Here are video instructions on how to get an EIN. There’s also written instructions below if you prefer.

Note: The video above shows an old interface for the IRS’s website, however, the steps are still the same.

How to complete the online EIN Application for an LLC

Hours: The EIN Online Application is only available Monday through Friday, from 7:00am to 10:00pm Eastern Time.

Cost: An EIN is $0 (free) from the IRS.

Note: The instructions below are only for people who have an SSN or ITIN.

If you are a Non-US Resident and don’t have an SSN or ITIN, you can still get an EIN for your LLC. But you’ll need to follow different instructions: How to get an EIN without an SSN or ITIN.

Get started:

Visit the IRS Online EIN Application:

IRS: Get an Employer Identification Number (EIN)

Click the blue “Apply for an EIN” button in the middle of the page.

Click “Begin Application Now“.

1. Legal Structure

In this section, you’ll tell the IRS:

- what type of legal structure will be attached to the EIN (this will be your LLC)

- how you would like the legal structure (your LLC) to be taxed

- why you’re applying for an EIN

Don't have an LLC yet? Hire Northwest to form your LLC for $39 + state fee (then add EIN to your order).

Have an LLC, but no EIN? Hire Northwest to get your EIN:

I have an SSN | I don't have an SSN

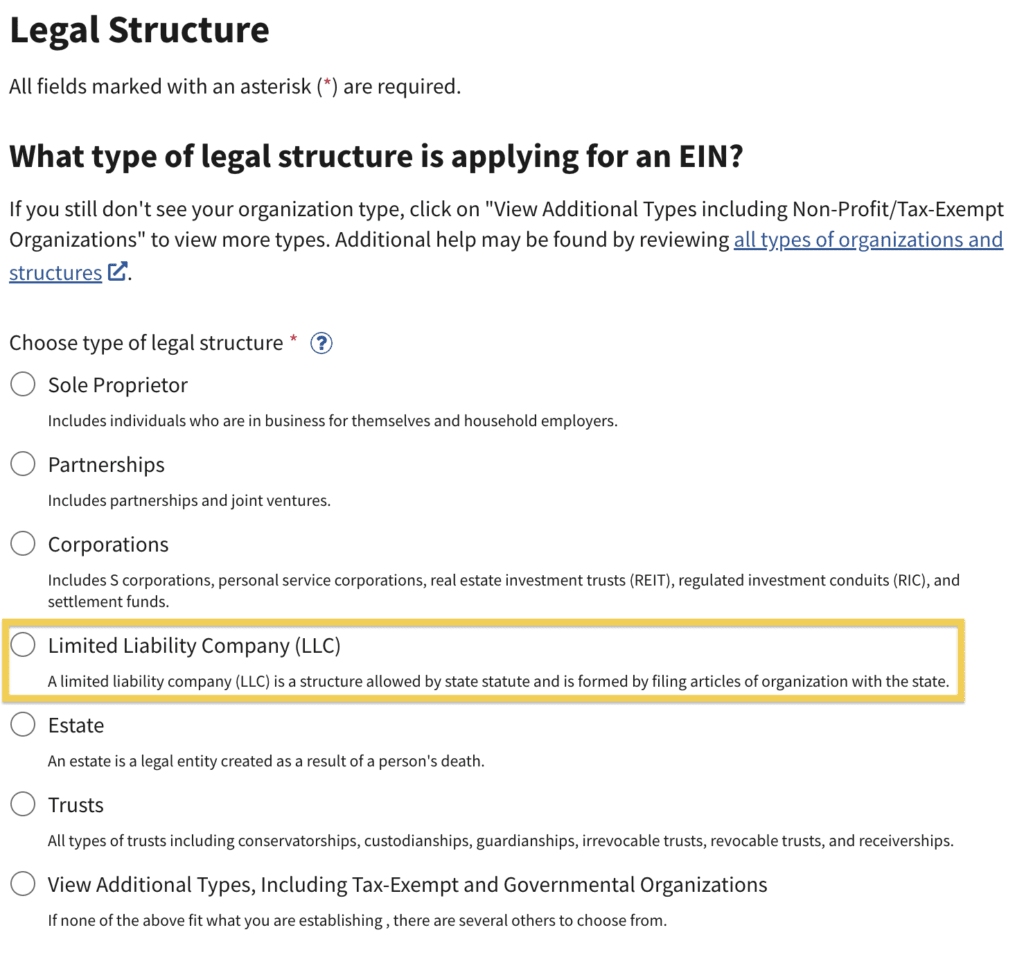

What type of legal structure is applying for an EIN?

Select “Limited Liability Company (LLC)“.

Note: You’ll see a blue “info box” appear discussing what an LLC is. There’s actually nothing to “confirm” here. It’s just information.

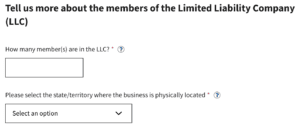

Tell us more about the members of the Limited Liability Company (LLC)

- Enter the total number of LLC Members.

- Then select the state where your LLC was formed.

Note: You’ll see another blue “info box” appear discussing tax classification. This can feel a little overwhelming to read. But don’t worry, we’ll break it down below. Also, there’s actually nothing to “confirm” here. It’s just information.

LLCs can be taxed by the IRS a few different ways.

There are default tax classifications (based on the number of LLC Members). And there are optional elective tax classifications.

Default – Single-Member LLC:

- By default, the IRS will treat your LLC as a Disregarded Entity, and tax your LLC like a Sole Proprietorship.

- Your LLC’s income will “pass through” to your personal tax return (Form 1040), and

- You’ll report the LLC income on your Form 1040 using a Schedule C, E, or F.

Pro Tip: How your LLC is taxed by the IRS has nothing to do with your LLC’s liability protection. Your personal assets will still be protected regardless of how your LLC is taxed, even if your LLC is treated as a Disregarded Entity.

Default – Multi-Member LLC:

- By default, the IRS will tax your LLC like a Partnership.

- This means you’ll need to file a 1065 Partnership Return and issue K-1s to each LLC Member.

- Then each Member’s profit (reported on the K-1) will “pass through” to their personal tax return (Form 1040).

Optional – Elective classifications:

Instead of their default tax classifications, LLCs (both Single-Member and Multi-Member) can request to be taxed like a Corporation. There are two types:

- LLC taxed as a C-Corporation

- LLC taxed as an S-Corporation

LLC taxed as a C-Corporation: This election is made by filing Form 8832. However, this isn’t a common election made by small business owners. There are a number of tax ramifications to be aware of.

LLC taxed as an S-Corporation: This election is made by filing Form 2553.

While this is more common than a C-Corporation election, we don’t recommend jumping into this right away. There’s a lot of misleading information online stating that “being taxed as an S-Corp is the best“.

We recommend considering this election once your LLC makes consistent profit, and generates $50k to $70k of net income per Member per year. At that point, it’s wise to speak to an accountant to see if it’s the right fit for your business. Otherwise, prematurely electing S-Corp status for your LLC can be stressful and lead to extra costs.

Note: If you choose to have your LLC taxed as a C-Corporation or S-Corporation, you’ll still need to complete the EIN Online Application first. And then afterwards file the appropriate form (8832 or 2553) with the IRS to request the desired election.

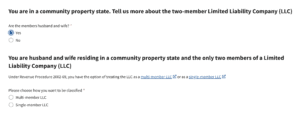

Husband & Wife LLCs in Community Property States (aka Qualified Joint Venture)

If a married couple forms an LLC in a community property state, the IRS will ask if you want your LLC to be taxed as a Multi-Member LLC or Single-Member LLC.

- If you choose Multi-Member LLC, your LLC will be taxed in its default status – like a Partnership.

- If you choose Single-Member LLC, your LLC will be taxed like a Sole Proprietorship (this is a special election called a Qualified Joint Venture).

What is a Qualified Joint Venture (QJV)?

It’s when 2 LLC Members (who are spouses and meet the requirements) choose to have their Multi-Member LLC treated as a Single-Member LLC.

And therefore, their Multi-Member LLC is taxed as a Sole Proprietorship (instead of a Partnership).

The benefits of a Qualified Joint Venture are:

- Simplified return: Instead of a separate 1065 Partnership Return and K-1s, taxes are reported on Form 1040 (with 2 Schedule Cs).

- Saving money on tax prep: Since a separate 1065 Partnership Return isn’t needed, this saves money on tax preparation (if you have an accountant).

- Social Security and Medicare: A QJV lets both spouses earn Social Security and Medicare credits (on their share of the business income), without increasing the total tax owed.

If you’re considering making this election, please read Qualified Joint Venture LLC to get the full picture.

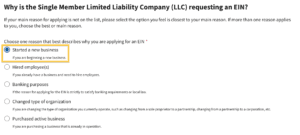

Why is the LLC requesting an EIN?

Select “Started a new business” and then click “Continue“.

Tip: Even if you’re forming an LLC for something other than running a business (ex: holding real estate, managing investments, etc.), you can still select “Started a new business.”

2. Identity (EIN Responsible Party)

Think of the EIN Responsible Party as the “contact person” for your LLC.

If needed, the IRS will mail notices (or questions) to this person.

When applying for an EIN online, the Responsible Party must have an SSN or ITIN.

Tip: If you’re a Non-US resident and don’t have an SSN or ITIN, you can still get an EIN for your LLC. You just need to follow a different set of instructions: How to get an EIN without an SSN.

Who should be the EIN Responsible Party for my LLC?

- If you have a Single-Member LLC: You will be the EIN Responsible Party.

- If you have a Multi-Member LLC: One of the LLC Members will be the EIN Responsible Party.

The IRS just wants one person as the EIN Responsible Party. They don’t want all the LLC Members’ information. (The IRS gets all the Members’ information when you file your 1065 Partnership return.)

What if my LLC is owned by another company? If your LLC is owned by another company, list an owner of the parent company. The IRS rules changed in 2018 and they no longer allow another company to be the EIN Responsible Party. Said another way, the EIN Responsible Party must be a person.

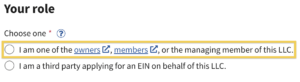

Your Role

Select “I am one of the owners, members, or the managing member of this LLC“.

Then click “Continue” to proceed.

ITIN Number:

- If you are entering your ITIN number, please note that there is a 30% chance you will receive an error message (called a reference number) at the end of the EIN Application.

- If you receive an error message at the end, don’t worry, you can still get an EIN for your LLC. You just need to mail or fax in Form SS-4 instead. You can find the instructions here: apply for EIN with Form SS-4.

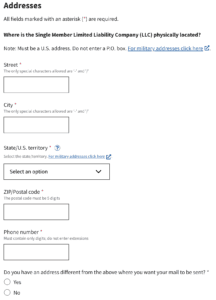

3. Addresses

In this section, you’ll give the IRS:

- your LLC’s physical address

- a phone number where the IRS can reach you

- a secondary mailing address (this is optional)

Where is the LLC physically located?

Enter your LLC’s physical address and your U.S. phone number.

A PO Box address isn’t allowed. You must enter a physical street address.

Most people use their home address.

You can also list an office address, mailbox rental address, or Registered Agent address. However, generally speaking, it’s usually best to just use your home address.

(Note: Unlike LLC filings with the state, your EIN information and address isn’t on public record.)

Pro Tip: The only special characters that are allowed in the address fields are a hyphen (-) and a forward slash (/). You can’t use the number sign (#), a comma, or a period.

For example: if your address is “123 Main Street, Apt. #3”, you’ll need to enter it as: “123 Main Street – Apt 3” or “123 Main Street Apt 3“.

Non-US residents: If you don’t live in the US, you can use a mailbox rental address or the address of your Registered Agent, such as Northwest Registered Agent.

Do you have an address different from the above where you want your mail to be sent?

If you want mail from the IRS to be sent to a different address than your physical address, select “Yes” and enter that address here.

The IRS will use this address as your mailing address instead of the LLC’s physical location.

Verify your Physical Location:

If a page appears asking you to verify your physical location, it just means the IRS is formatting your address to match the “standardized format” from the United States Postal Service.

You can click “Accept Database Version” and then click “Continue“.

4. Additional Details

Tell us about the Limited Liability Company (LLC).

In this section, you’ll tell the IRS:

- your LLC’s legal name

- where your LLC is physically located

- where you formed your LLC, and

- when your LLC was formed.

Legal name of LLC:

Enter the full name of your LLC, but don’t use any punctuation or special characters. The only special characters allowed are the hyphen (-) and ampersand symbol (&).

For any other special characters, you’ll need to spell them out or replace them.

For Example:

- ABC Widgets, LLC becomes ABC Widgets LLC

- Claire’s Closet LLC becomes Claires Closet LLC

- MySite.com LLC becomes MySite dot com LLC

- A+ Solutions LLC becomes A Plus Solutions LLC

- Jones @ the River LLC becomes Jones at the River LLC

- Me$ha Talent LLC becomes Mesha Talent LLC

- Black/White Records LLC becomes Black-White Records LLC

Keep in mind though, this doesn’t affect the legality of how your LLC is filed with the state. It’s simply the IRS “normalizing” their database records.

Trade Name/Doing Business As:

If your LLC has a DBA (aka Trade Name), enter it here.

If your LLC doesn’t have a DBA (aka Trade Name), leave this blank.

Note: A DBA or Trade Name isn’t required for an LLC. An LLC can just operate under its true and legal name. For more information, please see Do I need a DBA for my LLC?

County where LLC is located:

A lot of people read this too fast and think it says “country” (like the USA). It doesn’t. It says county (with no “r”).

Enter the county where your LLC is located. If you’re not sure which county your address is in, you can use this tool.

Note: If your address doesn’t have a county, enter the parrish, borough, independent city, or county equivalent.

State/Territory where the LLC is located:

Enter the state where your LLC was formed.

State/Territory where Articles of Organization are (or will be) filed:

Enter the state where your Articles of Organization was filed. For most people this will be the same state as where the LLC is located.

Note: In some states, the Articles of Organization is called the Certificate of Organization or Certificate of Formation. But they all mean the same thing.

LLC start date:

Enter the month and year your LLC was approved.

Note: The month doesn’t have to be exactly precise. It’s okay if it’s a couple months in the past, or a couple months in the future.

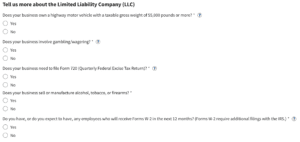

Tells us more about the LLC:

Read the following questions and select either “Yes” or “No“, then click “Continue“.

(For most people the answer will be “No”.)

- Does your business own a highway motor vehicle with a taxable gross weight of 55,000 pounds or more?

- Does your business involve gambling or wagering?

- Does your business need to file Form 720 (Quarterly Federal Excise Tax Return)?

- Does your business sell or manufacture alcohol, tobacco, or firearms?

- Do you have, or do you expect to have, any employees who will receive Forms W-2 in the next 12 months?

Note: If you’re not sure if you’ll have employees, you can select “No“. This won’t impact your ability to hire any employees in the future.

What does your business or organization do?

Select your LLC’s primary business purpose from the list of given choices.

If it doesn’t fall under any of the choices provided, you can select “Other” and then specify your LLC’s business purpose.

Once you’re done, click “Continue“.

Pro Tip:

- This choice won’t impact your income taxes. For example, if you switch from a bakery to an online business (or vice versa).

- Your selection isn’t “set in stone”. You can change your business purpose at any time.

- And there’s no need to file any paperwork to make this change.

- This is America, baby! 🇺🇸

- You can change your LLC purpose as often as you’d like 💪

- If your LLC will engage in multiple business activities, just choose or enter one of them.

5. Review & Submit

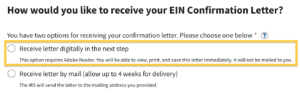

In this section, you’ll decide how to receive your EIN Confirmation Letter. And you’ll review everything before submitting it to the IRS.

How would you like to receive your EIN Confirmation Letter?

We recommend selecting “Receive letter digitally in the next step” as this is the fastest way to receive your EIN Confirmation Letter (PDF).

You’ll be able to download your PDF file right after you submit your application.

Summary of your information

Review the information you entered carefully. Look for any spelling issues or typos. If you need to fix anything, click the “Back” button.

Once everything looks good, click “Submit EIN Request” to submit your filing to the IRS.

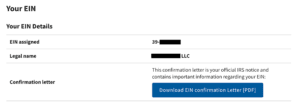

Congratulations, the EIN for your LLC has been successfully assigned!

You’ll see a message confirming that an EIN has been successfully assigned to your LLC.

★ Important (make sure to download your EIN Confirmation Letter):

Click the blue download link to save and print a PDF copy of your EIN Confirmation Letter.

(Take a screenshot too as a backup!)

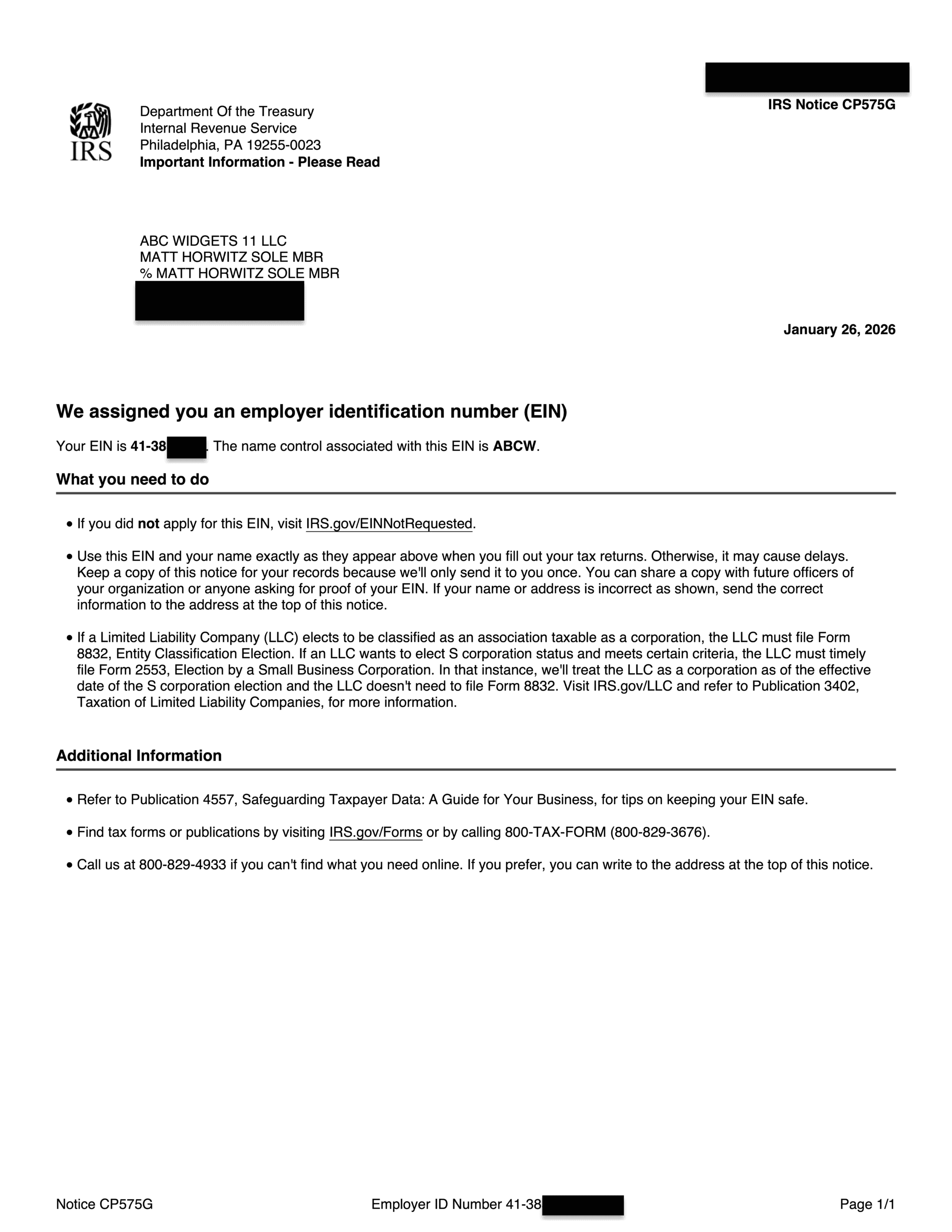

EIN Confirmation Letter (CP-575G):

The PDF you just saved is called your EIN Confirmation Letter (CP 575G).

Again, make sure you download and save a few copies of this form (before closing your browser tab).

The EIN Confirmation Letter will be 2 pages.

It looks like this:

What happens if I lose my EIN Confirmation Letter?

If you misplace the EIN Confirmation Letter, you can always call the IRS (1-800-829-4933) and request another letter. The IRS won’t be able to issue another CP 575G, but that’s okay.

Instead, they’ll issue an EIN Verification Letter (147C).

LLC Business Bank Account

Once you get an EIN for your LLC, you’ll then be able to open an LLC business bank account.

You’ll need the following items in order to open an LLC bank account:

- EIN Confirmation Letter (CP 575G) or EIN Verification Letter (147C)

- LLC approval docs (Articles of Organization, Certificate of Organization, or Certificate of Formation)

- LLC Operating Agreement

- Your Driver’s License and/or Passport

IRS Phone Number & Contact Information

If you have any questions while going through the online EIN Application (or you receive any EIN reference numbers), you can call the IRS at 1-800-829-4933.

The IRS hours are Monday through Friday between 7am and 7pm (local time). The earlier you call, the shorter the wait times.

Frequently Asked Questions

What happens if I get an EIN Reference Number/Error Message?

If you get an IRS error message (called an “EIN reference number”), please see this page to learn how to fix it: EIN Reference Numbers 101 to 115 (and How to Fix Them)

How to apply for an EIN using Form SS-4?

If you need to file Form SS-4 instead of the online application, you’ll find those instructions here: How to apply for EIN with Form SS-4.

How to get an EIN without an SSN

If you’re a Non-US Resident (and you don’t have an SSN or ITIN), you can still get an EIN for your LLC.

You can follow our instructions here: How to get an EIN without an SSN.

Can I change the EIN Responsible Party for my LLC?

Yes, you can change the EIN Responsible Party for your LLC.

Please see this page: Change EIN Responsible Party for LLC.

How do I change the address on my EIN?

If you need to change the address for your EIN Number, we have instructions here: Change LLC address with the IRS.

References

IRS: About Form SS-4

IRS: About Name Control

IRS: When to Get a New EIN

IRS: Understanding Your EIN

IRS: Instructions for Form SS-4

IRS: Form SS-4 (EIN Application)

IRS: What is a Responsible Party?

IRS: Employer Identification Number FAQs

IRS: Limited Liability Company Information

IRS: LLC Filing as Corporation or Filing as Partnership

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hi!

Your info has been super helpful, but I just wanted to alert you and others that it’s still possible to run into issues. I just created a new LLC with Northwest, official 2/12/26. I tried to get an EIN today (2/19/26) online and when I submitted the form I got an instant error message telling me that I would have to apply by fax or mail. No reason provided. I called the IRS to try to get more information and was told that this “just happens to some people for many different reasons”. Not super helpful. I’m guessing that it might be because the online application asks for the month and year that the LLC was started, so perhaps my request was booted because I applied in the same month? I reviewed every field and even printed it out. I really have no idea, but am now going to have to fax the application. I’m planning to send a copy of the articles of organization with it for good measure, but in hind sight I’m regretting not just paying Northwest the $50 to do this for me as it’s turning out to be a bit of a pain.

Hi Matt,

I applied for an EIN online on 1/23/26, and downloaded the “EIN Confirmation Letter” once completed. However, the letter looks completely different than the example you have above, and I can’t find anything about a change to the letter’s format anywhere on the IRS website or online elsewhere, other than a reddit post from December 2025 (1 month ago) where other people were having the same issue as me. They said the IRS EIN website went down for 1 day, and the day after, the confirmation letter had changed format. The form I downloaded does say “IRS Notice CP575G” and has a barcode, my EIN number, my address, LLC name, etc. Do you know anything about this change? My bank won’t accept the document because it doesn’t look like the old EIN letter, but I do think this is the new digital CP575 and I don’t know how to prove that.

For reference, this is the post I saw:

https://www.reddit.com/r/paralegal/comments/1pu1h0j/did_the_irs_recently_change_their_online_ein/

Also thank you so much for all of your advice on this website! It has been very helpful.

Hi Bonnie, thank you for the kind words. You’re very welcome :) And no, this is the first time we’ve heard of this. I actually just sent you an email to look into this, if you’re able to share the form. Thank you.

Hi Matt,

I’m a bit confused. I’m a foreign resident, but I applied for an ITIN through the CAA. If I register a Wyoming LLC now, can I apply for an EIN online? I noticed that the online EIN application requires a US phone number, which I don’t have.THANKS!

Hi Adams, after your Wyoming LLC is approved, then yes, you can apply for the EIN online using your ITIN. About the phone number (if using the online application), maybe there’s a friend’s number you can use. You could also buy a US phone number. I’ll add that the phone number isn’t super important and the IRS doesn’t usually call people. Hope that helps.

Hi Matt,

Your website and explanations have helped me a lot in understanding the concepts, so thank you for putting all of that together.

I have a couple of questions about completing Form SS-4 and was hoping you could clarify how you handle these situations in practice:

1. For a single-member LLC owned by an individual and taxed in the default way (disregarded entity / sole proprietorship), how should Line 9a be completed?

Should the owner check “Sole proprietor (SSN)”,

or check “Other (specify)” and write “Disregarded entity – sole proprietorship”, following the SS-4 instructions?

2. For a married couple in a community property state that formed an LLC and chose to have it treated as a single-member LLC / Qualified Joint Venture, what do you recommend for Line 9a?

Would you use “Other (specify): Disregarded entity – husband & wife (qualified joint venture)”, or Disregarded entity – sole proprietorship?

3. For a single-member LLC owned by another business entity (for example, a corporation or another LLC) that is treated as a disregarded entity, is it correct to use “Other (specify): Disregarded entity” on Line 9a?

I really appreciate any guidance you’re able to share.

Hi David, you’re very welcome!

1. Other (specify): “Disregarded entity – Sole Proprietorship”

2. Other (specify): “Disregarded entity – Sole Proprietorship”

3. Correct. If the parent company is taxed as a Disregarded Entity, then Other (specify): “Disregarded entity”.

I utilized Northwest to create an Ohio LLC. The mailing address and principal address are that of the registered agent as I assume that is the best practice if I want to shield my home address.

I would like to file for an EIN on my own. Do I utilize the addresses used in the creation of my LLC by Northwest (which is their address), or do I give my home address?

And if you don’t mind, is it problematic to have the mailing and principal address of my LLC that of Northwest (i.e. do you recommend that be changed)?

Thank you, and thanks for this resource.

Hi Feek, to clarify, there is just one address on the Ohio Articles of Organization (the Registered Agent address). There is no principal address or mailing address on the Ohio Articles of Organization.

(I know it’s probably confusing since you may have seen those fields when you checked out at Northwest. But they collect the info that way to “normalize” their checkout flow across the states.)

So yes, it’s totally fine that you use the Northwest address on your Ohio Articles of Organization.

For the EIN application, at the end you’ll get an EIN Confirmation Letter (CP 575). This will have an address on it. This letter is not on public record. I would personally just use your home address for this.

Hope that helps. Let me know if you have any follow up questions.

Hello, I have completed all the steps leading up to here (Certificate of Formation etc..) I have everything done for the state of Alabama while currently living in CA. I will not have a physical Alabama address until January.

So when applying for my EIN, is this where I would use my Registered Agent address and then put my CA address for mailing? I am staying there very temporarily, it is not my dwelling.

Hi Christina, are you a resident of California? Where do you reside, and why the Alabama LLC? Typically, you wouldn’t use the Registered Agent address on the EIN application (although, it’s possible). Do you have a good long-term home address at this time?

Hello,

No, I do not have an address. I am just staying with family in CA until the first of the year but plan on working my business remote for the next few months to build up the income to get back to AL until then.

My Drivers License will remain AL while I’m out here but it has my X’s address and I’m not comfortable using that.

I may able to use my daughter’s address in AL, but I won’t actually be living there and would not match my drivers license……..: (

Thanks for the details Christina. Totally understand, and all makes sense. In this case, I’d actually call the bank where you want to open an LLC bank account and see if they want any “address matching” to occur. Some banks are more flexible (ex: Wells Fargo), however, other banks may be more strict (ex: they want the address on your EIN Confirmation Letter to match a residential address). If the bank doesn’t care, then you could use whichever address is more reliable for you on your EIN application (ex: your CA address, your Registered Agent address, or family member’s address in Alabama). I’d use whichever is the most reliable to get mail and the most “long term” address. Hope that helps.

Hi, as my LLC is owned by another company, where do I reflect the owner in the application? Or is this not needed anymore? Thanks!

Hi Kyle, you actually can’t do that in the EIN Application. Instead, this would just be documented in the LLC Operating Agreement. And in the Articles of Organization, if applicable (aka if required in the state where the LLC was formed). Hope that helps.

Got it! Ownership is only reflected in the Internal documents (Articles + Operating Agreement). Thank you for this!

You’re welcome Kyle. To clarify, just the Operating Agreement is an internal document (meaning, it’s private). On the other hand, the Articles of Organization isn’t an internal document (it’s on public records).

👍

If I already had an EIN number before creating my LLC can I just add the old EIN number or I have to apply for another one !?

Hi Anderson, you should get a new EIN Number for your new LLC (and not use the old one).

Thank you !

Hi Matt,

I’m starting an Airbnb business, which category should I fill with IRS? Rental/ Leasing or Real Estate? Thank you!

Hi R, the category you use with the IRS isn’t super important (and you’re not forced to do it). I would just use Real Estate as it’s the most generic.