Skip to:

How to get EIN online ↓

How to get EIN by mail or fax ↓

How to get EIN without SSN or ITIN ↓

An EIN stands for Employer Identification Number and it is issued by the IRS to business entities, such as an LLC.

Don't have an LLC yet? Hire Northwest to form your LLC for $39 + state fee (then add EIN to your order).

Have an LLC, but no EIN? Hire Northwest to get your EIN:

I have an SSN | I don't have an SSN

Even though it’s called an Employer Identification Number, it doesn’t mean that you have to have employees. The EIN is just a type of Taxpayer Identification Number (TIN) that identifies your LLC with the IRS.

An easy way to think of an EIN is that it’s like a “social security number” for your LLC.

An EIN is similar to a social security number in that it has 9 digits.

To differentiate an EIN from an SSN (123-45-6789), there are 2 digits followed by a hyphen and then 7 more digits (ex: 12-3456789).

EIN Synonyms

An LLC’s EIN has many different names, but they all mean the same thing:

- EIN Number

- Employer ID Number

- Employer Identification Number

- Federal Employer ID Number

- Federal Employer Identification Number

- FEIN

- Federal Tax Number

- Federal Tax ID Number

- Federal Tax Identification Number

What is an LLC’s EIN Number used for?

EIN Numbers are used for:

- All correspondence with the IRS

- Deposits and payments for federal taxes

- Opening an LLC business bank account (checking, savings, or investment accounts)

- Filing tax return and other documents (federal, state, and local)

- Handling employee payroll (if applicable)

- Obtaining business lines of credit or business loans

- Obtaining credit cards in the name of the LLC

- Applying for business licenses

Wait for LLC Approval

Important:

Wait for your LLC to be approved by the state before applying for your EIN. Otherwise, if your LLC filing is rejected, you’ll have an EIN attached to a non-existent LLC.

Exception to the rule:

If you are forming a Louisiana LLC or a West Virginia LLC, things are a little backwards (make sure to follow our lessons step-by-step). You’ll need to confirm your LLC name availability first, then get your EIN from the IRS, and then file your Articles of Organization with the state.

Applying for an EIN for your LLC is free ($0)

Applying for an EIN for your LLC is completely free.

The IRS doesn’t charge anything for applying for an EIN.

Don’t have an SSN or ITIN?

I made a mistake in the video above. I said: “If you are a foreign national you will need to use your ITIN. If you don’t have your ITIN, you will first need to apply for your ITIN before applying for your EIN.” This is not true.

Apologies for the confusion. We now have better information from the IRS about how to get an EIN without an SSN or without an ITIN.

If you have a foreign-owned LLC, you can still get an EIN without an SSN or ITIN. You just can’t apply for your EIN online. Instead, you’ll need to mail or fax Form SS-4 to the IRS. We have instructions here: How to Apply for EIN without an SSN or ITIN.

EIN Phone Application

Note: The video above also explains how you can get an EIN by phone. This is no longer the case. The IRS has discontinued this service.

The only businesses that can get an EIN by phone are Exempt Organizations (like non-profits) and Foreign Companies (companies formed or organized outside of the United States).

EIN for Husband and Wife LLC

If you have a 2-member LLC owned by husband and wife, and are located in a community property state, you can elect a special form of taxation called a “Qualified Joint Venture LLC“.

A Qualified Joint Venture with the IRS allows your husband and wife LLC to file taxes as a Sole Proprietorship instead of a Partnership. This can save you time and money in accounting and tax costs.

There may be additional benefits to obtaining Qualified Joint Venture status with the IRS and this is a conversation you’ll want to have with an accountant.

Please see our full article here: Qualified Joint Venture (Husband and Wife LLC)

EIN Responsible Party for LLC

The EIN Responsible Party is the person that goes on file with the IRS when you apply for an EIN for your LLC.

Think of the Responsible Party as the LLC’s “contact person”. This is the person the IRS will send mail and correspondence to.

If you have a Single-Member LLC:

You will be the EIN Responsible Party.

If you have a Multi-Member LLC:

One of the LLC Members will be the EIN Responsible Party.

The IRS just wants one EIN Responsible Party. They don’t want all the LLC Members information. The IRS gets the other Members’ information when you file your 1065 Partnership return and issue K-1s each year.

Although any LLC Member can be listed, the person listed will take on the responsibility of making sure the LLC’s taxes are handled properly.

If your LLC is owned by another company:

The IRS made changes in 2018 that no longer allow an EIN Responsible Party to be a company. The EIN Responsible Party must be an individual person. So it’s best to list one of the individual owners of the parent company.

Note: If you have an LLC that is owned by another company and you try to get an EIN online, you’ll just get an error message at the end of the application.

Learn more:

To learn more about who can be the EIN Responsible Party for your LLC, please see EIN Responsible Party for LLC.

LLC taxed as a Corporation

By default, an LLC is taxed based on the number of Members (owners).

And “by default” means the LLC doesn’t elect to be taxed as a Corporation (either a C-Corporation or an S-Corporation). Instead, the LLC is just taxed in its default status.

(related article: how are LLCs taxed)

The default tax status for a Single-Member LLC is a Disregarded Entity, meaning if the LLC is owned by an individual, the LLC is taxed like a Sole Proprietorship. If the LLC is owned by a company, it is taxed as a branch/division of the parent company.

The default tax status for a Multi-Member LLC is Partnership, meaning the IRS taxes the LLC like a Partnership.

If instead, you want your LLC to be taxed as a C-Corporation, you’ll first apply for an EIN and then later file Form 8832.

If you want your LLC taxed as an S-Corporation, you’ll first apply for an EIN and then later file Form 2553.

If you choose to have your LLC taxed as a C-Corporation, make sure you speak with an accountant as there are a lot of details you need to consider. Having an LLC taxed as an S-Corporation is a much more popular choice than having an LLC taxed as a C-Corporation. S-Corporation taxation usually makes sense once an LLC generates about $70,000 in net income per year.

How to apply for an EIN for your LLC

Below you will find 3 different sets of instructions:

1. If you have an SSN or ITIN, use the online EIN application

We recommend applying for an EIN online for your LLC if you have an SSN or ITIN.

This is the easiest filing method and has the fastest approval time.

We have instructions here:

How to apply for an EIN online

2. If you apply for an EIN online, but you get an error message

If you have an SSN or ITIN, apply for an EIN online, but you get an error message (called a reference number) at the end, you will need to mail or fax Form SS-4 to the IRS instead.

We have instructions here:

Apply for EIN for LLC with Form SS-4

3. If you don’t have an SSN or ITIN

If you don’t have an SSN or ITIN, you can still get an EIN for your LLC. You just can’t apply for an EIN online.

You will need to mail or fax Form SS-4 to the IRS. You must also fill the form out a certain way (on line 7b) in order to have your EIN approved.

We have instructions here:

How to get an EIN without an SSN or an ITIN

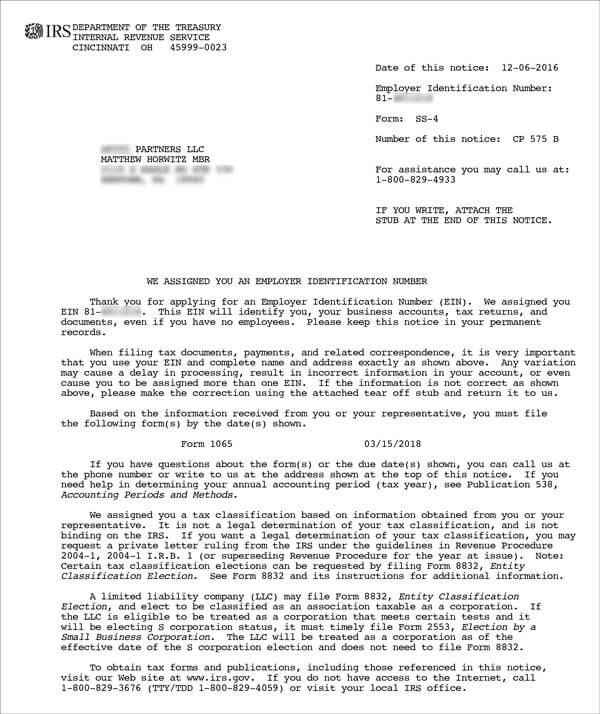

EIN Confirmation Letter (EIN Approval)

Once the IRS issues an EIN for your LLC you will receive your official approval, known as an EIN Confirmation Letter (CP 575).

The method in which you applied for an EIN will determine how you receive your EIN Confirmation Letter.

If you apply for an EIN online:

You’ll be able to download a PDF copy of your EIN Confirmation Letter at the end of the online application. There is no waiting time. The IRS will also send you a duplicate copy in the mail in about 4 to 5 weeks.

If you send Form SS-4 by fax:

The IRS will fax you back your EIN Confirmation Letter within 4 to 7 business days.

If you send Form SS-4 by mail:

The IRS will mail your EIN Confirmation Letter within 4 to 8 weeks.

Here is what the EIN Confirmation Letter for an LLC looks like:

How to Cancel an EIN?

If there was a mistake with your first EIN application or you need to cancel your EIN Number for any reason, you just need to mail a cancellation letter to the IRS.

We have instructions here: how to cancel an EIN.

You don’t have to wait for your EIN cancellation to be finalized before getting a new EIN for your LLC.

LLC Business Bank Account

After getting your EIN, you can then open a separate business bank account for your LLC.

Banks usually ask for the following documents to open an LLC business bank account:

- EIN Confirmation Letter

- LLC Approval (stamped and approved Articles of Organization, Certificate of Organization, or Certificate of Formation)

- LLC Operating Agreement

- Driver’s License and/or Passport

Aside from the above, banks may also require other paperwork (like proof of address), so we recommend calling a few banks ahead of time before going in. It’s also a good idea to ask if they have monthly fees on their “basic” business checking accounts. There are a number of banks that don’t have monthly fees.

If you’re a non-US resident (foreigner), you will need to show 2 forms of identification, such as your foreign passport and your foreign driver’s license. There are additional things (shown below) to keep in mind when opening a U.S. bank account for your LLC: Non-US resident opening U.S. bank account for an LLC

IRS Contact Information

If you have any questions, you can call the IRS at 1-800-829-4933. Their office hours are 7am – 7pm local time, Monday through Friday.

We recommend you call the IRS early to avoid the typically long holding times.

References

IRS.gov: Employer ID Numbers

IRS.gov: Do You Need a New EIN?

IRS.gov: Limited Liability Company (LLC)

IRS.gov: Single Member Limited Liability Companies

IRS.gov: Apply for an Employer Identification Number (EIN) online

IRS Publication 1635: Understanding Your EIN

IRS Publication 3402: Taxation of Limited Liability Companies

Electronic Code of Federal Regulations: Section 25.169 – Application for EIN

Electronic Code of Federal Regulations: Section 301.6109-1 – Identifying Numbers

Electronic Code of Federal Regulations: Section 24.47 – Execution of IRS Form SS–4

Electronic Code of Federal Regulations: Section 422.112 – Employer Identification Numbers

Electronic Code of Federal Regulations: Section 40.361 – Execution and Filing of Form SS–4

Electronic Code of Federal Regulations: Section 301.7701-12 – Employer Identification Number

Electronic Code of Federal Regulations: Section 301.7701-3 – Classification of Certain Business Entities

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hey Matt,

So started a business with my brother, I applied for an EIN online, Multi-Member LLC, we were approved but only my name was listed as a member on the document. How can I add my brother as another member ? How can he receive a copy of the business EIN addressed to him ?

Hi Nick, I apologize for our slow reply. That is correct. Only the EIN Responsible Party is listed on the EIN Confirmation Letter. Other Members aren’t listed on the EIN Confirmation Letter. The other Members will be included in the LLC’s tax return (the 1065 Partnership Return). We recommend working with an accountant to get that filed. Hope that helps.

Hi! Your guides are super helpful, thank you so much! I have a question about filling out the “LLC/LLP Request for Information” in NY. As a single member LLC working from home, do I have to fill out “new address information” if there is none, and do I list myself as a member under the “New Business information” if it’s just me? (or do i just sign my signature at the bottom of the section).

Hi Atara, you’re very welcome! The answer is yes to all your questions. You’ll actually be completing every section of that form. You can use your home address for the “new address information” section.

Hello Matt, all this information has been very helpful. I am also currently waiting for my EIN for my concrete co. which I sent the application by fax. I will call the IRS this week to ask for the EIN verification since I applied for it about 5 weeks ago. Thank you again!

Do you know of any agency or company helping with contractor license services in Arkansas? I am looking for one to make sure everything is filled correctly and helps me to understand this process.

I also have a friend who wants to start his business in roofing but he doesn’t know if he can apply for AR contractor license with itin. Do you have any information about it?

Hi Scarlet, you’re very welcome! We don’t know of such an agency and aren’t sure about the use of an ITIN. However, typically with government filings, an ITIN can be used instead of an SSN since not everyone is legible for an SSN. We recommend contacting the Arkansas Contractors Licensing Board at 501-372-4661 for assistance. Hope that helps and thanks for your understanding.

Thank you so much for your reply. I searched online and I didn’t find anything either I’ll give it a try myself on filling up the application. I didn’t know anything about bonds and balance sheet but after searching online I get the idea.

I’ll let him know to call the Board and find out about his business.

Thank you again Matt and thank you for having this information available for people like us starting a business! Blessing to you.

Hi Scarlet, you’re very welcome! Thank you so much. And best wishes to you :)

I obtained a LLC for a newly purchased rental property. The rental property is in a state that I do not live in. The fourth section of the EIN application requests the county and states of the LLC. Is that the county of property and state of the property or county and state of the business address in another state? In your example you use Florida for both answers so I am uncertain and do not want to make a mistake on an IRS form. The IRS website offers no answer.

Thank you for your help.

Hi Diana, the IRS doesn’t really care. They just treat the address as a mailing address. You can just use your address. It doesn’t matter if it’s in a different state than the LLC and/or the property. Hope that helps.

Hey Matt

I just signed up to start a business yesterday. Your website has been a godsend! Quick question that I haven’t been able to definitively answer.

I’ve created a LLC and will be applying for the EIN very soon. I plan to operate the business under a DBA name, but I’d like to have the EIN number before the DBA paperwork has been completed. Do I have to add the DBA name to the EIN documentation for the IRS once it is completed? Does it matter if the EIN documentation ever gets the DBA name(s)?

Hi Bradley, that is awesome to hear! Great question. No, you don’t have to update the IRS with the DBA name. The IRS doesn’t really care. They just go off the EIN. Hope that helps :)

I faxed the IRS and haven’t gotten any response for two months now and my fax service has given out my fax number because I didn’t resubscribe in time, well honestly I wasn’t aware it has expired. I don’t know what to do now.

Pls how can I notify the IRS? Or should I send a new fax?

Hi Macklyn, we recommend calling the IRS and requesting an EIN Verification Letter (147C). Call around 7am or 8am for the shortest holds times. Hope that helps :)

Won’t it be faxed to me?

The EIN Verification Letter (147C) can be faxed or mailed to you. However, they can fax it to you while you’re on the phone with them. But you’ll need to call in to request the EIN Verification Letter (147C). You can give them a new fax number for the 147C. It doesn’t have to match the original fax number.

Thanks Matt for your support, I appreciate. Can you pls help with the number I should call to request for the 147c letter?

You’re very welcome Macklyn :) Please see here for detailed instructions: How to request a copy of your EIN from the IRS (147C).

Hi there!!!

Oh boy do I have some questions!

My girlfriends and I got an LLC for an online shop to sell our crafts. Will we need an EIN? All 3 of us are listed on the LLC as well so will we all need to be on the EIN? What happens at tax time? Will it affect my “normal” filing I do with my husband? What if out online shop doesn’t work? Or if we don’t sell anything?

Ohhh I feel we are in over our heads…..eek

Any help would be greatly appreciated!!!

Thank you

Kelli

Hey Kelli! Congratulations on jumping in! Yes, the LLC will need an EIN. You’ll use the EIN to open an LLC bank account and to file tax returns. Only one person applies for the EIN on behalf of the LLC. This person is known as the EIN Responsible Party. What date was the LLC approved? And in what state did you form your LLC? I’ll answer the other questions in my next reply. I’d say, take a deep breath. You’re doing fine ;) Next step will be to apply for the EIN for your LLC. If you are going to be the EIN Responsible Party, you can apply for the EIN online and the IRS will issue the EIN right at the end of the online application. Takes about 10-15 minutes if it’s your first time. We have instructions here: apply for EIN online for LLC.

Matt,

Thank you for the quick reply!!! It looks like it was approved on 01/13/2021 and I filed in Missouri (I just moved here in December). However, my girlfriends live in CA, will that cause a problem?? We figured doing it in MO would make things a bit cheaper than CA. We have always talked about having a little business like this and all of a sudden it is happening (I think)!

Yes, please explain all I (we) need to know about the EIN. It scares me a bit when I see the letters IRS! Especially since they are quite powerful and I wouldn’t want this to effect our own personal lives. Will I need to give my SSN when applying for an EIN?

Thanks again for all of your help!!!

Kelli

Hi Kelli, you’re welcome. For federal tax purposes, your Multi-Member LLC will be taxed like a Partnership. The federal return is the 1065 Partnership Return. That will be due in March each year, beginning in 2022 (for the 2021 tax year). We recommend speaking with a few accountants after you get the business up and running. Yes, the EIN Responsible Party will be providing their SSN or ITIN. Unless the EIN Responsible Party doesn’t have an ITIN or SSN. However, in that case, they can’t get the EIN online and it would take about 2 months.

California is quite strict actually. Because you have LLC Members who are going to be “doing business” for your Missouri LLC in California, it’s as if the Missouri LLC is “doing business” in California. So your Missouri LLC actually needs to register as foreign LLC in California and pay franchise tax there ($800 per year) and file Form 568 and any other tax filings required by the California Franchise Tax Board (FTB). I know that is some bummer news, however, I wouldn’t want you to be surprised if your partners got a letter in the mail from the FTB with penalties and late fees.

That means you’ll have 1 LLC (a Missouri LLC) that is authorized to do business in two states (Missouri and California). You’ll be maintaining two LLC filings. You’ll need a Registered Agent for your Foreign LLC qualification in California (one of your girlfriends can serve this role or you can hire a company) and you’ll have to meet the annual requirements for LLCs in California, too. Luckily, Missouri doesn’t have Annual Reports for LLCs.

I know that’s a lot to add onto all this. I’d recommend getting the EIN first and then looking into the California foreign LLC registration. Let me know if you have any follow up questions.

You are such a wealth of knowledge!! Soooo, is there any way around the CA fee? What if we take the CA girls off the LLC (maybe make them silent partners-ish) and just keep me. CA is so darn greedy! Are there any other options? Also, I got a bill type thing for $94.00 from Labor Law Poster Compliance Service….if we are internet only and won’t have employees per sae, do I need to pay for Labor Law posters??? Ugghhhh this is so confusing…

Thanks again for your help!!

Kelli

Hey Kelli, thank you ;) Happy to help. You can ignore that letter regarding the $94. It belongs in the garbage and is border-line a scam. Look carefully on the letter (at the bottom or on the back). It will say something like “this is not a bill”, “we are not endorsed by the government”, “we are not the government”, etc. You don’t need to worry about labor posters unless you have employees. And those posters can be obtained for free online if you did need them.

There really isn’t a legitimate way around the CA LLC fee if an LLC is doing business in California. If you removed them as LLC Members, I’m not exactly sure what the best way to do business with them would be. If y’all can afford it, it may be worth considering just registering as a foreign LLC in California and adhering to the California rules and filing requirements.

Great article, thanks for sharing this valuable information.

I’m already in the process of applying for the EIN, in fact I applied by mail almost three months ago and still haven’t had an answer, what can I do to know the status?

Thank you in advance for taking the time to respond and help me…

Hi Oswaldo, you’re very welcome. The IRS mail filings are delayed, however, you can call to check the status and get an EIN Verification Letter (147C) while you wait for your EIN Confirmation Letter (CP 575) to arrive in the mail. Please see How to get a copy of my EIN number.

I just want to say thank you for this information! I have been wondering these questions for a few months now and could never find the answers and no one when I called was able to help or return my phone call or mail in letter.

I had a sole proprietor EIN then got an LLC (single member) so I was not sure if I needed to get a new one or I could just use my current EIN. Your website made it very clear that I DO need to apply for a new EIN. What do I do about my old EIN then?

Thanks!

Hi Kristen, you are very welcome! Thank you for the kind words :) After your final tax return is filed, you can cancel the EIN with the IRS. Hope that helps :)

Matt, thank you for explaining.

Since my EIN is not attached to an LLC as no such LLC exist, then I don’t need to worry about the LLC part. So to apply for “PLLC,” do I cancel the original EIN, and then apply for PLLC first, and reapply for EIN? Or can I keep my original EIN and just apply for PLLC? Please advise. Thank you

Hi Ramos, it’s much better to form the PLLC first and wait for it to be approved. Then apply for an EIN. You can cancel the original EIN at any time. You don’t need to wait for the first EIN to be cancelled before forming your PLLC or applying for a new EIN.

Thank you so much, very informative!

You’re very welcome Ramos :)

Hi Matt,

I have a few questions that I need help with urgently. I’m stuck on a few thoughts:

The agency I will be working for requiring an EIN number so I obtained an EIN number without obtaining LLC first (I saw your other post about this). My question:

-Do I need to apply for LLC since my agency just wants an EIN number to be able to start working as 1099.

-If no, then perfect. If I require to apply for LLC, should I cancel this EIN and obtain a new one since I didn’t follow the correct order?

-So I did a test trial to see if I can apply for an LLC in NY, and I wasn’t able to move forward because there is a “reject” under action and the message said “the proposed name includes a phrase that is normally used for a professional limited liability company.” I think there is a reject message because I have “name, therapist, LLC.” In this case, I am assuming I need to apply for PLLC and not LLC?

-So my final question- how do I solve this mess, and if I have to create PLLC what is the big difference between PLLC and LLC as far as tax-wise?

My main concern is to obtain an EIN for the agency in order to work (that is all they require me to do). I called the IRS and waited for hours and then get disconnected. I don’t know where to seek help, please advise. Thank you for your time.

Hi Ramos, we can’t comment on whether or not you need an LLC for the 1099 work you are doing for the agency. We recommend asking the agency if they mean an EIN for a Sole Proprietorship or an EIN for an LLC (or other business entity). Let us know what you hear and I can respond to your other questions.

Hi Matt,

The agency just required an EIN to work as 1099. So I clicked to apply for EIN and then I clicked on LLC (I chose LLC because I heard that is best). Thanks

Hi Ramos, I understand that. However, “just required an EIN” is an ambiguous statement. Since an EIN can be for a Sole Proprietorship, an LLC, or any business entity. So you are missing the larger picture of what this agency wants. Or maybe they don’t care if you are a Sole Proprietorship or you form an LLC (and then the decision is up to you). Either way, telling the IRS you have an LLC is not the same forming an LLC. The LLC is formed at the state level. Then an EIN is obtained for that state-level entity at the federal level (from the IRS).

Hi Matt,

I called the agency and they do not care what I put down. So I clicked “LLC.”

In this case, I am assuming I need to apply for PLLC. Could you please explain the big difference between PLLC and LLC as far as tax-wise?

Thank you for your time.

Hi Ramos, we recommend backing up a bit and determining whether or not you want to engage with this agency as a Sole Proprietorship or an LLC (or PLLC). You can find more information about that here: LLC vs. Sole Proprietorship. As it stands, your EIN is not attached to an LLC as no such LLC exists. Regarding whether or not you need a PLLC depends on the services you are providing and your professional state licensure. We have more information here: What is a PLLC. There are no tax differences between an LLC and a PLLC. We do recommend that you speak with an accountant though to look at your arrangement with the agency. Hope that helps.

Hi Matt,

I have an EIN for my LLC but it was started as a 2 member LLC. The LLC Is now only in my name (just a single member llc now) and the EIN had my former business partner as the responsible party and home address. The business is now at my home address and I do have a bank account that I’m still using that was opened under it.

I’ve received conflicting information on whether I need to just file a form to change the address or if I need to cancel and get a new one. The state for the LLC (Utah) hasn’t changed.

If I have to get a new one is it usually a non issue to just update it with the bank? And are there penalties for timing on these updates? I noticed one the change of address form (8822-B) it said it should be within 60 days but we’re out of that window now.

Thanks So Much!

-Chase

Also if it’s relevant the LLC has no employees and I don’t collect from it though it does have a very small revenue amount. My former partner also never filed any federal returns with the LLC’s EIN#

Hi Chase, great question. And with proper concern. “When does an LLC need a new EIN?” can be a very confusing question. And unfortunately, IRS phone support agents don’t always give out the right answer. The EIN is attached to the LLC. And the LLC doesn’t need a new EIN if LLC Members are added or removed. You just need to keep the IRS updated regarding the change in tax classification and with the change in the EIN Responsible Party, as you’ve mentioned.

In your situation (assuming the LLC was taxed in its default status), you had a Multi-Member LLC (being taxed like a Partnership) and now you have a Single-Member LLC (being taxed like a Sole Proprietorship). Below are the things you need to do.

1. File Form 8822-B to change the LLC’s mailing address and the EIN Responsible Party to yourself. We have instructions here: How to chhange LLC address with IRS. Wait for the IRS to return the correspondence on this before filing Form 8832. I wouldn’t worry too much about the 60-day window. It’s not going to be enforced.

2. File Form 8832 to let the IRS know about the change in tax classification for your LLC. We don’t have an article on this yet, so the steps below should help. This is how you change an LLC’s tax classification from LLC taxed as a Partnership to LLC taxed as a Sole Proprietorship (at the time of this reply):

• Enter your LLC name, it’s EIN, and your LLC’s recently updated address

• In your case, after “Check if:”, you don’t need to check anything

• 1: B

• 2A: No

• 2B: Skip/leave blank

• 3: No

• 4: Enter your name and Social Security Number (or Individual Taxpayer Identification Number)

• 5: Skip/leave blank

• 6: C (A domestic eligible entity with a single owner electing to be disregarded as a separate entity)

• 7: Skip/leave blank

• 8: The date the other Member left the LLC and transferred their ownership interest to you

• 9: Enter your name and title (use “Owner”)

• 10: Enter your phone number

• Part II (Late Election Relief): Skip/leave blank

3. Let your accountant know about the change in tax classification.

4. Contact the Utah State Tax Commission regarding any updates that may be needed on your account.

Hope that helps!

Hi Chase, also… I’m not sure when your LLC was formed. Every year it existed (and had 2 Members), a 1065 tax return needed to be filed. Even if no taxes were owed, the 1065 (which is informational in nature), still needed to be filed. Make sure to discuss with a competent accountant. Hope that helps.

Matt,

All years have been in Utah and we did get 1065’s done. I meet with a new accountant this week so your advice came just in time. Thank you for helping me sort this out and for your donanations in time for the great resource you and your site is.

Much Appreciated,

Chase

Chase, awesome to hear about the 1065s and already having met with a new accountant. Man, you’re on top of it! Nice work. You’re very welcome :) Thanks so much for the kind words!

Hello Matt,

thank you for your dedication to this website. We have a trust for asset protection that owns the LLC and the trust has it’s own EIN, so the LLC is new and we are trying to get the LLC an EIN but on the site it states to put my ssn but I don’t own the llc, I’m just a trustee, is there a way to get the LLC the EIN showing and or using the trust’s EIN? Thank you

Mari

Hi Mari, you’re very welcome! Thank you. No, you cannot list the Trust’s EIN. The IRS changes these rules last year. For more information, please see EIN Responsible Party for LLC. Hope that helps.

Dear Matt,

Want to thank you for your advise and guidance. Following the steps you outlined, I applied for and received the EIN for my LLC. (an early Xmas present)

I am very thankful to you!

That is wonderful to hear! You are very welcome :)

Why does the doc with my EIN number have SOLE MBR next to my name?

Hi Rochelle, how many members are in your LLC? And in what state did you form your LLC? If there are 2 members, are they husband and wife?

Thanks for such a great website and all the research you’ve put into it.

Like others, I moved to another state and filed a Certificate of Organization and new operating agreement for a member-managed LLC with my new state NE. I received NE approval of our paperwork and did online request for a new EIN with our same LLC name, with the new address and registered agent info, but it wouldn’t let me because it was the same info of name and members and responsible person, saying I had to call the IRS to get it.

The IRS agent double-checked with her boss, and told me that because it was the same business, just in a different state, they would not issue a new EIN. I was instructed to mail the IRS a copy of our new articles with a letter saying “We want to amend our EIN information for a different state and wished to keep the same EIN.”

Just thought I’d let you and everyone else know, since this seems like a change from the “how-to” instructions on your site.

Hi Karen – I found this very interesting! Just a month ago, I received a new EIN number for my same name, same manager LLC but in a different state. Thanks for the feedback though!

Hey Chloe, that sounds quite strange. Someone else formed an LLC in another state, same as your LLC name, but the approval letter (CP 5750 went to your address? That may not be a “new EIN”. That could be a system glitch. We recommend calling the IRS to straighten that out.

You’re welcome Karen! I think the information you’ve been given is incorrect. Although it’s the same LLC name, it is a different legal entity. The IRS may have thought you domesticated the LLC (changed its jurisdiction) or extended its authority (a foreign LLC registration). Or the representative could have been confused… which does often happen. As you said, the representative checked with their boss and stated it was “the same business”. It actually wasn’t the same business. It’s a different business. A new LLC is a new entity, and it should have a separate EIN. You could get on the phone again with them and check for best plan of action. Hope that helps. Feel free to keep us posted.

Hi Matt,

I got my EIN number for my LLC company but I forgot to add the words LLC to the name of the company. Do I need to make the correction with the IRS?

Hi Cinthia, when you applied for your LLC’s EIN Number, on the first question (“What type of legal structure is applying for an EIN?“), did you select LLC or Sole Proprietor? If you selected LLC, and then later on the “Tell us about the LLC” page, you forgot to enter “LLC” in the “Legal name of LLC” box, then yes, you’ll want to get that taken care of. This can be done via a letter to the IRS. Please see this page: how to change LLC name with IRS. You can mail that letter, adding “LLC” to your LLC’s name. Include a note that you forgot to enter it in the EIN Online Application. Also include a copy of your approved LLC’s state filing. Hope that helps!

Hi,

Thank you for sharing all your brilliant knowledge! I already have an EIN #, I am an independent contractor (healthcare consultant). I now want to start a different business with a LLC. Do I need to get a new EIN#? My current EIN# is just registered under my legal name.

Thank you for answering my question

Hi Matt,

I really appreciate what you are doing with LLC University. I have learned a lot about the formation of LLC and the necessary steps that are required for the formation of one.

I have one question about registering for an EIN number, I have filed the LLC in Delaware, but since I am running most of my business in California, I registering my LLC in California as well. I would like to know if I would need 2 EINs in this case or should register for 1 EIN as a company in Delaware and that would cover the entire company.

I really appreciate your help and your good work.

Regards,

Udit

Hi Udit, thanks for the kind words! You technically only have one legal entity, that’s a Delaware LLC. The Delaware LLC is simply authorized to do business in California as a result of your Foreign LLC filing. You just need 1 EIN. Hope that helps.

Hi Matt,

I just finished filing my EIN and received a hint to file a 1128 form to adapt, change or retain a tax year. Do you know why I would receive something like this? And thank you so much for this wonderfully informative university.

Hi Tracy, you’re very welcome. Glad you are getting value from the site :) What do you mean by “hint”? And who sent you this letter? Did it come from the actual IRS? It doesn’t like it did.

Hi Matt,

Yes, it came from the IRS as I completed the form. It appeared after I placed the month and year when I will start my business.

Hi Tracy, it may have just been a note about changing an LLC’s tax year (if needed). You shouldn’t need to file Form 1128 though. The tax year should just be the calendar year by default. Just in case you did something incorrect during the EIN application though, I recommend calling the IRS business line at 800-829-4933 and giving them your EIN. Then ask to make sure your LLC is running on the calendar year (January 1st to December 31st). It should be that way, but it’s best to call and double check. They open at 7am during the week. The earlier you call, the shorter the wait time. Hope that helps!

Hope that helps.

Will do and thanks again.

You’re welcome Tracy :)

Hi Matt,

I am thinking of setting up a consulting LLC where I am the principal and only member. Since income is reported on my personal tax return as a pass through, do I need an EIN or can I simply use my SSN?

Hey Ian, I just replied to this a few minutes ago ;) Please see my reply to Michael. I believe it’s just a few up from your comment.

Hello I have a partnership business with my mom and aunt. We filed for an ein first then 4yrs later I filed for a llc. Do we need a new ein and I’m the registered agent do I need to add them on as well?

Hi Enjoi, yes, all Multi-Member LLCs need to obtain an EIN from the IRS. The EIN you have from before is not attached to this new LLC. And it doesn’t matter who the Registered Agent is. It matters who the LLC Members (owners) are. Hope that helps.

Ok so we need to obtain a new ein? What about our bank acct with the

old ein would that be affected?

That bank account is likely for your Partnership, not your LLC. Now, your LLC is taxed as, but it is not a Partnership. There’s a big difference. You’ll want to open a new bank account for your new entity or ask the bank if the account owner information can switched from your Partnership to your LLC.

Is it okay to create an LLC but not file for an EIN?

Thanks!

Mike

Hey Mike,

Curious, why would you not want to get an EIN for your LLC?

Your LLC is required to get an EIN if:

– You have a Multi-Member LLC

– Your LLC is taxed like an S-Corporation

– Your LLC is taxed like a C-Corporation

– Your LLC will have employees (for withholding, payroll, and employment taxes)

– Your LLC will withhold income (non wages) for a non-resident alien (an individual who is not a US citizen or a US resident alien)

– Your LLC has a retirement account/pension/SEP/Keogh

– Your LLC need to file federal excise taxes

– Your LLC needs to file alcohol, tobacco, or firearms taxes

If you have a Single-Member LLC and none of the above apply, your LLC isn’t required (by the IRS) to get an EIN:

For federal tax purposes, if you have a Single-Member LLC that will be taxed in its default status (taxed as a Sole Proprietorship) AND your LLC falls outside of the requirements mentioned above, your LLC doesn’t need an EIN and you can just use your SSN on your federal tax returns. However, there are reasons outside of reporting federal taxes with the IRS where a Single-Member LLC may still need to get an EIN:

• Some states and local governments (county, city, township, etc.) may require an EIN for certain tax returns and payments.

• Some business licenses and permits may require your LLC to have an EIN.

• When opening up an LLC bank account for a Single-Member LLC, even though the IRS doesn’t require an EIN (again, only if your LLC falls outside of the requirements mentioned above), most banks will still require an EIN for your LLC to open an account. We did some research on this however and found that approximately 10-20% of banks we spoke with will still be able to open an LLC checking account for a Single-Member LLC using the owners’s SSN (and not requiring an EIN).

As a final note, even if your Single-Member LLC doesn’t need an EIN with the IRS right now, if you change your tax status with the IRS at any point (by electing S-Corp or C-Corp taxation or by adding a member to your LLC [and therefore becoming an LLC taxed as a Partnership]), you will need to apply for an EIN.

Hope that helps!

Sorry I miss spoke (typed). I did not put my EIN number in for my LLC. I put it in for my sales tax license.

Thanks.

Hi Heidi, apologies for the slow reply. Did the state approve your LLC filing? Does your EIN Confirmation Letter have the same name as your LLC? If so, then you’re all good. Yes, you’re supposed to do the LLC first (wait for approval), then obtain the EIN… but if you got the EIN first and the LLC was approved second, it still has the exact same effect. The IRS doesn’t check to make sure the LLC exists first.

Thank you for the reply! Yes the state approved my LLC filing. But I see now that the letter I got from the IRS with my LLC name has an EIN number on it which is dated 12-26, but I also recieved a notification thru LARA Department of licensing and affairs on January 4th that i have my llc but the id number they have on it is different than the ein i was issued. ‘Im confused. Did they issue me a new ein or is the id number something different?

Hi Heidi, the ID Number from LARA is not the same thing as your EIN. Your EIN comes from the IRS. Your Michigan LARA ID Number is issued by LARA and is another way they keep track of businesses in the state. Hope that helps.

Hi Matt

I’ve recently started an online business and i got my EIN before deciding to apply for my LLC. I found your youtube video stating that it should not be done that way and now I’m worried. I did have to put in my EIN number when applying for my LLC. Should I be okay? How do i find out if my EIN is properly associated with my LLC? Your help would be greatly appreciated!

Heidi

Hi Matt,

Hope you can help with a question. I am a foreigner and my attorney registered me my single member LLC via an SS-4 form. I received the CP575A notice from the IRS and it only lists my name on the notice, my company name is not on there. When my attorney registered for the EIN, she listed my name on Line 1 for Name of Legal Entity on the SS-4, and the company name on Line 2 under Trade Name. She checked “yes” to LLC on Line 8. For 9a, she put “Sole Proprietor”. Our LLC is registered with the state under the company name, not under my name. I believe the EIN may have been registered incorrectly. Shouldn’t my company name be listed somewhere on the CP575A?

I spoke with the IRS today and they said to submit a letter requesting to update the information. Have you ever heard of this situation before? They can’t tell if I’m registered as a sole proprietor or a disregarded entity. I’m a little confused.

Thanks in advance for your help!

Hi Ellis, this is technically not correct, as the existing EIN is registered to you as an individual (Sole Proprietorship) and having the LLC as a trade name is also not correct. Although you can write a letter to the IRS requesting the change, it’s probably easier to cancel the EIN and then get a new one. As a foreigner I’m assuming you don’t have an SSN or ITIN. If so, you can follow the instructions here and mail or fax Form SS-4 to the IRS: how to apply for EIN without SSN or ITIN. Hope that helps!

Hi Matt,

Thank you for all of your useful information and your time. It is greatly appreciated! I was hoping that Ellis’ reply would answer my question but I am still not clear and worried about filing wrong.

I have my Articles of Organization for my LLC. On the EIN form, should the business name go on line 1 and then my name and SSN goes on line 7a&b?

Hi Carol, you’re very welcome! Thank you for your nice comment :) Yes, you are correct. The LLC name goes in #1 of Form SS-4 and your name and SSN go in 7a and 7b, since you are the EIN Responsible Party. As an FYI, although you can apply for an EIN with Form SS-4, if you have an SSN (or ITIN), it’s easier to apply for an EIN for your LLC online. Hope that helps!

Hi Matt,

Excellent work on all the areas you are posting in this website. Extremely helpful!

I would vey much appreciate if you could advise me on the situation I describe below regarding the EIN.

I am a homemaker and file taxes jointly with my husband. Recently I have been looking at the various options to work from home through online jobs. Along these lines I have looked into:

– typing

– translating documents from and into French

I applied to an online agency who would consider me as an independent contractor when forwarding to me the assignments. This agency has requested me my social security number. Providing my social security number through a website is something I am not too comfortable with particularly due to the risk of identity theft.

Here is where I have the following questions with which I hope you may help me.

1) In the IRS website I saw that there is a number (EIN) which may be used instead of the social security number and thus protect the SSN. Would this be a possibility for the situation I described?

2) If I get an EIN how would this affect the joint tax filing? Would I have to file everything under the EIN or only what I have earned by my online jobs?

3) If I get an EIN but then it turns out that I don’t get any assignments thus I don’t earn any money, what happens them? What is it I then have to do when the time comes to file my taxes?

4) Can a company refuse to use my EIN instead of my SSN and insist that if I don’t provide them with the SSN then they will not consider me for the typing and/or translating assignments as independent contractor?

5) Is there something else I should consider and/or be cautious about?

Thank you.

Sincerely,

Iris

Hi Iris, thanks for the kind words. Glad the site has been helpful for you :) This is a little bit outside of our wheelhouse, but I’ll answer as best I can. 1. The EIN is used for business activity, whether that’s an LLC, or a Sole Proprietorship. The purpose of the EIN is not to mask the SSN, but sometimes an EIN can offer privacy, say when filling out a W9 or similar tax form. I think you can use the EIN for your Sole Proprietorship/Independent Contracting and it will have that affect for you. 2. It should not affect your joint tax filing, but please double-check with your accountant. 3. I can’t tell you how to file your taxes, but if you get an EIN and then don’t have any tax obligations, no need to worry. Simply obtaining an EIN doesn’t mean you owe a return. 4. Yes, but it’s not that common. 5. Yes, you could form an LLC and then do the contract work through the LLC. You’ll get an EIN for the LLC (instead of for yourself) and you’ll also get liability protection in case you were ever involved in a lawsuit. Just something to consider. Hope that helps :)

It has been very helpful. Thank you!

You’re welcome Iris!

I registered my EIN before my LLC was approved and it is approved but I am a Single Member LLC and already have a business checking account and sales tax permit. I am pretty sure my EIN is connected to a Sole Proprietorship, but if i am going to be taxed as a disregarded entity either way considering I am the only member, do i need to get another EIN for my LLC?

Thank you for all of the information you provide.

Hi Fred, the first EIN you applied for, was that under your name, or under the LLC? If it’s under your name, then it’s attached to you as an Sole Proprietorship. If your bank is okay with moving the account into your LLC name, then you may be okay. But it is cleaner to get a new EIN so it’s “attached” to the LLC. Also note, your business checking account and sales tax permit are are also attached to you and not the LLC. If you’re going to form an LLC and do business through the LLC, then the bank account and sales tax permit should be in the LLC’s name.

Thank you for the extremely quick response. I have an EIN registered for my business and a separate bank account with that EIN in the LLCs name. The sales tax permit is also in the LLCs name. I think I have done everything correctly so far, my only concern was that I created the EIN before I created the LLC. When creating my original EIN I picked LLC on the first page when it asks you what legal structure you identify yourself as. I than picked starting a new business and that I am the only member. The only other thing is when I was creating the EIN, when it asks who is the responsible party, I picked myself the individual, not an existing business. Both my name and the LLCs name are on the EIN, my name has Sole MBR next to it. Thank you again for any information you can provide for me.

Fred

Okay, thanks for the details. I had it incorrectly understood the first time. You did everything correctly Fred. You just applied for the EIN before the LLC was actually approved. It’s usually best to form the LLC first then apply for the EIN, but since everything went through, you’re fine and all set :) You applied for the EIN correctly.

Same here – thanks for answering Fred’s question as I had the same one. thank you!

Nice! You’re welcome. It pretty much works like this… the IRS doesn’t check if the LLC is “approved” before they issue an EIN. Hope that helps.

Hi Matt,

i am a huge fan of LLCUniversity. you are a giver and i really appreciate it. keep up the good work , which you are already doing great.

i have a question regarding EIN. i am going to start e-business where i’ll import sales tax exempt goods from europe and will sell them online. while setting up my EIN, it asks for business category in “Details” section. it has many categories but “Retail” seems very close but neither short description nor the IRS help / google tells exactly what should be the category.

Could you please give me some guidance or refer me some link which explains this kind of business category.

thanking in advance.

regards,

moen chishti

Hi Moen, apologies for the slow reply. And first, thank you for the kind words! I really appreciate it! There are no good write ups on this, so, based on what you’ve shared, it’s easiest just to select “other”, and then manually and briefly explain your business. Hope that helps! Let me know if you need anything else.

When changing the name of an LLC do I need a new EIN number? Thank you for all info.

No, an LLC name change does not require a new EIN. You can find additional details from the IRS here.