Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Skip the overview, jump to the instructions ↓

Filing a Florida LLC Annual Report

After you form an LLC in Florida, you must file an Annual Report for your LLC and pay $138.75 every year.

You need to file your Florida LLC Annual Report each year in order to avoid the penalty and keep your LLC in compliance and in good standing with the Florida Division of Corporations (aka “Sunbiz”).

Florida LLC Annual Report fee

$138.75 per year. This is paid once per year for the life of your LLC.

Florida LLC Annual Report due date

Annual Reports are due every year between January 1st and May 1st. The last day to file (before it’s late) is May 1st, up until 11:59pm.

Your first Florida LLC Annual Report is due the year after your LLC is formed.

Your first Florida LLC Annual Report is due the year after your LLC is formed.

For example: If your LLC is approved on April 10th, 2024, your first LLC Annual Report is due between January 1st and May 1st of 2025.

Then, the following year, your 2nd LLC Annual Report is due between January 1st and May 1st of 2026, and so on.

How early can I file my Florida LLC Annual Report?

You can file the Florida LLC Annual Report as early as January 1st.

$400 penalty for late Annual Reports

If you file your LLC Annual Report after May 1st, there is an automatic (and non-negotiable) $400 penalty that will be applied to your total at checkout.

This means that if you file a late LLC Annual Report, the total amount you’ll pay is $538.75.

However, it may not be that bad:

If you’re late and wait for dissolution (about 4 months after deadline), you can save $300.

Administrative dissolution if not filed by September (tip for saving money)

If you still don’t file your LLC Annual Report by the 4th Friday in September, the Florida Division of Corporations will administratively dissolve (shut down) your Florida LLC.

Although this sounds really bad, it’s actually less worse than the $400 penalty. Meaning, If your LLC is dissolved (shut down) by the state, you can “bring it back to live” by filing a Reinstatement. A Reinstatement costs $100 and you have to pay the Annual Report fee ($138.75), but you don’t have to pay the $400 penalty.

So if you miss the May 1st deadline for filing your LLC Annual Report, it’s actually cheaper to wait until the end of September, wait for your LLC to be dissolved, and then reinstate it for $238.75 ($100 Reinstatement fee + $138.75 Annual Report fee). In this manner, you save $300 ($538.75 – $238.75).

What are the filing methods for a Florida LLC Annual Report?

You can only file your Florida LLC Annual Report online. This is the only method available.

The Florida Division of Corporations does not accept LLC Annual Reports by mail, fax, or in-person.

Where can I file my Florida LLC Annual Report?

LLC Annual Reports are filed online at Florida Division of Corporations: File Annual Report.

If you need help and instructions, please read the rest of this page first.

Will I receive LLC Annual Report reminders?

Yes, the Florida Division of Corporations (aka Sunbiz) will send you 4 different courtesy reminders.

The first Annual Report reminder notice is sent out around the middle of January. The rest will be sent every 4-5 weeks.

Where are the reminder notices sent?

If you filed your Florida Articles of Organization by mail, the state will mail the reminder notices to the address you listed on your Cover Letter.

If you filed your Articles of Organization by mail, but did not include a Cover Letter, the state will mail the reminder notices to your Florida Registered Agent address.

If you filed Articles of Organization online, the state will email you the reminder notices. They may also mail reminder notices to your Florida Registered Agent.

Not sure if the correct email address is on file?

Don’t worry. During the Annual Report filing, you can update your email address that will be used for Florida LLC Annual Report reminders.

Set your own reminder, too

Keep in mind that the notices sent from the state are “courtesy” reminders.

The state is not required by law to send them. Meaning, even if you don’t receive a reminder, it is still your responsibility to make sure you file and pay your LLC Annual Report each year.

We recommend putting a repeating reminder on your phone and/or computer.

A helpful trick is shortly after you celebrate the New Year, remind yourself to file your Florida LLC Annual Report.

Another helpful trick is to use Google Calendar to create LLC Annual Report reminders. Please see the video below.

Either way, it’s your responsibility to file your LLC’s Annual Report each year.

Florida LLC Annual Report Instructions

Video instructions for Florida LLC Annual Report

Note: The Florida Division of Corporations has updated their website since the recording of this video, however, the video is accurate. The only thing that has updated is that Annual Reports, if paid for with a debit or credit card, can be downloaded right away (video says wait 24-48 hours, which is no longer correct).

Get started

Go to Florida Division of Corporations: Annual Report – Sunbiz to get started.

Document Number

Enter your Florida LLC’s 12-digit Document Number and click “Submit”.

You can find your LLC’s Document Number by:

- looking at your stamped and approved Articles of Organization

- or searching your LLC name here: Florida Division of Corporations: Search Records by Name

Total charges

In the upper right, you will see the total amount due.

If you’re filing your LLC Annual Report on time, your total will be $138.75.

If you’re filing your LLC Annual Report during the late period, your total will be $538.75.

Review your information

The Florida LLC Annual Report is pretty straightforward.

The state pulls the information from your LLC and then you review it. If anything has changed, click the “Edit” buttons and make the necessary updates.

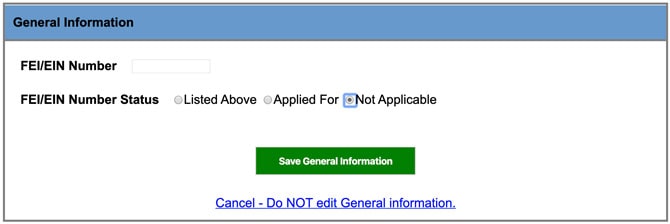

FEI/EIN Number

Your LLC EIN Number (aka Federal Tax ID Number) may already be filled in or the field may be blank.

The state does request that you submit your LLC’s EIN Number, however, if you prefer not to make the number publicly available, you can click “Edit” and then select “Not Applicable”.

Principal Address

This is the main address for your LLC. This is where business activity occurs or where you keep business documents and records. This can be an actual office address, but it doesn’t have to be.

The Principal Address can be:

- an actual office address

- a home address

- a virtual office address

- a mailbox rental address

- your Florida Registered Agent address (if allowed by Registered Agent)

The Principal Address cannot be:

- a PO Box address from the United States Postal Service

The Principal Address can be located:

- in Florida

- in any state

- or in any country

Mailing Address

A Mailing Address is the preferred address where you’d like to receive mail for your LLC. The Florida Division of Corporations uses this address as an actual mailing address. Meaning, they’ll send notices and any applicable mail for your LLC to this address.

This address may be the same as your Principal Address, but it doesn’t have to be.

Some large companies have an office (Principal Address) in one location, but prefer their mail to be sent elsewhere (a Mailing Address).

However, most people use the same address for both the Principal Address and the Mailing Address.

The Mailing Address can be:

- an actual office address

- a home address

- a virtual office address

- a mailbox rental address

- a PO Box address

- your Florida Registered Agent address (if allowed by Registered Agent)

The Mailing Address can be located:

- in Florida

- in any state

- or in any country

Registered Agent Name / Signature

A Florida Registered Agent is a person or company who agrees to accept legal mail on behalf of your LLC.

You can be your LLC’s Registered Agent if you are a Florida resident, have a street address in Florida, and are 18 years of age or older.

A friend or family member can also be your LLC’s Registered Agent if they are a Florida resident, have a street address in Florida, and are 18 years of age or older.

You can hire a Registered Agent company (called a Commercial Registered Agent) if you don’t want to be your own Registered Agent or if you don’t want your address listed on public records.

If you want to hire a Registered Agent, we recommend Northwest Registered Agent.

You can leave this section as-is if there are no changes. Or you can also change your Registered Agent in this section if you’d like.

If you are hiring a Commercial Registered Agent or switching to a new Commercial Registered Agent, make sure you hire them first before listing them in your LLC’s Annual Report.

Registered Agent Information

This section lists the physical address of your LLC’s Registered Agent.

Name And Address of Person(s) Authorized to Manage Limited Liability Company

If your Florida LLC is Member-managed:

- the LLC Member(s) will be listed here

- the correct title to use is “AMBR“, which stands for Authorized Member

If your Florida LLC is Manager-managed:

- the LLC Manager(s) will be listed here

- the correct title to use is “MGR“, which stands for Manager

Your LLC should use the correct title abbreviations (AMBR or MGR). Your LLC should not use titles meant for Corporations (Chairman, CEO, President, Vice President, Secretary, etc.). In fact, an LLC should only use either AMBR (Authorized Member) or MGR (Manager) and nothing else.

Note: Most Florida LLCs are Member-managed. For more information on LLC management, please see Member-managed vs Manager-managed LLC.

Do you want an LLC Certificate of Status?

A Certificate of Status (aka Certificate of Good Standing) is an official document from the Florida Division of Corporations that certifies that your LLC is in good standing and in compliance with filing its Annual Reports.

This document is optional and is not required.

Most people don’t need a Certificate of Status.

However, if you would like a pretty-looking official letter, you can order one for $5.

Note: If you’re registering your Florida LLC as a foreign LLC to do business in another state, you will need a Certificate of Status.

Move to Final Review

If everything looks okay, click “Move on to the Final Review” at the bottom.

Final Review

Review all your information again. Look for any errors or typos.

If you need to make any changes, click the red “NO! Continue Editing” button.

If all looks good, move onto number 5 where you’ll enter your email address.

Email and Signature

Enter your email address twice.

The Florida Division of Corporations will use this email address to send LLC Annual Report reminders next year.

And if you ordered a Certificate of Status (optional), it will be emailed to this address.

Privacy: Your email address is private. It will not be listed on public records.

Signature

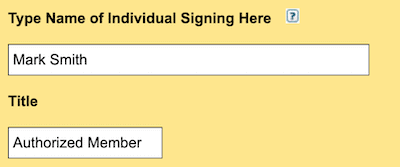

If you are the LLC Member (owner):

Enter your first and last name and your title. Most people who own their LLC have a Member-managed LLC. If that’s the case, your title will be Authorized Member.

Example:

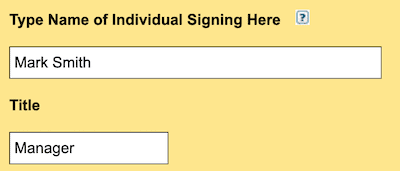

If you are an LLC Manager:

Enter your first and last name and your title. If you are the Manager of a Manager-managed LLC, then your title will be Manager.

Example:

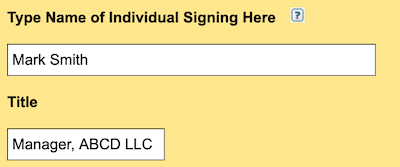

If your Florida LLC is owned by another company:

Enter your first and last name. In the title box, enter your title at the parent company and the name of the parent company.

Example:

Note: ABCD LLC is the name of the parent company. And Mark Smith is a Manager of ABCD LLC filing an Annual Report on behalf of ABCD LLC’s subsidiary company (the subsidiary company name doesn’t appear in the signature block).

Click “Move on to Payment Section” to proceed.

Choose Your Payment Option

Credit or debit card

If you pay with a debit or credit card, your LLC Annual Report is processed right away and is available for immediate download.

This is the payment method that we recommend.

Select “Credit / Debit Card” and then click “Continue”. Enter your billing information and click “Continue”. Review your information and click “Process Payment”.

On the next page, you can save your receipt. You can either click “Print” to print it out or “View as PDF” to save on your computer.

After you’ve saved a copy of your receipt, click “Finish”. On the next page, you’ll see a Final Confirmation message. After you see this message, you can close the browser tab. You’ve successfully filed your Florida LLC Annual Report.

Congratulations! Your Florida LLC Annual Report has been filed.

How to download a copy of your filed Annual Report

If you paid with a credit or debit card, you can download your filed Annual Report right away.

If you paid by check or money order, you’ll need to wait approximately 3-5 weeks before you can download your filed Annual Report.

Download your LLC Annual Report for your records

We recommend downloading a copy of your LLC’s filed Annual Report for your records. Here’s how:

- Visit Florida Division of Corporations: Search Records by Name

- Enter your LLC name and click search

- Find your LLC in the results and click on its name

- Scroll down to the bottom and look for “Document Images”

- Click on the corresponding Annual Report to open it

- Download or print the filed Annual Report for your records

Here’s a video:

How to create LLC Annual Report reminders using Google Calendar

Florida Division of Corporations

If you have any questions you can contact the Annual Reports Department of the Florida Division of Corporations at 850-245-6059.

Their hours are Monday through Friday, from 8am to 5pm Eastern.

Alternatively, you can send them an email: corphelp@dos.myflorida.com (however, it will be a few days to a week before you get a reply.)

References

Florida Division of Corporations: Title Abbreviations

Florida Division of Corporations: File Annual Report

Florida Division of Corporations: Annual Report Instructions

Florida Division of Corporations: Document Processing Dates

Florida Division of Corporations: Limited Liability Company Annual Report Help

Florida Legislature: 817.155 of the Florida Statutes

Florida Legislature: Section 605.0212 of the Florida LLC Act

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Florida LLC Guide

Looking for an overview? See Florida LLC

Hi, I just started an LLC on May 1, 2023. Do I need to file an annual report now or will that be next year since I just registered?

Hi Jessica, no, you don’t have to file the Florida LLC Annual Report in 2023. Your first one will be due next year. And you can file anytime between January 1st and May 1st of 2024.