Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

The average cost to set up an LLC is $132. This is the one-time filing fee that creates the LLC by state law.

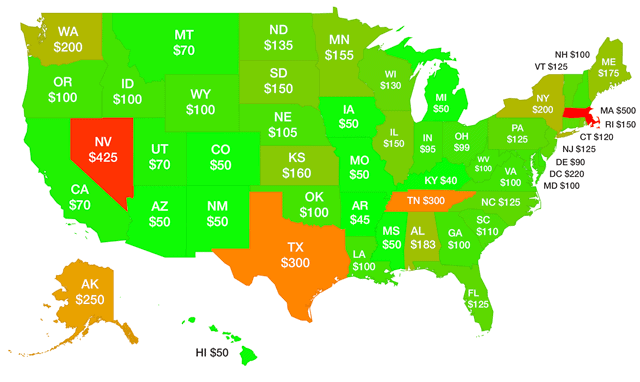

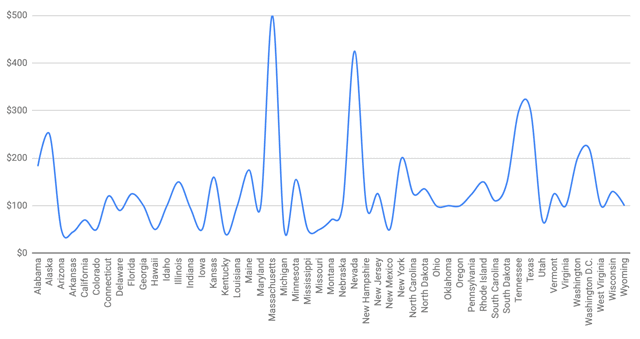

The map, chart, and table below show the LLC filing costs in all 50 states, plus Washington DC.

The cheapest state to start an LLC in is Kentucky, with a $40 filing fee. The most expensive state to form an LLC in is Massachusetts, with a $500 filing fee.

Illinois used to have a $500 filing fee as well, but in 2017, the Illinois Secretary of State brought the filing fee down to $150, in order to be more in line with the national average.

There are 10 states with a $100 filing fee and 8 states with a $50 filing fee.

Note: These numbers don’t include additional LLC fees, such as LLC Annual Fees and registered agent fees (if needed). More on those additional LLC costs below.

Need to save time? Hire a company to form your LLC:

Northwest ($39 + state fee) or LegalZoom ($149 + state fee)

(Learn why Northwest is #1 in Northwest vs LegalZoom)

Cost to set up an LLC:

| State LLC | State LLC Filing Cost |

|---|---|

| Alabama LLC | $200 |

| Alaska LLC | $250 |

| Arizona LLC | $50 |

| Arkansas LLC | $45 |

| California LLC | $70 |

| Colorado LLC | $50 |

| Connecticut LLC | $120 |

| Delaware LLC | $90 |

| Florida LLC | $125 |

| Georgia LLC | $100 |

| Hawaii LLC | $50 |

| Idaho LLC | $100 |

| Illinois LLC | $150 |

| Indiana LLC | $95 |

| Iowa LLC | $50 |

| Kansas LLC | $160 |

| Kentucky LLC | $40 |

| Louisiana LLC | $100 |

| Maine LLC | $175 |

| Maryland LLC | $100 |

| Massachusetts LLC | $500 |

| Michigan LLC | $50 |

| Minnesota LLC | $155 |

| Mississippi LLC | $50 |

| Missouri LLC | $50 |

| Montana LLC | $35 |

| Nebraska LLC | $100 |

| Nevada LLC | $425 |

| New Hampshire LLC | $100 |

| New Jersey LLC | $125 |

| New Mexico LLC | $50 |

| New York LLC | $200 |

| North Carolina LLC | $125 |

| North Dakota LLC | $135 |

| Ohio LLC | $99 |

| Oklahoma LLC | $100 |

| Oregon LLC | $100 |

| Pennsylvania LLC | $125 |

| Rhode Island LLC | $150 |

| South Carolina LLC | $110 |

| South Dakota LLC | $150 |

| Tennessee LLC | $300 |

| Texas LLC | $300 |

| Utah LLC | $54 |

| Vermont LLC | $125 |

| Virginia LLC | $100 |

| Washington LLC | $200 |

| Washington DC LLC | $99 |

| West Virginia LLC | $100 |

| Wisconsin LLC | $130 |

| Wyoming LLC | $100 |

Where Should I Form a LLC?

A lot of readers see the chart above and think they should form an LLC in a different state in order to save money.

Think again.

Forming your LLC outside of your home state (or the state where you are doing business) will end up costing you far more in the long-run.

For example, if you live and do business in California, but form an LLC in Wyoming, the state of California will require you to register your Wyoming LLC in the state of California. This is called a “Foreign LLC Registration”.

The means you now have to pay 2 state filing fees, 2 state annual report fees, and maintain a Registered Agent in Wyoming (where you don’t have an actual physical presence).

Worse, you won’t save any money on taxes because taxes are paid where the money is made, meaning you’ll still end up paying California taxes anyway.

To learn more about Domestic LLCs, Foreign LLCs, and where you should start your LLC, please read this article: best state to start an LLC.

There are a few exceptions to this rule

Legally doing business

If you are legally doing business in a state besides your home state, then you should form your LLC there. For example, if you live in Ohio, but own restaurants in Pennsylvania, then you should form your LLC(s) in Pennsylvania.

Real estate

If you are going to own or lease property in another state, then that is where you should form your LLC, since that is where you are legally doing business.

Non-US residents

There are no citizenship or residency requirements to forming an LLC in the US. If your LLC won’t have a physical presence or physical activities in the US, you can pick any state you’d like. If your LLC will have a physical presence (like an office) or physical activities, then you should form the LLC in the state where you are doing business.

We have more information for non-US residents here:

How a non-US resident can get an EIN for a US LLC

How a non-US resident can get a bank account for a US LLC

Form 5472 for Single-Member LLC non-US resident LLC

A note for US residents and US citizens who work online

If you work online or work from home you are still doing business in your home state, so it’s best to form an LLC in your home state. If you form an LLC in another state, it will need to be registered as a foreign LLC in your home state. If you’re looking to move, you should consider a state like Texas. Yes, the state filing fee is higher, but there are no personal state taxes in Texas. Here’s our complete guide on how to start an LLC in Texas.

LLC Registered Agent Fees

You need to list a Registered Agent on your LLC filing form in nearly all states (except for New York and West Virginia).

A Registered Agent is a person or company who agrees to accept Service of Process (legal and court mail) in the event your LLC is sued.

If you or someone you know has an address in the state where you are forming your LLC, then you/they can serve as your LLC’s Registered Agent (and this will save you money).

If you don’t have an address in the state where you’re starting an LLC, or you prefer to hire a professional, you can use the services of a Commercial Registered Agent.

Although Commercial Registered Agent fees can be as high as $360 per year, the two companies that we recommend only charge $99 per year and $125 per year.

Initial LLC Filing Requirements

The LLC fees above are just the filing costs.

Many states have Initial Filing Requirements, which are usually due within 1-6 months after the LLC is created (in addition to ongoing Annual Report requirements.)

Here are a few examples:

• For California LLCs, you must file a Statement of Information ($20) within 90 days of your LLC being created.

• For New York LLCs, you must file newspaper ads (fees range from $100 to $1,200) in two papers and file a Certificate of Publication within 120 days of your LLC being formed.

• For Alaska LLCs, you must obtain a State Business License after your LLC is formed, but before you conduct any business.

Those are just a few examples. Not all states have Initial Filing Requirements, but many states do.

For more details on your state’s LLC set up and filing costs, see our free step-by-step LLC guides.

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

When you stated “If your business is 100% digital and you don’t have any US presence”, what is considered digital? I am looking into ecommerce sells so I will not have a physical store. I anticipate getting items shipped to my home address and then shipping out to others via mail across the country. We are military and move frequently.

I am hoping to minimize annual fees so should I start the LLC in the AZ where I live now even though we do not pay AZ taxes? We are residents (with drivers licenses) in SD. Thank you!

Hi Laurie, LLC filings are a bit challenging if you move often because of how the state laws work regarding “doing business” and the authority to do business. You may want to consider forming an LLC in your “base state” of South Dakota. Then you can register your South Dakota LLC as a foreign LLC where you are doing business; in Arizona. If you move to another state, you’d withdraw that foreign LLC qualification in Arizona and register the LLC as a foreign LLC in the next state. Hope that helps.

Or could I just establish my LLC in AZ and avoid South Dakota altogether? It would be cheaper that way (only having the original Llc) and I’m not doing business in SD because we aren’t living there. My only concern is we pay taxes to SD for our military pay. Would we pay taxes for our LLC to AZ? Thanks so much for your input!

Hi Laurie, yes, that is also an option. Most likely, you would apportion your income among different states, however, I can’t say for sure. I recommend speaking with a few accountants. Thank you for your understanding.

I am starting an LLC with someone from Idaho. I live in Texas. The business will essentially have 2 physical addresses, 1 in each state. To make things more complicated, we will be bidding on government call-when-needed contracts that could order our assets for temporary work in any state. Would it be appropriate to simply set up the LLC in Idaho?

Hi Derrick, sounds like you’ll be doing business in both states. In that case, you may want to consider forming a domestic LLC in Texas ($300) and then registering as a foreign LLC in Idaho ($100). If you were to go the other way around and form a domestic LLC in Idaho ($100), the foreign registration in Texas is $750. Hope that helps save you some money.

Hi Matt,

I live in NJ but own rental apartments in TN. I wanted to create individual LLCs for each unit.

Do I to open up individual LLCs for each apartment in TN or can I register them in NJ?

Hi Jay, since you’re doing business in Tennessee, the LLCs that own the properties need to either be formed as Domestic LLCs in TN or registered as Foreign LLCs in TN (this is where the LLC is formed in NJ but registered to do business in TN). Another options is to form the LLCs in TN but instead of you owning them personally, they are owned by a parent LLC, say formed in NJ. Some investors form the parent company in Wyoming for better asset protection. And something else to consider is a Series LLC in TN. This will reduce the formation costs and still offer asset protection. However, Series LLCs are relatively new and tax law and liability cases are still evolving. With all those options, we strongly recommend speaking with a few real estate attorneys about how to best structure your setup. And here’s a related article: Domestic LLC vs Foreign LLC. Hope that helps.

What about trucking and shipping companies that transport goods to many states. Could an LLC operate out of one state and service many without encumbering taxes across many states? Basically I’m asking if there is an advantage to one state over another when transporting across state lines with drivers living in more than one state? Is there an advantage to picking a specific state as the base of operations to work out of and distribute loads?

Hey John, apologies it took me a while to get to your reply. I’d say unless you’re actually going to have a REAL physical presence in a particular state (like an actual office, staff, real business, etc.), there could be more risks to going outside of your home state. I’d ask yourself:

Where do you reside?

Where do you pay state taxes?

Where do you receive your income? Where are payments mailed and/or in what state was your bank setup?

What state is you vehicle tagged/registered in?

Where do you return to between hauls?

And to answer your question about taxes, generally no. If you haul through certain states often you usually have reporting and filing requirements in that state. An accountant familiar with the logistics industry should be able to help you identify where and what you need to file. Most people in your industry form their LLC in their home state; the state where they reside. People have run into issues when they go out of state, but aren’t actually doing business there. Things like some owner-operators being audited by DOT/FMCSA compliance officers at their place of business, as well as “office” (whether an actual office or home) inspections done by state DMV compliance officers. There have also been known cases of states going after revenue (and imposing penalties and fines) on residents who form their LLCs out of state. Hope that helps!