Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

We know dealing with the IRS can be intimidating, but getting an EIN for your LLC doesn’t have to be scary.

This page explains what an EIN is and we provide step-by-step instructions on getting an EIN for free for an Oklahoma LLC.

What is an EIN Number?

EIN stands for Employer Identification Number and is assigned to your LLC by the Internal Revenue Service (IRS), a division within the federal government.

The EIN identifies your business to the IRS, the same way a Social Security Number identifies a person. You could also think of the EIN as your “account number” with the IRS.

Note: An EIN is not issued by the Oklahoma Secretary of State. It is only issued by the IRS.

Don't have an LLC yet? Hire Northwest to form your LLC for $39 + state fee (then add EIN to your order).

Have an LLC, but no EIN? Hire Northwest to get your EIN:

I have an SSN | I don't have an SSN

EIN Synonyms

You might see your EIN Number referred to in many different ways. They all mean the same thing, though.

Other terms for an EIN include:

- EIN Number

- Employer Identification Number

- Federal Employer Identification Number (FEIN)

- Federal Tax ID Numbers

- Oklahoma Federal Tax ID Number

- Federal Tax Identification Number

Note: An EIN Number is not the same thing as an Oklahoma state Tax ID Number. An EIN is issued by the IRS. And an Oklahoma Tax ID Number is issued by the Oklahoma Tax Commission.

What’s an EIN used for?

An Employer Identification Number (EIN) is used by several different government agencies to identify your LLC.

Having an EIN for your Oklahoma Limited Liability Company lets you:

- Open an LLC bank account

- File federal, state, and local tax returns

- File Oklahoma income tax

- Register for sales taxes

- Obtain business lines of credit or business loans

- Get a business credit card for your LLC

- Apply for business licenses or permits

- Handle employee payroll taxes (if applicable)

- Register with the Oklahoma employment security commission (if applicable)

How much does it cost to get an EIN?

Applying for an EIN for your Oklahoma LLC is completely free. The IRS doesn’t charge any service fees for the EIN online application.

When should you get an EIN?

Don’t apply for an EIN until your Oklahoma LLC is approved.

Tip: If you applied for an EIN before your LLC is approved, or made another mistake, please see our FAQs below. We explain how to fix the most common EIN mistakes.

How do I file an EIN Application for my Oklahoma LLC?

Important: Make sure you finalize how many LLC Members you have before you apply for an EIN. Changing from a Single-Member LLC to a Multi-Member LLC (or vice versa) requires filing paperwork with the IRS and the state. Additionally, you’ll need to transfer LLC ownership, amend your Operating Agreement, and update your accountant (since your tax filing will change).

Note: An LLC doesn’t stand for Limited Liability Corporation. It stands for Limited Liability Company.

Apply for an EIN (US Citizens and US Residents)

We recommend applying for an EIN online if you have a SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number).

This is the easiest filing method and it has the fastest approval time. Your EIN Number will be issued at the end of the online application, which takes about 15 minutes to complete.

We have step-by-step instructions on this page:

How to apply for an EIN online

Note: You can also apply for an EIN by mail or fax, but this is really slow compared to the online filing. We only recommend this if you get an error message (called an EIN reference number) and the IRS says that you have to.

Apply for an EIN (Non-US residents)

If you’re a non-US resident (and don’t have an SSN or ITIN), you can still get an EIN for your Oklahoma LLC. You just can’t apply for a Federal tax EIN online.

Instead, you need to mail or fax Form SS-4 to the IRS. The SS-4 is the application form. We have step-by-step instructions on this page:

How to get an EIN without an SSN or ITIN

Note: If you’ve read somewhere that you have to hire a third party designee, this is not true. You can obtain your EIN yourself without using a third party designee.

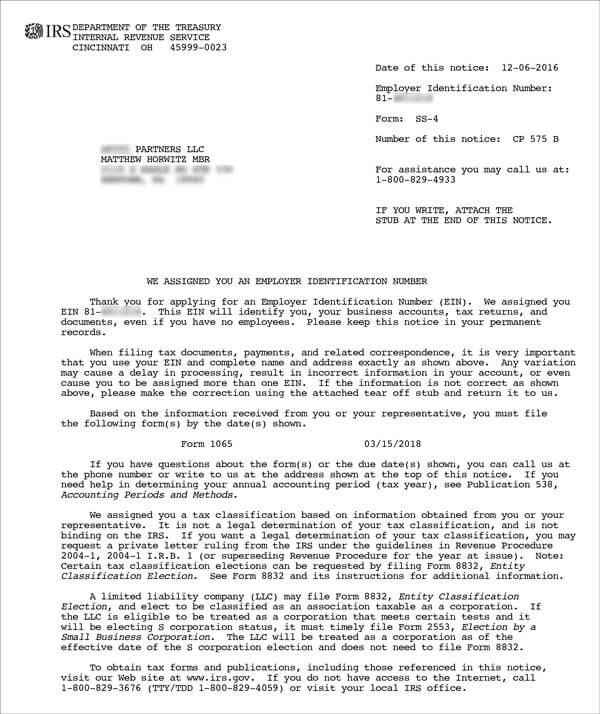

EIN Approval (EIN Confirmation Letter)

Once the IRS issues an EIN for your Oklahoma LLC, you will receive your official approval, known as an EIN Confirmation Letter (CP 575).

The method you use to apply for an EIN will determine how you receive your EIN Confirmation Letter. If you apply online, you can download the EIN Confirmation Letter at the end. If you mail or fax SS-4, the IRS mails your EIN Confirmation Letter.

Here is what the EIN Confirmation Letter looks like:

LLC Business Bank Account

After getting an EIN, you can open a business bank account for your Oklahoma LLC. The bank will need your EIN Confirmation Letter (or EIN Verification Letter) to open the account.

Please see business bank account for LLC for a list of recommended banks (and the documents you should bring).

If you’re a non-US resident, you can still open a US bank account for your LLC. Please see this page: Non-US resident opening US bank account for an LLC

Internal Revenue Service (IRS) Contact Information

If you have any questions, you can call the Internal Revenue Service (IRS) at 1-800-829-4933. Their office hours are 7am – 7pm, Monday through Friday.

Use these options to speak to a live person:

- Press option 1 for English.

- Then press option 1 for Employer Identification Numbers.

- Then press option 3 for “If you already have an EIN, but you can’t remember it, etc.”

Note: Pressing option 3 is the only way to get a live person.

We recommend calling the IRS right after they open to avoid long hold times.

The IRS won’t give you legal assistance or guidance, legal or tax advice, but they will answer questions about the EIN application process.

EIN Frequently Asked Questions

Does a Single-Member LLC need an EIN?

You may have seen other articles online say that Single-Member LLCs are the one type of business structure that don’t need an EIN. While this is technically true, it’s bad advice.

Having an EIN can protect you from identity theft, and you’ll need an EIN for other purposes – not just filing taxes. Your Oklahoma LLC needs an EIN to:

- Open an LLC business bank account

- Obtain business lines of credit or business loans

- Get a business credit card

- Apply for business licenses or permits

- Handle employee payroll (if applicable)

Plus, getting an EIN is free and takes just 10 minutes online. Said another way, we strongly recommend getting an EIN for your Single-Member LLC.

Does a Multi-Member LLC need an EIN?

Yes, all Multi-Member LLCs are required to get an EIN from the IRS. This is because it’s required by the Internal Revenue Code.

Do I need an EIN for my DBA?

No. A DBA can’t have an EIN. Remember, a DBA is just a nickname for a business or a person(s).

However, the business or person(s) that owns the DBA may need an EIN.

DBA owned by an LLC

If you have an LLC, your LLC needs its own EIN.

If your LLC has a DBA, don’t get an EIN for the DBA. The DBA is just a nickname for your LLC, and the IRS doesn’t recognize DBAs.

DBA owned by individual(s)

If you registered a DBA, but didn’t form a legal entity (like an LLC), then you’re operating a Sole Proprietorship (1 owner) or a General Partnership (2 or more owners).

Sole Proprietorship: Your Oklahoma Sole Proprietorship (with or without a DBA) isn’t required to have an EIN, but it’s optional.

General Partnership: Your Oklahoma General Partnership (with or without a DBA) must get an EIN. It’s required by the IRS.

Again, in both cases, the DBA itself doesn’t get the EIN. It’s the underlying business entity that gets the EIN.

Do I need an EIN for an LLC with no employees?

Yes, you should still get an EIN for your Oklahoma business even if you don’t hire employees.

Even though it’s called an Employer Identification Number, it doesn’t mean you have to have employees. Again, the EIN Number is just a way for the IRS to identify your business.

(Note: If you are the only owner in your business, you are not considered an employee. You are simply the owner.)

How should a husband and wife LLC get an EIN?

In most states, husband and wife LLCs can only be treated as a Multi-Member LLC taxed as a Partnership.

However, in community property states, married couples can choose between:

- Husband and wife LLC taxed as a Partnership

- Husband and wife LLC taxed as a Single-Member LLC (aka Qualified Joint Venture)

Oklahoma is not a community property state. So Oklahoma husband and wife LLCs can’t choose to be taxed as a Qualified Joint Venture (Single-Member LLC).

How you complete your EIN application determines the LLC’s tax status. For more information, please see Husband and Wife LLC (Qualified Joint Venture).

Common EIN mistakes and how to fix them

How do I find my EIN number online?

If you lose your EIN Confirmation Letter (CP 575), or forget to download it online, you can’t get another one.

However, you can request an EIN Verification Letter (147C), and you can use that instead.

Both forms are accepted by everyone (including banks and the state government).

I thought applying for my EIN is what forms my LLC, right?

No, just getting an EIN from the IRS doesn’t form an LLC. LLCs aren’t formed with the IRS. They are formed with your state.

You are supposed to form an LLC in your state, and then apply for an EIN (aka Federal Tax ID Number).

If you’ve been operating your business by having an EIN and have not formed an LLC, you have unknowingly been operating as a Sole Proprietorship and the EIN is “attached” to you, personally.

Said another way, the Tax ID (EIN number) is not connected to your company – because the company (the LLC) hasn’t been formed.

If you want to have your company be an LLC: First, form an LLC, wait for it to be approved, and then apply for a new EIN. Later you can cancel your first EIN.

What if I applied for an EIN before my LLC was approved?

If your LLC gets approved (using the name you listed on your EIN application), there is nothing to worry about. As long as the name on your EIN Confirmation Letter matches your LLC name, then you can use that EIN for your LLC.

If your LLC is rejected, then you need to refile with the state and wait for your new LLC name to be approved. Then get a new EIN from the IRS. And cancel the old EIN.

How do I cancel an EIN?

If you need to cancel your EIN Number, you need to mail a cancellation letter to the IRS.

We have instructions and the cancellation letter here: How to cancel an EIN.

References

IRS: About LLCs

IRS: Taxation of LLCs

IRS: Employer ID Numbers

IRS: Understanding Your EIN

IRS: Do You Need a New EIN?

IRS: About Single-Member LLCs

IRS: Get an Employer Identification Number

IRS: Links for Small Businesses in Oklahoma

Code of Federal Regulations: Section 422.112

Code of Federal Regulations: Section 25.169

Code of Federal Regulations: Section 40.361

Code of Federal Regulations: Section 24.47

Code of Federal Regulations: Section 301.7701-3

Code of Federal Regulations: Section 301.6109-1

Oklahoma Tax Workshops, Meetings and Seminars

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Oklahoma LLC Guide

Looking for an overview? See Oklahoma LLC

I formed an llc with my husband and we are going to both be equally active in running the business . In Oklahoma can we get an ein and be considered a joint venture?

Hi Cayce, we have a full article on that here: husband and wife qualified joint venture. However, Oklahoma isn’t a community property state, so it won’t apply. You can certainly still get an EIN for your LLC though. Your LLC will just be taxed as a Partnership instead of a Sole Proprietorship (as in a qualified joint venture). Hope that helps.

Your LLC site is absolutely great! It would have taken me ages to figure out all this stuff myself! Can’t thank you enough!!

Hey Glenn, thanks for the kind words! We’re very happy to hear that :) Best wishes with your business!