Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Starting an Ohio LLC costs $99. And it takes 1 day to get an LLC in Ohio.

There are 5 steps to start a Limited Liability Company in Ohio:

There are 5 steps to start a Limited Liability Company in Ohio:

- Choose an LLC Name

- Select a Statutory Agent

- File Articles of Organization

- Create an Operating Agreement

- Get an EIN (Federal Tax Identification Number)

If you want to form your Ohio LLC yourself, follow our free guide below.

If you want someone to take care of it for you, we recommend hiring Northwest Registered Agent.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(We recommend Northwest. We've reviewed all the top companies in the industry. And Northwest is our #1 pick for prices, customer support, and address privacy. Check out Northwest vs LegalZoom to learn more.)

How much does it cost to start an LLC in Ohio?

It costs $99 to start an LLC in Ohio. This is the fee to file the Articles of Organization – the document that creates an LLC.

To learn more about LLC Costs, see LLC Costs in Ohio.

How long does it take to get an LLC in Ohio?

If you file your LLC by mail, it will be approved in 1 business day (plus mail time).

But if you file online, your LLC will be approved in 1 business day.

Please see How long does it take to get an LLC in Ohio to check for any delays.

Here are the steps to forming an LLC in Ohio

1. Search your LLC Name

Search your Ohio LLC Name to make sure it’s available in the state.

Search your Ohio LLC Name to make sure it’s available in the state.

You need to do this because two businesses in the state can’t have the same name.

First, make sure the business name you want is unique from existing businesses using the Ohio Business Search tool from the Ohio Secretary of State.

Second, familiarize yourself with the naming rules in Ohio (so your Ohio LLC gets approved).

We’ll explain both in more detail here: Ohio LLC Name.

2. Choose an Ohio LLC Statutory Agent

The next step is to choose an Ohio Statutory Agent (also called a Registered Agent).

The next step is to choose an Ohio Statutory Agent (also called a Registered Agent).

An Ohio Registered Agent is a person or company who accepts legal mail and state notices on behalf of your LLC in Ohio.

Who can be a Registered Agent for an LLC in Ohio?

You have 3 options for who can be your LLC’s Registered Agent:

- You

- A friend or family member

- A Registered Agent Service

Ohio law requires that all LLC Registered Agents have an address in Ohio. This can be a physical address or a PO Box address in Ohio.

The Statutory Agent must be available at this address during normal business hours to accept legal documents.

And the Registered Agent’s name and address will be listed on public records.

If you don’t have an address in Ohio, or you want more privacy, you can hire a Registered Agent Service for your LLC.

We recommend Northwest Registered Agent

Our favorite feature about Northwest is they’ll let you use their business address throughout your LLC filing. This way, you can keep your address off public records.

They’ll also scan any mail sent to your LLC and upload it to your online account.

Northwest has excellent customer service, and they’re who we trust to be our own Statutory Agent.

Special offer: Hire Northwest to form your LLC ($39 + state fee), and you'll get a free year of Registered Agent service.

(Why is Northwest the best? Read our Northwest Registered Agent review)

3. File Ohio LLC Articles of Organization

To start an LLC, you need to file the Ohio Articles of Organization with the Ohio Secretary of State.

To start an LLC, you need to file the Ohio Articles of Organization with the Ohio Secretary of State.

Filing the Ohio Articles of Organization costs $99 if you file online. This is a one-time fee to create your LLC.

If you want to file this yourself, see our step-by-step guide: Ohio Articles of Organization.

Or, you can hire a company to do it for you.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

4. Create an LLC Operating Agreement

Simply put, an Ohio LLC Operating Agreement serves as a “companion” document to the Articles of Organization.

Simply put, an Ohio LLC Operating Agreement serves as a “companion” document to the Articles of Organization.

The Articles of Organization creates your LLC, and the Operating Agreement shows who owns the Limited Liability Company.

An LLC Operating Agreement is an “internal document“. Meaning, you don’t need to file it with any government agency (like the Ohio Secretary of State or the IRS). Just keep a copy with your business records.

Some banks require LLC owners to provide their LLC Operating Agreements in order to open an LLC business bank account.

Having an Operating Agreement will also be very helpful if you ever end up in court. Reason being, it helps prove that your LLC is being run properly.

That’s why we recommend that all LLCs have an Operating Agreement – including Single-Member LLCs.

You can download our free template below.

Then, learn how to fill it out by watching our step-by-step Ohio Operating Agreement video.

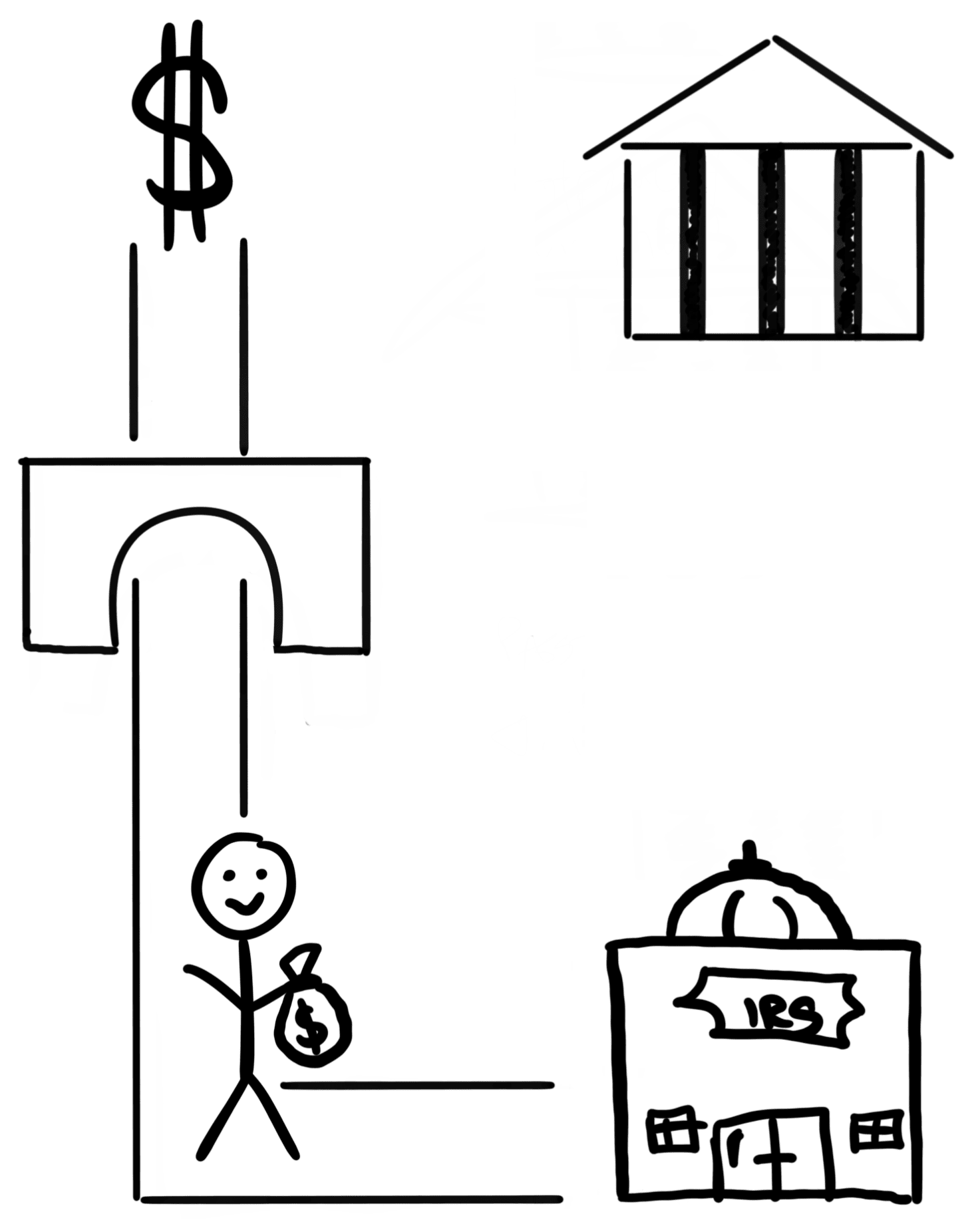

5. Get an EIN for your LLC

The next step is to get an Ohio EIN Number from the IRS for your Limited Liability Company.

Note: An EIN Number is also called a Federal Tax ID Number or Federal Employer Identification Number.

An Employer Identification Number is used to:

An Employer Identification Number is used to:

- identify your LLC for tax purposes

- open a business bank account

- apply for an Ohio business license and/or permit

How much does an EIN cost for an LLC in Ohio?

Getting an EIN Number from the Internal Revenue Service is completely free.

How long does it take to get an EIN?

If you apply online, it takes 15 minutes to get an EIN from the Internal Revenue Service.

If you apply by mail or fax, it can take 1-3 months.

How can I get an EIN for a Limited Liability Company?

US Citizens/US Residents: If you have an SSN or ITIN, you can apply for an EIN online. Follow these instructions: Apply for an EIN online.

Non-US Residents: You can’t get an EIN online, but you can still get one by fax or by mail. Follow these instructions: How to get an EIN without an SSN or ITIN.

What do I do after my Ohio LLC is approved?

After the Ohio Secretary of State LLC is approved, there are some additional steps.

Open an LLC bank account

You’ll want to open a business bank account for your LLC.

This makes accounting and record-keeping much easier for your business finances.

Having a separate business bank account also maintains your personal liability protection. This is because it keeps your business entity finances separate from your personal finances.

Get Ohio business licenses and permits

Good news, Ohio doesn’t have a state general business license.

Good news, Ohio doesn’t have a state general business license.

However, depending on where your LLC is located, you may need local Ohio business licenses or permits.

For example, if you want to start a daycare, you may need business licenses from the city and/or county.

You can learn more on our Ohio Business License page.

File and pay taxes

LLCs don’t pay income tax on the business income. Instead, the LLC Members pay the taxes for the LLC.

Said another way, each Ohio business owner pays taxes for the LLC business profits as a part of their personal tax return.

How will my Limited Liability Company be taxed?

By default, an Ohio LLC is taxed by the IRS based on the number of owners your LLC has:

- A Single-Member LLC is taxed like a Sole Proprietorship.

- A Multi-Member LLC is taxed like a Partnership.

Alternatively, you can ask the IRS to tax your LLC like a C-Corporation or S-Corporation.

Besides federal income tax, there are also state and local income taxes – and sales tax. And if you hire employees, you’ll also need to register for payroll taxes. Learn more in Ohio LLC Taxes.

Pay the Ohio Commercial Activity Tax

Most businesses in Ohio must also file and pay the Ohio Commercial Activity Tax (CAT).

What is the Ohio CAT?

The Ohio CAT is an annual privilege tax. Meaning, it’s a tax on businesses for the privilege of doing business in the state of Ohio.

The amount you owe for Commercial Activity Tax is based on your Ohio LLC’s taxable gross receipts made in Ohio in the previous calendar year. And this payment is the Annual Minimum Tax.

You can find out more about what the Ohio Department of Taxation considers to be taxable services and goods, and how to know if your gross receipts are taxable in Ohio here: Ohio Commercial Activity Tax: General Information.

How much will I owe for Commercial Activity Tax?

The amount that you owe is called the Annual Minimum Tax, and will vary based on your income range.

- If your LLC makes more than $150,000 per year in taxable gross receipts, you must file the CAT and pay an Annual Minimum Tax.

- If your LLC makes less than $150,000 per year in taxable gross receipts, you don’t have to file the CAT or pay an Annual Minimum Tax.

What is the Annual Minimum Tax (AMT)?

The Annual Minimum Tax is the minimum amount your LLC will need to pay for that year’s Commercial Activity Tax.

It is also based on the previous calendar year’s taxable gross receipts.

Said another way, the AMT is the minimum amount you’ll pay for that year’s Commercial Activity Tax.

The Annual Minimum Tax:

- costs $150

- is due by May 10th of the current tax year

- is paid with your annual return every year

How much is the Annual Minimum Tax for an LLC in Ohio?

The amount of Annual Minimum Tax your Ohio LLC will owe varies based on how much money your LLC made the previous year:

- If your LLC makes less than $150,000 per year in taxable gross receipts, you don’t have to pay the Annual Minimum Tax or file the CAT.

- If your LLC makes more than $150,000 per year in taxable gross receipts, you’re required to file the CAT and pay an Annual Minimum Tax once per year on your annual return.

When are the CAT and AMT due?

How often you’ll file your CAT return varies depending on last year’s taxable gross receipts:

Most businesses will need to file a CAT return once every year on your annual return.

That said, if your LLC’s taxable gross receipts were over $1 million per year, you’re required to file a CAT Return every quarter (instead of once per year on your annual return).

And your Annual Minimum Tax will be $800 or more.

You can read more about the CAT and Annual Minimum Tax fees here: Ohio Commercial Activity Tax: General Information.

And you can register for Commercial Activity Tax online with the Ohio Department of Taxation using the Ohio Business Gateway.

How to Start an LLC in Ohio FAQs

Can I start an LLC online in Ohio?

Yes, you can file your LLC online in Ohio. The Articles of Organization filing fee is $99.

When you start your LLC online, it will be approved in 1 business day.

What are the benefits of an LLC?

The first benefit of an LLC is personal asset protection. Meaning, if your business is sued, your personal assets – like your home, cars, and bank accounts – are protected.

This protection applies to all Ohio LLC owners (called LLC Members). It doesn’t matter if you have a Single-Member LLC or Multi-Member LLC. All of the LLC owners are protected from the business debts and liabilities.

This type of protection wouldn’t apply if you operated as a Sole Proprietorship or Partnership. With these types of informal business structures, the owners aren’t protected in the event of a lawsuit. For that reason, Limited Liability Companies (LLCs) are a much more popular business structure.

Another benefit is LLC pass-through taxation. This means the LLC itself doesn’t pay federal income taxes. Instead, the profits “pass through” to the LLC Members. And the Members pay the taxes on their personal tax return.

Another benefit is LLC pass-through taxation. This means the LLC itself doesn’t pay federal income taxes. Instead, the profits “pass through” to the LLC Members. And the Members pay the taxes on their personal tax return.

And Ohio state income taxes are very similar, since the Ohio Department of Taxation honors the federal tax treatment of your LLC. Meaning, Ohio LLCs are taxed the same way at the state level.

To learn more, please see How are LLCs taxed.

Is Ohio a good state to start an LLC?

Whether Ohio is a good state to start an LLC depends on where you live – and where you’re doing business.

Meaning, if you live in or do business in Ohio, then you should form your business entity in Ohio. While many websites talk about tax rates and advantages of certain states, none of that applies if it’s not the state where you live and do business.

For example, if you form an LLC in Delaware, but live in and conduct business in Ohio, you’ll also need to register your Delaware LLC in Ohio (and pay extra fees). And you’ll end up paying Ohio taxes anyway. This ends up leading to more costs and more headaches with no advantages.

In summary, if you live in and conduct business in Ohio, then yes, Ohio is a good state to start a business. If you aren’t an Ohio resident or business owner, Ohio isn’t a good state to start a business.

Real estate exception: If you’re purchasing real estate outside of Ohio, you should form your LLC in the state where the property is located.

For more information, please see Best State to Form an LLC.

Do I need to file an Ohio LLC Annual Report?

Ohio LLCs don’t have to file an Annual Report or pay an annual fee.

Ohio LLCs don’t have to file an Annual Report or pay an annual fee.

Although most states do have annual reports and fees, Ohio is one of the few states that doesn’t require LLCs to file an Annual Report or pay an annual fee.

For more information, see: Ohio LLC Annual Report.

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Thanks, Matt, for providing all of this helpful guidance for forming an LLC. I also used the link for the reduced first-year cost for Northwest Registered Agent Service for the LLC filing. I will apply for the EIN and put together an operating agreement myself using the template you provided. Many thanks!

Hey Paul, you’re very welcome! Sounds like a great course of action you took :)

Hi Matt,

My son and I starting an LLC in Ohio and he is under 18. I’m having a hard time finding an answer regarding what % of ownership of the LLC he can own as stated in the membership certificate. Can have have 0% or does it need to be at least 1%. Or can it be 50%/50%. If he does own any percentage does that mean he will need to file a personal income tax? He has never done so before and the business itself is slated to bring in less than $8,000 for the year. Thank you. This site was very helpful and easy to navigate!

Hi Tracy, there is nothing in the Ohio LLC Act that would prevent your son from owning an Ohio LLC. So the LLC ownership (called LLC Membership Interests) can be split any way you’d like. As far as how taxes would be handled, you’ll want to speak with an accountant about that. Thank you! You’re very welcome.

Can a LLC do trade at MT5 platform through any broker? And does it need any licence or permission from state or federal authority?

Hi Malik, most brokerages allow you to open an account in the name of your LLC. You’ll just need to look into the details with your brokerage (or brokerages) of choice. I’m not an active trader, but as far as I understand, MT5 is just trading software. And I’m quite sure you don’t need a federal or state license to trade and invest.

Hello Matt,

This is my first visit to you website, what a wonderful resource you have built here!

My question is; I filed the articles of organization for my LLC in 2020 and the lawyer listed my PO box number AND home address as the statutory agent location.

Now, with just a basic web search, anyone can find my name, my home address and my LLC name on numerous sites such as bizapedia or opencorprates – this is not good at all. Personal anonymity is extremely important to me.

Will a change of statutory agent and address (to a p.o. box) be enough to undue what’s been done here? Or will there be a public record of previous statutory agent information? Do I need to contact each of these privately owned sites and hope they are willing to make a correction?

If I am required to list a physical business address for banking, tax registration or license purposes, but my statutory agent is a p.o. box; What should I do?

Alternatively, If I were to use my accountant as a statutory agent; should I then use their physical address as my own when providing info for banking, legal documents, state license or credit card applications, ect?

I apologize for the length of my inquiry. I look forward to your response!

Hi Dan, thanks so much! Check out a service called OneRep. They can take care of a lot of record removal.

However, like you assumed, even with a change of Registered Agent, there will still be traces that you once were. If you haven’t done a lot of business yet, you can hire a company to form a new LLC (they’ll sign as Organizer) and be your Registered Agent (aka Statutory Agent).

In terms of banking, you can just use whatever address you want (the bank should know the difference between a Statutory Agent address and your personal mailing address). By the way, bank information isn’t public record. And if you used your accountant as the Statutory Agent, the same would apply (just use your address). Hope that helps!

I am non US-resident. Do I need ITIN to get reseller certificate or sales tax exemption certificate in sate of OHIO.

Hi Kashif, no, you don’t need an ITIN for the Ohio Sales and Use Tax Unit Exemption Certificate or the Ohio Sales and Use Tax Blanket Exemption Certificate. You also don’t need an ITIN if you apply for a Vendor’s License. You can just use the EIN number for your LLC and skip the SSN/ITIN box. Hope that helps.

Thanks Matt

Hello Matt,

I am a foreigner and I recently established a LLC in Ohio. I want to get Vendor license for which I am applying through Ohio Business Gateway. It needs SSN for responsible party, and as a foreigner I don’t have this number. Can we apply for vendor licence without SSN and how ?

Thanks.

Hi Javed, we are actually not sure about this as we don’t do work with vendor’s licenses. We recommend contacting the Ohio Department of Taxation for assistance. Please see Ohio Department of Revenue: Help Center for phone numbers and email address.

Hi Matt,

My wife and I found you through your video interview with Stephen Key at inventRight. We would like to register a LLC in Ohio for signing licensing agreements with companies for product ideas.

We would like to hire an agent that helps with filing an LLC, be a registered agent, create a bank account, assist in taxes and any other processes involved in LLC formation and maintenance.

In short, we are looking for a go-to company who can handle our LLC filing and management processes so that we can concentrate on our business.

Do you have any recommendations for us?

Thank you!

Hi Nehash, that’s wonderful to hear! Ohio is a great state. It’s a very simple filing (the Ohio LLC Articles of Organization) and there is no Ohio LLC Annual Report. Just a heads up, there aren’t any Registered Agent companies that assist with taxes (nor LLC filing companies). You’ll want to speak with an accountant for that. The same thing goes for opening an LLC bank account. There is no company that can open a bank account on your behalf due to beneficial ownership rules for LLC bank accounts. We strongly recommend against any company that says they can open a bank account for you. It’s usually a scam. As far as being your LLC’s Registered Agent and filing your LLC, we recommend Northwest Registered Agent. Hope that helps :)

Hi Matt, thank you so much for the prompt response and the links you added to the post!

You’re very welcome Nehash :)

HI Matt

I am Simon, I am from Tennessee. Me and my friend want to open LLC in ohio. He is ohio resident. Do I have to be ohio resident to be a member in that llc. Is there gonna be complication on doing tax preparation. We wanna open trucking bussiness(freight hauling with semi-truck).

Hi Simon, no, you don’t need to be a resident of Ohio to be a Member of an Ohio LLC. Additionally, it won’t complicate taxes, since you’ll each pay your respective share of taxes in your home state.

Thank you soo much..it was soo helpful for me.

Hi Matt, thanks for all your helpful videos! I am a psychologist in OH and work for someone else but they will be closing next year. I am also a life coach trainer and every once in a while do some work as a sole proprietor. I am planning to increase both and be on my own next year. I know I should make an LLC to protect our personal assets. Can I have both my psychology practice and my life coaching training go under one business name/llc? Also, my work is online/virtual. How can I protect my home address? I think in OH I can use a PO box for registered agent. Can I also use it for LLC? Can my husband and I be listed as QJV so he can help with business as needed but I’m doing most of this work? My husband and I are considering rental property in another state could this same LLC register as a foreign LLC in that state or would we need to have a separate LLC in that state? Thanks!

HI Sherri, you’re very welcome :) An Ohio LLC actually only has one address on the Articles of Organization (the Ohio Registered Agent address).

Because you are a licensed psychologist, you will need to form a Professional LLC (PLLC) for that business. And you’ll need to check on the requirements in Ohio (we don’t specialize in PLLCs). Typically, most states require that all Members in a PLLC hold a state license. So if you’re husband isn’t a licensed practitioner, he may not be able to be an LLC Member.

Whether or not you want to have the real estate and other business activities under one LLC is up to you, however, there could be some extra liability risk. If you want 3 LLCs, it may not be too bad. Ohio LLCs are relatively affordable and the fact that there is no LLC Annual Report is a plus.

Do you plan on purchasing more property in the future? If so, in what states? I may have something for you to consider if it’s more than one property. Hope that helps.

Hi Matt,

I am a foreign real estate investor and now considering investing in the US real estate market and Ohio is one of my targeted states. From my internet research, it seems that quite a number of investors use Wyoming LLC to hold another LLC (say Ohio if the real estate situates at Ohio) and then holds the real estate. I just wonder whether there is need to form a Wyoming LLC to hold the LLC (Ohio)? Any comment?

Hi Kelvin, it’s challenging to give an absolute answer here. Some say it’s overkill and some say it’s better asset protection. Thanks for your understanding and hope that helps a bit.

Hi Matt,

My business partner submitted an Ohio LLC Form 533A with my wife’s name on it instead of mine accidentally. We are wanting to correct the issue and have myself added and my wife removed as a member. We reviewed form 543A and the instructions are not very clear. Can you please provide some guidance on how to rectify the issue?

Thank you,

Dan

Hi Dan, it depends on where her name was placed. Was she listed as the Ohio LLC Statutory Agent and did she consent (agree) to that role? Or did she enter her name and sign on the “signature page”? Was an Operating Agreement signed? If so, who is it that is supposed to be the LLC Members (owners)?

Hi Matt, She was listed as and agreed to serve as the Ohio LLC Statutory Agent (page 2 of Form 533A). In addition to my business partner, she was also listed and signed on the “signature” page (page 3 of Form 533A). My name was not listed anywhere on Form 533A. Our operating agreement has been created but has not been formally signed by any member. I am listed as a LLC Member on the operating agreement but we have held off on having the document notarized until we resolve this issue. The LLC members should have only been my business partner and I. Our intent was for my wife to only be listed as the Statutory Agent. Also, this is a newly created LLC as of 6/11/19.

Thanks again,

Dan

Hi Dan, there’s a few things going on here. First, the signature page cannot be amended. And in this case, it wouldn’t be necessary. A signatory on the Articles of Organization can be either a Member, Manager, or an Authorized Person (such as an LLC Organizer). So just because someone signed an Articles of Organization, doesn’t make them a Member (owner of the LLC). So you could think of it this way: your wife and your business parter are the LLC Organizers. And you and your business partner are the LLC Members (which is how it will reflect in the LLC Operating Agreement).

In order to “connect the paper trail” between your LLC’s Articles of Organization and the Operating Agreement, your wife and business partner can sign a Statement of LLC Organizer where they appoint you and your business partner as the 2 LLC Members. Once that is signed as well as the Operating Agreement, you and your business parter will be the 2 Members and your wife will still be the LLC’s Statutory Agent. So in summary, it’s just “internal documents” that need to be signed (the Statement of LLC Organizer and the Operating Agreement). Nothing needs to be filed with the Ohio Secretary of State. Hope that helps!

Do I need to issue stock certificates for my LLC? If so , do they need to be registered with ant entity? Thanks

Hi Donna, stock certificates would only apply to a Corporation. The LLC equivalent are Membership Certificates. They are not required, as LLC membership can be handled via the LLC’s Operating Agreement. If you did use LLC Membership Certificates, they don’t need to be registered. Hope that helps.

Hi…do you have any recommendations of good accountant/tax lawyer in the Cleveland, OH area that can deal with the annual returns of a LLC. In particular, as I am a foreign citizen, I wanted to discuss the tax implications. I believe th UK has double taxation treaty with US.

Hi Khalid, we don’t have specific recommendations, but we have a general article about how to find an accountant. You’ll want to work with someone who specializes in working with non-US filers. Feel free to share any of your findings if you’d like. Hope that helps and thanks for your understanding.

We are caring for a senior that is a snow bird (lives in OH 6 months out of the year and in FL 6 mo out of the year). We will be providing care in both locations.

Thank you for clarifying. I interpreted your first message as the snowbird was your business partner. It’s best practice to consult an attorney, however, it sounds like’ll be doing business in both states. In that case, if the LLC was formed in one state, it would need to be registered as a foreign LLC in the other state. Hope that helps and thanks for your understanding.

I am opening a home health care LLC. We will be working with a couple who are snowbirds. They will spend 50% of the time in Ohio and 50% of the time in Florida. Is it okay for me to just operate with an Ohio LLC?

Hi Scott, where are the services being provided? That is most likely going to be where your LLC is transacting business. What will your partners be doing from Florida?

Can I ask whether it is possible to get a loan through the LLC. I wish to purchase properties, but as a foreigner, I can’t get a loan in my own name?

Thanks

Hi Khalid, yes, it’s possible for the LLC to get a mortgage. You’ll want to call around and speak to banks as they all do it differently. It’s usually done within the commercial lending department of the bank. It’s a good idea to try the local and small banks close to where you’d be purchasing property. Hope that helps.

Hello Matt,

I live in and own a home in Ohio, but all of my business is done in Michigan. Should I file an LLC in Michigan or Ohio?

Thank you

Hi Linsey, what type of business are you doing in Michigan? Are any of those activities done Ohio as well? Do you do administrative work from home in Ohio?

I am a recreational therapist. I do work from home completing notes and am doing some administrative work from home. When I see clients it’s 98% in Michigan.

Hi Lindsey, do you need to hold state licensure for being a recreational therapist? If so, in which state? Where an LLC needs to be formed/registered comes down to where you’re “doing business”. While there are state statutes that define this, they define what isn’t doing business (leaving things open to interpretation by the courts). So you’re in a bit of a gray zone. It sounds like you’re doing business in both Michigan and Ohio, although the primary activities are taking place in Michigan. Forming your LLC in one state and then registering as a Foreign LLC in the other state may be worth considering. You may also need to form a Professional LLC (PLLC) for your business. I’m not 100% sure on this as we don’t cover PLLCs in depth though.

Hi Matt,

Can you open a business bank account if you are a foreigner? If so, what does one need to do?

Thanks

Khalid

Matt – I will be creating an LLC in Ohio for a rental property that I will be buying. Do you know if I have to purchase the property in the LLC name, or can I do it as myself? Thank you.

Hi Susanna, the property must be owned by the LLC in order to get the benefits provided by having an LLC. Hope that helps clarify :)

Is an Ohio Llc good for 1 year or 2 before renewing?

Hi Lanell, there are no Annual Report filing requirements for Ohio LLCs, so you don’t renew the LLC with the Secretary of State. Hope that helps.

Hi Matt, we permanently live in Ohio but own a vacation condo in South Carolina that we rent out weekly when we’re not there. We want to create an LLC for the condo. Should we create it in Ohio or South Carolina? Thanks for the help.

Hey Rich, since you’re doing business in South Carolina, you’ll need an LLC either formed there (a Domestic LLC) or an LLC registered to do business there (a Foreign LLC). More info here: Domestic LLC vs Foreign LLC. Three common setups are: 1) An LLC formed in South Carolina, 2) An LLC formed in Ohio that’s then registered as a Foreign LLC in South Carolina in order to do business, and 3) An LLC formed in Ohio that owns an LLC formed in South Carolina. Option 1 is the simplest and most affordable. Option 2 is more expensive since you need to pay for 2 LLC filings and maintain a Registered Agent in both states (so you may need to hire one or two Registered Agents). Usually, most people would also need to file Annual Reports in both states too, however, Ohio LLCs don’t have Annual Reports and neither do South Carolina LLCs (unless the LLC is taxed as a Corporation). Option 3 may provide better asset protection. Hope that helps!

Matt, thanks a lot for your time and the advice on the LLC process. It was very helpful. I appreciate it.

You’re very welcome Rich!

Hi Matt, I appreciate all your info, please help me with those questions below: I’ve registered my TM and LLC in Ohio, I’m gonna have private label business and my chemical supplier could be from any state. do i need to file another LLC when I signed the contract with them in their state also?

would I be ok to sell my products nationwide just with my OH LLC and trademark?

Do we have federal LLC?

Thanks agian.

Hey Avaz, just signing a contract with a company in another state doesn’t mean you’re doing business there, so no, you won’t need to file a Foreign registration in that state. Nope, there’s no such thing as a federal LLC. Good question though. Yes, you can still sell nationwide with your Ohio LLC. Your state trademark has nothing to do with where you can do business. It just protects your mark in Ohio. Hope that helps!

Thanks a lot again.

Sure thing!

Matt

Could you tell me how can I register my company’s designed logo and slogan in OH?

Although it’s not necessary and it cost probably too much.

Hi Avaz, we don’t have information on state-level trademarks, but you can reference the Ohio Secretary of State’s Trademark Guide here: registering your trademark or service mark in Ohio. Hope that helps.

Hi. For an Ohio LLC, does the state require disclosure of the LLC’s “members”? I would rather not disclose the “members” to the state or on public records. I’m okay with disclosing the “managers”, but am not okay with disclosing the “members”. Thanks.

Hi Alan, nope, Ohio does not require any Member or Manager information on the Articles of Organization. Hope that helps. Let me know if you have any other questions.

I currently live in Maryland, but my contract is only for 3 year’s. Then I will move back to my home state of Ohio. Maryland charges nearly $300 a year for the annual filing if I want to start my own side business. Ohio does not have an annual filing fee. Is it still recommended to file in Maryland?

Sorry Matt, I forgot to ask another question. I have subscribed and watched a lot of your videos on youtube and bookmarked your website. However, I couldn’t find the answer to this question: As a motivational speaker and consultant looking to form my own business; Do I need to register with more than one state (Maryland or Ohio)? Especially; since I travel all over the country.

Hi Adrian, based on your last comment, if Ohio is your home state, I’d register there. You don’t need to do a Foreign LLC registration just to speak or consult in a particular state a few times per year.

Hi Adrian, in this case you could form an LLC in Ohio and operate with that. If Maryland sends you notice to register in the state, then you can file a Foreign Maryland LLC. If you’re still a resident of Ohio though and are paying taxes there, that makes the “ohio only” choice a little more justified.

Thank you very much; this has been very helpful. I filed in Maryland after re-watching your videos a few more times. 1) I live in Maryland currently. 2) I can serve as my own resident agent and not have to rely on someone in Ohio to receive all of my documents and mail. When/if I move back to Ohio. I can file a Foreign LLC. Also I wanted to update you that the new expedited fees for Maryland are $70 instead of $50. In total walking out the door today I paid $192 plus processing fee to register my business.

Hey Adrian, this one (re: OH vs MD) was a bit of a toss-up, but it sounds like you made the right decision. Thanks for letting us know about the change in fees. We’ll get that updated asap.

Hi, Matt I was wondering if I should file it by myself or if I should have someone else do it on my behalf? I live in Ohio, and the LLC I looking to acquire would be for an internet site. The site wouldn’t have an income for the first year or so. The site is more for a social experience for people. The site in the future will have a membership option, but we would have that rolled out for sometime after. I’m new to this and when it says a Tax ID number, what exactly is that for? Sorry if any questions are a little obvious. I’m just now starting this process of an LLC and a trademark. Thank you!

Hi Kyle, you can do it either way. The pros and cons are mostly based around privacy. If you’d like to learn more about what an Organizer is (the one who files the Articles of Organization), you can read this article. Also, we have a video and article on the Federal Tax ID Number (aka EIN) here.

Thank you Matt I will look into the links you’ve provided. Seriously appreciate your time!

Sorry, Matt my phone autocorrected your name to Mark. My applosgizes, so embarrassing.

No worries Kyle :) Thanks!

do I have live in the state or do business in the state that I file the LLC in.

Hi Daniel, for most people, yes, but it depends on how your business is operating. Where do you reside, work from, and currently pay state taxes? What state are you thinking about? Check out this article: what’s the best state. I think it will help.