Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

To start an LLC in Illinois, file Articles of Organization with the Illinois Secretary of State. This costs $150 and takes 10 days for approval.

There are 6 steps to follow:

- Choose an LLC Name

- Select a Registered Agent

- File Articles of Organization

- Create an Operating Agreement

- Get an EIN

- Register with the Department of Revenue

If you want to form your LLC yourself, follow our free guide below.

If you want someone to take care of it for you, we recommend hiring Northwest Registered Agent

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(We recommend Northwest. We've reviewed all the top companies in the industry. And Northwest is our #1 pick for prices, customer support, and address privacy. Check out Northwest vs LegalZoom to learn more.)

How much does it cost to start an LLC in Illinois?

It costs $150 to start an LLC in Illinois.

And then it costs $75 per year.

What are these fees for?

- The $150 is to file the Articles of Organization – the document that creates an LLC.

- The $75 per year is for your Annual Report – a mandatory filing that keeps your LLC in good standing.

To learn more about LLC Costs, see LLC Costs in Illinois.

How long does it take to get an LLC in Illinois?

If you file your LLC by mail, it will be approved in 7-14 business days (plus mail time).

But if you file online, your LLC will be approved in 7-14 business days (plus mail time).

Please see How long does it take to get an LLC in Illinois to check for any delays.

Here are the steps to forming an LLC in Illinois

1. Search your LLC Name

Search your LLC Name with the Illinois Secretary of State to make sure the name is available in the state.

Search your LLC Name with the Illinois Secretary of State to make sure the name is available in the state.

You need to do this because two businesses in the state can’t have the same name.

First, search your business name and compare it to existing businesses in Illinois. You can make sure the LLC Name you want is unique from any existing business entity using the Department of Business Services’ Business Entity Search from the Illinois Secretary of State.

Second, familiarize yourself with the naming rules in the state (so your LLC gets approved).

We’ll explain both in more detail in our Illinois LLC Name instructions.

2. Choose a Registered Agent

The next step is to choose your LLC’s Registered Agent.

An Illinois Registered Agent is a person or company who accepts legal documents and state notices on behalf of your Illinois Limited Liability Company.

An Illinois Registered Agent is a person or company who accepts legal documents and state notices on behalf of your Illinois Limited Liability Company.

Who can be an LLC Registered Agent?

You have 3 options for who can be the Registered Agent:

- You

- A friend or family member

- A Registered Agent Service

Illinois law requires LLC Registered Agents to have a physical street address in the state. PO Boxes aren’t allowed.

And the Registered Agent’s name and address will be listed on public records.

If you don’t have an address in Illinois, or you want more privacy, you can hire a Registered Agent Service for your LLC.

We recommend Northwest Registered Agent

Northwest has excellent customer service, and they’re who we trust to be our own Registered Agent.

Our favorite feature about Northwest is they’ll let you use their office address throughout your LLC filing. This way, you can keep your address off public records.

They’ll also scan any mail sent to your LLC and upload it to your online account.

Special offer: Hire Northwest to form your LLC ($39 + state fee), and you'll get a free year of Registered Agent service.

(Why is Northwest the best? Read our Northwest Registered Agent review)

3. File Articles of Organization

To start an LLC, you need to file the Illinois Articles of Organization.

To start an LLC, you need to file the Illinois Articles of Organization.

This gets filed with the Illinois Secretary of State.

The Illinois Articles of Organization costs $150 if you file online.

This is a one-time fee to create your LLC.

If you want to file this yourself, see our step-by-step guide for filing Illinois Articles of Organization.

Or, you can hire a company to do it for you.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

4. Create an Operating Agreement

An Operating Agreement serves as a “companion” document to the Articles of Organization.

An Operating Agreement serves as a “companion” document to the Articles of Organization.

The Articles of Organization creates your LLC, and the Operating Agreement shows who owns the LLC.

Additionally, some banks require an Operating Agreement when you open an LLC bank account.

And having an Operating Agreement will be very helpful if you ever end up in court. Reason being, it helps prove that your LLC is being run properly.

That’s why we recommend that all LLCs have an Operating Agreement – including Single-Member LLCs.

Furthermore, an Operating Agreement is an “internal document“. Meaning, you don’t need to file it with the state or the IRS (Internal Revenue Service). Just keep a copy with your business records.

You can download a free template below.

Then, learn how to fill it out by watching our step-by-step Illinois Operating Agreement video.

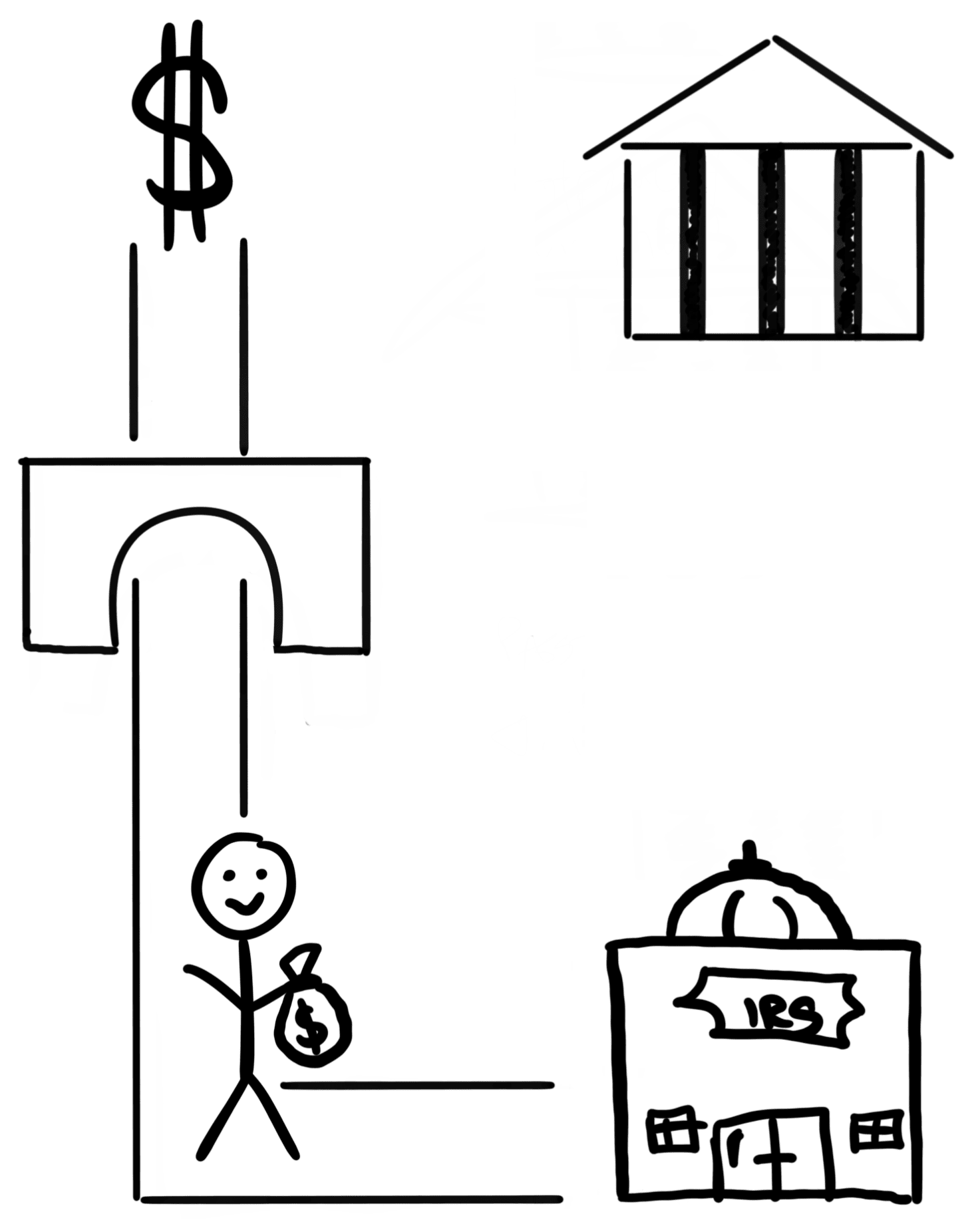

5. Get an EIN for your LLC

The next step is to get an Illinois EIN Number from the IRS for your LLC.

Note: An EIN Number is also called a Federal Tax ID Number or Federal Employer Identification Number.

An EIN Number is used to:

An EIN Number is used to:

- identify your LLC for tax purposes

- open a business bank account

- apply for business licenses and permits

How much does an EIN cost?

Getting an EIN Number from the IRS is completely free.

How long does it take to get an EIN?

If you apply online, it takes 15 minutes.

If you apply by mail or fax, it can take 1-3 months.

How can I get an EIN?

US Citizens/US Residents: If you have an SSN or ITIN, you can apply for an EIN online. Follow these instructions: Apply for an EIN online.

Non-US Residents: You can’t get an EIN online, but you can still get one by fax or by mail. Follow these instructions: How to get an EIN without an SSN or ITIN.

6. Register with the Department of Revenue

Good news, Illinois doesn’t have a state general business license.

Good news, Illinois doesn’t have a state general business license.

That said, all LLCs must register with the Illinois Department of Revenue in order to do business in the state.

When you register, the DOR will give you a Certificate of Registration and a Taxpayer ID.

The Certificate of Registration acts like a general business license, and the Illinois taxpayer ID is different from your LLC’s federal EIN number.

The Certificate of Registration and Taxpayer ID are free ($0), and both are required in order to do business in Illinois.

Also, depending on where your LLC is located, you may need a local business license or permit.

For example, if you want to start a daycare, you may need a business license from the city or county.

You can learn more on our Illinois Business License page.

What do I do after my LLC is approved?

After your LLC is approved, there are some additional steps.

Open an LLC business bank account

You’ll want to open a business bank account for your LLC.

This makes accounting and record-keeping much easier for your business finances.

Having a separate business bank account also maintains your personal liability protection. This is because it keeps your business finances separate from your personal finances.

File your Annual Report

All Illinois LLCs must file an Annual Report every year.

All Illinois LLCs must file an Annual Report every year.

This filing keeps your LLC in good standing with the state.

How much does an Illinois Annual Report cost?

The Annual Report filing fee is $75 per year.

When is the Annual Report due?

Your Annual Report is due before the first day of your LLC’s anniversary month, every year. And your LLC’s anniversary month is the month your LLC was formed.

For example, if your LLC is approved on May 16, 2025, your anniversary month is May. That means your Annual Report is due before May 1, every year.

When is my first Annual Report due?

Your first Annual Report is due the year after your LLC was approved.

For example, if your LLC was approved on April 12, 2025, your first Annual Report is due before April 1, 2026.

How do I file my LLC Annual Report?

You can file your LLC’s Annual Report online or by mail. We recommend the online filing because it’s easier to complete.

Follow our step-by-step guide here: Illinois LLC Annual Report.

Pay Taxes

LLCs don’t pay federal taxes. Instead, the LLC Members pay the taxes for the LLC.

Said another way, the owners pay taxes for the LLC as a part of their personal tax return.

How will my LLC be taxed?

By default, an LLC is taxed by the IRS based on the number of owners your LLC has:

- A Single-Member LLC is taxed like a Sole Proprietorship.

- A Multi-Member LLC is taxed like a Partnership.

Alternatively, you can ask the IRS to tax your LLC like a C-Corporation or S-Corporation.

Illinois LLCs are also required to pay 1.5% of their net income to the Illinois Department of Revenue. This is called the Personal Property Replacement Tax.

Learn more about federal, state, and local income taxes (plus sales tax) in Illinois LLC Taxes.

Illinois State Agency Contact Information

Illinois Secretary of State

Illinois Secretary of State: Department of Business Services

217-782-6961 (extension 7736 for the LLC department)

217-782-6875

217-524-8008

Illinois Department of Revenue

Illinois Department of Revenue

217-782-3336

217-524-4772

Monday – Friday, 8am – 4:30pm

Additional contact info

How to Start an LLC in Illinois FAQs

Can I start an LLC online in Illinois?

Yes, you can file your LLC online in Illinois. The Articles of Organization filing fee is $150.

When you start your LLC online, it will be approved in 5-10 business days

What are the benefits of an LLC?

The first benefit of an LLC is protecting your personal assets. Meaning, if your business is sued, your personal assets – like your home, cars, and bank accounts – are protected.

This protection applies to all LLC owners (called LLC Members). It doesn’t matter if you have a Single-Member LLC or Multi-Member LLC. All of the LLC owners are protected from the business debts and liabilities.

This type of protection wouldn’t apply if you operate as a Sole Proprietorship or Partnership. With these types of informal business structures, the owners aren’t protected in the event of a lawsuit. For that reason, Limited Liability Companies (LLCs) are a much more popular business structure.

Another benefit is LLC pass-through taxation. This means the LLC itself doesn’t pay federal income taxes. Instead, the profits “pass through” to the LLC Members. And the Members pay the taxes on their personal tax return.

And Illinois state income taxes are very similar, since the state honors the federal tax treatment of your LLC.

To learn more, please see How are LLCs taxed.

Is Illinois a good state to start an LLC?

Whether Illinois is a good state to start an LLC depends on where you live – and where you’re doing business.

Meaning, if you live in or do business in Illinois, then you should start your LLC there. While many websites talk about tax rates and advantages of certain states, none of that applies if it’s not the state where you live and do business.

Here’s how it works: If you form an LLC in Delaware, but live in and conduct business in Illinois, you’ll also need to register your Delaware LLC in Illinois (and pay extra fees).

Said another way, you’ll be required to have the same LLC formed in one state (as a Domestic LLC), and registered in the other (as a Foreign LLC). There are different instructions and additional costs for filing a Foreign LLC vs Domestic LLC.

And you’ll end up paying Illinois taxes anyway. This ends up leading to more costs and more headaches with no advantages.

In summary, if you live in and conduct business in Illinois, then yes, Illinois is a good state to start a business. If you don’t live in and do business in Illinois, then no, Illinois isn’t a good state to start a business.

Real estate exception: If you’re purchasing real estate outside of Illinois, you should form your LLC in the state where the property is located.

For more information, please see Best State to Form an LLC.

References

Illinois Secretary of State: LLC Resources

Illinois Secretary of State: LLC Forms and Fees

Illinois Department of Revenue: Business Registration FAQ

Illinois Dept. of Commerce and Economic Opportunity: Business Startup Resources

Illinois Dept. of Commerce and Economic Opportunity: Step by Step Guide to Starting a Business

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Illinois LLC Guide

Looking for an overview? See Illinois LLC

I am new at LLC’s and would like to know more. I intend to hire the services of Northwest as advertised on this website. What are the things I have to do on my end since I should not expect Northwest to do everything for my LLC? What sort of documents do I have to submit from my end (not Northwest’s end). Sorry, I did read the information on the website but it is all too much for me to take in; the questions I have above are the ones that I think should be clearly explained to me first. Thank you.

Hi Del, if you’re going to hire Northwest Registered Agent to form your LLC (and be your Registered Agent), the only thing I’d recommend thinking about ahead of time is your LLC name. Besides that, there’s really not much else to do. Once your LLC is approved, you’ll be the one to open an LLC business bank account. And after that, you’re off to the races! It might also be a good idea to speak to an accountant or two and have them lined up for when it comes tax time. Hope that helps :)

Matt,

You have an awesome website. Thanks for sharing. Do you consult on an hourly basis?

Thanks James! No, we don’t offer consulting services at this time. Thank you for your understanding.

Hi Matt,

I am a licensed clinical professional counselor in Illinois and want to start my own practice. Can you clarify if I need an LLC or PLLC? The Secretary of State seems to say I need a PLLC since I’m licensed in the state but it’s unclear. Calling them did not result in any answers either. Thank you!!

Hi Michele, the answer is PLLC. As per Section 1-25 (letter d) of 805 ILCS 180/1-25, if your LLC will offer services that are licensed by the IDFPR, the LLC must be formed in compliance with the Illinois PLLC Act. Also, all the LLC Members (if it’s more than just you), also must be licensed. Here’s a more reader-friendly page: IDFPR: Professional Limited Liability Company. In the “Resources and Publications” section, check out the checklist. Hope that helps!

Thank you so much!! This is so helpful!

You’re very welcome Michele! Best wishes with your new business :)

Hi, I “moved” to Ohio from Chicago to be with my family bc of the pandemic. My LLC is filed in Illinois. I don’t think I’ll be moving back to Chicago (I plan on being a digital nomad). Would you recommend I move my LLC to Ohio (my new homebase) or keep it in Illinois, until I decide my permanent location to call home? Also, is it possible to change my LLC to a new state if my driver’s license is still set at Chicago?

Hi Kimmy, yes, you can “move” an LLC to any state regardless of where your driver’s license is from. Typically, there are three ways to “move” an LLC. I’ll explain in my next reply. First, is the cheapest route the most appealing to you… or do you want to keep the company history the same, such as the EIN and the bank account… or both?

There isn’t much history on this LLC, so I am not tied to the EIN and bank account. I however, have one client that I started working with. How hard will it before them to switch up paperwork when I “move” my LLC?

Hey Kimmy, okay, thank you. I’m not sure what you mean by “how hard will it be for them to switch up paperwork”. I’m not sure who the “them” is you’re referring to. The three ways to move an LLC are: Dissolve and form new LLC, Foreign qualification, and Domestication.

Dissolve and form a new LLC: You would dissolve the Illinois LLC and form a new LLC in Ohio. You’d need a new EIN and new bank account. This is like starting fresh. This is the easiest and the most affordable. However, the negative is you lose the company history. However, you did say that wasn’t a big deal. I’m just mentioning that in case others see this.

Foreign qualification: You keep the Illinois LLC open and in good standing and you register it as a foreign LLC in Ohio. This is one LLC, but it has authority to do business in 2 states. The EIN and bank account stay in place. While it is 1 LLC, you’ll be maintaining two LLC filings.

Domestication: This is a more complicated filing process and we recommend hiring an attorney if you choose this route. This “converts” an Illinois LLC into an Ohio LLC. First, the Illinois LLC foreign qualifies in Ohio. Then the entity is converted into an Ohio LLC. Then the Illinois LLC is dissolved. This EIN and bank account stay the same. This is more expensive up front, but more affordable in the long run as you wouldn’t have to maintain the Illinois LLC filing.

Hi Matt,

I have had an LLC for my business on Illinois for a year now. Due to Covid I moved back home to NC and my previous address is no longer valid from Illinois. My question is how do I move my LLC from Illinois to North Carolina? Also my yearly payment is due for Illinois and I am just not sure if I should be paying that or not due to my current situation.

Thank you so much. You have been such a great help and I have shared your resources to a lot of my friends and family.

Hi Cameren, you’re very welcome. Thank you for sharing the site :) Do you need to retain any of the company history, bank account, or the EIN? It sounds like you’d rather not pay more than you have to. Typically, there are three ways to “move” an LLC, but I think you’d get the most value out of dissolving the Illinois LLC (the Illinois LLC Annual Report still needs to be filed) and form a new LLC in North Carolina. You’d need a new EIN and a new LLC bank account for the North Carolina LLC.

Hi Matt, thank you for your response. The main reason I feel like I need to move it is because I don’t have an home address in Illinois anymore and I think that is required? I would prefer to retain the bank account and the EIN number. Because of this should I keep it in IL? I am conflicted now on what to do especially being that I do not have an address to update them with.

Hi Cameren, an Illinois LLC has a Principal Office address, Registered Agent address, and the address(es) for any LLC Members or Managers. You are not required to have a home address in Illinois to own an Illinois LLC. The only address that needs to be in Illinois is the Illinois Registered Agent address (and it doesn’t have to be a home address). If you are currently the Registered Agent for your Illinois LLC, you can hire a Commercial Registered Agent in Illinois to take care of that requirement. Or you can use the name and address of a friend or family member in Illinois. The Principal Office address and address of LLC Members/Managers can be located in any state.

So besides the “dissolve and form new” strategy, the other two methods of “moving” an LLC is domestication (converting an LLC from one state to another, aka changing an LLC’s domicile) or registering the LLC as a foreign LLC in the new state. However, North Carolina doesn’t have domestication, so you’re left with foreign qualification.

So by registering the Illinois LLC as a foreign LLC in North Carolina you are extending the LLC’s authority to do business. Meaning, it’s still 1 LLC (the Illinois LLC), but now the LLC can do business in Illinois and in North Carolina.

The Illinois LLC’s foreign registration in North Carolina will require designating a North Carolina Registered Agent and filing a North Carolina LLC Annual Report.

I know that is a lot to digest and it can cause stress, but let it simmer for a few days. It’s often a lot of new information to absorb. I hope that helps. Let me know if you have any follow up questions.

Hi Matt,

Wow Thank you so much for giving me that information. I think the foreign registration might be worth while for me. That is a lot to digest so I will definitely let that simmer and decide on what the best option is.

Thanks again.

Cameren

Hi Cameren, you are very welcome :)

Dear Matt,

I live in Pakistan, and I have garment related business, I want to bring my manufactured stuff in US to find a good market. I need to open LLC in Illinois from Pakistan, I have read above all your mentioned stapes, please tell me how I will open the bank account without my presence in US after approval of LLC, and later on I want to open a small office in US for one or two person only, please tell me what will be the procedure.

Regards

Wasif

Hi Wasif, this page is just an overview of the steps to forming an LLC in Illinois. Please check out the “Detailed Lessons” links at the top, which go into more detail. Please see this page: LLC bank account for non-US resident. If you are going to rent an office, you’ll most likely need to visit in person. This is not a subject matter we cover though. However, I imagine most places will not want to rent to your business without meeting you. Maybe some rental transactions can be facilitated by phone, but I’d also imagine you’d want to physically see the place too before renting it. Hope that helps.

Hi Matt,

Great article. I am looking to start a IT consulting business. I am resident of IL, but I am considering starting in either IL, DE or WY (leaning mostly towards WY). I do not know where my customers will be from, but I plan to work from home office in IL. Any recommendation based on the nature of business, uncertainty in size and future, and business being mostly online on what might be the best state to incorporate? I read that WY has the least filing and taxes hence leaning towards it, not sure how the future of the business will go. Also, suppose I do start with IL and it does hit big, how easy or difficult is it to move the business to another state. I might move out of IL in the next 2 years (Texas is in consideration), in that case would it be better to go with DE or WY instead of IL? Thanks!

Hi Jim, thanks! The taxes and laws of Wyoming will not apply since you are doing business in Illinois. The fact that it’s an online business doesn’t affect the laws of “transacting business“. You are running everything from home, therefore, that’s where you are conducting business. Please see what’s the best state to form an LLC for more information.

Moving an LLC from one state to another (usually called LLC domestication) can be a bit complicated, but it’s usually the primary way to “move” an LLC. Alternatively, you can register your Illinois LLC as a foreign LLC in the state where you move to next. In that case, you would be maintaining 2 LLC filings. It’s really one LLC (an Illinois LLC with authority to do business in Illinois and in the new state), however, it’s 2 filings (and 2 Annual Report filing requirements).

From a tax perspective, you’ll simply apportion the income to the appropriate state (the state where you reside) and pay income taxes there (or not, if Texas, for example). However, keep in mind, the foreign LLC filing fee is Texas is more expensive than a regular LLC filing. Hope that helps!

Hello Matt, thank you for the marvelous job at informing and educating with this article. As a 19 year old, turning 20 in less than 10 days, this was very easy to understand and provided me with the correct path to complete the requirements and objectives.

My two questions are as stated, (1) If I were to fill my home address and registered myself as my own “agent’, what steps would need to do if I move within the same state? Also what steps would I need to take if I were to move out of Illinois to let’s say New York or Texas?

(2) Since both of my businesses are online, all of my employees will be hired, and employed virtually online. I know under this scenario I would just file the LLC under my current location which is the state of Illinois. But in the future when I get bigger and older, I would like to consider having a hub or office area where I would have hired employees working physically in person although most but not all of the business will still take place online.

I hope you can give me some advice, and a wholesome sorry for any typos or confusion in advance.

Sorry, I forgot the actual question to #2, my question is with that information provided would I need to file them as managers in the LLC-5.5 form? Also I will have supervisors that will be higher than managers in the chain of command, so would they also being required in the “managers” section even if they’re not considered as managers?

Just to clarify, I will have two different titles, Team Manager and Project Supervisor and the PS position will be higher than the TM position.

Hey Rex, you’re very welcome! If you are going to be the Registered Agent for your Illinois LLC and your address within Illinois changes, you can file what’s called a “Change of Registered Agent and/or Agent’s Office Address”. This can be filed online or by mail (the form is LLC-1.36/1.37). If you move out of state, you will need to change the Registered Agent to another person in Illinois or to a Commercial Registered Agent.

Regarding expansion, where an LLC needs to be registered as a foreign LLC depends on where your LLC is “transacting business”. Having W-2 employees (if that’s what you mean) constitutes transacting business and you would need to register your LLC as a foreign LLC in all states where you have W-2 employees. Furthermore, you also need to register your LLC with those states’ Department of Revenue (or equivalent agency) in order to process payroll and properly withhold taxes. You can also just hire people as Independent Contractors, which may be simpler to start with as you don’t need to run payroll or worry about foreign LLC qualification.

Please read LLC officer titles. The word Manager, in regards to LLCs, is FAR different than the general term “manager”, as in “he’s the store manager”. If you’re hiring people (which by the way, doesn’t mean they have to be W-2 employees), you likely don’t want to make these people LLC Managers or Members. You can give them the title “manager”, but you don’t need to put their names in your LLC Articles of Organization (LLC 5.5) or your LLC Operating Agreement, which would give them authority to bind your LLC in contracts and agreements. You can give (and restrict) their rights via any type of agreement (a contract), such as an Independent Contractor Work for Hire agreement or an Employment Agreement (if you go the W-2 employee route). You can use whatever titles you want for the people you hire. Again, those titles and those people’s names don’t need to (and you likely don’t want them to) appear in your Articles of Organization or Operating Agreement. Hope that helps!

Yes that most certainly helped a lot, thank you so much for all of your wisdom. You’re a lifesaver!

You’re very welcome Rex!

Hi Matt,

You have so much great info. here.

In Illinois, what is the Anniversary date of the LLC? The date on the “Assumed Business Name Application? The date the EIN was acquired? Some other date?

Thanks.

Thanks Betty! Great question. An Illinois LLC’s anniversary date is the date it was approved by the Secretary of State. You can find that date on your approved Articles of Organization or by searching your LLC name on the state’s database and looking for “Organization/Admission Date”. You can find the state’s database link on this page: Illinois LLC name search. Hope that helps!

I am trying to start a staffing agency for temporary employment. As it stands right now I have no idea what I need or don’t need. I believe having an LLC is the best option for me right now but I don’t know how to make the actual decision. Do you have any helpful information about the legality of a staffing agency that would help me with the decision process?

Hi Gary, we don’t have industry-specific information. You could call a few attorneys for some guidance on entity structures though. Hope that helps.

Thank you Matt, for your response. Does this mean that I should apply by mail, or can I apply on line and attach a copy of my reservation?

Thank you

Hey Loretta, you’re welcome. Apologies for not mentioning this in the first reply. Unfortunately, there isn’t an “upload” step in the online Illinois Articles of Organization filing. To be safe, it would probably be best to file the Articles of Organization by mail along with your name reservation approval. If you submit the Articles of Organization online, an examiner will cross-reference the LLC name with their records. They’ll see your name reservation on their end. And they’ll look to see if your name is on the Articles of Organization (“connecting” the filings). Having said that, it’s not a standardized process. Meaning, depending on who you speak to at the Secretary of State’s office, you’ll get a different tone of confidence. In summary, there’s a chance it’ll work if you file online, but it definitely go through if you file by mail. Hope that helps.

Thanks again Matt!!

Hi Matt, I have reserved the name for my LLC, with the state of Illinois for 3 months. Once I am ready to file my articles of organization, how is it determined that my name is reserved when I apply? will my reservation Information automatically be linked to me name?

Hi Loretta, they are not automatically linked. You can include a copy of your approved name reservation when you submit your Articles of Organization with the identical name. Hope that helps.

Hi Matt,

What happens if I choose a Registered Agent and they move? Is it difficult to change this information once the LLC is formed?

Thank you in advance!

Hey Crystal, you’ll want to update the Secretary of State. Pretty easy to do. The filing is called the “Statement of Change of Registered Agent and/or Registered Office”. It’s $25. You can file by mail (Form LLC-1.36/1.37) or online (Illinois LLC Change of Registered Agent). Hope that helps!

Thank you!

Matt,

I am SO grateful to have come across your site as well as the information on Northwest to help with creating an LLC ! I have looked at numerous other sites and your site and Northwest’s services are by far the best. I am starting a mobile drug testing business in which we will go to jobsites to test company DOT or NonDOT employees for their random testing programs, job fairs where prospective employees can complete their drug screen right after the interview as well as random testing programs at high schools etc. I have already obtained 3 small contracts and other potential companies are very interested. This business is strictly service based, myself and my partner are providing the service of completing the drug screen for the employer. We both work full time and will be doing this on the side, testing the waters so to speak. We feel that an LLC is a good option but how do we bypass being double taxed? Is an S-Corp the most beneficial? Thank you in advance for your guidance!

Mary, thank you! That is so great to hear :) I’m not sure what you mean by double taxed, since an LLC isn’t double taxed. Regarding the S-Corp: the S-Corp isn’t a state entity (like an LLC or Corporation). It’s a tax election made with the IRS that “sits on top of” either an LLC or a Corporation. So instead of the question being LLC vs S-Corp, it’s really LLC taxed in default status vs LLC taxed as an S-Corp. Here’s the link about LLC/S-Corp: LLC electing S Corp status. Hope that helps!

Hello Matt,

Context, I have already formed my business but I was advised that if my business would do more than realestate I can establish a division of the LLC that would handle business management and a different SIC and NAICS could be attached to that part of the division (business). In Illinois is this something that we can do or no? Hopefully I am explaining this properly.

Hi Kimberly, while yes, that context does make sense, again, the term “division” is not an official entity term used at the state level. The IRS does however use the word “division” when talking about a disregarded entity LLC. If that’s what the person who told you about the “division” is referring to, then they may be talking about a Parent/Child LLC setup. This is where one LLC is owned by another LLC. Again, you can’t form a “division” in Illinois. You would need to determine if this advice you received was about an LLC being a Member of another LLC or if were about a Series LLC, or some other entity setup. But just talking about “establishing a division” in Illinois doesn’t make sense. Hope that helpful. Thank you.

Great site! I have a question. I currently have an LLC oiginally my main purpose was real estate. I am now adding management and consultant (not in relation to real estate) as another component of the business. I was told I should establish a division. I have been looking all over. Are you able to advise how I can form a division of my LLC in IL?

Thanks Kimberly! The word “division” isn’t an official term used in the context of forming an LLC, so we’re not sure exactly what you’re looking to do. It could be a new LLC owned by a you, a new LLC owned by your current LLC, or just additional activity within your existing LLC.

Great article, thanks for the information! I am forming an LLC in Illinois, a home based business but the majority of my work with clients will be at their homes, so not really any public traffic. I’ve seen recommendations to use a registered agent, and also to get a USPS or UPS mailbox street address instead of using my home address for privacy reasons and to avoid junk mail. However, I’ve also seen horrible reviews of the mailbox street address services, especially regarding price increases and high cost and process to make a change. What would you recommend, privacy or risk of price/change hassles?

Thanks!

Hey Kay, you’re very welcome! Great question. In this case, you could use an Illinois Registered Agent service, specifically Northwest Registered Agent, since they’ll let you use their address for your Registered Agent’s address, Principal Place of Business address, Manager/Member’s address, as well as the LLC Organizer‘s address. Having said that, you could use a private mailbox (commercial mail receiving agency). The Illinois statute (805 ILCS 180/1-35) is silent on the use of CMRAs. We haven’t run into price increases issues, however, one issue is that you can’t use USPS mail forwarding on a CMRA address if you later change your address. If you go the CMRA route, we recommend keeping a spreadsheet of every place the address is used so you know where to make updates if/when needed in the future. Furthermore, we have a mailbox rental questionnaire which you can use to make phone calls and “interview” a few places in your area. Hope that helps! Let me know if you have any follow-up questions.

Hello, there!

Thanks so much for this awesome information. I have 2 questions and I’m hoping you can provide some guidance.

1. For 2017/2018, I was a sole proprietor and applied for an EIN. I am in the process of creating an LLC with a completely different business name as I am re-branding. Can I roll the old EIN over to the new business or will I need to cancel the old EIN and re-apply for a new number?

2. I have lived in NYC for more than a decade but am originally from Chicago and toggle between both cities. My plan is to incorporate in Illinois even though a lot of my business is conducted online. Are there any best practices you’d recommend for filing as a foreign agent? I’m wondering if I need to also file in NYC if I’ll be there for stints at a time. Again, much of my business is conducted online as I’m an online marketer.

Again, thank you for such awesome information. I’ve been looking for a resource like this for quite some time and your site is a tremendous help.

Thanks!

Hey Amber! You’re welcome!

1. You can do either. You can write a letter to the IRS to transfer the EIN over from your Sole Proprietorship to your LLC (as long as you’re the only LLC Member). You can also apply for a new EIN for your LLC and then cancel the other EIN after you file your final return.

2. Do you mean for filing as a Foreign LLC? I’m not sure what a “foreign agent” is. That term isn’t used. If regarding whether or not you need to file as a Foreign LLC in New York, it’s a bit of gray zone. Where do you reside and pay state taxes? Will you have any employees in NY? What kind of business activities will you be doing in NY?

Thank you for getting back to me!

Regarding #2, I meant filing as a foreign LLC in NYC. Since I toggle between NYC and CHI, I was not sure. I technically have residences in both states. My employees are virtual (I typically outsource to SE Asia).

Quick update, I did register my business in IL because a) it made sense financially and b) I want to be eligible for certain resources when I return. I may need to consult my accountant to get a better perspective on this. It’s just tough because there does not appear to be a clear cut answer when a business is essentially virtual (meaning I can work from anywhere).

You’re welcome Amber! You’re correct, “which state” for an online businesses can be a gray area. Basically, state law + tax code moves slow. Much slower than entrepreneurial innovation. You’re likely okay with just the Domestic Illinois LLC for now. If later there is a need, you can always register as a Foreign LLC when the time comes. Hope that helps.

Bro this site is so awesome. I’m forming a LLC for low and high voltage. I already had a ein number. Will I be able to use it when my LLC is approved? (My name is unique so I’ll be fine) And where do I look to get construction bids on low and high voltage jobs?

Thanks Raimont! Is the EIN for your Sole Proprietorship or another business entity? If another business entity, you’ll need to get a new EIN after your LLC is approved. If the EIN was for your Sole Proprietorship, you can transfer it to the LLC by writing a letter to the IRS. You can also just get a new EIN for your LLC too. We’re not sure about where to bid on jobs. Hope that helps.

Hi Matt,

Any information on setting up a Series LLC and what advantages/disadvantages that may have? I am in Illinois…and have a couple of different business ventures that I am balancing.

Hey Jeff, since there isn’t a ton of established case law and detailed tax information, at this time, we’re not getting into Series LLCs. Maybe in the near future. Thank you for your understanding. We recommend a few conversations with some tax attorneys in the state. Hope that helps.

Hi Matt. I am trying to open company in Illinois which will help other people who are willing to open their own LLC and they don’t know how to do that or simply don’t want to deal with applying for Articles, FED ID, Annual reports…

Any suggestion or advice what exactly do I need to open company like that? Any permits or how to start something like that?

Hey Dina, you would just form a regular LLC like you would for any business. You don’t need any permits or licenses to do that. Hope that helps and best wishes.

Hi Matt. I am a member of a not for profit corporation. French Marines of Fort de Chartres. We were told we should become a LLC to protect our personal assets in the event of a lawsuit.Would this be the llc5.5?

Hi Kim, yes, Form LLC-5.5 is the Illinois Articles of Organization, the document used to create the LLC. It can also be filed online. We have both filing instructions here: Illinois LLC Articles of Organization instructions. However, you may also want to speak to a few attorneys to determine the best asset protection strategy for the details of your situation. Hope that helps.

If there is an incorrect spelling on the approved LLC for is there a charge to correct it?

Hi Anthony, what part of the filing had a typo? Thanks.

The address instead of suite # it says Sterling

Hi Anthony, we recommend filing an Articles of Amendment in order to fix that correction. You can also try calling the state, since if it was their error, there is a chance they will correct it without you having to pay the Articles of Amendment filing fee. Hope that helps.

Hey Matt,

Very helpful site you’ve built. Thank you for that. I’ve looked in so many places and I can’t seem to find reliable, concrete information regarding a Series LLC.

Would it be possible to make a guide about setting up one of those in IL? I can’t imagine it being much different than a regular LLC (saw there are Series Articles of Organization on the state website), but how does ownership structure and control prongs work?

For example: If I own Umbrella LLC as the parent and I create subsequent ABC1 LLC, ABC2 LLC, ABC3 LLC, how does it affect the formation process? Furthermore, what if I bring someone else to run one of the subsidiaries? Could they own AND control it? Or would my Umbrella LLC need ownership?

Thank you in advance for the help!

Hey James, thank you! Although the formation may be similar to some extent, the taxes and established case law just aren’t there yet, so we’ll get bombarded with post-formation questions that frankly, will likely be beyond our scope. Also, I don’t feel we’ll provide a ton of value yet since we haven’t fully researched the topic. We don’t write about anything that isn’t fully researched and understood first. Additionally, we have a large list of content items that we need to address in front of this subject. Wish I had some place to refer/recommend, but at this time, I don’t. Thanks for your understanding.

Hello Matt, I am opening a kayak rental business and would like any feedback you may have. I’ve been told that I should fille an LLC for that type of business. Any help would be great thanks.

Hi Matthew, when compared to operating as a Sole Proprietor, forming an LLC will protect your personal assets from business liability. I recommend checking out our Learning Center as many of the articles there will help you understand the big picture. I’d start off with LLC vs Sole Proprietorship. Hope that helps and let us know if you have any specific questions.

Hi Matt! First I just want to commend you on this article!! I was researching and finding different sites that weren’t as helpful or useful so I’m very excited I came across this! I just had a quick question.. if I were to apply for my EIN before filing for an LLC would I have to reapply again? Thanks in advance!

Hey Jess! Thank you for the kind words. Glad you found us :) We just recommend obtaining your EIN after your LLC is approved in case your LLC name is rejected, then you’re left with an EIN attached to the wrong LLC. If you have any issues though, you can always cancel an EIN by mailing a letter to the IRS. Hope that helps.

Hi Matt.

Really useful information – thanks.

Do you have any thoughts on whether an LLC is the correct vehicle for an overseas company looking to hire an employee in Illinois?

As I understand it, we need a US corporate entity to handle payroll and comply with employment regs, but is an LLC the correct choice?

Hey Chris, to be honest, I’m not sure. I’d apply phone a few accountants. Hope that helps and best wishes.

Hi Matt, this is more of an IRS question than Illinois LLC. I’ve changed my business address and I know that I have to use form 8822b. However, I’m not sure if I should fill out the whole thing (sections 5-9) or only my actual business address change (section 7).

Please take a look here:

https://www.irs.gov/pub/irs-prior/f8822b–2014.pdf

Hi Christian, we have instructions here: how to change your LLC address with the IRS Form 8822-B. Hope that helps!

Hi. Thanks so much for your information. You make it easy to understand how to form a LLC.

I’m forming a single member LLC, I’m also the registered agent & organizer. Question: when I’m signing as ‘Organizer’, it asks to print my name & title. Do I put a title (i.e., ‘owner’)? Or just print my name alone?

Hi Marla, you’re very welcome! Thank you for the kind words :) For the ‘Name and Address of Organizer’ section, use your first and last name followed by a comma and the word “Organizer”. Example: John Doe, Organizer. Hope that helps!

Matt,

I’m working on forming an LLC and based on info that I got from other sources, doing this in DL, NV or WY seemed like a really good plan. You’re the only source that I found who suggested that this may not be such a good idea. You also provide sufficient info to enable me to form the LLC without your help. However, your web site is so full of info & guidance, it strikes me as really good idea to hire you as I’m concluding that your expertise will smooth out quite a few bumps in the road.

Hey John, thank you for the kind words. I’m glad you found our information helpful and didn’t form the LLC out of state, since I assume you’re doing business in Illinois. Although we used to, we are not currently offering filing services. We may in the near future though.

Hi Matt, myself and a partner need to form an LLC. We plan to get into real estate, we want to flip houses and or may do some wholesaling, but our may goal is to flip houses. I guess my first question is, should be be forming an LLC or as S-Corp or something else, what is the best thing to do fr our situation. We are in Cook County in the Chicago area, can you please advise. Thank you so much! John

Hey John, you can’t “form” an S-Corp at the state level. An S-Corp is simply a tax election status made with the IRS that “sits on top of” an existing entity, like an LLC or a Corporation. Most real estate investors form LLCs and then once their net income reaches a certain level, speak to an accountant about the pros and cons of having the LLC taxed as an S-Corporation. Hope that helps!

Hi Matt – great helpful site. Thanks!

Can the registered agent also be a member?

Hi Ned, you’re welcome! Let me answer in reverse first. The LLC’s Registered Agent can be one of the LLC Members (but they don’t have to be). If you’re talking about a Commercial Registered Agent, no, they wouldn’t be an LLC Member. We have more information here: Illinois LLC Registered Agent. Hope that helps.