Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

As of July 1, 2023, this program is now over.

You can no longer get a free California LLC.

LLCs in California are now their regular price at $70.

To learn more about filing fees and costs, see California LLC costs.

Note: The information below is no longer applicable. Consider it historical reference.

California’s Budget Act of 2022 Waives the Filing Fee for LLCs

Forming a California LLC is free until July 1, 2023!

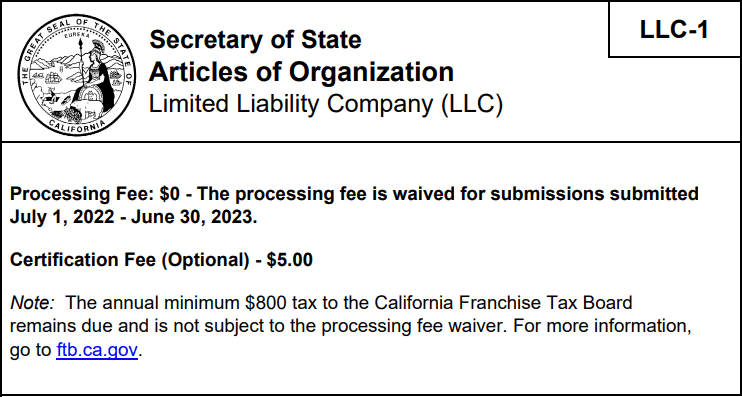

California passed a new Budget Act (Senate Bill 154) that waives the registration fees for California LLCs formed between July 1st, 2022 and June 30, 2023.

That means instead of $70 to form a California LLC, you can start an LLC for free in California!

If I already formed an LLC, can I get my money back?

No, unfortunately not. If you already formed a California LLC, there is no refund. Senate Bill 154 only affects newly formed LLCs in California.

Is a Certified Copy of my Articles of Organization free?

To start an LLC in California, you’ll file a form called the California Articles of Organization. Once the Articles of Organization is approved by the state, your LLC officially goes into existence.

If you’d like a Certified Copy of your approved Articles of Organization, this will cost $5.

Senate Bill 154 didn’t waive this $5 fee. It only waived the $70 fee to file the Articles of Organization. Said another way, you’ll still have to pay $5 for a Certified Copy of your Articles of Organization. We recommend obtaining this document when forming an LLC in California.

What other fees are there to form an LLC?

After your California LLC is formed, there are some other fees to be aware of.

Within 90 days of your LLC being approved, you’ll need to file an initial California Statement of Information. Then every 2 years, you’ll need to file a Statement of Information for the life of your LLC.

Then there is the California Annual Franchise Tax. This is $800 and is due every year by April 15th.

The two fees above were not changed via Senate Bill 154. They are still $20 for the Statement of Information and $800 per year for the Annual Franchise Tax.

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

According to the FTB.

“Exceptions to the first year annual tax

For tax years beginning on or after January 1, 2021, and before January 1, 2024, LLCs that organize, register, or file with the Secretary of State to do business in California are not subject to the annual tax of $800 for their first tax year.”

I don’t see this mentioned.

Hello, we have this covered here: California LLCs don’t pay $800 Franchise Tax (for 1st year)

I’m looking to start a business in TN. What steps do I need to take to obtain an LLC in my state?

Hey Sabrina, we have that information here: Start a Tennessee LLC.

Im a Ca resident that signed up for sole-pr LLC in Nevada recently. I read your article about that topic. I am an online business. So is there a way for me to close my Nevada LLC and just do CA LLC or I’m stuck with Nevada LLC forever? From the article it seems like I have to sign up for Ca LLC since I’m located in CA.

Does that mean from now on I have to pay for both Nevada LLC AND foreign CA LLC? How do I avoid that?

Hi Anna, no, you’re not stuck with a Nevada LLC forever. You can close it by filing a Dissolution and then forming a California LLC. This will be cheaper in the long run. Otherwise, you’ll need to register your Nevada LLC as a Foreign LLC in California and maintain 2 LLC filings.

If you close your Nevada LLC and form a California LLC, you will only pay fees in California. If you’d like help filing the dissolution, you can hire MyCompanyWorks or ClickDissolve Hope that helps.

Hi Matt I was charged 300$ for someone to build my llc and charged for a credit advisor who will establish my pay dex. I don’t know if I made a right choice.

Hi Blanca, we don’t do a lot of work with Paydex scores, so can’t comment on that, however, it sounds like you’re not that happy with the service?

Hey Matt,

Is the $800 franchise fee still being waived for the first year of a CA LLC’s formation? I thought it was being waived up until the end of 2023.

Thanks!

Hi Alan, yes, the $800 franchise tax is still being waived the 1st year because of Assembly Bill 85. Assembly Bill 85 will apply to any California LLC approved between 1/1/2021 and 12/23/2023. Hope that helps!

How much is the annual fee for an LLC in the state of California? Given now that it’s free until June 2023

Hi Derrick, all LLCs need to file a California LLC Statement of Information. This is $20. It’s first due 90 after the LLC is formed. And then due every two years.

You’ll also need to pay the $800 annual California LLC tax (Form 3522). And if your LLC will make more than $250k, you’ll also need to file Form 3536 (Estimated Fee for LLCs). Additionally, all LLCs need to file Form 568 (LLC Return of Income) to report their income and loss every year.

The Statement of Information is filed with the Secretary of State. However, Form 3522, Form 3536, and Form 568 are filed with the Franchise Tax Board. For those filings in particular, we recommend hiring an accountant. Hope that helps.

if i got a llc in ny would i be able to form another one in a different state?.

Hi Akada, what kind of business activities will this LLC be used for? And are you a California resident?

Hello, I have a New Mexico LLC. I would like to form a California LLC using the NM LLC as holding company. Will the CA LLC be a foreign LLC? Can I keep my name off of the CA SOS website?

Thank you,

JT

Hi Jack, no; if you form a regular LLC in California (owned by a New Mexico LLC), it’s a domestic California LLC. A foreign LLC registration would use a different form.

You can keep your name off the CA SOS website if you hire someone to file your California Articles of Organization and your California Statement of Information. You’ll also need to hire a Registered Agent Service (as opposed to listing yourself). Both of the forms below can be filed online, but I’m linking the forms so you can review all the fields more easily.

California Articles of Organization (Form LLC-1) – You’ll need to hire a Registered Agent Service for #3. You can list the LLC as being Manager-managed for #4. And you’ll want an LLC filing company, or someone else, to sign as the LLC Organizer and to enter their information on the Cover Sheet.

California Statement of Information (Form LLC-12) – You can list the New Mexico LLC as the Manager in #5. Leave #8 blank. Have an LLC filing company sign the form and enter their information on the Cover Sheet.