use: Google Docs | Excel

Below are some examples of places to update with your new LLC name.

Below are some examples of places to update with your new LLC name.

Branding and online presence:

- online stores (like eBay, Shopify, Amazon)

- website, domain registrar, hosting company

- letterhead, logos, invoices, contracts, and important documents

- social media accounts

Professional services:

- Registered Agent Service (if you hired one)

- accountant

- attorney

Other government agencies:

- local tax office (ex: city, county, township)

- business licenses and permits

- sales tax permit

- utility companies

- Department of Labor (if you have employees)

Stay calm: Don’t stress out thinking you have to change your LLC name everywhere right away. That’s not the case. Take your time and do the important ones first. Give yourself a few days or a few weeks to get them all done. Technically, your old business name will still work for quite some time.

Update your Pennsylvania LLC Operating Agreement

It’s a good idea to update the name on your LLC’s Operating Agreement. Don’t worry, this is a simple process. You can either:

- You can make a new version of the Operating Agreement you already have. Update the document with your new LLC name, and have the LLC Member(s) sign.

- Or, you can use our free template on Pennsylvania LLC Operating Agreement to create a new Operating Agreement with the new LLC name.

Tip: This is a good opportunity to review the other sections in your Operating Agreement and make any needed updates there, too. Have the LLC Member(s) sign, and distribute copies like you did with your initial LLC Operating Agreement.

Change LLC Name in Pennsylvania FAQs

How much does an LLC name change cost in Pennsylvania?

An LLC name change in Pennsylvania costs $70.

This is the filing fee for the Certificate of Amendment, the official form used to change your Pennsylvania LLC name.

If you’d like to learn about all the Pennsylvania LLC costs, please see Pennsylvania LLC Costs.

Can I file my Pennsylvania LLC name change by mail?

Yes, you can file the Certificate of Amendment by mail to change your Pennsylvania LLC name.

You will still complete the form online (follow our step-by-step guide above). But at the end of the process, you can choose to download your completed Certificate of Amendment form, print it out and mail it.

How many times can I change my Pennsylvania LLC name?

You can change the name of your Pennsylvania LLC as many times as you want. The state doesn’t care, as long as you pay the filing fee.

You’re allowed to change the name of your Limited Liability Company for any reason. The Amendment form doesn’t ask you why you want to change the name. No Pennsylvania law limits when you can file an Amendment to change the name of a company.

Who can change the Pennsylvania LLC name?

Generally speaking, the LLC Members (owners) can change the LLC’s name.

So, as long as all the LLC Members agree, you can go ahead and file the Amendment.

Technically, the LLC Members should vote to agree on the new name. However, a vote can be something informal, like an email or phone call.

Do I need a new EIN if I change the name of my Pennsylvania LLC?

No, you don’t need a new EIN number.

Getting a new EIN Number will actually cause confusion at the IRS, and that can create issues for your business.

So don’t get a new EIN number for your LLC.

Instead, you will simply change your Pennsylvania LLC name with the IRS (see above for instructions).

Do I need a lawyer to change the Pennsylvania LLC legal name?

No, you don’t need to hire a lawyer. You can file the Certificate of Amendment yourself or you can hire a company to do it for you.

If you want to hire a company, we recommend MyCompanyWorks.

Need to save time? We recommend hiring MyCompanyWorks ($119 + state fee) to file your LLC name change.

How do I change my LLC name in another state?

You can change an LLC name in any state. Click the link below to learn how to change your LLC’s name in that state.

Alabama LLC Name Change

Alaska LLC Name Change

Arizona LLC Name Change

Arkansas LLC Name Change

California LLC Name Change

Colorado LLC Name Change

Connecticut LLC Name Change

Delaware LLC Name Change

DC LLC Name Change

Florida LLC Name Change

Georgia LLC Name Change

Hawaii LLC Name Change

Idaho LLC Name Change

Illinois LLC Name Change

Indiana LLC Name Change

Iowa LLC Name Change

Kansas LLC Name Change

Kentucky LLC Name Change

Louisiana LLC Name Change

Maine LLC Name Change

Maryland LLC Name Change

Massachusetts LLC Name Change

Michigan LLC Name Change

Minnesota LLC Name Change

Mississippi LLC Name Change

Missouri LLC Name Change

Montana LLC Name Change

Nebraska LLC Name Change

Nevada LLC Name Change

New Hampshire LLC Name Change

New Jersey LLC Name Change

New Mexico LLC Name Change

New York LLC Name Change

North Carolina LLC Name Change

North Dakota LLC Name Change

Ohio LLC Name Change

Oklahoma LLC Name Change

Oregon LLC Name Change

Pennsylvania LLC Name Change

Rhode Island LLC Name Change

South Carolina LLC Name Change

South Dakota LLC Name Change

Tennessee LLC Name Change

Texas LLC Name Change

Utah LLC Name Change

Vermont LLC Name Change

Virginia LLC Name Change

Washington LLC Name Change

West Virginia LLC Name Change

Wisconsin LLC Name Change

Wyoming LLC Name Change

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

This document is pretty detailed step by step walkthrough to me. I have changed my org name pretty smoothly. Thanks Matt for your guidance through this wonderful article.

Best Regards,

Sudhakar

You’re very welcome Sudhakar! Glad we could help :)

I spent an hour plus circling the government site trying to figure out how to submit the form. Thank you so much for taking the time to thoroughly document these steps. This was so incredibly helpful.

Oh my! You’re very welcome Amanda. We’re happy to help :)

Same question as Jon Dec. 21, 2022 and Jen Jan. 1, 2023. Should have been addressed by now?

Hi Gary, we’ve been told to leave the box unchecked. Hope that helps.

Thank you for all the info! I’m trying to update the name on my LLC, but I get to the part where you need to check the box if the amendment restates the certificate. After checking the box, I’m then required to ‘upload the restated certificate’ to continue. I’m not sure what I’m supposed to upload here. Any insight on what needs to be on this form? Thank you!

Hi! I am currently “stuck” in the same spot. Any idea as to what is the “restated supporting document” that needs to be uploaded is?

Hi Jen, it’s a bug with their new filing system. Just leave the box unchecked and proceed with the filing.

Hi Jon, this is a bug with PA’s new filing system. You can just leave the box unchecked and proceed with the filing. Apologies for the confusion.

Great information! I was wondering if when I file for a name change for my LLC if I could change the owner of my LLC at the same time? I’m also unsure what needs done for this. I’m looking to establish a holding entity and have two sub LLC companies under it. I currently have one LLC that I just want to change the name of to pertain more specifically to the type of business and I want it to be owned by the soon to be established holding company.

Hi Kayla, thank you! Ownership changes to a Pennsylvania LLC are private, meaning, there isn’t anything to file with the Pennsylvania Bureau of Corporations. You’d sign an Assignment of LLC Membership Interest (we don’t provide this form at this time) and that would transfer your ownership to the holding company LLC. You’ll also want to amend the LLC’s Operating Agreement. Hope that helps.

Hi Matt

I don’t need to change my business name but my business address changed…do I have to update it with the PA Bureau?

Hi Neel, please see this page: Pennsylvania LLC Change of Address (this will change your LLC address with the Pennsylvania Bureau of Corporations). To change your LLC address with the Pennsylvania Department of Revenue, you’ll need to file Form REV-854. Here is the mailing address: Pennsylvania Department of Revenue: Where do I mail the REV-854. Hope that helps!

Thank you

My business name required approval from the State Registration Board for Professional Engineers, Land Surveyors and Geologists in order to use the word “engineering” in the business name. If I am trying to change to a new name which also includes the word “engineering” will my previous approval be sufficient, or is there an additional step to the name change process that I need to employ?

Hi Anthony, we recommend contacting the State Board to confirm, however, I believe the approval should include the entire name.

Hi! I would like to know if you have an example of filing for statement of correction? I just need to remove the period in my business name not necessarily changing the name completely.

Hi Anyae, we don’t at this time. Is the period in the designator (L.L.C.) or elsewhere in the name?

Hi! No it’s in the name part not the LLC

Thank you Anyae. In the Statement of Correction, #4 is where you’d make the correction. You can write this:

Certificate of Organization (DSCB:15-8821, filed XX/XX/2020). The LLC name was filed as The Incorrect Name and it should be corrected to Your Corrected Name, LLC.

For #3, you can enter “15 Pa.C.S., Section 8821”.

For #5, you can check off the middle box (The original document to which this statement relates shall be deemed re-executed.)

Hope that helps :)

Hello Matt. You’re break down of this was completely amazing. Really helped to get where I am now. I do have a few questions though. My mother and I bought an already established business. When filing the cert. of amend. Who files and signs, the former owner or us? ( the name is not changing) Second question is; does this certify that we are the new owners of this Business entity with PA?

Hi Dani, thank you very much! Glad to hear that. Any authorized person can sign the Certificate of Amendment. No, by default, LLC Members are not listed on the original Certificate of Organization and therefore Members can’t be added/removed via a Certificate of Amendment. If you’re buying a business, there should be a contract in place. Additionally, you’ll want an Assignment of LLC Membership Interest, where the prior Member(s) sell their shares of interest in the LLC to you and your mother. Additionally, the Operating Agreement would be amended. Additional contracts/agreement may also be needed/helpful.

Having said that, if you’re not working with an attorney on this transaction, it’s strongly recommended. You can buy the business without taking over the LLC. Meaning, you could just form a new LLC and acquire the assets of the business (without buying LLC membership interest). Taking over the LLC, means you take on all its assets and liabilities. Do you know if there are judgments against the LLC? Meaning, if the company has debt, it could now be your responsibility. Well, not you personally. But it’ll be attached to the LLC, which you’d then be a Member of. There may be other ways to structure the deal, too. But based on your message, it sounds like you’re trying to DIY the whole thing and it sounds a bit risky since you were trying to do it via the Certificate of Amendment… which does nothing as far as transfer LLC membership interest. Hope I don’t sound rude :) Just sharing some details that are hopefully helpful for you.

Matt,

Your site was extremely helpful for helping me determine if I should set up another LLC or simply establish a DBA. Keep up the great work!!

Wishing you continued success,

Mike

Hi Mike, that’s great to hear! Thank you so much!!

I have registered my business name. Can I use the name on letterhead and other official documents without attaching the LLC? Or do i need a DBA with the same name, just without the LLC?

Hi Lisa, it’s best to use the full legal name of the LLC (including the designator) so people know they are dealing with a legal entity. If you want to operate without using the “LLC”, you’ll want to file a Fictitious Name in PA. Hope that helps.

AMAZING INFO!!!! Walked me through step by step. Will definitely use services in the future!! Thanks sooooo much!

You’re very welcome Lisa! Thank you for the lovely comment :)

Your information has been very helpful. Especially the part on amending an LLC. I do have a question though. Our client is changing the name of his LLC. I’ve prepared the Amendment and Docketing Statement. Once those are approved he would still like to use the old LLC name as a DBA LLC. Is this possible? And, if so, how would I fill out the Registration of Fictitious Name if the DBA LLC name already exists in the system?

Hey Kristi, glad the guide has been helpful. Most states don’t allow for a DBA name to include a corporate designator, such as “LLC”, but PA is unique in that it does. However, the filing will be rejected because of the name conflict. What you’ll need to do, is along with your PA Registration of Fictitious Name, also a file a Consent to Appropriation of Name. Under #5 (“The consenting association is…”), check off the first option: “About to change its name”. Hope that helps!

Matt, That was very helpful. As it turns out, they won’t be “d/b/a” so it isn’t a problem after all. Thanks again. Kristi

Awesome! You’re very welcome Kristi :)

Thank you Matt for getting back. Everything got squared away with the exiting partner. I do have one last question. One of our entities is a Limited Partnership with Delaware, domiciled in PA. I am notifying the IRS of the name change. Do you think they will need to confirm the name change confirmation with both states or just Delaware? Thank you Matt

Hi Isaac, since it’s a Delaware LP, you’re likely okay to just include the DE confirmation of name change when you submit your letter to the IRS.

Thank you Matt for your help. Just waiting to receive that and I will be sending that out. Thank you again for your help.

Hey Issac, of course! You’re very welcome.

Wow, thanks so freakin much for this awesome guide!!!

Was such a huge pain trying to figure this out but you laid everything out perfectly.

Genuinely appreciate it!!!!

Hey Thomas, thanks so freakin’ much for your awesome comment!! Comments like your just keep up motivated to make even more helpful LLC guides! I really appreciate you chiming in :-)

Thank you Matt for the easy break down. I tried using PA’s site before but I was looking in the wrong areas. This helped tremendously. I will be changing our name along with a member. If you would not mind sharing – A member has already set in writing his removal. Would removing his ownership from the certificate be the same process as the name change? Thank you!

Hey Isaac, thanks for your comment. Glad we could help. In PA, the Member’s info is not listed in the Certificate of Organization, so your changes would just be “internal” (you don’t have to file a Certificate of Amendment). You’d amend your Operating Agreement (or make a new one) and also sign a Resolution about the member stepping down. On what section of the Certificate of Organization is this person’s information?

Hi Matt, Thank you for your helpful information. I had a similar issue. I am not sure if we need to notify PA state if we had change of ownership internally.

Hi JJ, you don’t need to notify the PA Bureau of Corporations (since LLC Members aren’t listed on the Certificate of Organization), but you’ll likely need to update PA Department of Revenue. And you’ll want to update the IRS as well. We’ll have more clear steps on how to do this in the future, but are working on other content and lessons currently. Hope that helps.

Thank you for your step-by-step instructions on how to easily change the name and address of my LLC. I have one question though. Does changing the name and address with the Pennsylvania Department of State also trigger them to change the name and address on my Sales Tax ID number, or do I need to fill out more paperwork to change that? Thanks so much

Hi Karen, you’re very welcome. No, the name change with the Corporation Bureau does not trigger a name change anywhere else. You’ll need to contact the PA Department of Revenue regarding your Sales Tax ID Number. You can find the form and instructions here. Hope that helps.

The information you provided was extremely helpful. Your step-by-step instructions were easy to follow and specific, saving me time and money.

Hey Lou, very happy to hear. You’re welcome! Thank you for the kind words.